- Whale transfer and rising exchange reserves caused speculation around the next major movement of XRP.

- Technical outbreak and growth in chains in line with liquidation zones to support Bullish Momentum.

A massive transfer of 66.9 million XRP, with a value of more than $ 143 million, has brought renewed excitement around the token between unknown portfolios. This important whale activity coincides with Ripple[XRP] Holding firmly above the psychological support of $ 2.00.

At the time of the press, XRP traded at $ 2.12 and achieved a profit of 3.97% in the last 24 hours. That is why attention is now shifting to the question whether this bullish setup can send a rally to the resistance level of $ 2.60.

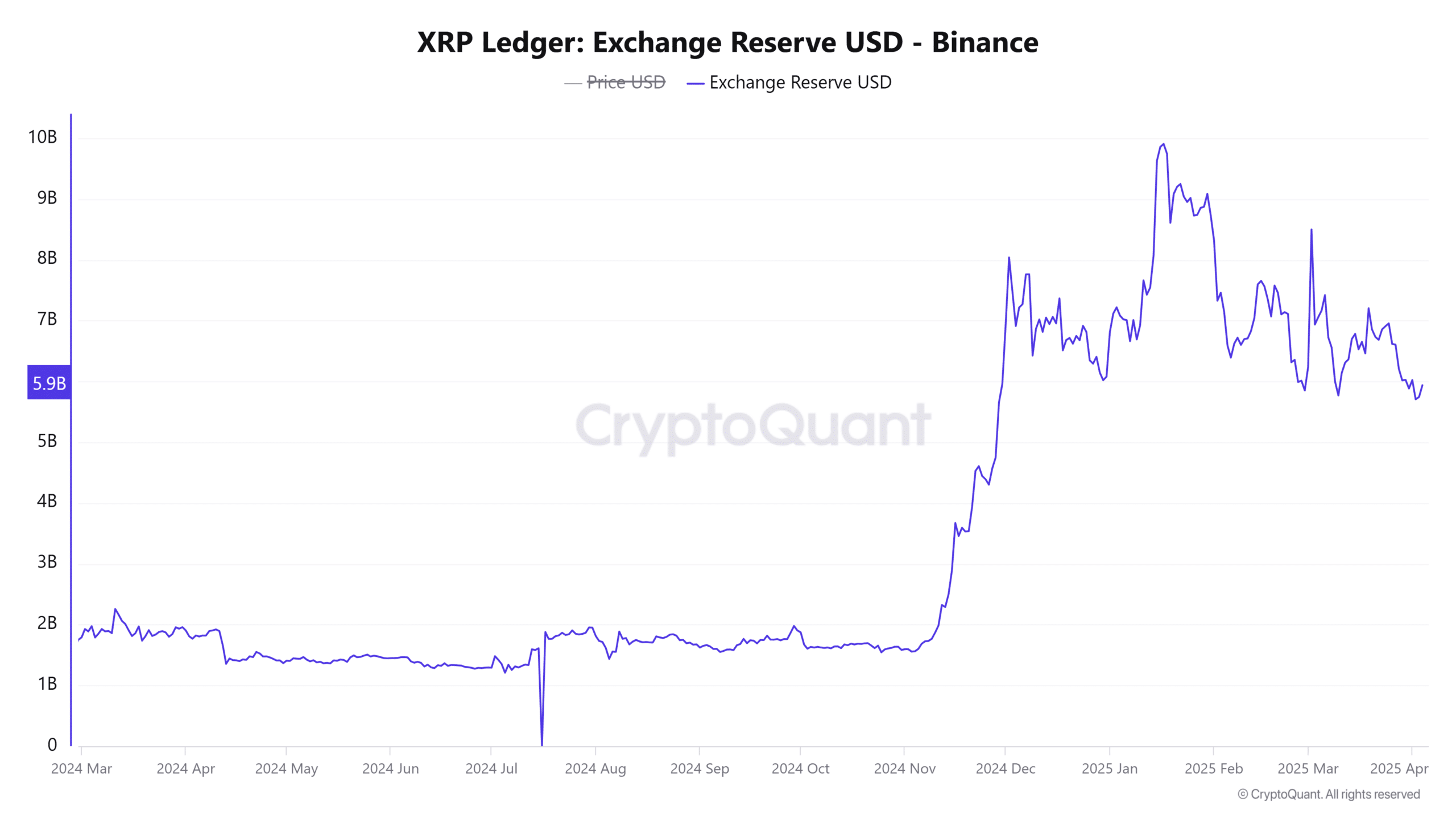

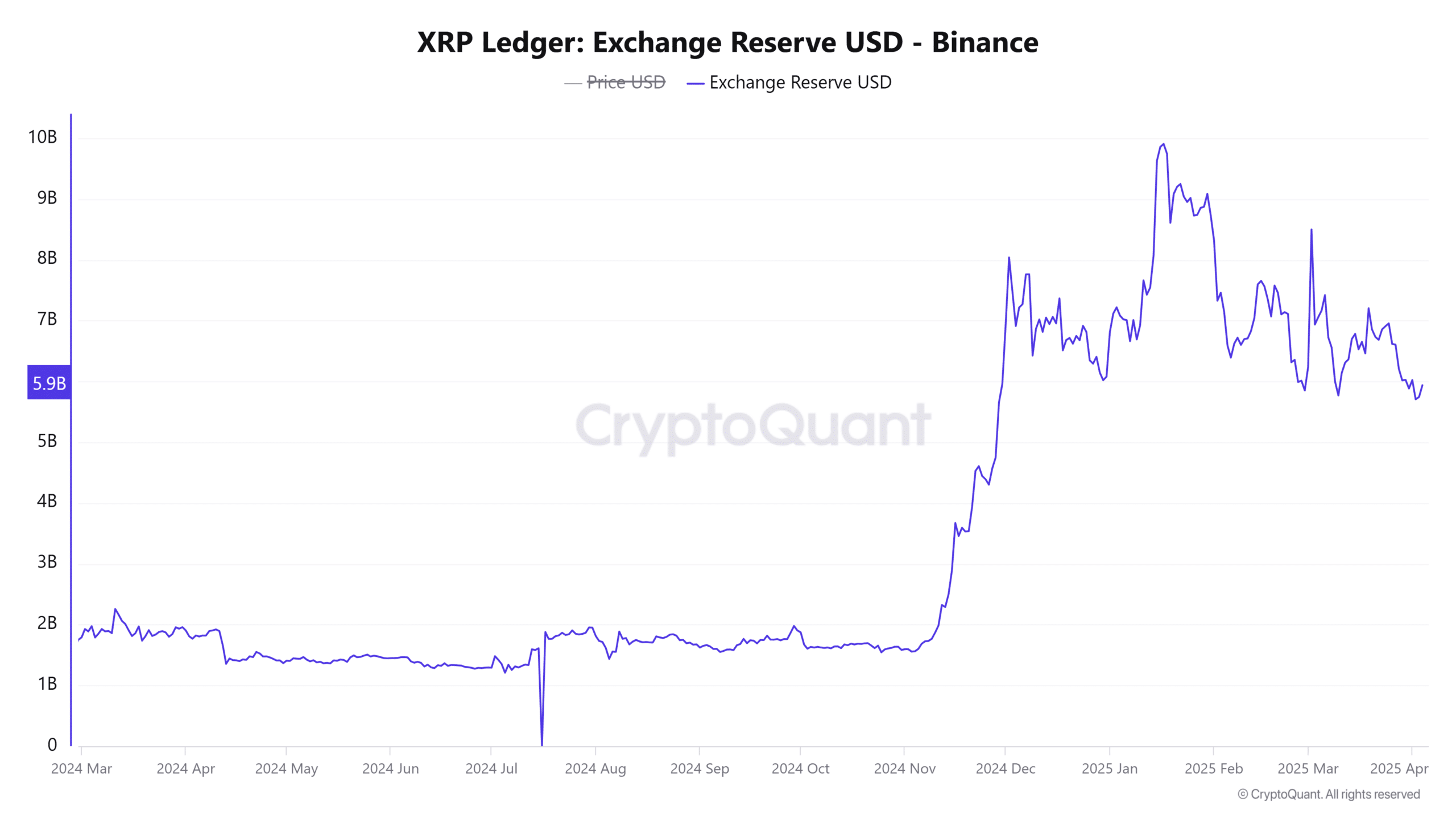

Rising exchange reserves: should traders worry or prepare?

According to data on the chains, the total exchange of XRP was at the time of the press of $ 6,066 billion, which marked an increase of 5.9% in the last 24 hours. Usually, on rising exchange reserves indicate a possible increase in sales pressure as more tokens become accessible to trade.

However, not all inflow lead to immediate landfills. Sometimes these transfers are strategic and you prepare for coming liquidity events or large accumulation zones.

Source: Cryptuquant

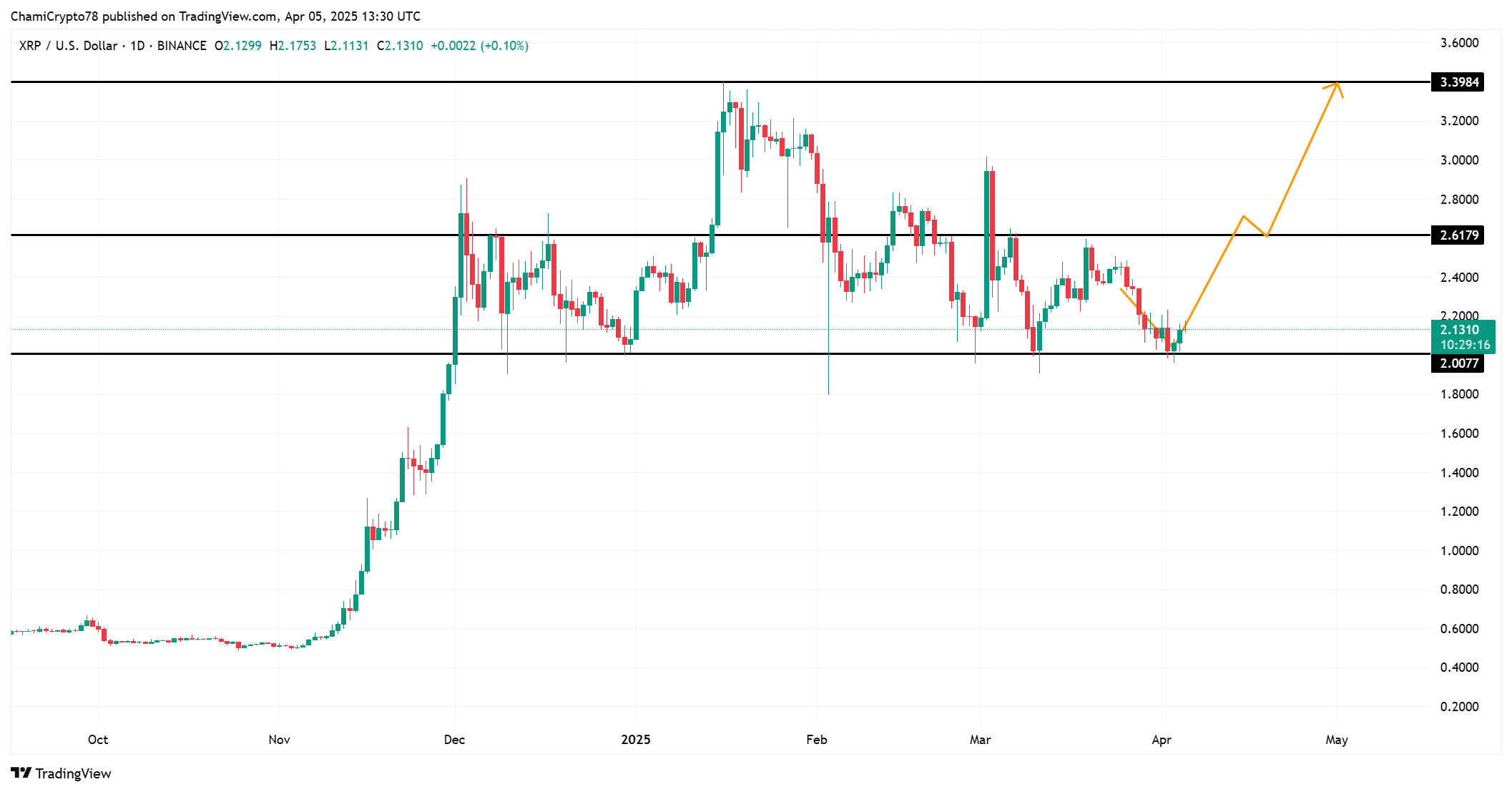

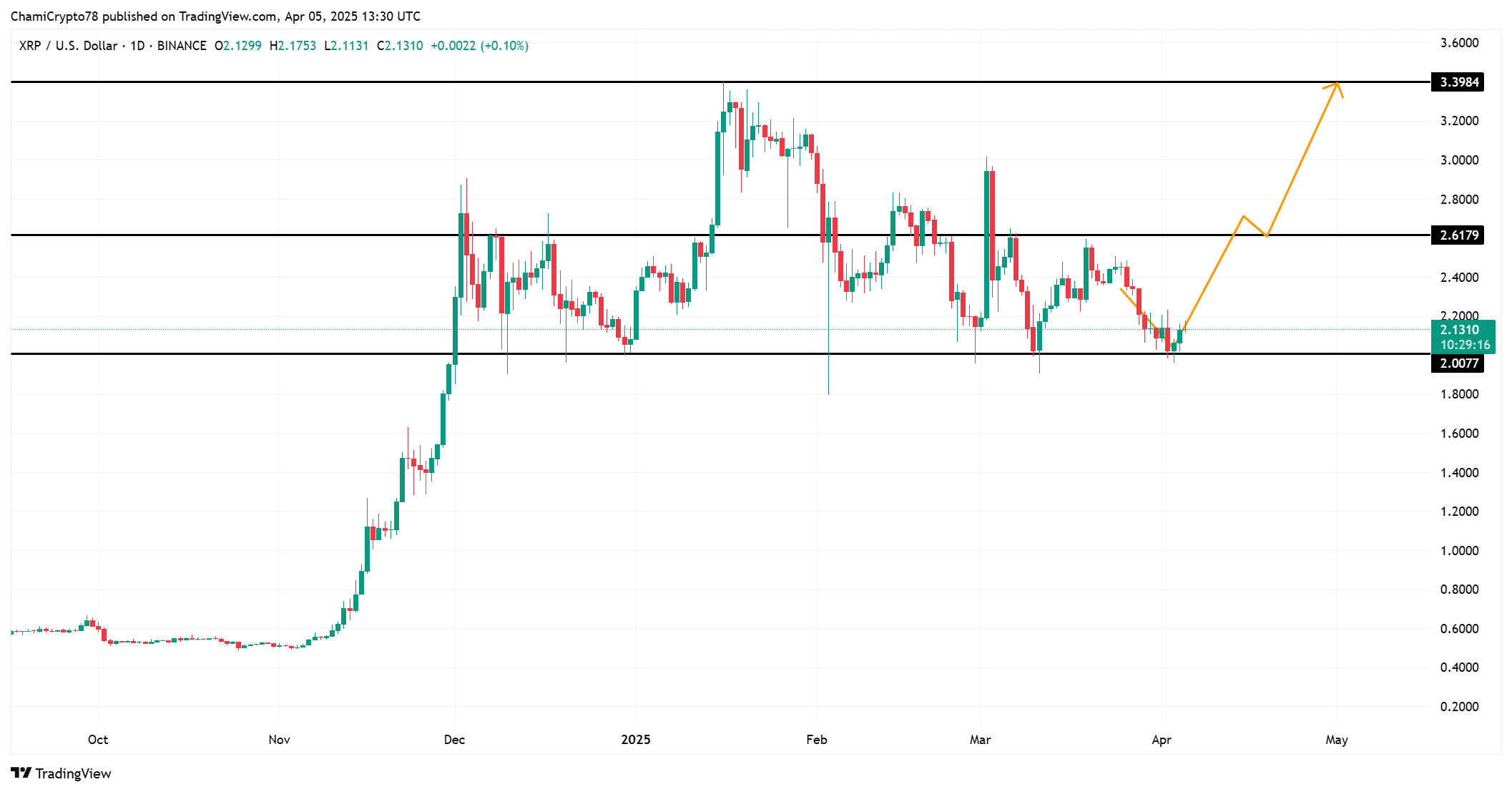

XRP Technical graph: Setting up for the next leg higher?

XRP respects a well -defined range and bounces strongly of the support level of $ 2.00 for the third time since the beginning of March. The current structure suggests the formation of a higher low, which indicates a bullish shift in Momentum.

If buyers push the price above the resistance level of $ 2.61, a quick movement to the $ 3.39 region can unfold. Moreover, an outbreak above this reach would confirm the continuation of the trend, so that new momentum traders are pulled on the market.

Source: TradingView

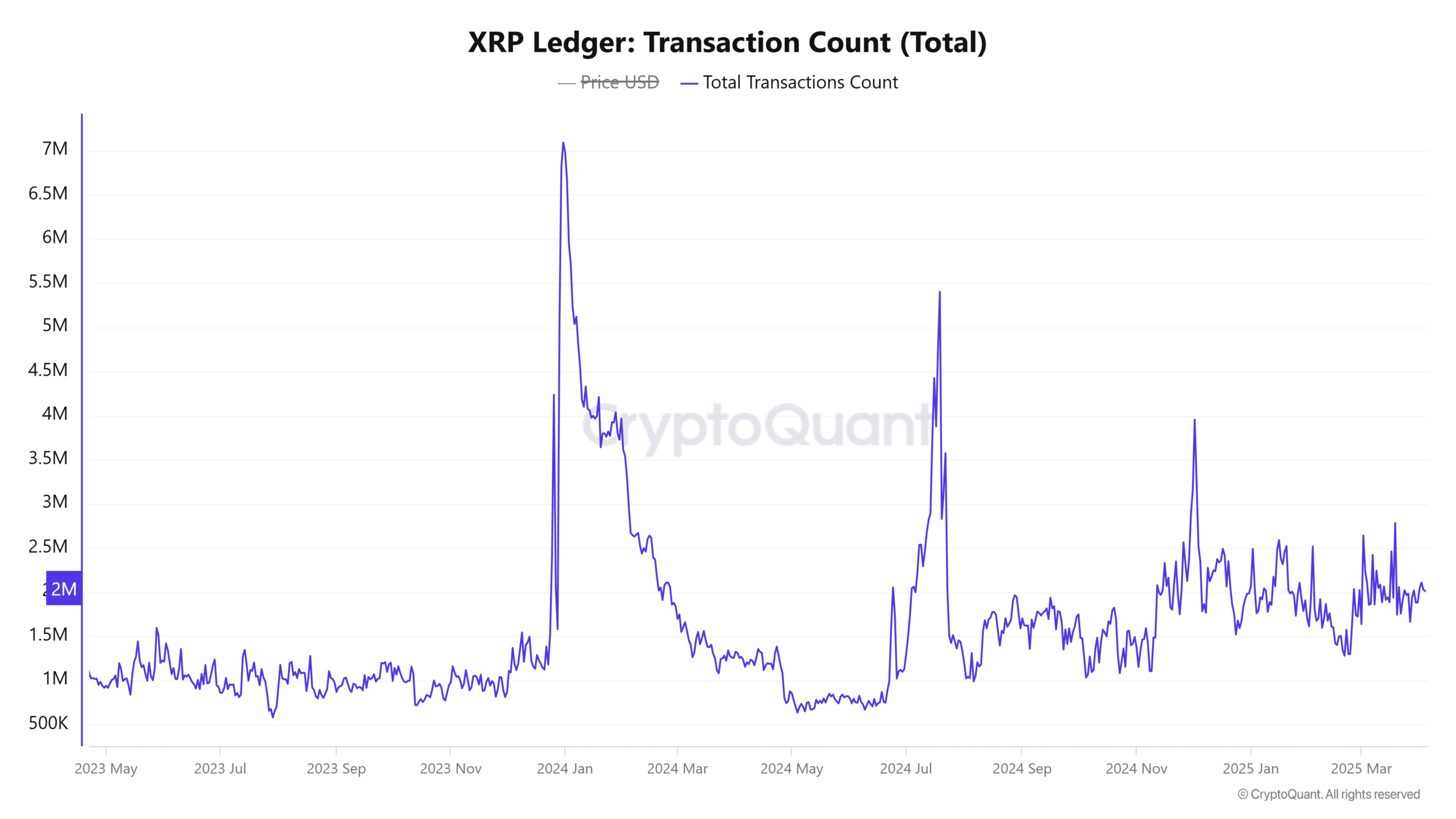

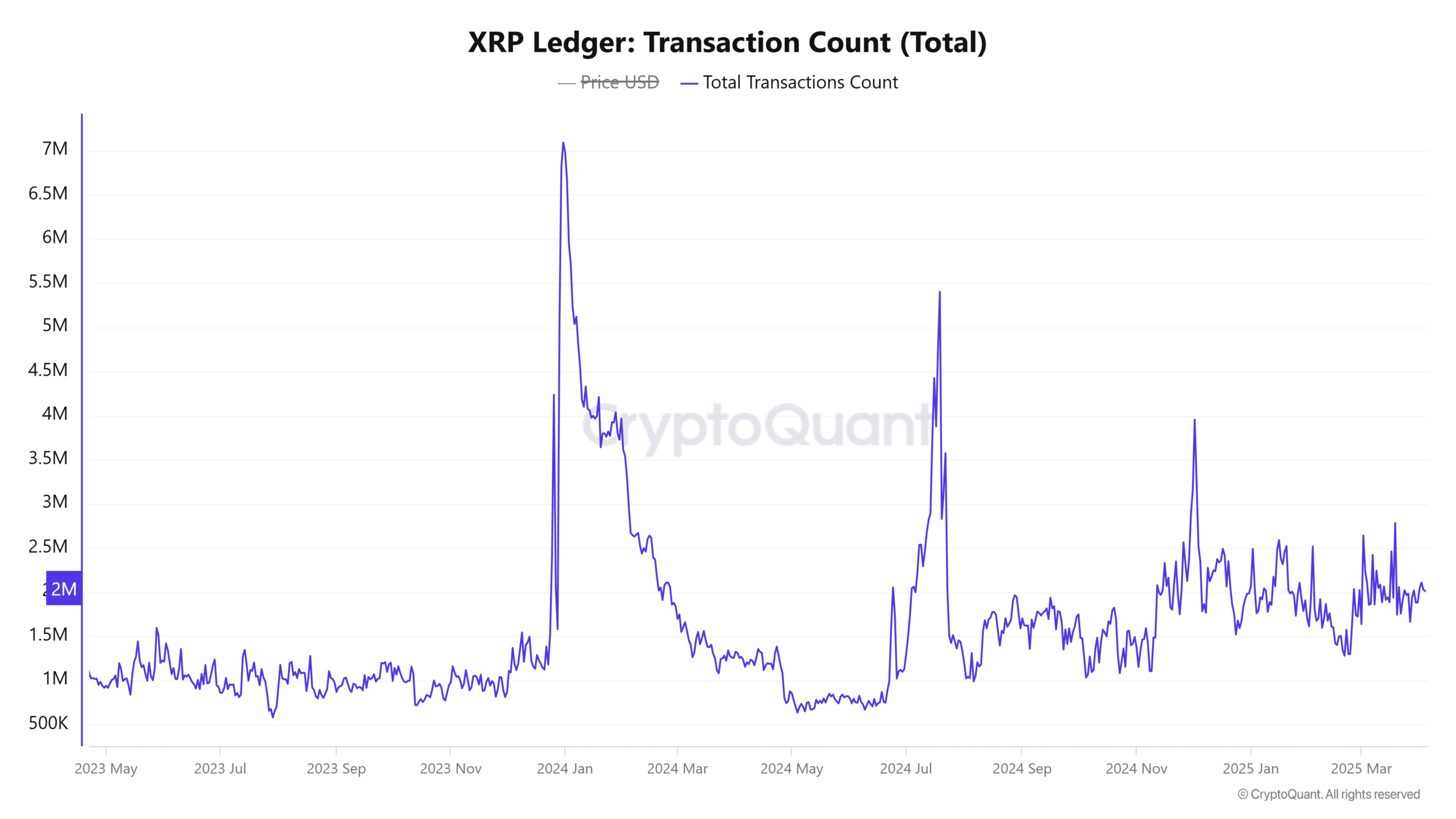

Activity on the chain is warming up-what does this mean?

On-chain statistics showed encouraging signs of renewed network participation. Active addresses grew by 0.92% for the past 24 hours and reached 21,057 unique portfolios. Moreover, the number of transactions also increased by 0.96%, by 1.94 million.

These increases reflect the rising user involvement, often prior or associated price rallies. That is why the increase in address activity closes in accordance with the growing optimism around the potential in the short term of XRP.

Source: Cryptuquant

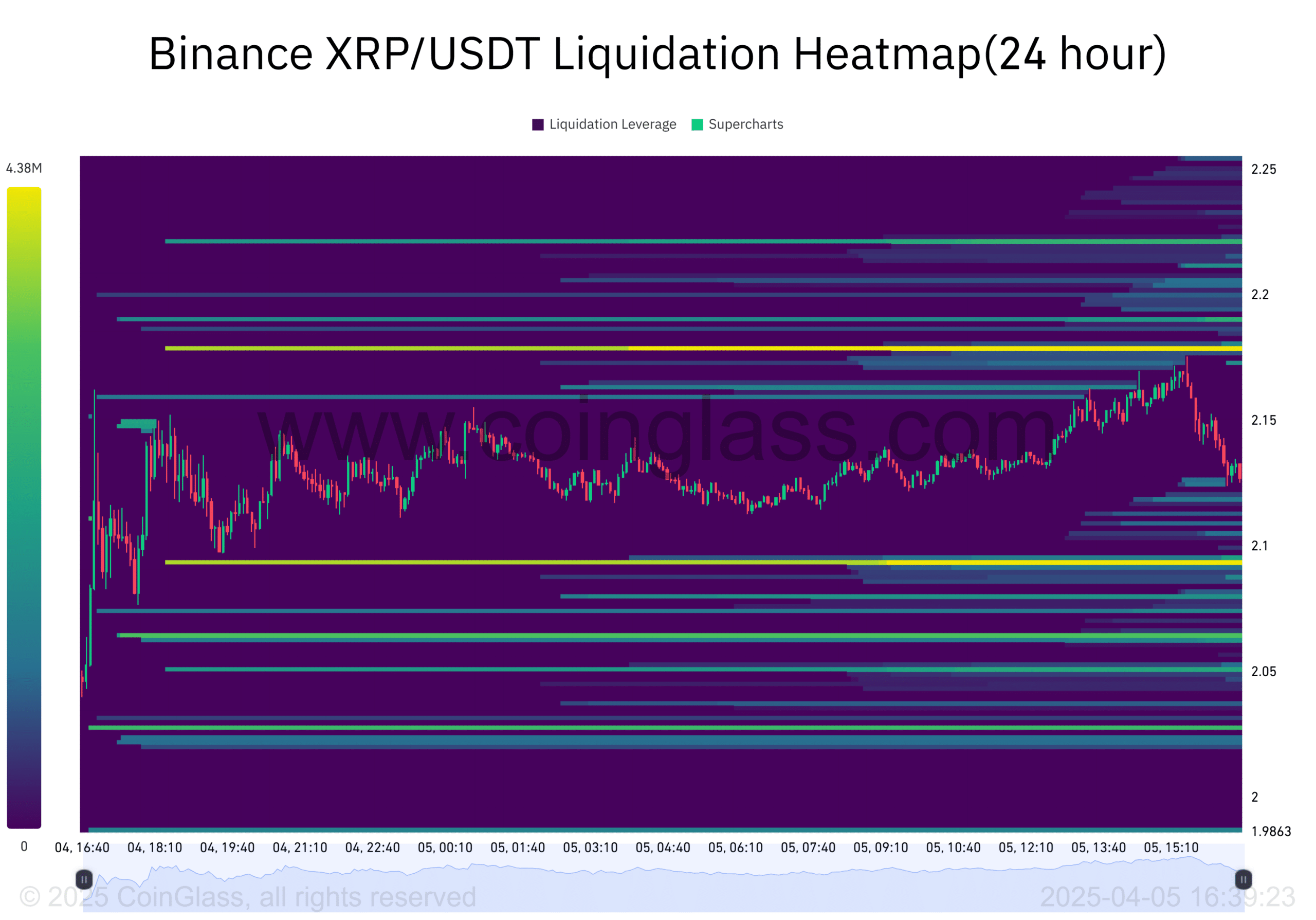

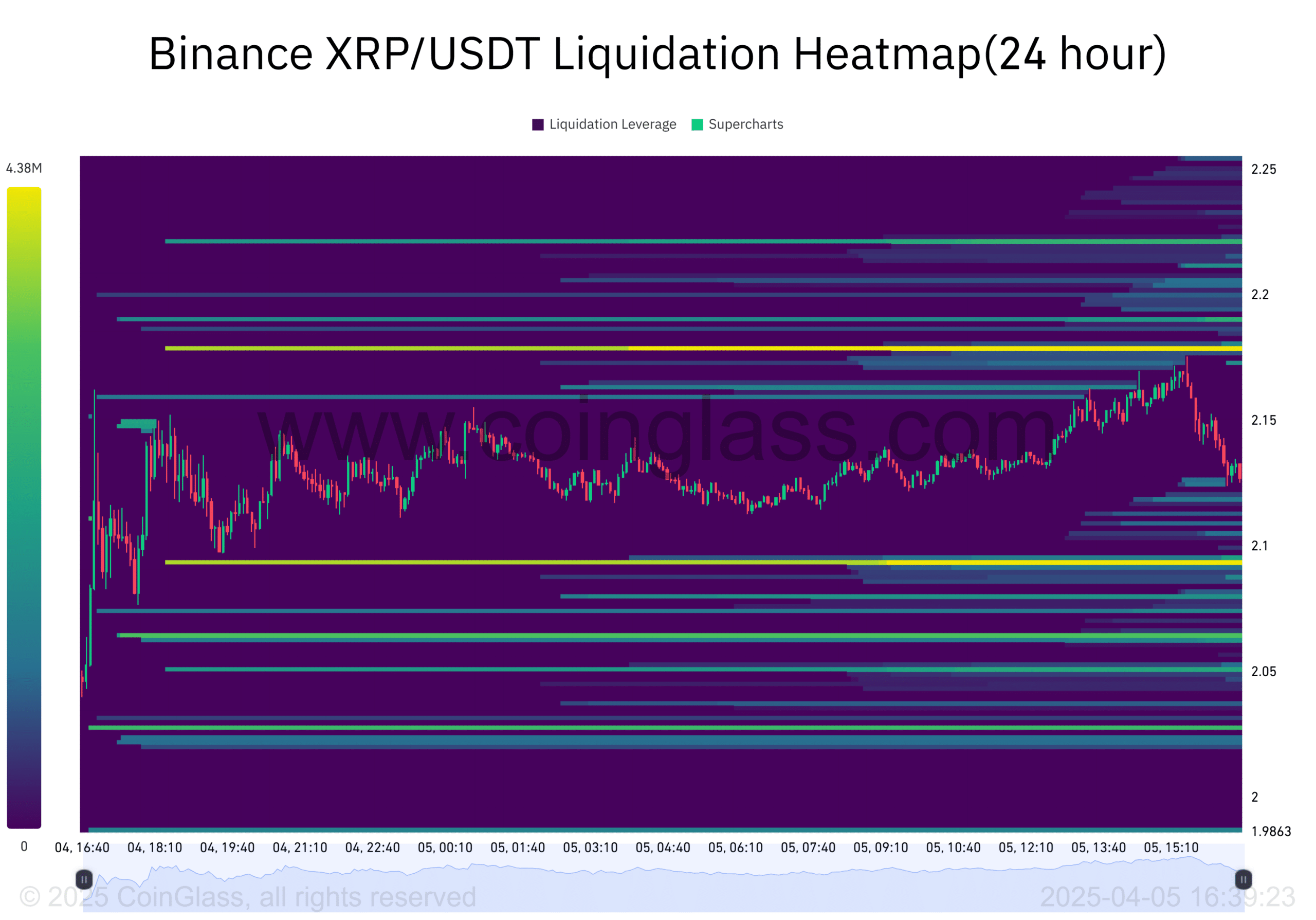

Liquidation Heat card: Where will the squeze take place?

The Binance liquidation heat shows dense liquidation clusters between $ 2.15 and $ 2.25. These levels can act as obstacles in the short term, but they also serve as a fuel for a potential outbreak.

As soon as the price infringes these areas, short liquidations can cause a step -by -step push in the direction of $ 2.60 and possibly higher. That is why this setup could quickly move to a high -volatility rally if the momentum maintains.

Source: Coinglass

Is XRP ready for an outbreak of $ 2.60?

XRP seems to be about to be from an outbreak to $ 2.60. Strong whale movement, bullish technical structure, growing activities in chains and layered liquidation levels support these prospects.

Unless a sharp reversal breaks under $ 2.00, the momentum of XRP remains firmly intact. Traders must prepare for a potentially explosive upward movement.