- Assets under management for institutional crypto products rose 14.1% to $43.3 billion.

- GBTC’s discount to the underlying Bitcoin fell to the lowest level since August 2021.

Building on the bullish rally that started in mid-October, Bitcoin [BTC] In November, the price pushed further north by more than 10%, leading many experts to label the current phase as the early phase of a crypto bull market.

During the month, the king coin regained levels last seen just before the start of the bear market. As of this writing, it exchanged hands for $38,016, AMBCrypto discovered using CoinMarketCaps facts.

Institutional interest in cryptos is increasing

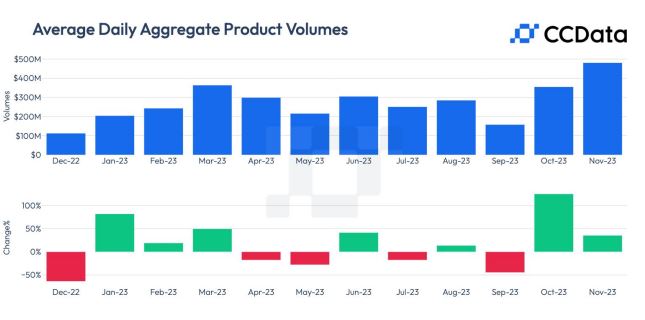

The bullish momentum continued to attract the attention of institutional investors. According to crypto market data provider CCDataaverage daily volume of digital asset investment products rose 35.3% to $481 million.

This was the highest recorded monthly volume in 2023 since March.

Additionally, total assets under management (AUM) for institutional crypto products increased 14.1% to $43.3 billion, a significantly higher growth rate compared to the previous month.

In fact, total assets under management have more than doubled since the beginning of 2023.

The AUM is a measure of the flow of investors into and out of a fund and the price development of the underlying asset.

As you would hear anyone in the market saying these days, the institutional interest was tied to the hype spot exchange-traded funds (ETFs) of both Bitcoin and Ethereum. [ETH].

Leading investment products are witnessing a rise in assets under management

For Bitcoin, optimism hinged on the possible approval of at least a dozen filings.

On the other hand, the number of TradFi giants applying for a spot Ether ETF has also increased significantly in November.

Big names like Blackrock and Fidelity filed spot Ether ETF applications with the US Securities and Exchange Commission (SEC) in November. This has increased the total number of such depots to seven.

Bitcoin-based investment products extended their winning streak in November.

Assets under management rose 12.5% to $31.8 billion over the month, cementing its market dominance. Year-over-year (YTD) cumulative increase was 140%.

A positive development is that assets under management of Ethereum-based products increased by 17.8% this month to over $8.55 billion. The turnaround came after consecutive months of underperformance.

The entry of the largest asset manager in the world Black rock to where the Ether ETF race might have helped change sentiment. Note that ETH registered a monthly growth rate of 13.82%, higher than BTC.

Moreover, other altcoin-linked products witnessed a sharp jump in market value. The assets under management for Solana [SOL] products, for example, nearly doubled in November to $424 million.

Impressive price gains helped increase the market value of SOL-linked products. Indeed, SOL was the best-performing large-cap crypto of the past 30 days, up more than 68% annually. CoinMarketCap.

Grayscale leads the change

Grayscale Investments, the world’s largest digital asset manager, saw a 10.3% increase in its assets under management to over $30 billion. Subsequently, market dominance reached more than 70%.

It is striking that the market leader’s assets under management have increased by 109% since last year.

As expected, growth was led by the most popular products, Grayscale Bitcoin Trust (GBTC) and Grayscale Ethereum Trust (ETHE). While GBTC registered an increase of 8.7% to $23.5 billion, ETHE grew 16.5% to $6.21 billion.

The most notable event, however, was GBTC cutting the discount on the underlying assets to the lowest level in more than two years.

The discount on NAV was almost 45% in June. However, growing optimism about the conversion to a spot Bitcoin ETF, aided by recent court rulings, led to a sharp decline.

As of November 24, the GBTC discount was only 8%.

Typically, a decreasing discount between a trust’s shares and the net asset value (NAV) of its investments indicates a bullish outlook.

Crypto stocks build on the bullishness

The bullish mood in the digital asset market was also channeled to related entities in TradFi.

Crypto-related stocks posted significant gains during the month. Coin base [COIN]the largest crypto exchange in the US, led the rise with an increase of more than 55%.