- The main and shoulder pattern of XRP is at a critical level and test important support and resistance.

- Rising daily active addresses contrast with falling transaction, which marks a mixed market sentiment from mixed.

XRP Tested a critical level in his price action, acted at $ 2.26 at the time of the press and reflected a decrease of 3.26% at the time of writing.

The price approached the neckline of a head and shoulder pattern, which is sharp. The left shoulder was formed at the end of 2024, with the head reaching its peak in December.

If XRP can prevent it from being closed under the neckline and being able to rise above the right shoulder, this can invalidate the bearish pattern. Consequently, this can lead to a bullish breakout, so that the price may be pushed to $ 5.

Source: TradingView

However, if XRP cannot break the resistance, the bearish -by -views could prevail.

XRP has critical levels to pay attention to possible price action. The immediate support level was $ 2.02, which has kept strong in recent weeks. If XRP falls under this support, this may further disadvantage.

On the other hand, resistance near $ 2.95 is an important barrier for the price of XRP. If the price breaks above this level, a strong bullish move could follow.

That is why the market will probably respond strongly around these key levels, which determines the next step for XRP.

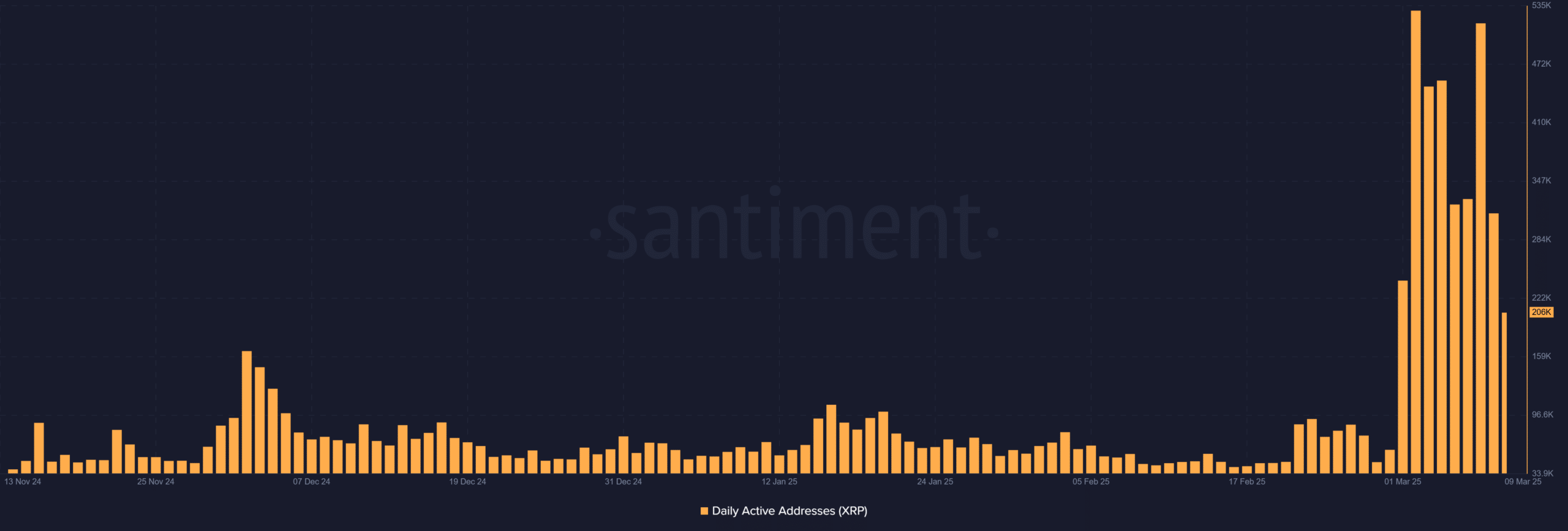

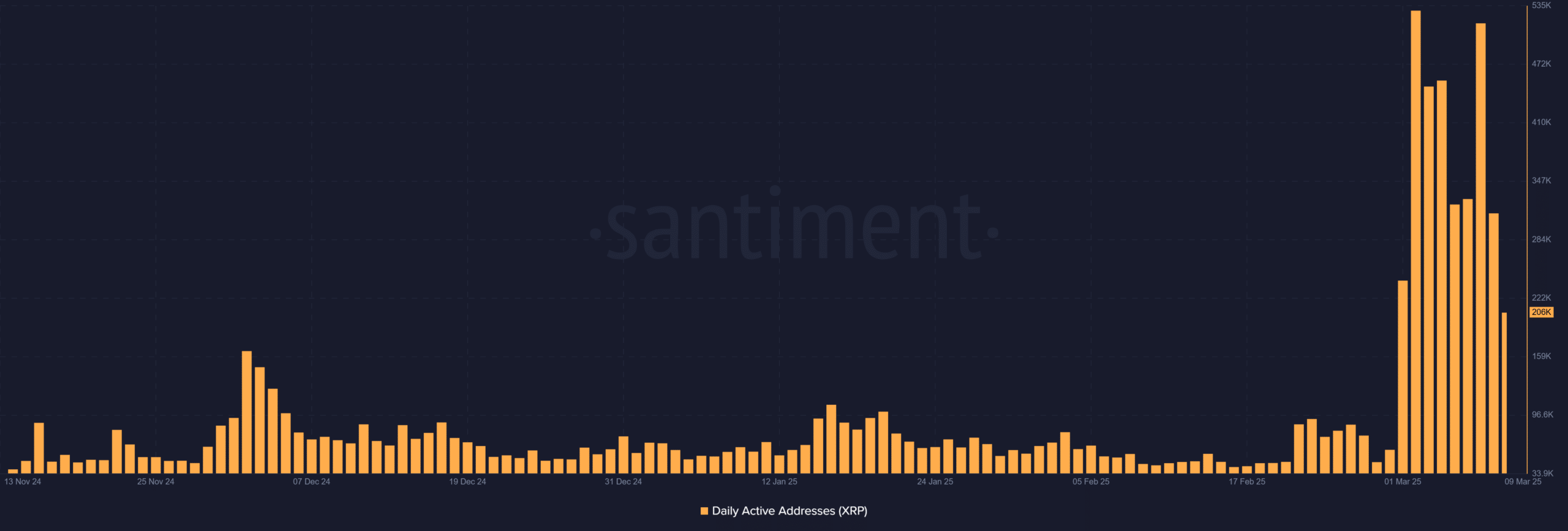

Are the rising daily active addresses a positive sign?

XRP has seen a remarkable increase in daily active addresses and reaches more than 206k on March 9, 2025. This increase in activity indicates the growing involvement in the network, which is often seen as a positive sign for adoption.

Higher daily active addresses usually suggest more interest in the cryptocurrency. As a result, this could support a bullish outlook for XRP.

However, the general market sentiment will still play an important role in determining the price movement.

Source: Santiment

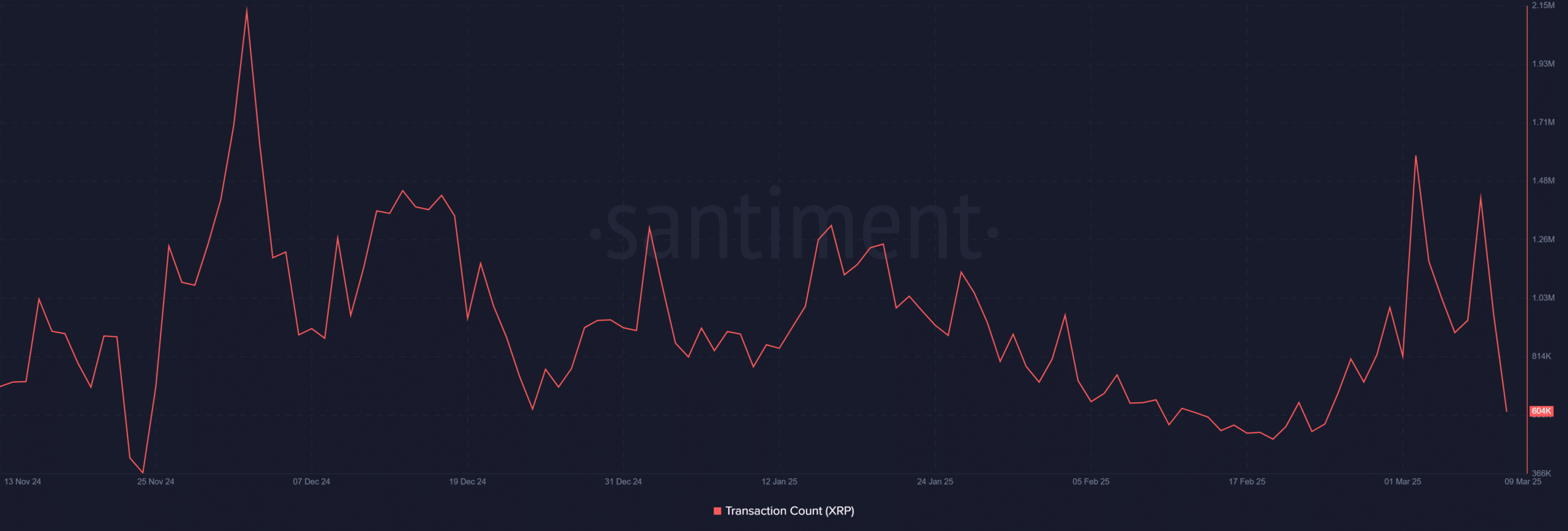

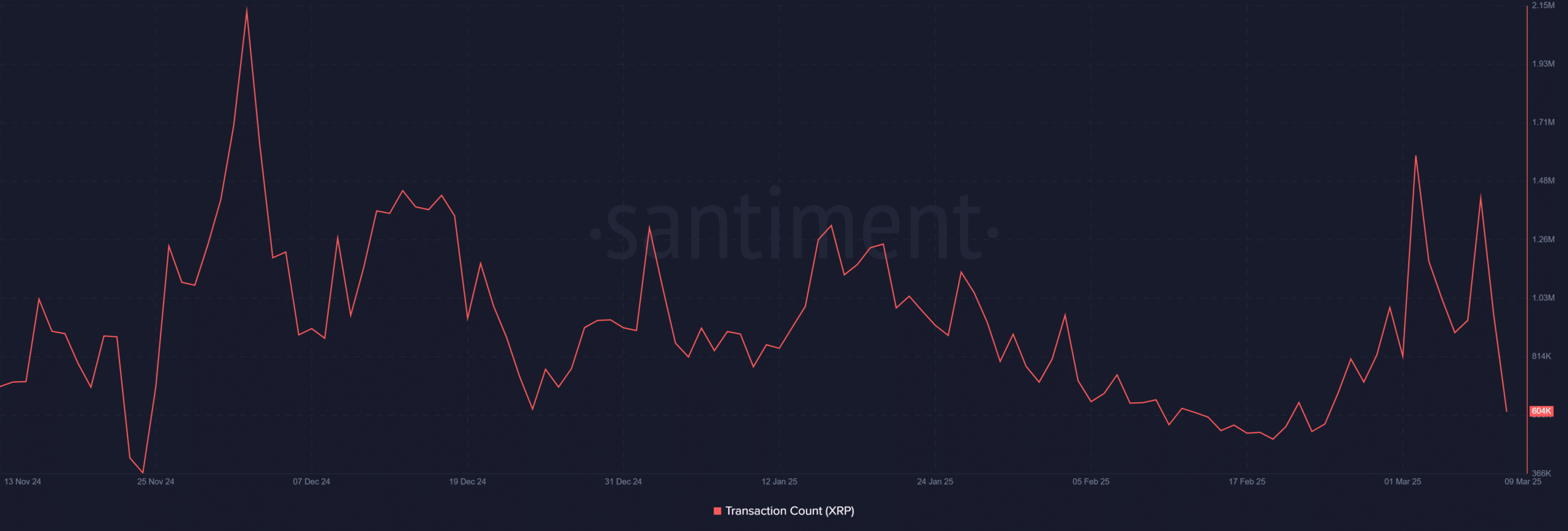

What does the decrease in the number of transactions mean?

Despite the increase in daily active addresses, the number of transactions from XRP has fallen. The latest data shows a decrease of 604k transactions, which suggests that fewer users are involved in the network.

This decrease in the transaction volume can indicate weakening momentum. As a result, bullish expectations could temper in the short term.

That is why this trend suggests caution, because a lower transaction activity can indicate less market interest rate.

Source: Santiment

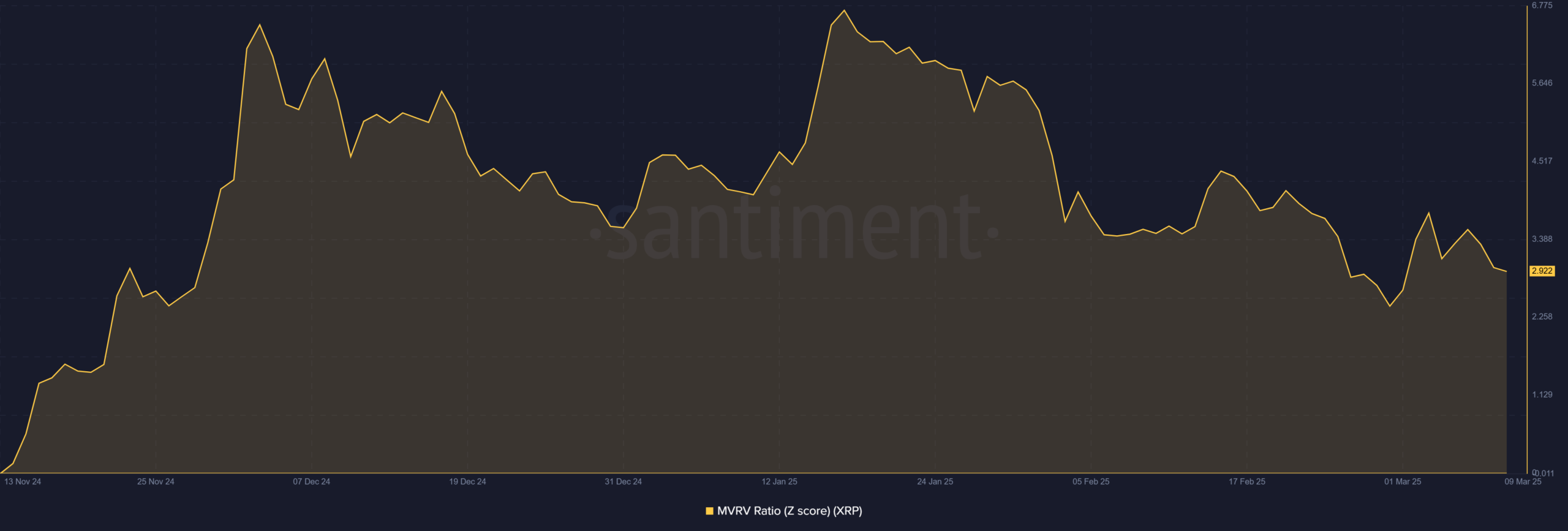

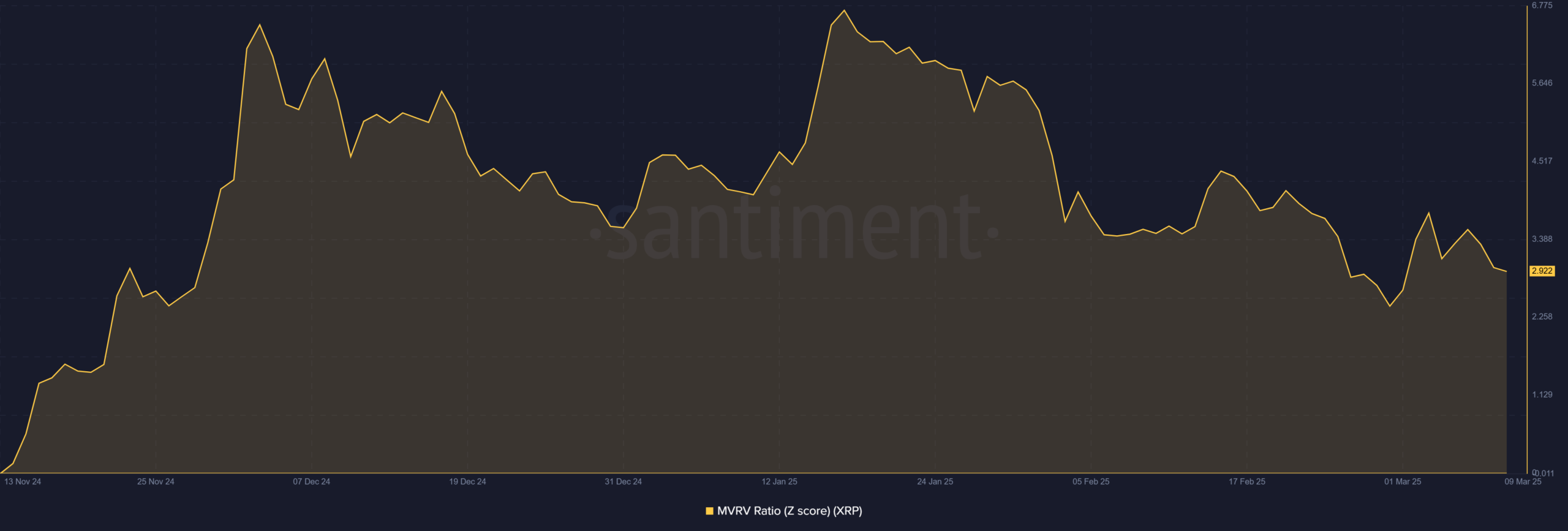

MVRV ratio indicates …

The MVRV ratio (Z -score) for XRP has fallen slightly to 2.92, suggesting that the market cooled after recent profits.

Although the ratio remains positive, the slight decrease can indicate that XRP is approaching overbough conditions.

However, the decrease is not substantial enough to create immediate concerns. Although the MVRV ratio points to a potential delay, it therefore does not yet suggest a significant price correction.

Source: Santiment

XRP has previously been confronted with a bearish continuation. Despite the rise in daily active addresses, the falling transaction count and a slight decrease in the MVRV ratio to weakening momentum indicate.

The main and shoulder pattern also indicates potential disadvantage if XRP fails to break above the most important resistance levels.

That is why the current price promotion suggests that XRP has difficulty maintaining an upward momentum, making a bearish continuation the more likely outcome.