- XRP’s bullish rally to $1.50 has hit a roadblock as weak hands exited after realizing profits.

- Without an external catalyst, a decline to $1.20 is likely.

Profit taking on Ripple’s [XRP] The daily chart is clearly visible, with the last five days showing a pullback after reaching $1.50.

XRP is now in a critical middle ground and faces several challenges before a bullish run to $2 can take shape.

Data on the chain showed increased whale activity, indicating a possible ground formation. Yet XRP’s staggering 200% increase in just one month has left the market teetering on the edge of overheating.

While a short-term correction seems likely, converting $1.20 into solid support is essential. Without this, reigniting FOMO and establishing a stronger bottom could prove difficult.

The market is looking for a ‘savior’

Interestingly, unlike previous cycles where memecoins thrived during Bitcoin’s consolidation, altcoins are regaining their dominance, with meme-based tokens leading the top 4 weekly losers. list.

Amid the increased volatility, investors appear to have switched to altcoins, opting for relatively safer bets over risky investments – an opportunity that XRP bulls must seize to keep prices within the $1.40 band.

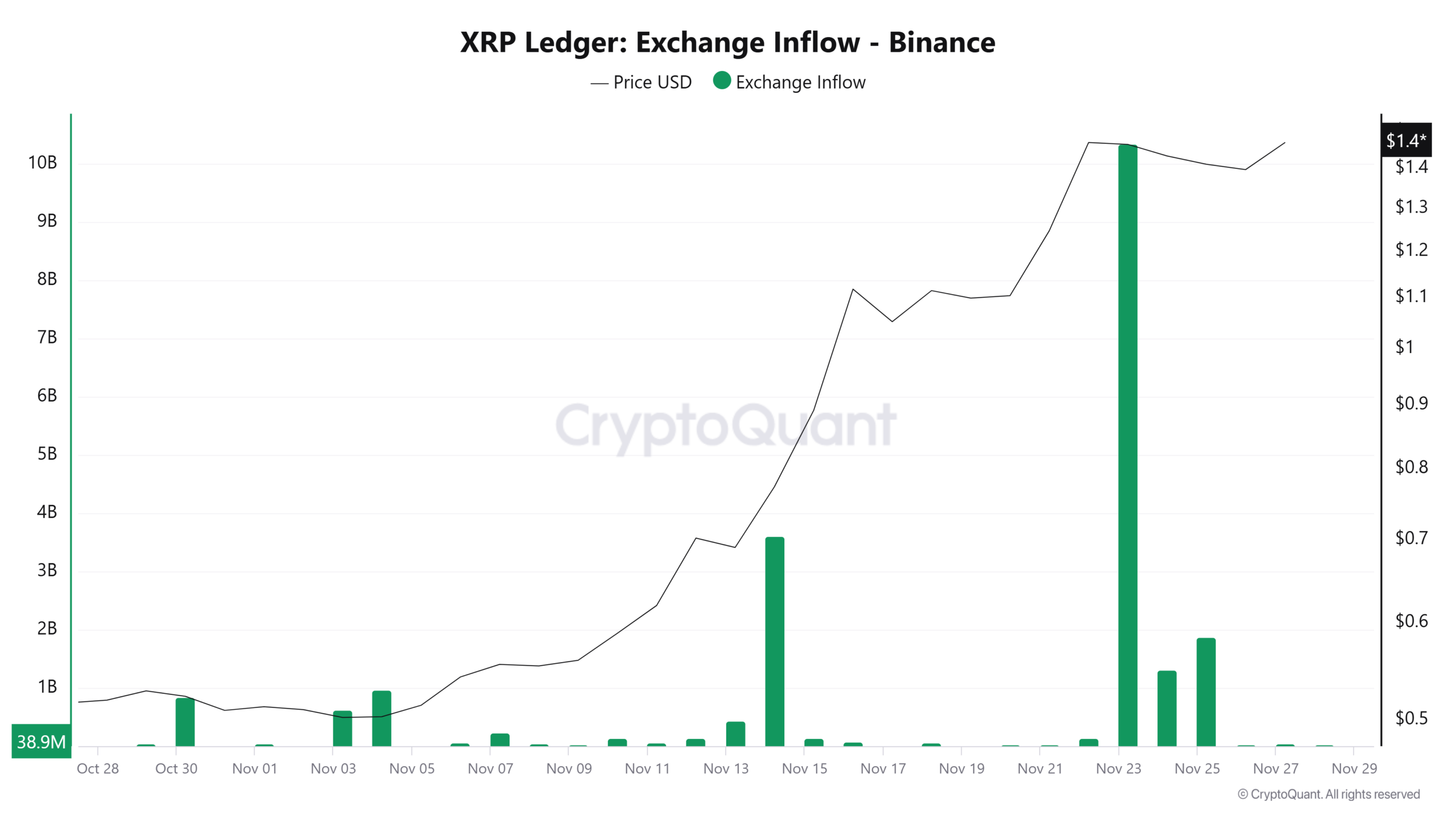

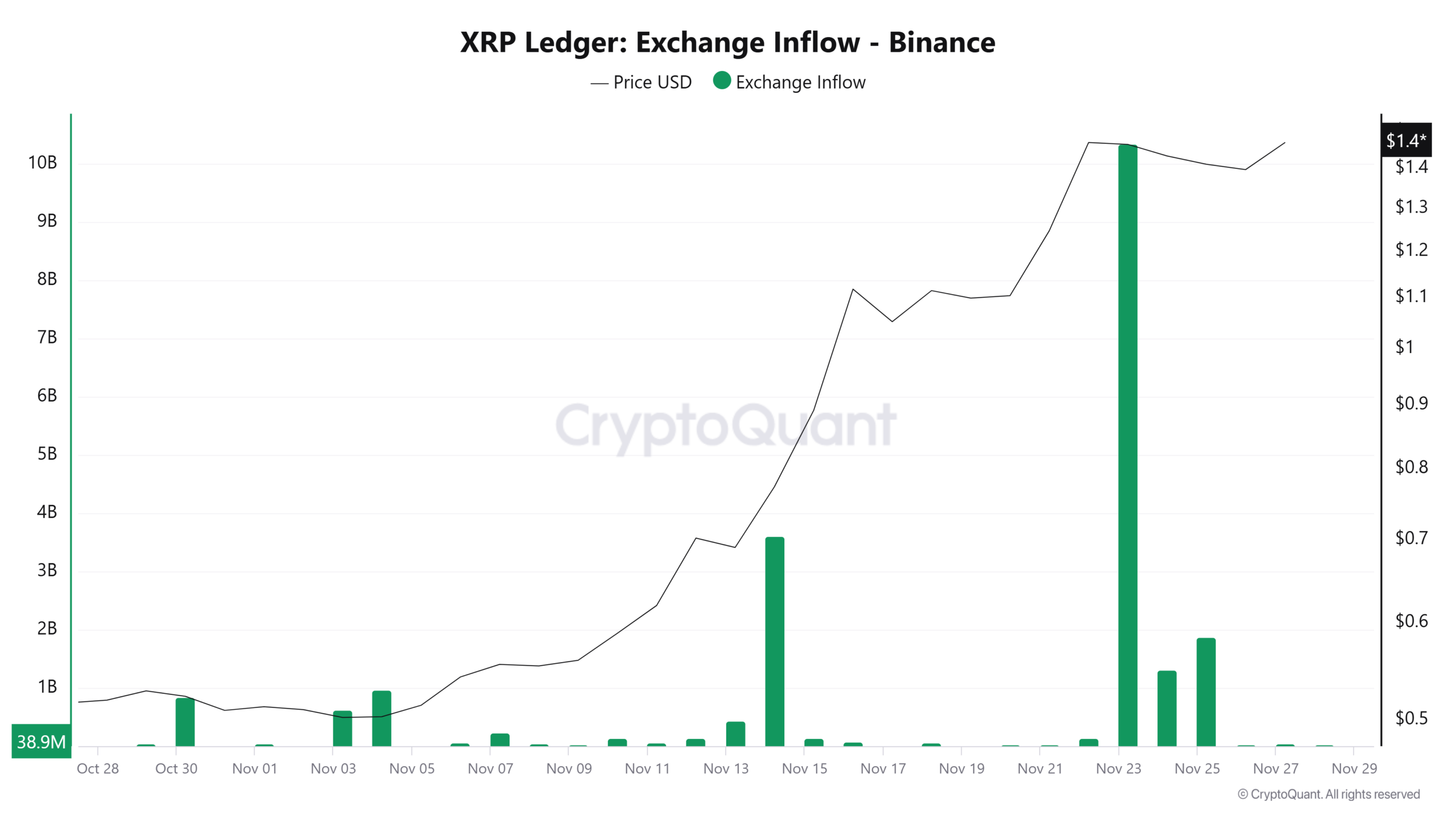

Whale activity has played a crucial role in supporting this, effectively countering the massive inflows of XRP that peaked five days ago.

This marked the second highest inflow of all time, with over 10 billion XRP tokens submitted to Binance.

Source: CryptoQuant

On the 1-day price chart, these deposits clearly had an impact, leading to four straight days of losses that pushed XRP back to $1.20, wiping out much of the previous day’s 18% gain.

Technically, long-term holders from the past three years continue to make profits, while many weak hands have pulled back after realizing profits in anticipation of a bullish run.

While the whale activity has likely encouraged HODLers to stay involved, the current market volatility means there is still a high chance of more weak hands being shaken out.

However, with a growing speculation Around a potential bullish Thanksgiving rally for Bitcoin, which could see a rebound to $99,000, this “social media-driven” momentum could push altcoins, including XRP, to breach key psychological resistance levels.

For XRP, $1.90 seems like a crucial price point to keep an eye on. Given the massive liquidity in the market and now that most stakeholders are pulling out.

This cycle now relies heavily on an external catalyst to dispel the idea that $99,000 could be a potential top for Bitcoin.

Additionally, since altcoins often benefit the most during Bitcoin’s bull runs, a similar reaction could trigger a bullish rally for XRP.

Is XRP Bullish Enough to Aim for $1.90?

As mentioned earlier, the $1.20 support is crucial for bulls’ defense. If the price reaches this level, panic is likely to ensue, leading to further selling as a significant portion of stakeholders’ portfolios are left in the red.

To limit losses, most positions will probably close.

However, there is a silver lining: as market dynamics dictate, every retracement presents an opportunity for retail investors to get in at a discounted price, potentially sparking a bullish rally.

Still, everything depends on the bigger picture — especially Bitcoin’s short-term moves — while Ripple’s position in its legal battle with the SEC could set the course for the long term.

With President-elect Trump returning as a staunch supporter of crypto, so has the Ripple community responded with optimism, fueling speculation that XRP could hit a new all-time high next year.

Realistic or not, here is the XRP market cap in terms of BTC

In the short term, however, breaking $1.90 is key to reigniting FOMO, with retailers eyeing $2. This largely depends on Bitcoin’s moves – either breaking resistance or consolidating, as XRP tends to follow suit.

On the other hand, a pullback in BTC could trigger a healthy retracement to $1.20, which could be a solid entry point for many. This could lay the foundation for a rally back to $1.90 and open the door to further gains.