- XRP’s price action was somewhat bullish at the time of writing

- Lack of demand meant the altcoin’s road north could be slow

The U.S. Securities and Exchange Commission filed its latest appeal on Thursday. The appeal aims to overturn parts of the ruling made in favor of Ripple and XRP in July 2023. This, although the SEC is now not contesting the decision that the sale of XRP through exchanges to retail investors was not a sale of securities.

The impact of this appeal on the price was negligible. For the most part, XRP has traded between the $0.52 and $0.62 levels since July. This trend has not changed and at the time of writing the token was still in a consolidation phase.

A positive response could encourage XRP buyers

Source: XRP/USDT on TradingView

XRP’s market structure was technically bullish, but the smaller range between $0.52-$0.62 meant that this fact was not very significant. The defense of the $0.52 level in October could be the trigger swing traders have been looking for to go long.

Buying volume was weak in October, even though XRP is up 8% from its low. The OBV showed this observation and maintained a support level from August. The CMF has indicated strong selling pressure over the past twenty periods as the calculation takes into account the sharp rejection from the $0.665 level.

The daily RAI was just below neutral 50. All in all, swing traders may choose to go long based on the price action, but strong demand has not materialized. There is a good chance that other large-cap altcoins will outperform XRP in the coming days or weeks.

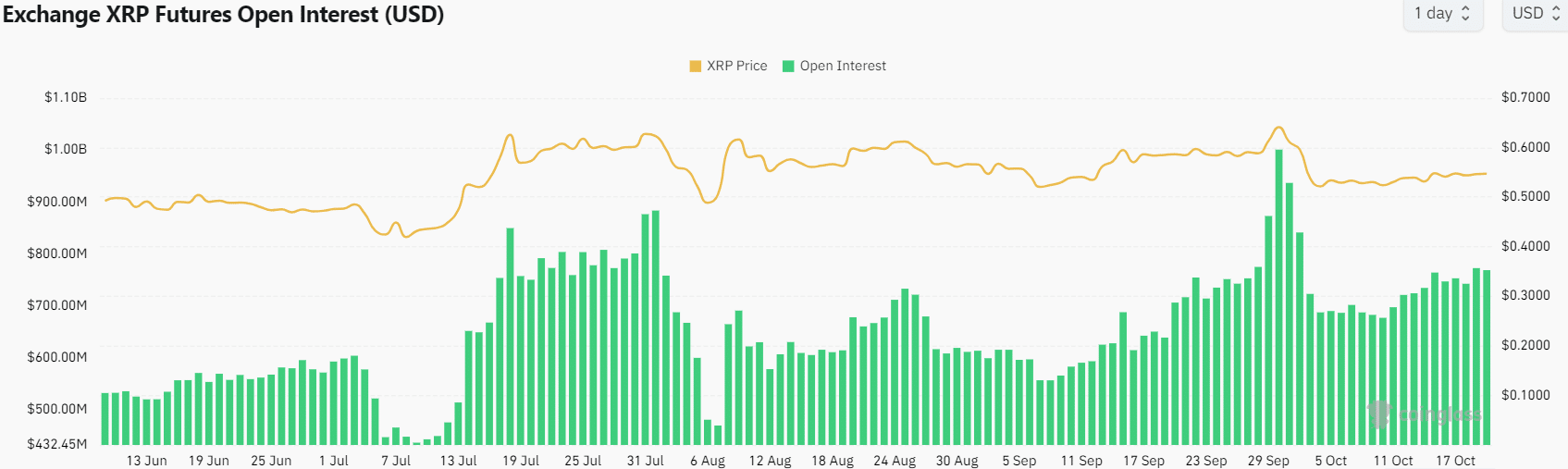

Derivatives data did not support the bullish case

Open Interest was $772 million, a level that has been maintained for most of the time since July. A price move above $0.62 would attract more speculators, as it did at the end of September.

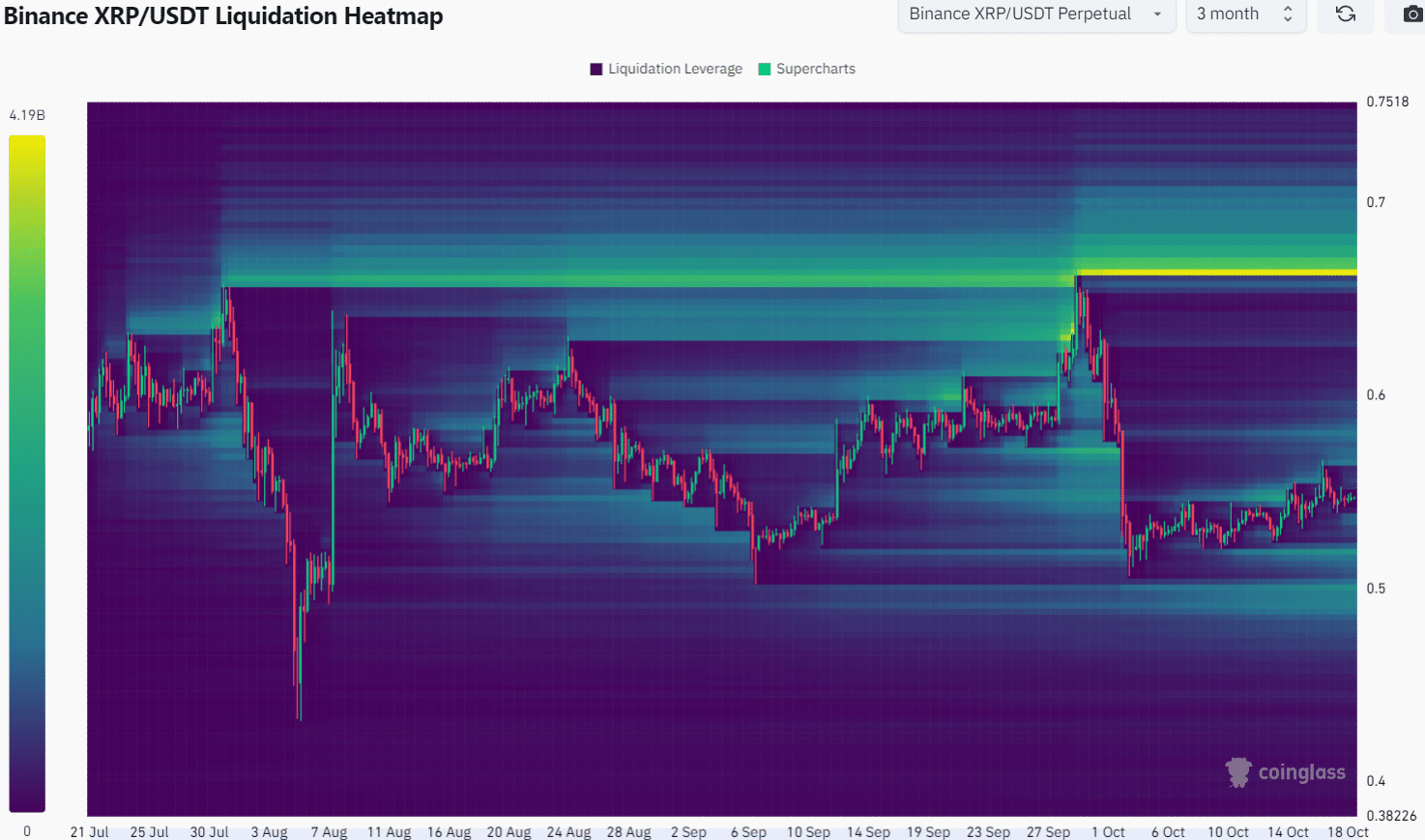

It may take a news event to catalyze a real break past the $0.62 resistance. In fact, the three-month lookback liquidation heatmap showed that the $0.667 level would be the next target in such a scenario.

Is your portfolio green? Check the ripple profit calculator

Looking at the lower time frame heatmaps, the USD 0.52 and USD 0.57 levels appear to be the nearby magnetic zones that could force the short-term price trends to reverse.

Disclaimer: The information presented does not constitute financial advice, investment advice, trading advice or any other form of advice and is solely the opinion of the writer