Reason to trust

Strictly editorial policy that focuses on accuracy, relevance and impartiality

Made by experts from the industry and carefully assessed

The highest standards in reporting and publishing

Strictly editorial policy that focuses on accuracy, relevance and impartiality

Morbi Pretium Leo et Nisl Aliquam Mollis. Quisque Arcu Lorem, Ultricies Quis Pellentesque NEC, Ullamcorper Eu Odio.

Este Artículo También Está Disponible and Español.

XRP turns the heads again An impressive after Toon of resilience in recent days, Bouncing lows of $ 2.08 earlier this week to reclaim $ 2.4 at the time of writing. This upward momentum, now clocks more than 15% profits Of the test of the $ 2 supportHas an interesting historical pattern in the daily graph of XRP.

A comparison of the current price structure of XRP with its 2017 trajectory shows that a rare arrangement can indicate a huge outbreak on the horizon, with a target price as high as $ 9.

Related Reading: 3.5 million Trump -Tokens on the road -Trump -Team makes a big game

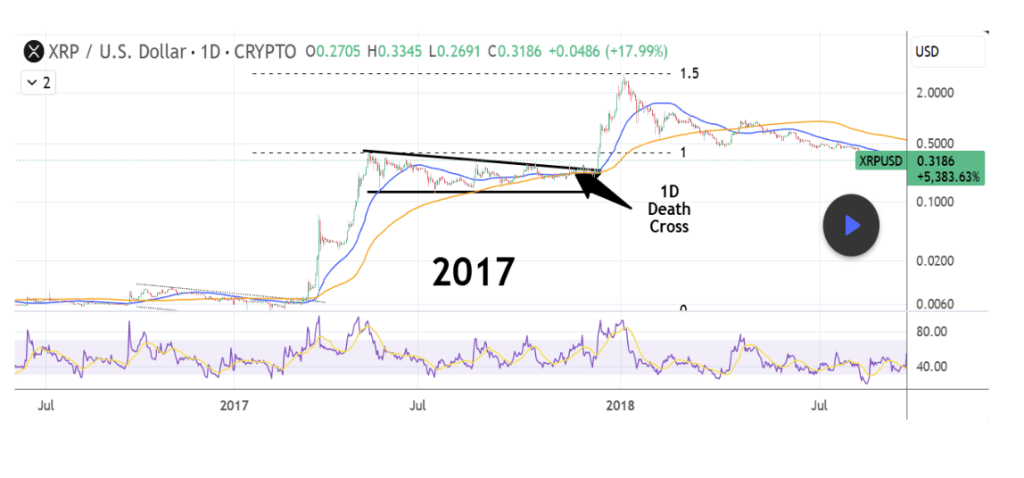

XRP -price flashes 1D Death Cross signal, but the price history suggests a turn

On the surface a death cross has appeared on the XRP Daily Candlestick Time Frame graph. This type of cross takes place when the 50-day advancing average crosses under the 200-day advancing average and would usually be interpreted as a bearish board. However, According to a crypto analyst On the TradingView platform this may not be the case for XRP.

A further consideration of Historical precedent from 2017 suggests that this technical signal may not be as bad for XRP as it sounds. At the time, XRP showed almost identical behavior of trade in a falling triangle just before the death cross took place. That moment marked a misleading shift, because the price action of XRP quickly turned the direction and exploded at the benefit. Within a few weeks of the death cross of 2017, XRP reached the 1.5 Fibonacci expansion zone and yielded the return of more than 1,350% compared to the pre-Breakout level of $ 0.23 to its current all-time high from $ 3.4.

XRP has again spent months consolidating in a tight falling triangle in the 2025 line -up prior to the current Death Cross, which is the first in more than a year. Despite the bearish implications of the death cross, the parallels in the map structure with the pattern and timing of 2017 have made this formation a bullish wildcard.

A similar play-out of the Death Cross Rally 2017 would send the XRP prize to new all time highs with the 1.5 Fibonacci extension. As far as a target price is concerned, the analyst noted that the 1.5 Fibonacci Expansion for this year is aimed at Near the price level of $ 9.00, which would represent a rally of 325% of the current price of XRP.

XRP 2017 Price chart: Picture of TradingView

XRP 2017 Price chart: Picture of TradingView XRP 2025 Price chart: Picture of TradingView

XRP 2025 Price chart: Picture of TradingView

Indicators remain neutral but optimistic

In particular, the XRP price has a neutral but promising technical outlook on higher timetables. XRP has a relative strength index (RSI) of 54,799 on the weekly period. This is a central range and shows that there is still enough room to climb before XRP becomes overbough. The MACD lecture at 0.197 indicates a mild upward pressure, while the ADX is at 30,423.

Related lecture

At the time of writing, XRP acts at $ 2.38. The bullish scenario of the analyst depends considerably About or institutional interest Connect with the technical outbreak.

Featured image of Unsplash, graph of TradingView