- XRP catches up again for the first time since 2021.

- Whale running ease; Dormant wallet activity refers to a possible phase with building and accumulation.

Ripple [XRP] has recovered third place by market capitalization, catching up tether [USDT] In a movement that shows renewed investor confidence.

The rally marks an important milestone in the way to restoring token, with data on chains that add weight to the momentum.

While whale activity is cooling, a wave of long-term wallet reacts to deeper shifts-somewhat suggests that this outbreak can be more than a short-term peak.

XRP Reclaims #3 Markt Cap Spot

XRP has officially exceeded Tether to become the third largest cryptocurrency of market capitalization, a position that it has not held since the beginning of 2021.

Trade on $ 2.49 – Short touch of $ 2.60 – The revival of XRP seems to be supported by more than just market sentiment.

Source: Coinmarketcap

A proposed Missouri Bill (House Bill 594) could make the State the first in the US to allow full income tax deduction of digital assets, including XRP.

The number of XRP holders has also grown by more than 11% in 2025, while the increased utility in the practice-network as the new mention as a payment method on Travala is further increases.

Signs of stabilization

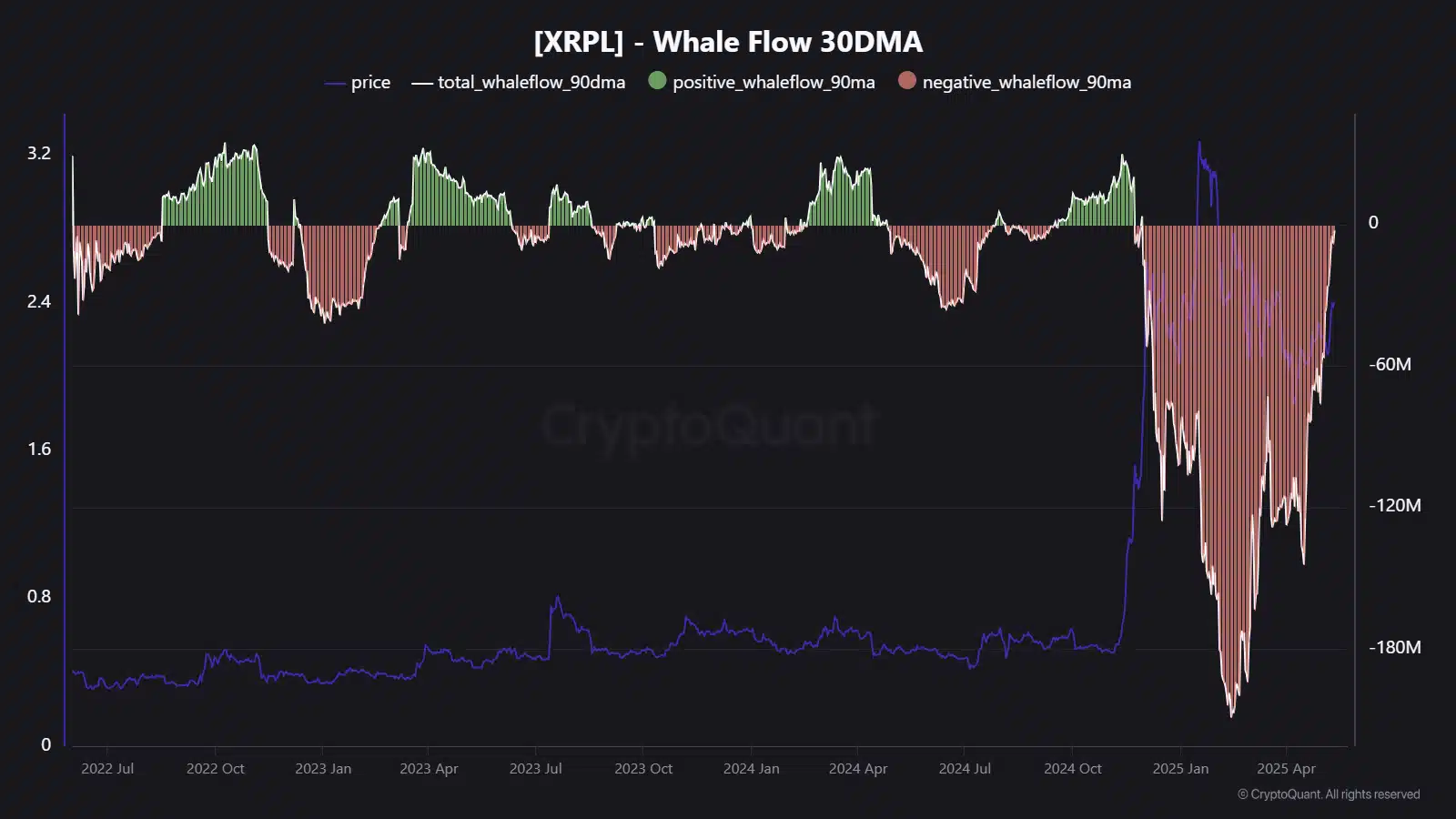

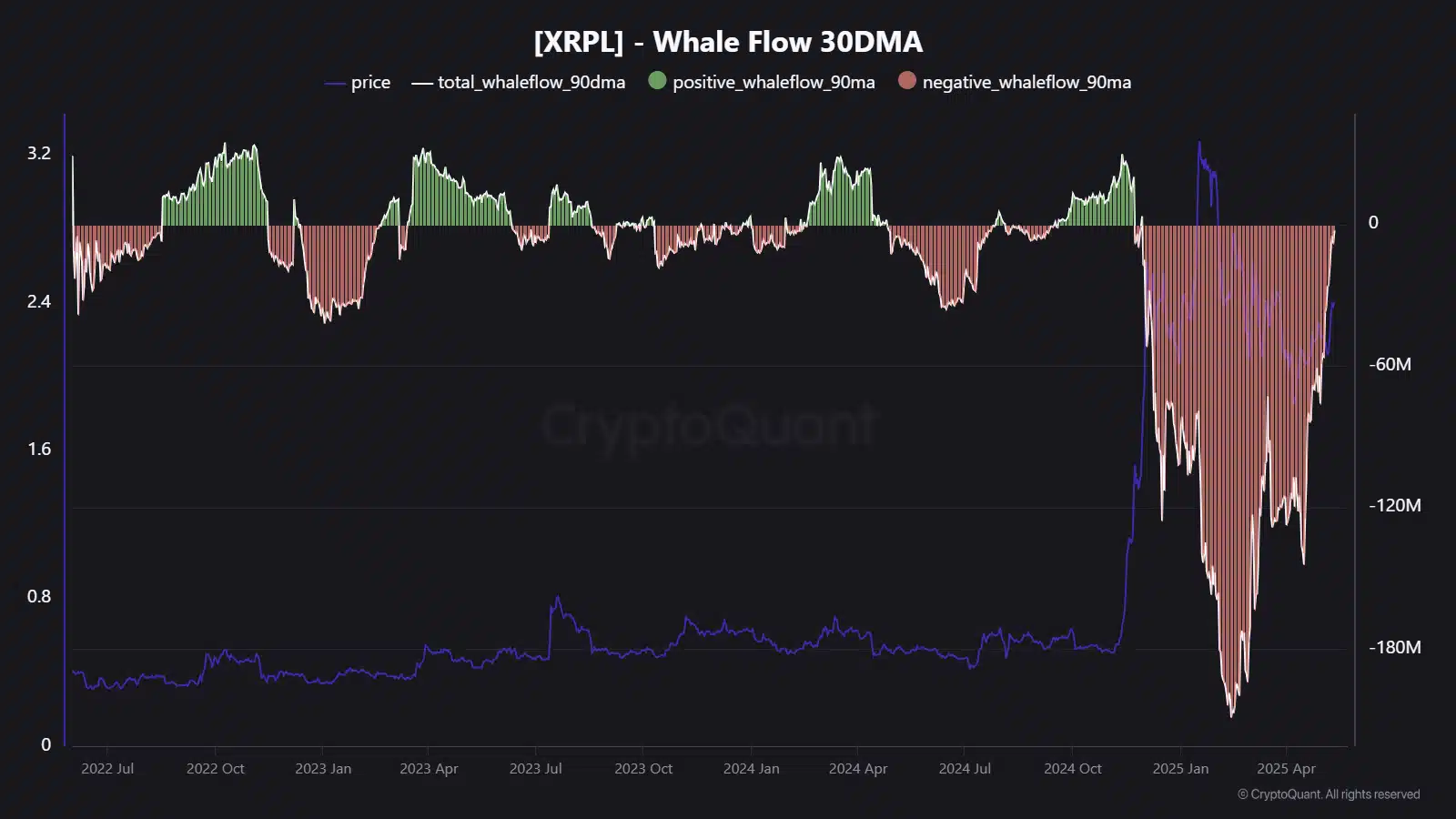

The 30-day progressive average Whale activity is now curling upwards.

Source: Cryptuquant

Data from the chains shows that the total whale flow remains negative, but the steep decline has fallen considerably since March 2025.

Historically, such shifts preceded long -term price repair. The graph reflects this trend, with red rods softening and approaching neutral territory.

Although the 30DMA does not yet have to turn green, the delay on the weakening of Beerarish indicates pressure.

This shift can lay the foundation for a more stable base – and possibly the next leg up.

Why the delay matters

XRP is confronted with months of persistent whale running, one of the worst since the beginning of 2023. These outsource have put pressure on both price and investor sentiment.

Net streams are now stabilizing and the price diagram shows renewed strength, some careful optimism.

Usually, when the whale base flows outside and starts to restore, this indicates accumulation or basic buildings.

In earlier cycles, such as mid -2023, similar whale activity preceded several weeks of rallies. If this current delay continues, this may indicate a shift from volatility to consolidation.