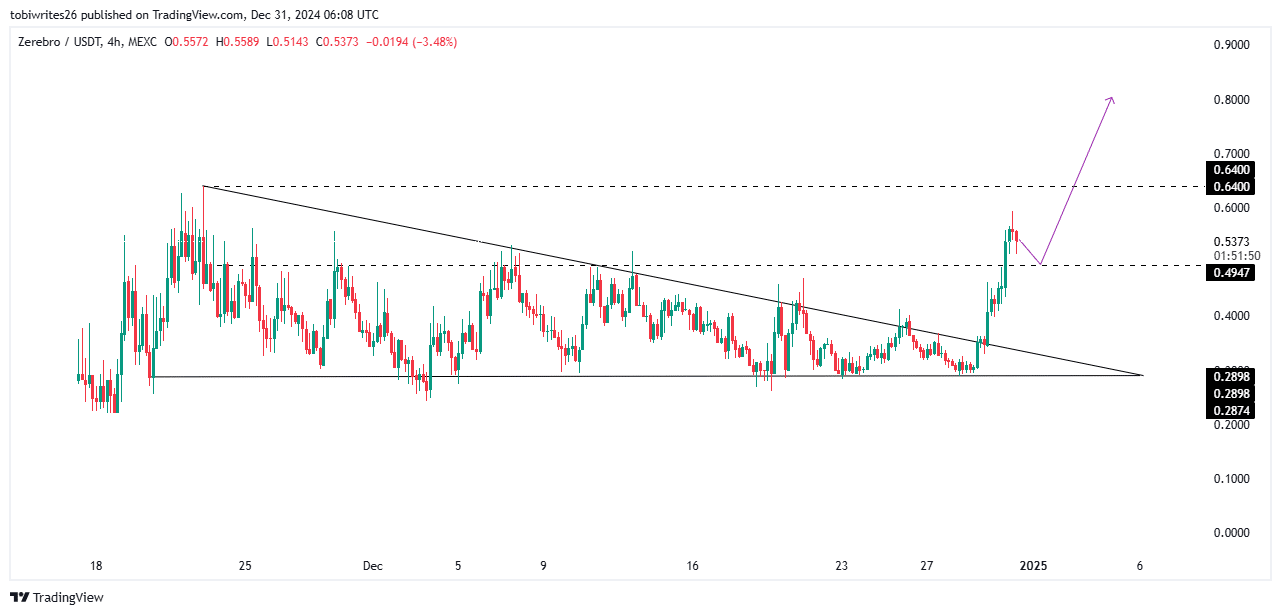

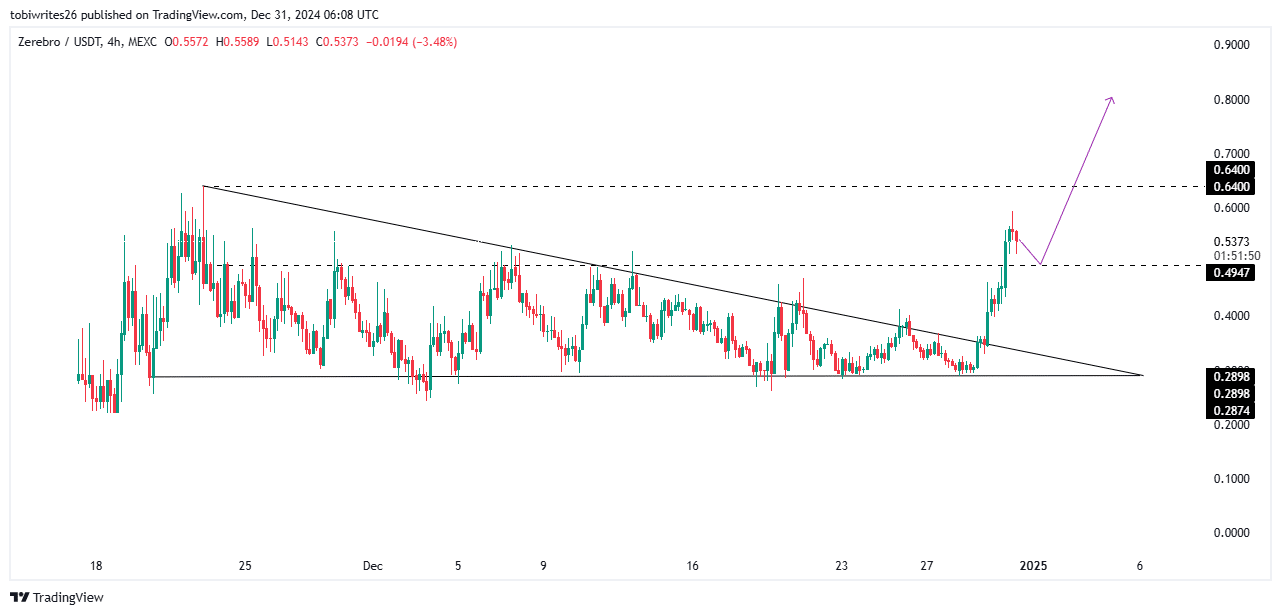

- The rally came after the asset came out of a consolidation channel where it had been trading for several days.

- Currently, a strong support level on the chart indicates that ZEREBRO could rise even further, possibly to $0.80 or more.

ZEREBRO has shown an impressive upward trajectory, gaining 67.92% in the past month and another 35.90% in the past 24 hours. Currently, the market capitalization is $541.6 million.

While these gains could indicate that ZEREBRO is nearing its peak and could recover, AMBCrypto’s analysis indicates that the asset remains bullish, with room for further upside potential.

Is ZEREBRO ready for further gains?

ZEREBROThe fund’s recent rally comes as it broke the key consolidation channel that lasted for weeks from November, pushing it higher on the charts.

Normally this breakout would indicate a push towards a high of $0.64, but the asset is currently slowing to $0.55. Analysis suggests two possible paths for ZEREBRO: reaching the $0.64 peak or climbing higher to the $0.80-$1 range.

In the last scenario, illustrated in the attached chart, ZEREBRO would first have to return to a support level at $0.497. A recovery from this level could then push assets towards $1, potentially pushing the market cap above $1 billion.

Source: TradingView

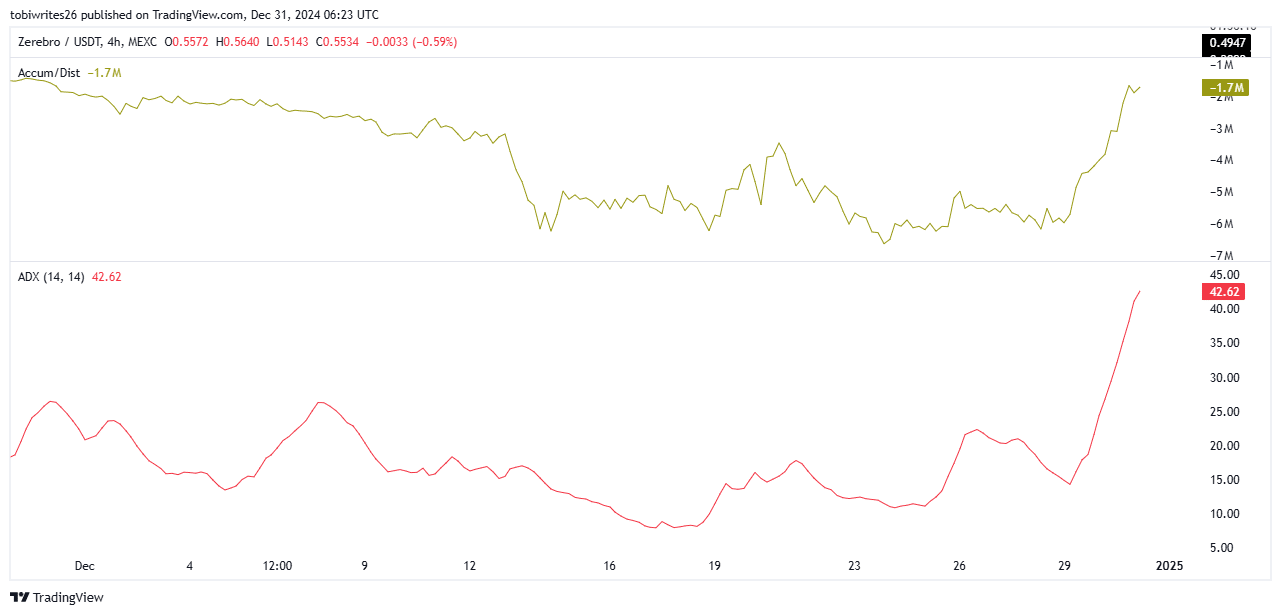

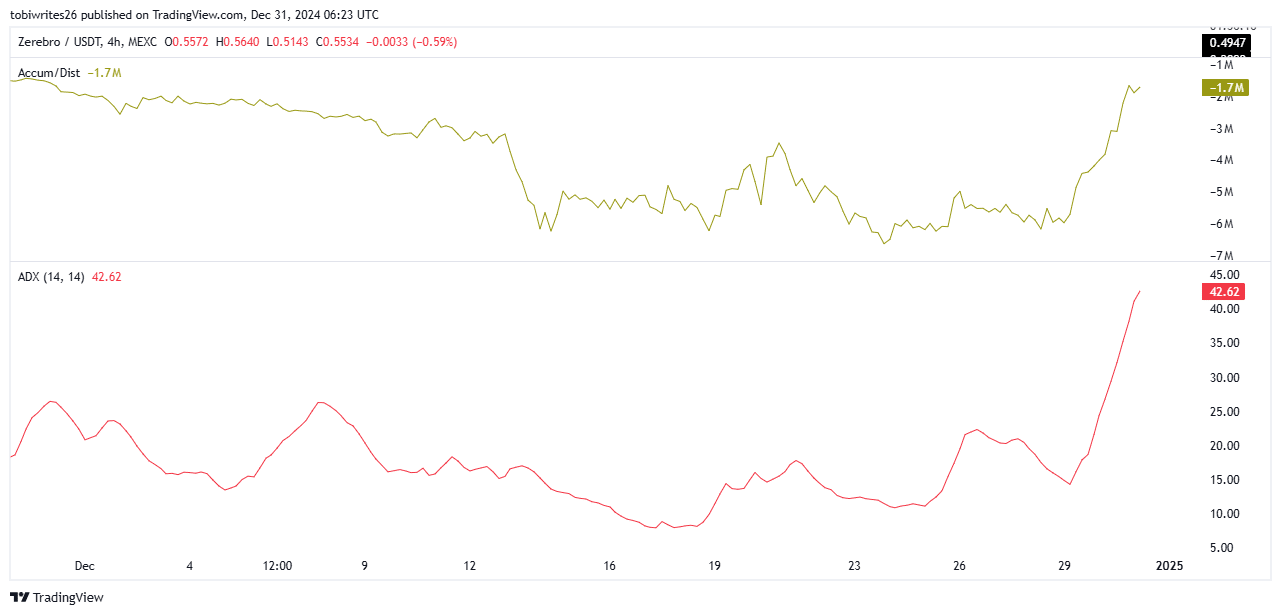

To assess the likelihood of continued bullish momentum, AMBCrypto analyzed key technical indicators, which confirmed that the bulls remain active.

Rising accumulation could take ZEREBRO higher

At the time of writing, ZEREBRO’s Accumulation/Distribution (A/D) indicator was showing an accumulation phase, confirmed by an upward trend line.

The A/D indicator combines price and volume to measure the direction of the market. When the trend is up alongside the price movements, as seen here, it indicates high demand for the asset.

Source: TradingView

To confirm the directional bias, the Average Directional Index (ADX) was analyzed. The ADX measures the strength of a price development.

When an asset’s price trends are rising alongside a rising ADX, it indicates strong bullish momentum. For ZEREBRO, an ADX reading of 42.62 reinforces this bullish outlook, suggesting the asset could rise further from its current price point.

The on-chain metrics are also in line with this trend, showing increased activity among derivatives traders in the market.

Derivatives traders go long

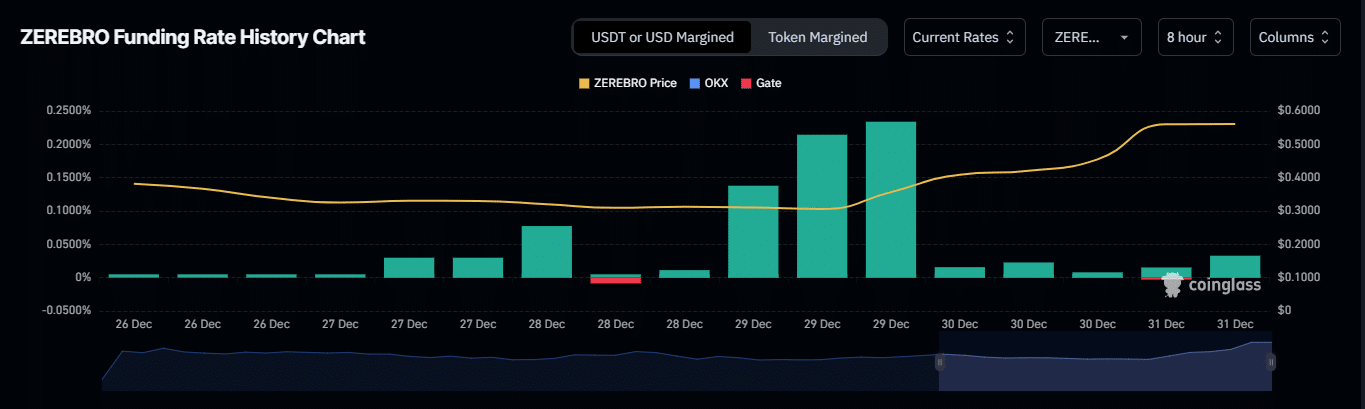

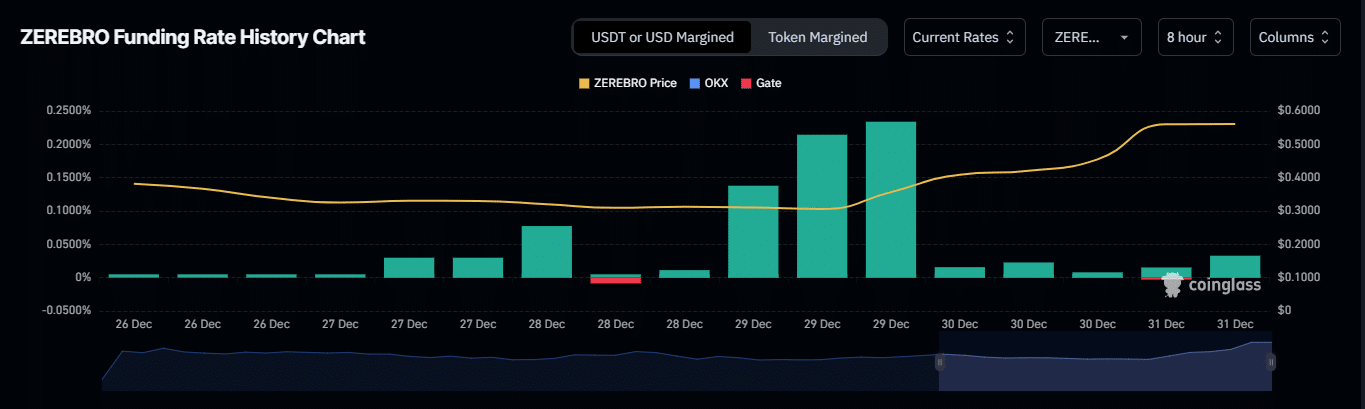

ZEREBRO has seen an increase in the number of long contracts in the derivatives market. At the time of writing, the financing rate stands at 0.0320%, reflecting increased bullish sentiment among traders.

A rising funding rate usually indicates a bullish market, as long traders (buyers) are willing to pay a premium to hold their positions.

Source: Coinglass

This shows confidence in ZEREBRO’s upward momentum, with traders covering the price difference between the spot and futures markets.

If this trend continues, ZEREBRO could either experience a brief dip before a major rally or head straight for a new all-time high.