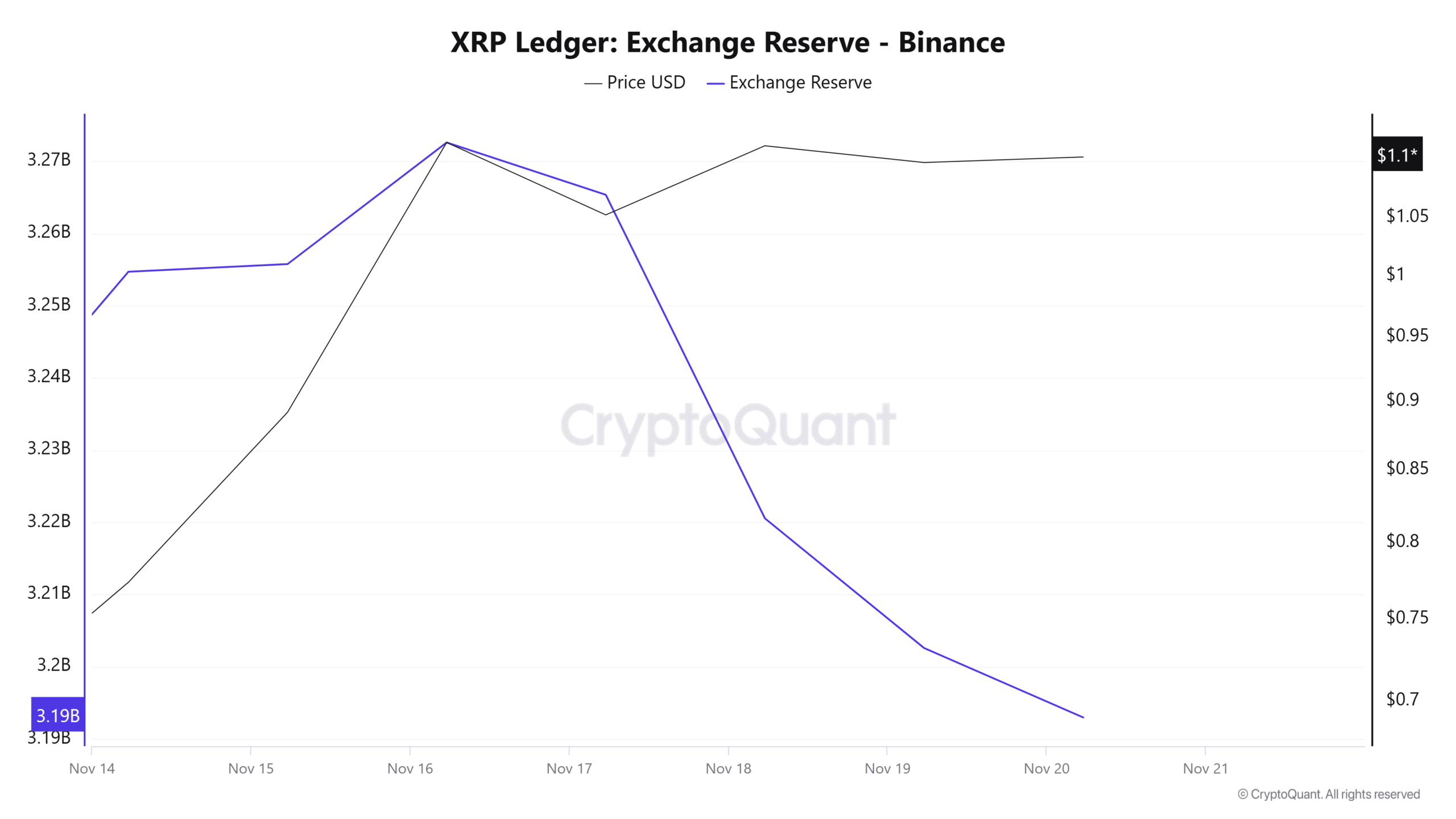

- XRP reserves on exchanges are continuously declining, indicating significant withdrawals of tokens by whales and institutions.

- XRP could rise 63% to reach the $1.90 level if it closes a candle above the $1.15 level.

Ripple [XRP] has received significant attention from whales and institutions following the formation of a bullish price action pattern.

In addition, Bitcoin [BTC] has driven the overall cryptocurrency market to new heights. This shifted market sentiment from consolidation to an uptrend as it approached the $100,000 mark.

XRP whale bags tokens worth $124 million

Amid this bullishness, on November 20, a crypto whale transferred nearly 111 million XRP tokens worth $123.59 million from Binance to an unknown wallet.

This significant pullback may be driven by bullish market sentiment and XRP’s strong price action.

Furthermore, XRP reserves on exchanges continued to decline, indicating that retailers, whales, and institutions were significantly withdrawing tokens.

This is a bullish sign because it reduces the chance of a price decline for the asset.

Source: CryptoQuant

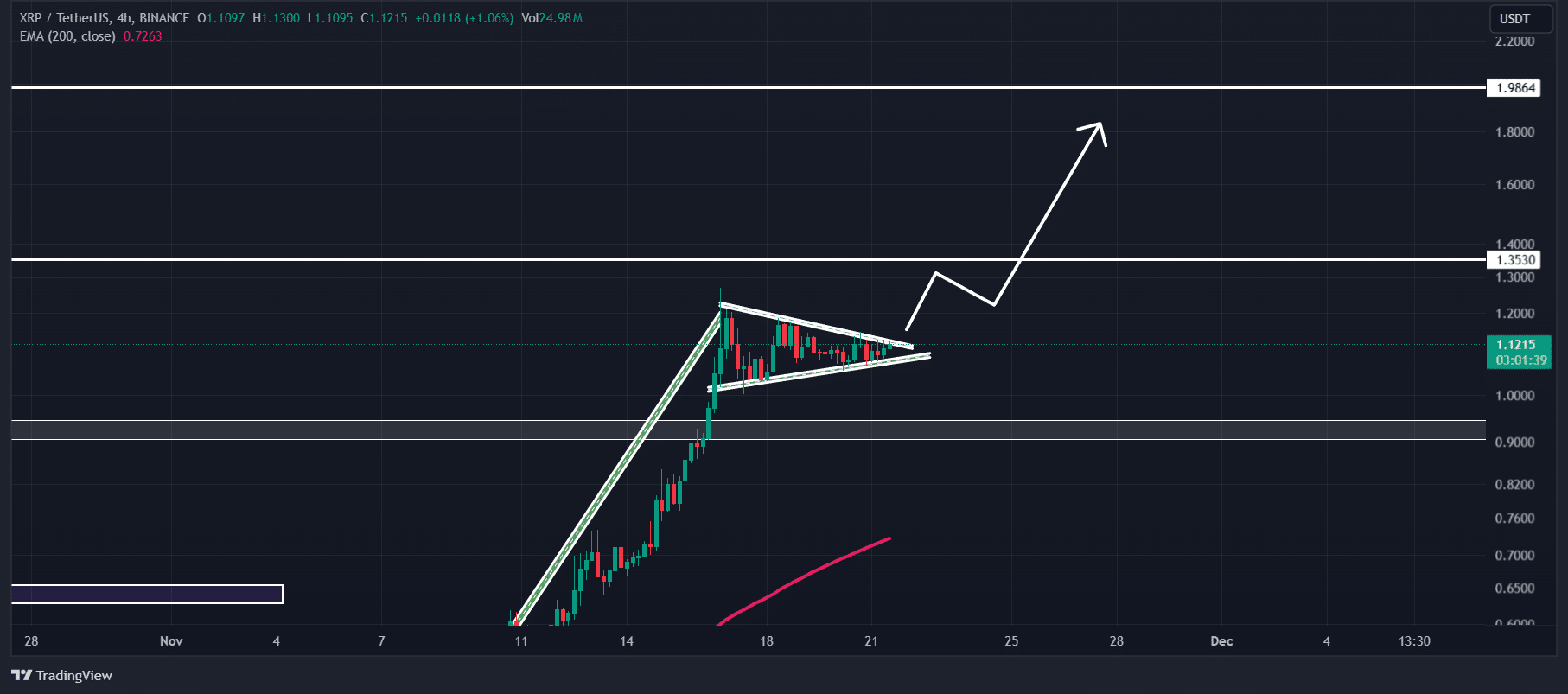

The technical analysis and key levels of XRP

AMBCrypto’s technical analysis showed that XRP formed a bullish pennant price action pattern within a four-hour time frame. It was on the verge of an outbreak.

If XRP breaks this pattern and closes a candle above $1.15, it could rise 63% to reach $1.90 in the coming days.

Source: TradingView

XRP’s Relative Strength Index (RSI) and the 200 Exponential Moving Average (EMA) indicated bullish momentum. This highlighted a potential upside rally in the coming days.

Increasing open interest

However, the on-chain metrics further supported the altcoin’s bullish outlook.

According to on-chain analytics company Coinglass, traders are actively participating in trading activities, leading to a significant increase in Open Interest (OI).

Over the past 24 hours, XRP’s OI is up 4.5%, with a gain of 2.78% in the past four hours. This growing interest in the altcoin indicates a bullish trend.

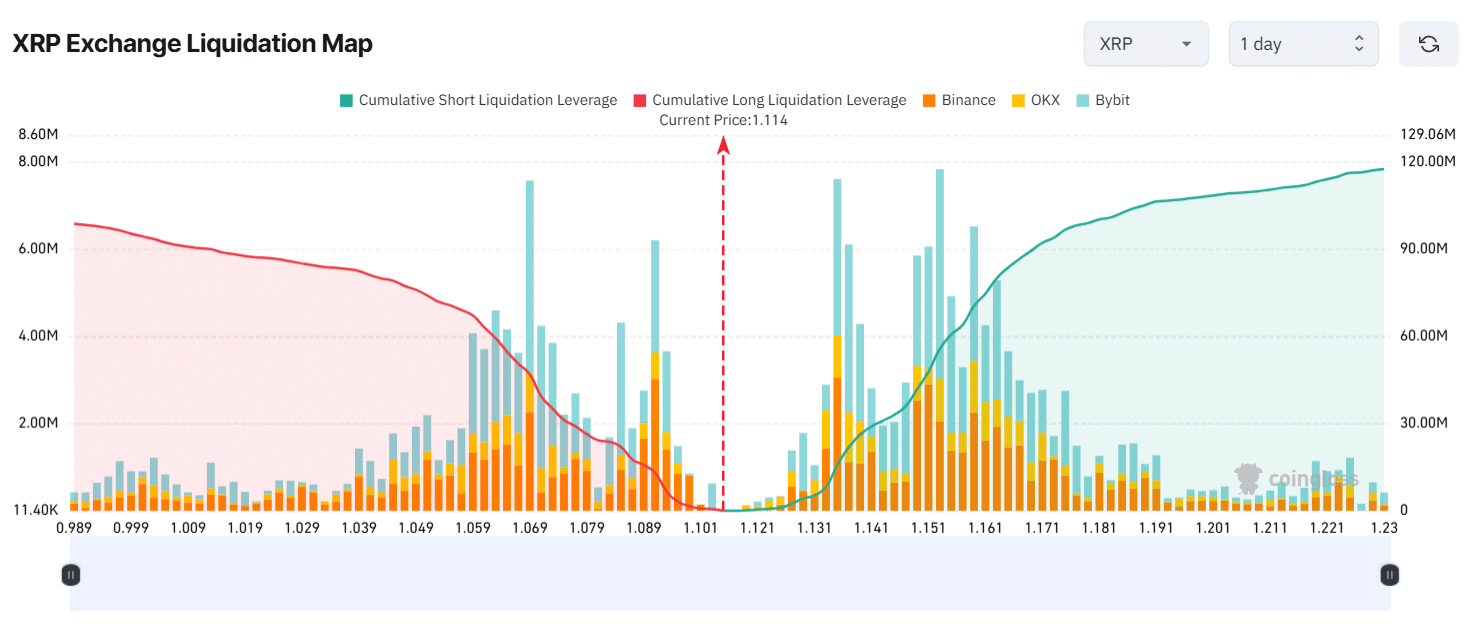

Key liquidation levels and market sentiment

Examining where traders are currently placing bets on XRP, the data shows that the key liquidation levels are $1,069 on the downside and $1,135 on the upside.

According to Coinglass, traders at these levels are overleveraged.

Source: Coinglass

If market sentiment remains bullish and the price rises to $1,135, short positions worth nearly $15.76 million will be liquidated.

Conversely, if sentiment changes and the price falls to $1,069, long positions worth almost $49 million will be liquidated.

This liquidation data indicates that bulls with long positions have strongly dominated the assets over the past 24 hours compared to short sellers.

Realistic or not, here is the XRP market cap in terms of BTC

At the time of writing, XRP was trading around $1.13 and has registered a price increase of over 3.2% in the past 24 hours.

During the same period, trading volume has increased by 25%, indicating greater participation from traders and investors amid a bullish outlook.