In a recent technical analysis published by crypto analyst Egrag, an inverse head and shoulders (H&S) formation has been identified on the XRP/USD chart, indicating a potential bullish reversal in the short term. The pattern, which has formed over the past two weeks, suggests that XRP could be preparing for a significant price increase.

XRP Price Poised for an Upcoming 20% Jump?

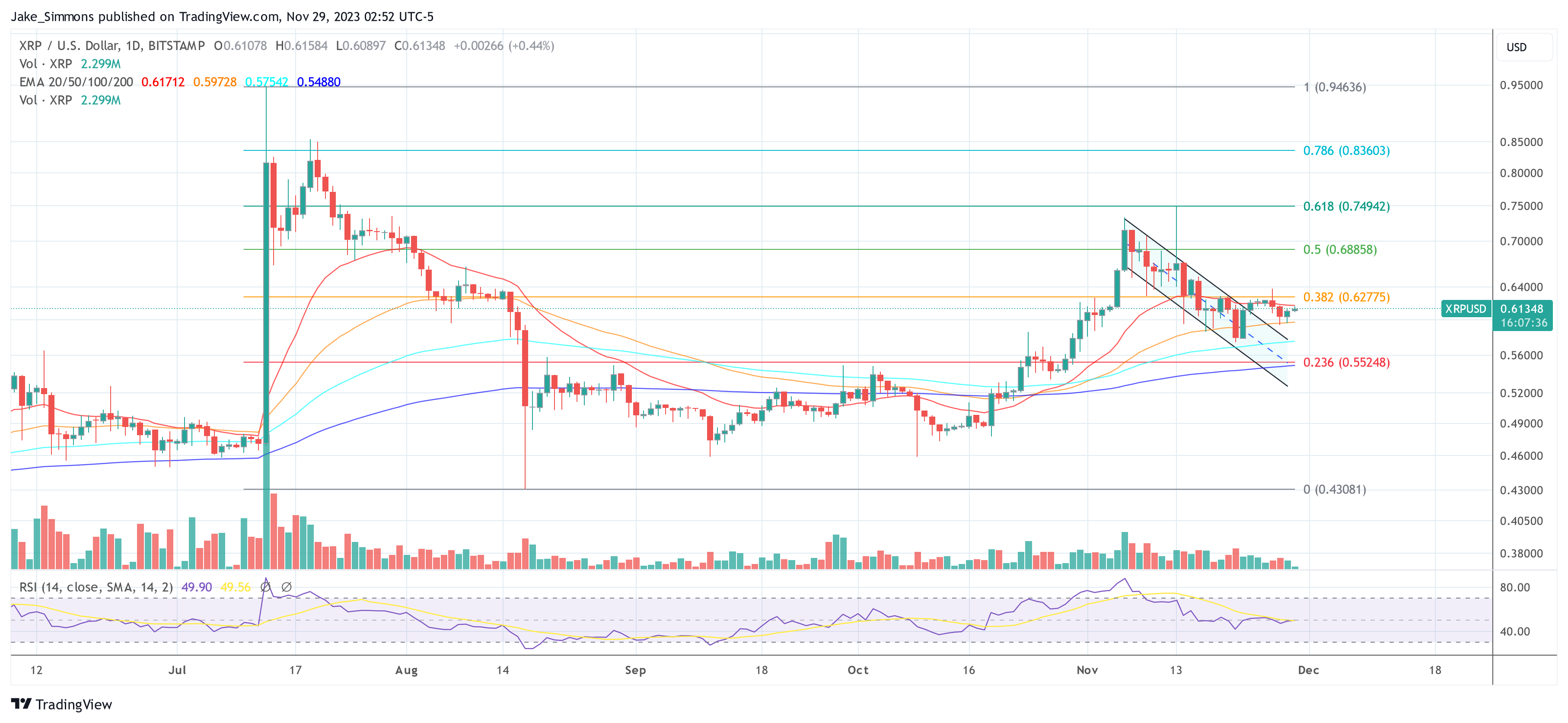

Egrag’s chart shows XRP price action on a 4-hour time frame, trading within a descending channel (blue) since early November. A descending channel is generally considered a bearish pattern.

However, last Wednesday, the XRP price broke out of the descending channel. Although the breakout did not last and eventually became a fake breakout, it paved the way for the emergence of the inverse H&S pattern, which is now shifting momentum in favor of the bulls.

Technically, the inverted H&S pattern is distinguished by two smaller peaks (shoulders) on either side of a larger trough (head), which is clear from the map annotations. The left shoulder formed around the support level at $0.586, with the head falling as low as $0.574, before moving up to form the right shoulder at $0.593.

This pattern is indicative of a bearish trend losing momentum and a potential bullish reversal if the pattern completes. Egrag’s analysis points to key price levels to watch, with the neckline of the inverse H&S pattern at around $0.6289.

A decisive breakout above this resistance level could see XRP prices rise towards $0.7000, which is in line with the pattern’s predicted breakout target. Additionally, the analyst’s target is at $0.7311, which marked the beginning of the descending channel. A rally to this price level would represent a 20% increase from the current XRP price.

It is crucial to note that while the inverse H&S pattern suggests a bullish outcome, the validity of the pattern will only be confirmed after a clear break and close above the neckline. As always, while the technical setup is constructive for XRP bulls, market participants should consider several factors including market sentiment, news flow, and broader market trends.

In a bearish scenario where the inverse head and shoulders pattern is invalidated, the XRP price could move towards the trendline of the descending channel. In his chart, Egrag marks $0.5564 and $0.53 as crucial support levels for the XRP price where a reversal could occur.

At the time of writing, XRP was trading at $0.61348. On the one-day time frame, the Fibonacci retracement level of 0.382 at $0.628 remains the key short-term resistance level.

Featured image from Forbes, chart from TradingView.com