Over a billion dollars in liquidations sent the XRP price and the crypto market back from the dead to local highs. However, new data suggests the rally could be short-lived, pushing the emerging sector into critical support.

At the time of writing, the XRP price is trading at $0.5 with a gain of 4% in the past week. The cryptocurrency has rallied over the past 24 hours but has retraced its steps in recent hours, signaling potential losses unless buyers step in and defend these levels.

XRP Price Brackets for Impact?

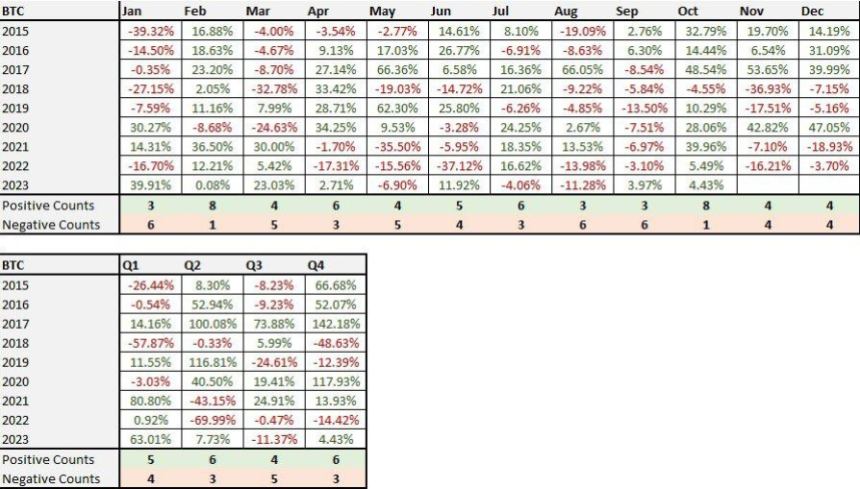

According to trading desk QCP Capital, the current rally is in the crypto market coincides with seasonality. In the emerging sector, October is known as ‘Uptober’ as major cryptocurrencies, including the XRP price, are on an upward trend.

In recent years, every Bitcoin, Ethereum, and XRP price rally started in October, making it the best month for the market, as seen in the chart below. However, the trading desk warned its followers on social media

However, we are not completely convinced of this move, and we think BTC could test super key 25k support sometime in the last quarter of 2023 (…) This aggressive rebound so far has been almost entirely due to exogenous factors and has may not have the momentum to sustain it.

The trading desk believes that these factors may not have enough strength to support the current price action. Furthermore, the saga surrounding the approval of a future Ethereum Exchange Traded Fund (ETF) in the US could set the stage for a bloodbath.

Two years ago, when the price of Bitcoin reached its all-time high of $69,000, the Securities and Exchange Commission (SEC) approved a BTC futures ETF. This event marked the top of the crypto market, making the current ETH future ETF an ominous event for XRP and the altcoin market.

QCP Capital claims that the newly approved financial asset could increase selling pressure in the sector due to adding “synthetic coins” to the market. In other words, the ETH futures ETF creates an imbalance between supply and demand forces in the industry. The company added:

We would go even further if we said that a futures-only ETF is demonstrably damaging to the spot price because it potentially diverts demand from the spot market to a synthetic market.

Good news in the short term for XRP

XRP price could benefit from the US government shutdown on the macro front. The analysis shows that over the past thirty years, every US government shutdown preceded a bull run on the financial market. This is the only positive news for the cryptocurrency in the medium term.

In the short term, XRP still has a chance to get back above $0.6; As for Bitcoin, the trading firm expects the resistance at $29,000 to $30,000 to remain intact.

Cover image from Unsplash, chart from QCP Capital and Tradingview