In a ruling that could help shape the future of cryptocurrency regulation in the United States, U.S. federal judge Analisa Torres has issued a mixed verdict in the case between the Securities and Exchange Commission (SEC) and the San Francisco-based blockchain company Ripple Labs. The lawsuit, which was closely watched by the crypto industry, centered on whether Ripple’s XRP token constituted an unregistered security offering.

The court ruled that while Ripple’s institutional sale of XRP was indeed an unregistered securities offering, the sale of the token on exchanges did not. The decision — which comes after a three-year legal battle — could set a precedent for future token classification cases and currently has the crypto market responding.

Long ago

The SEC initially filed a lawsuit against Ripple Labs in December 2020 alleging that the company raised $1.4 billion through an unregistered securities offering. The court granted part of the SEC’s motion related to $728 million in institutional sales.

In its ruling, the court stated that “reasonable investors…in the position of institutional buyers would have bought XRP expecting to reap profits from Ripple’s efforts.” However, the court also ruled that “XRP, as a digital token, is not in itself a ‘contract, transaction[,] or scheme’” that embodies the requirements of an investment contract according to the Howey test.

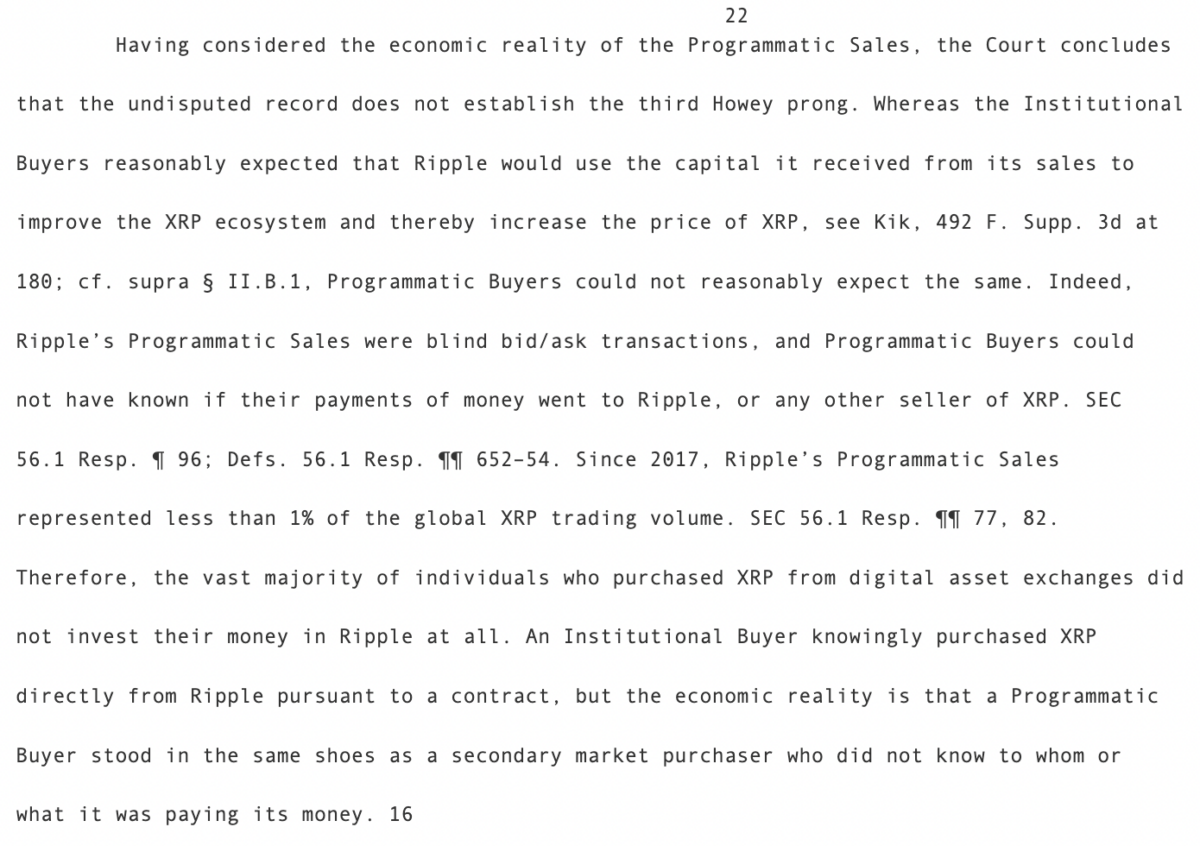

“After considering the economic reality of the programmatic sale, the court concludes that the undisputed record does not constitute the third Howey prong,” the legal filing said. “While the institutional buyers reasonably expected Ripple to use the capital it received from its sales to improve the XRP ecosystem and thereby increase the price of XRP […]Programmatic Buyers could not reasonably expect the same.”

The court decision also addressed Ripple’s “essential ingredient” defense, in which the company argued that a physical contract must exist to be considered an investment contract. The court ruled against this defense, stating that in every instance where Ripple offered or sold XRP as an investment contract, a contract did indeed exist.

The ruling also covered the roles of Ripple co-founder Chris Larsen and CEO Brad Garlinghouse. The judge concluded that “On the basis of the disputed facts on file, […] a reasonable juror could determine that Larsen and Garlinghouse were unaware of or recklessly ignored Ripple’s Section 5 violations.”

In response to the ruling, Garlinghouse tweeted, “We were on the right side of the law and will be on the right side of history.”

How Hinman’s emails played a role

The case also brought attention to the so-called Hinman documents, internal SEC drafts and emails related to former director William Hinman’s speech from more than four years ago. These documents, which Ripple’s defense team gained access to after they were publicly released, suggested that the regulator may be picking which projects to target.

The ruling comes at a time when the SEC has become increasingly active in its enforcement actions against various cryptocurrency projects. However, the decision in the Ripple case may signal a shift in how the SEC approaches the classification and regulation of digital tokens and how judicial authorities are considering similar cases involving Web3 organizations.

The news has caused the crypto market to bounce back, with the XRP token rising to $0.6993 and ETH rising to $1,988, pushing the tokens up 48.61 percent and 5.21 percent respectively as of this writing. percent increased.

Editor’s Note: This article was written by an nft now contributor in collaboration with OpenAI’s GPT-4.