- XRP’s Recent Downtrend Triggered a Bearish Crossover at the 20-Day and 50-Day EMAs

- Derivatives data was slightly skewed in favor of bulls, especially as the altcoin approached its near-term support level

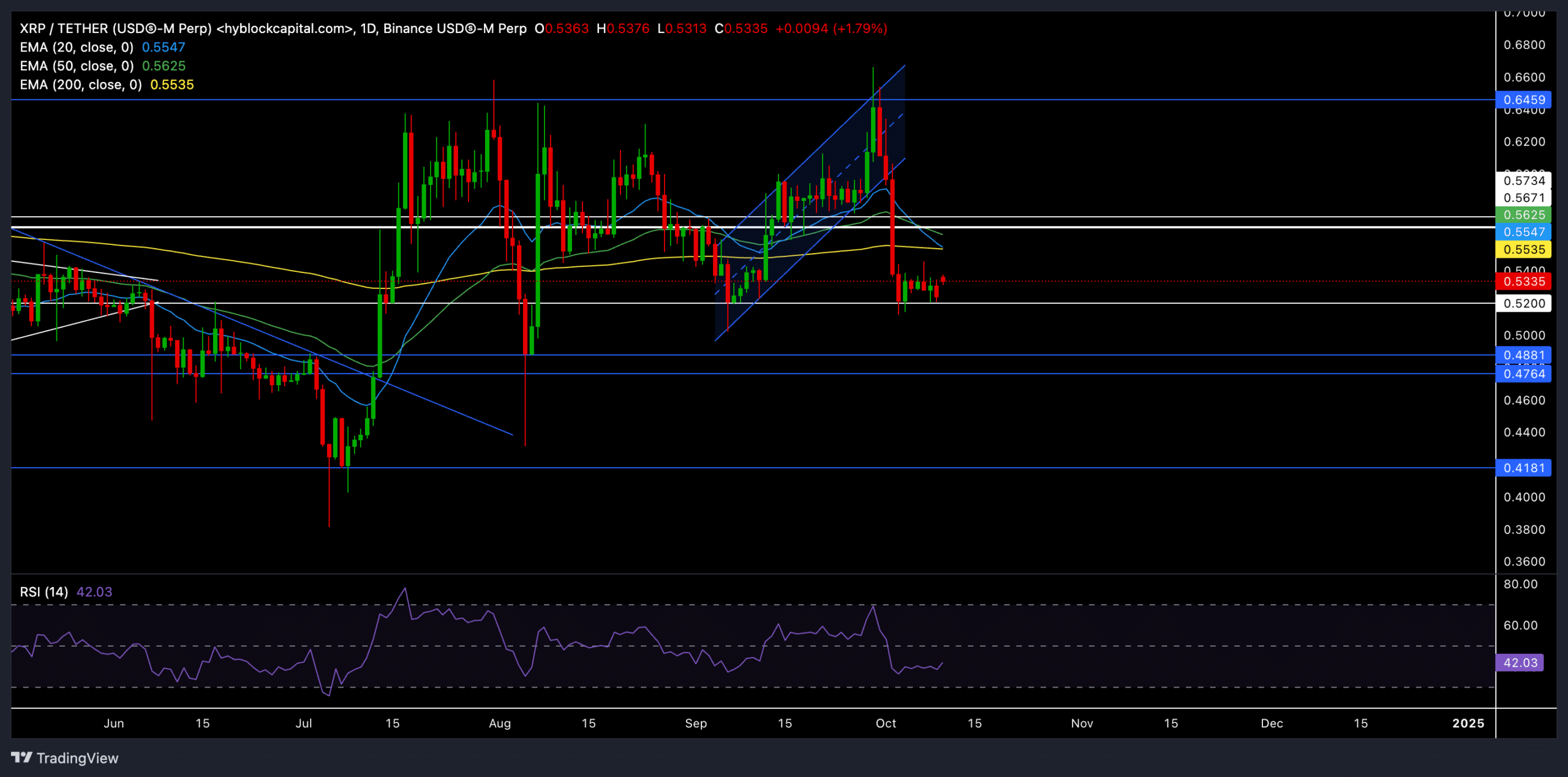

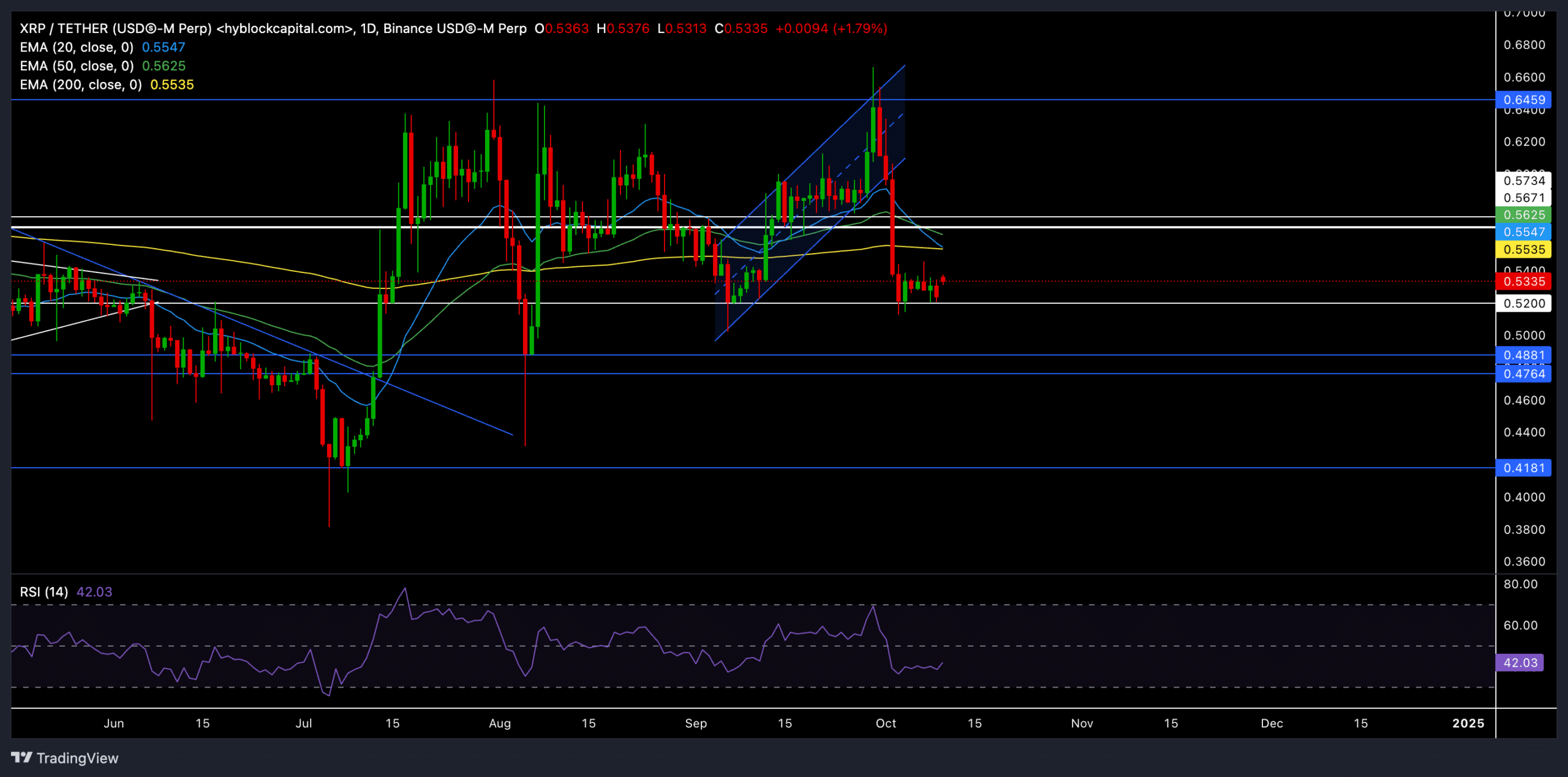

XRP continued its sideways trajectory after being repeatedly rejected at the $0.60 resistance level for almost three months. The recent pullback from this level resulted in a break in the rising channel on the daily chart, highlighting a possible shift in sentiment.

At the time of writing, XRP was trading at around $0.5328, up 1.66% in the past 24 hours.

Can XRP Bulls Make a Comeback?

Source: TradingView, XRP/USDT

XRP has consistently faced resistance at the USD 0.60 level, resulting in a prolonged consolidation. The recent rejection of this level caused a classic break in the rising channel, leading to a drop below the 20-day EMA and the 50-day EMA – levels that now act as immediate resistance.

The downtrend of the 20-day EMA and the likely bearish crossover with the 200-day EMA suggested that bearish power has increased. If this crossover materializes, XRP could continue to consolidate below the USD 0.56 resistance level, limiting the room for an immediate recovery.

However, XRP showed a strong rebound trend from the $0.52 support level. A sustained recovery in this support could help the country regain its EMAs, potentially paving the way for a near-term recovery. If momentum strengthens, a retest of the $0.56 resistance could be on the cards, followed by $0.6.

The RSI stood at 41.79 at the time of writing, reflecting a rather bearish sentiment. The recent movement of the RSI showed flatter lows, compared to the higher lows of the price action since August, indicating a mild bullish divergence. This hinted at a possible recovery if the bulls intervene, although this remains largely dependent on a broader shift in sentiment.

Derivatives data revealed THIS

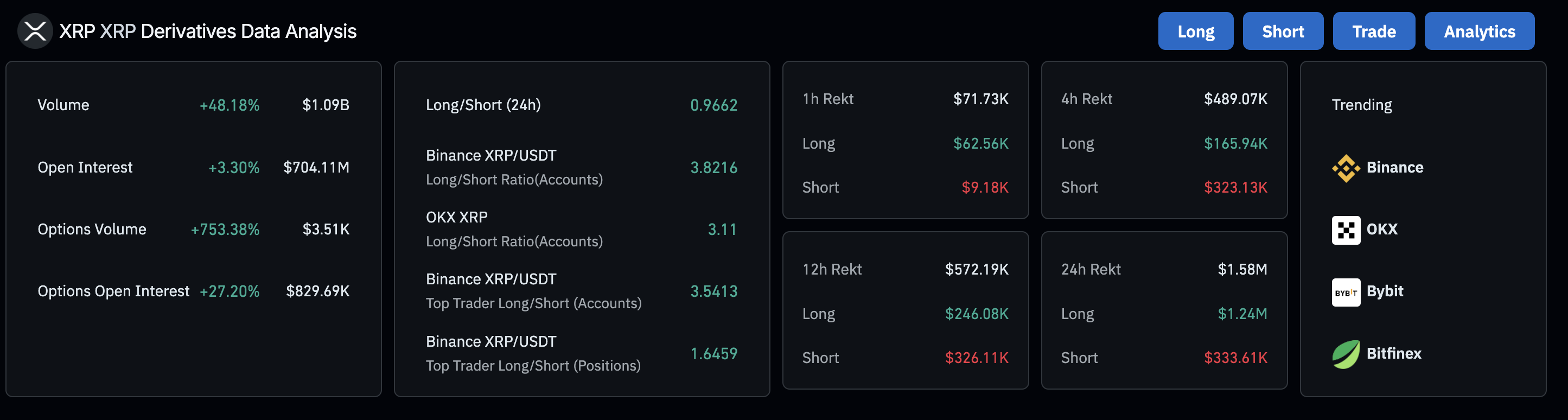

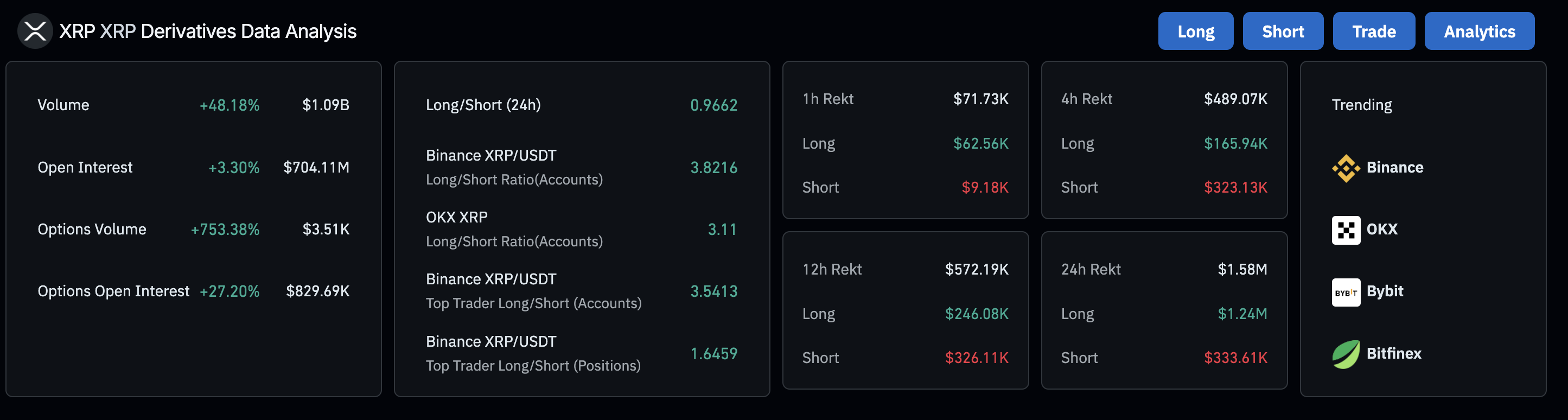

Source: Coinglass

Sentiment in the derivatives market for XRP appeared mixed, but slightly leaning towards a bullish outlook. The 24-hour long/short ratio was approximately 0.9662 at the time of writing. However, this ratio on Binance and OKX revealed a strong bullish edge: 3.8216 and 3.11, respectively.

Interestingly, XRP options volume increased by over 753%, indicating an increase in speculative activity. Open Interest also rose 3.3% and the huge increase in Options Open Interest (+27.2%) indicated renewed interest among traders, despite the recent recession.

Here it is worth noting that long liquidations were higher, indicating profit-taking behavior as XRP failed to maintain its gains above $0.56. However, the prominent long positions among top traders implied that there may still be a potential recovery.