The recent recovery of XRP has caused a new optimism among traders, but what happens behind the scenes, says a fascinating story. This is not just a typical jump; The graphs reveal a calculated shift in Momentum. Technical indicators such as the Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) are starting to coordinate, suggesting that XRP is approaching a crucial decision zone.

After the recent decline in the market, the price is now a bullish recovery after testing the $ 1.7 important support level with increasing conviction. If the current momentum continues and resistance zones neighborhoods, XRP can be about to be an important outbreak. However, not building at the momentum can catch token in another consolidation phase or a deeper retracement.

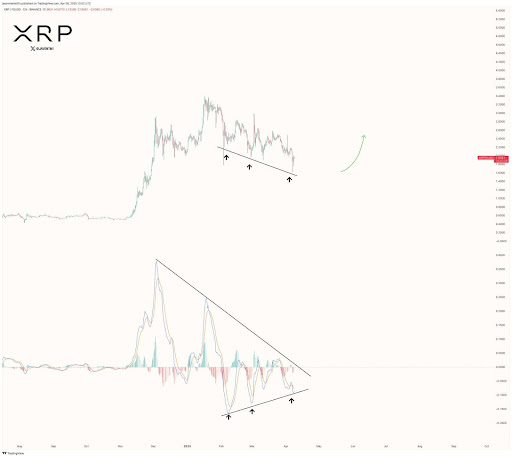

MacD signals that brew bullish for XRP

In a recent Post on XBe crypto analyst Javon Marks that the MACD of XRP is approaching a critical breaking point, which may indicate a shift in Marktmomentum. He emphasized that this MacD indicator shows signs of a bullish crossover, which could mark the start of a strong upward movement.

In combination with this, Marks emphasized that XRP currently has an important regular bullish divergence, where the price has created lower lows while the MACD has higher lows. This indicates a weakening of Beerarish pressure, making the stage for a potential reversal.

Marks suggested that this technical setup could be the catalyst for the bulls to take control, which may lead to a powerful movement that breaks through the current resistance levels. With this convergence of bullish signals, XRP can be prepared for a rally back to the range of $ 3.30+, which continues the previous Uptrend.

Most important levels to view: the exact outbreak and rejection zones that matter

To fully understand the future movements of XRP, it is crucial to determine the most important levels that will send the price higher or cause a reversal. Firstly, the Breakout zone is for the Altcoin around the $ 1.97 resistance level.

If the price succeeds in surpassing this threshold with a strong volume, it can cause an increase of higher levels, including $ 2.64 and $ 2.92. This outbreak would probably confirm the upward momentum that is suggested by the MACD and the regular bullish divergence.

On the other hand, a rejection at the resistance level of $ 1.97 can indicate a lack of purchase interest. If the ash cannot break above this level, the price can withdraw to lower support levels such as $ 1.7 or even $ 1.34. Not holding these support levels would cause the potential for a more substantial decline, whereby bears live back.