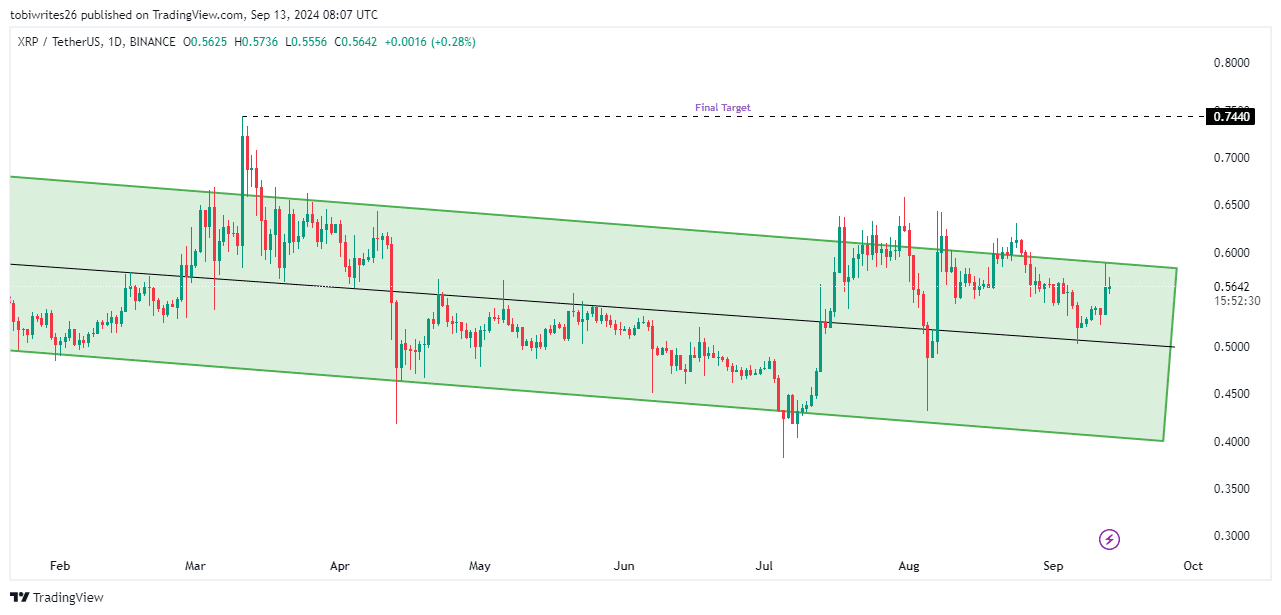

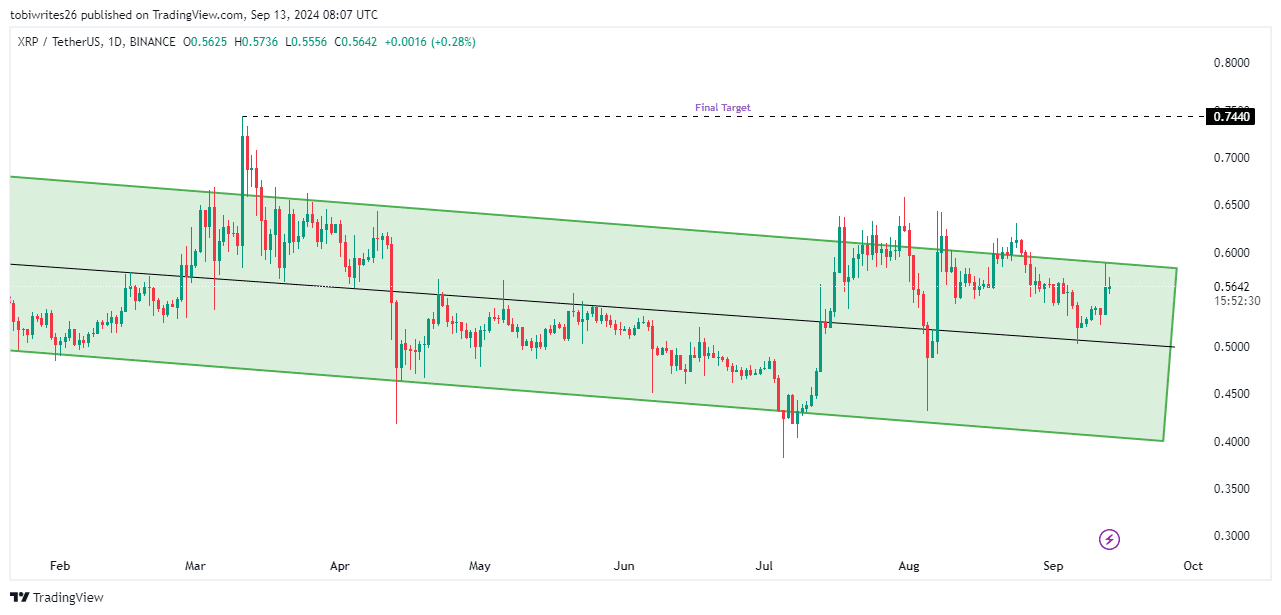

- Should XRP maintain its current momentum after breaking out of the descending channel, XRP could reach $0.74.

- An increase in the number of active addresses and a decrease in supply support this increase, indicating strong interest from merchants.

XRP is on the verge of reversing its month-long losses, with gains of 5.26% per week and 4.59% per day, paving the way for a rally.

The potential rally could come from a pullback from the centerline of the descending channel, a critical point of accumulated momentum.

XRP signals the first rally sign

XRP has been confined to a descending channel since November 2023, as observed in the daily time frame. Currently, it is showing signs of a breakout, indicating a shift in price action.

Normally, a descending channel is considered a bullish pattern. It is characterized by price fluctuations between two main zones as the trend moves down, eventually leading to a breakout.

XRP’s current pattern fits well with this expectation.

If the mid-range support (marked as a black line) experiences greater buying pressure, it could overcome the channel’s upper resistance line. So the price could move to a short-term target of $0.74.

Source: trading view

An in-depth analysis by AMBCrypto suggests that XRP is primed for a breakout.

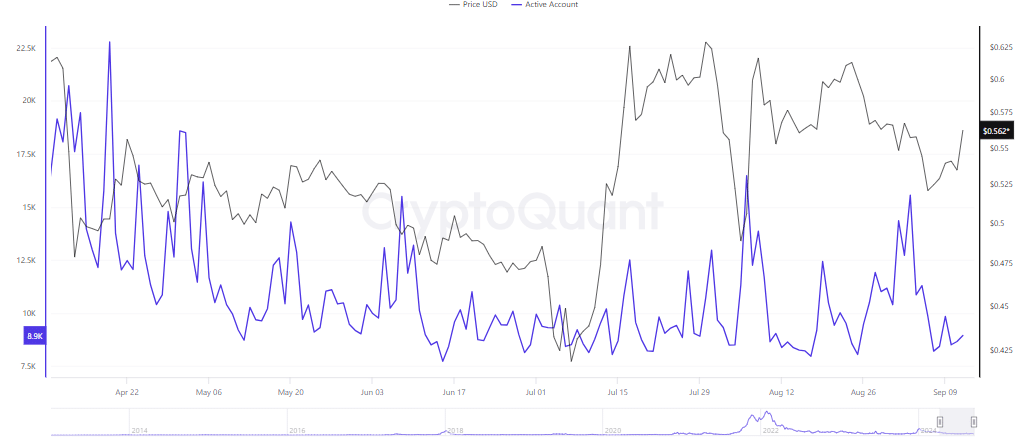

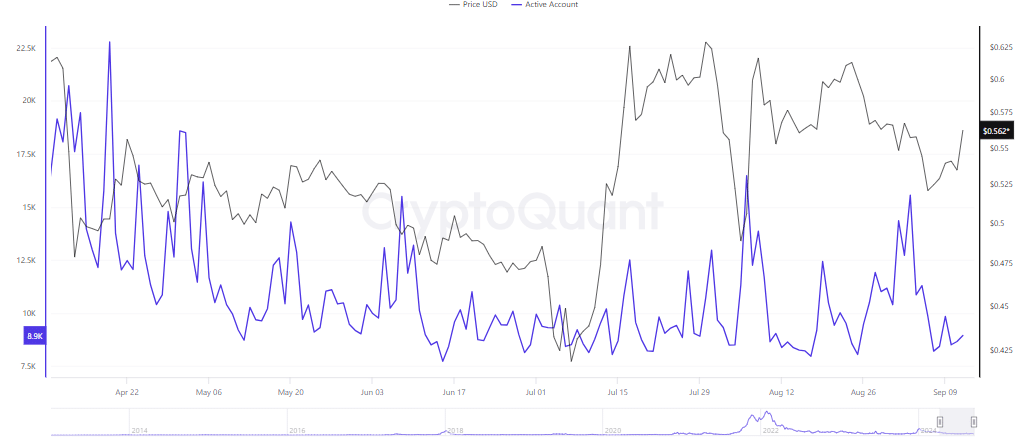

Growing interest in XRP

Recently data from CryptoQuant highlighted a resurgence of interest in XRP. After a sharp drop in the number of active addresses on September 9, there was a significant increase to 8.9,000 active addresses.

This increase in the number of active addresses has helped push prices up, offsetting the large losses between September 5 and 6.

Source: CryptoQuant

Furthermore, both the exchange rate reserve and the price of XRP have increased simultaneously.

This pattern generally indicates strong demand exceeding available supply, despite increased deposits on exchanges for potential trading.

These indicators collectively indicate strong buyer interest, positioning XRP favorably for a possible surge towards the aforementioned target.

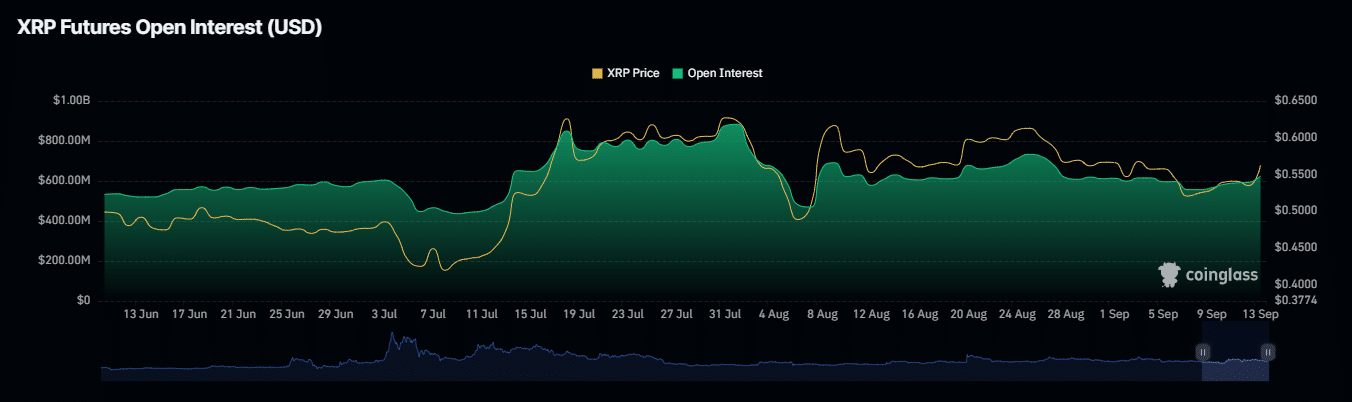

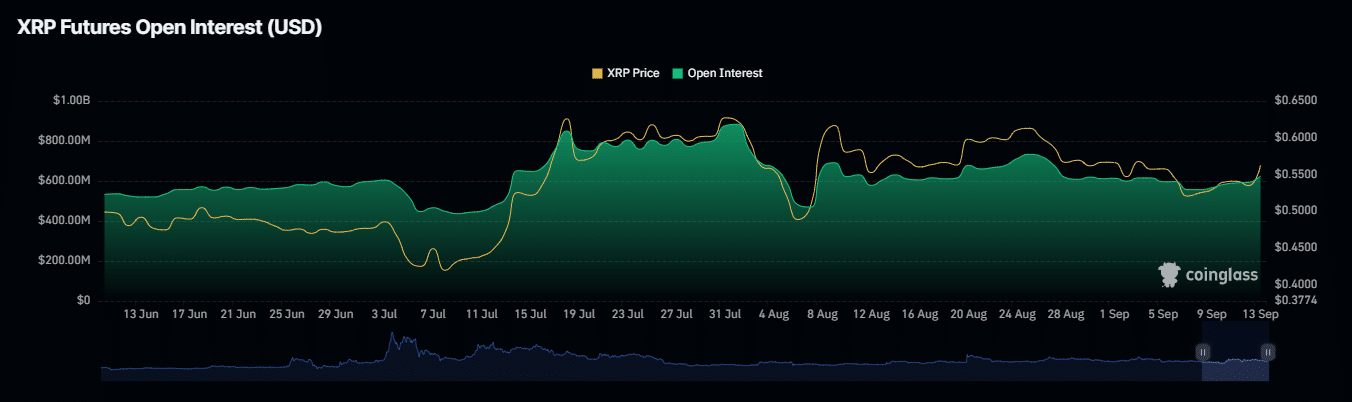

Open Interest stimulates the growth potential

Open Interest, which represents the total number of unsettled derivative contracts such as futures or options, signals growing market momentum and accumulation by traders when it increases.

At the time of writing, XRP’s Open Interest, according to Coinglassrose 5.7% over the past 24 hours to reach $625.48 million despite earlier declines.

Read XRP’s 2024-2025 Price Prediction

This uptrend suggested increased buying activity that could support a continued rally towards the critical $0.74 price level.

Source: Coinglass

Should this uptrend falter in Open Interest or other key data sets, it could cause XRP to retreat to the midrange or even the lower end of the descending channel.