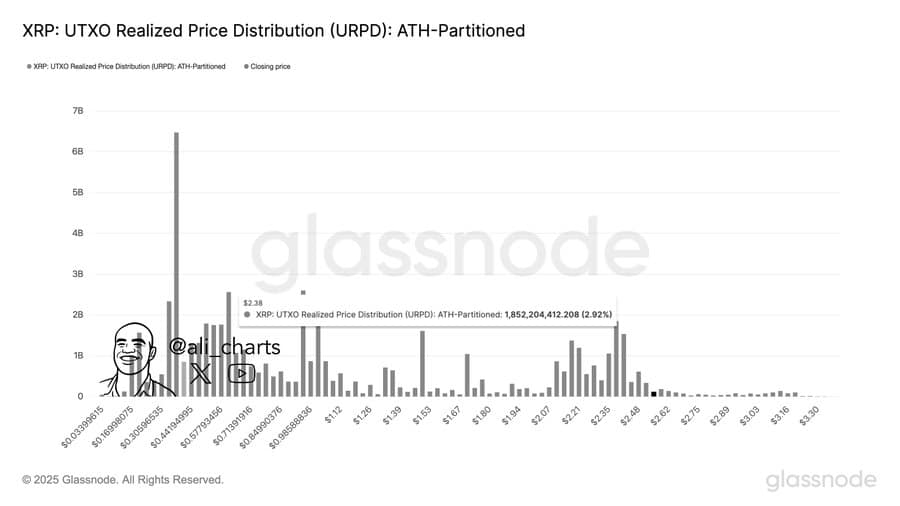

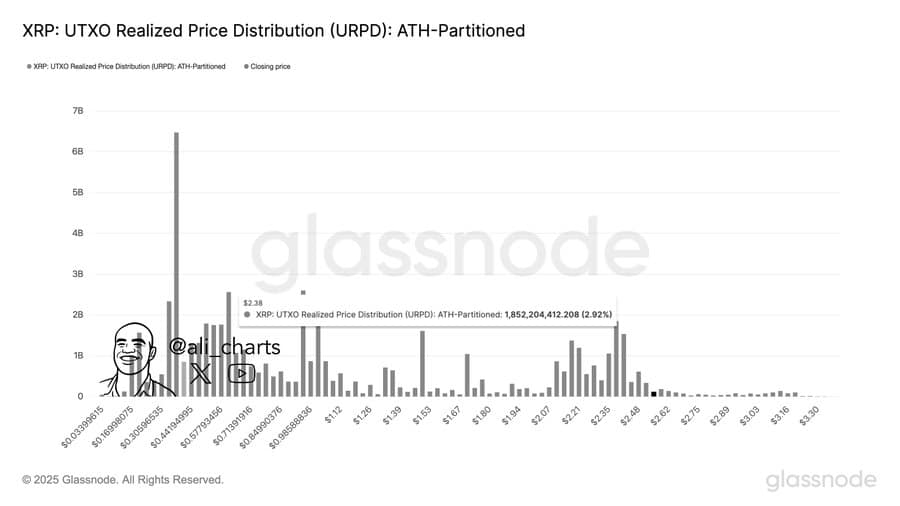

- There is no significant resistance level in front of the bow, which means that XRP is a clear path to potentially large profit.

- However, the rally would probably be inflamed as soon as investors enter the market.

XRP has registered a modest increase in the last 24 hours, with the price by 4.56%. This holds its weekly performance in the double digits, at 21.21%.

Without resistance or level of supply to activate sufficient sales pressure, XRP has a strong potential for a large price rally.

The analysis of Ambcrypto emphasizes the most important factors that will probably view this movement and the criteria to view.

Is this a free path for XRP?

The analysis of Ambcrypto does not show a significant resistance level for XRP, which can make a free rally possible.

Resistance levels usually form above current price levels and are areas where large sales orders are placed, which often causes a price correction or withdrawal.

Source: Glassnode

Interestingly, even if a wider market falls to fall, it is likely that it is actively falling to an important level of support at $ 2.38.

Buying activity remains high on the market

Buying sentiment has remained strong in both the derivatives and the spot markets. This has increased the chance of an increase in the upcoming trade sessions.

In the past week alone, a total of $ 48.93 million in XRP was withdrawn from trade fairs and moved to private portfolios.

Source: Coinglass

This type of fund movement suggests that spot traders have a long -term prevention and collect XRP pending a large rally.

In addition, both futures and options on the derivatives market have considerably increased their position sizes as open interest rates.

In the Futuresmarkt, the amount of troubled contracts has risen by 17.17% to $ 5.5 billion, while the option market saw an increase of 18.78% to $ 1.03 million.

Source: Coinglass

However, this increase only confirms the bullish intention if long traders dominate these restless contracts.

With the help of the open interest -weighing financing percentage, Ambcrypto has established that these contracts are indeed dominated by bulls.

If the OI-weighted financing rate remains positive, this suggests that most troubled contracts come from lever intake that an XRP rally expect.

The circumstances still remain for XRP

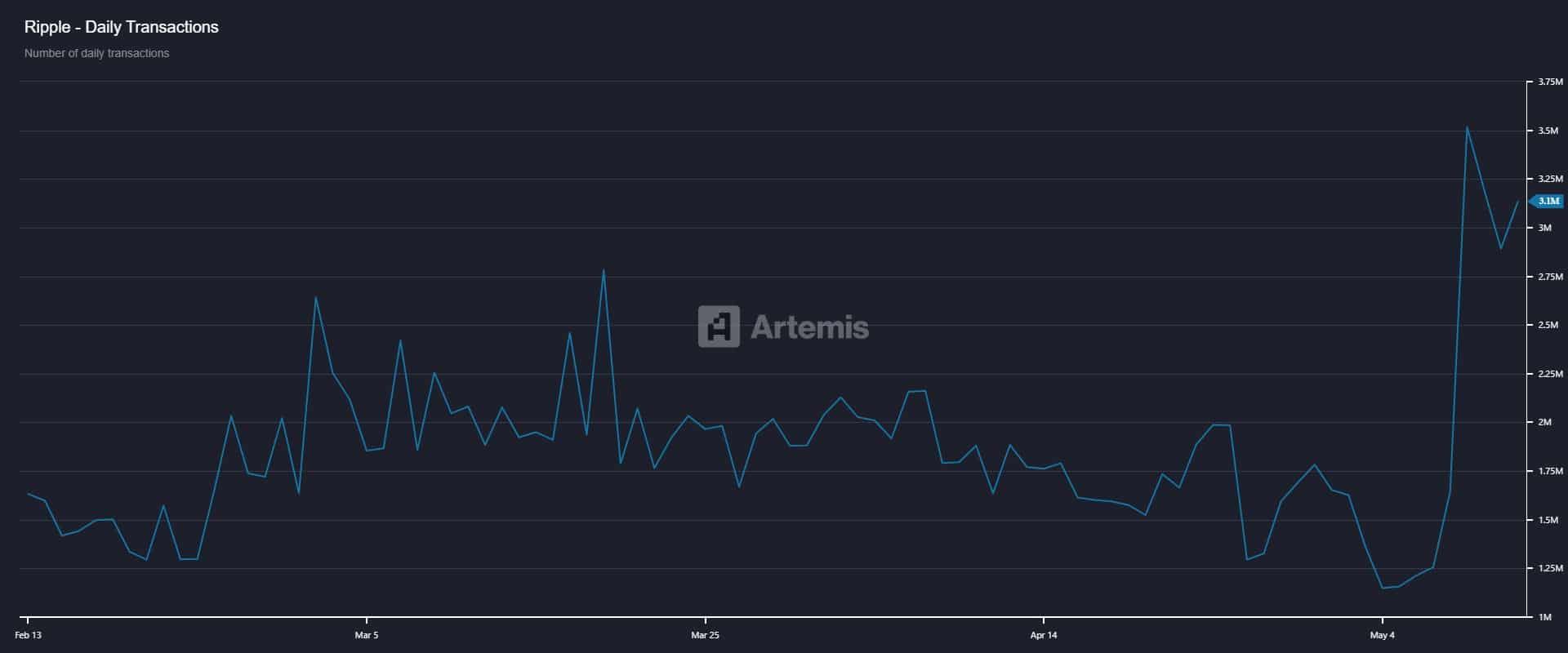

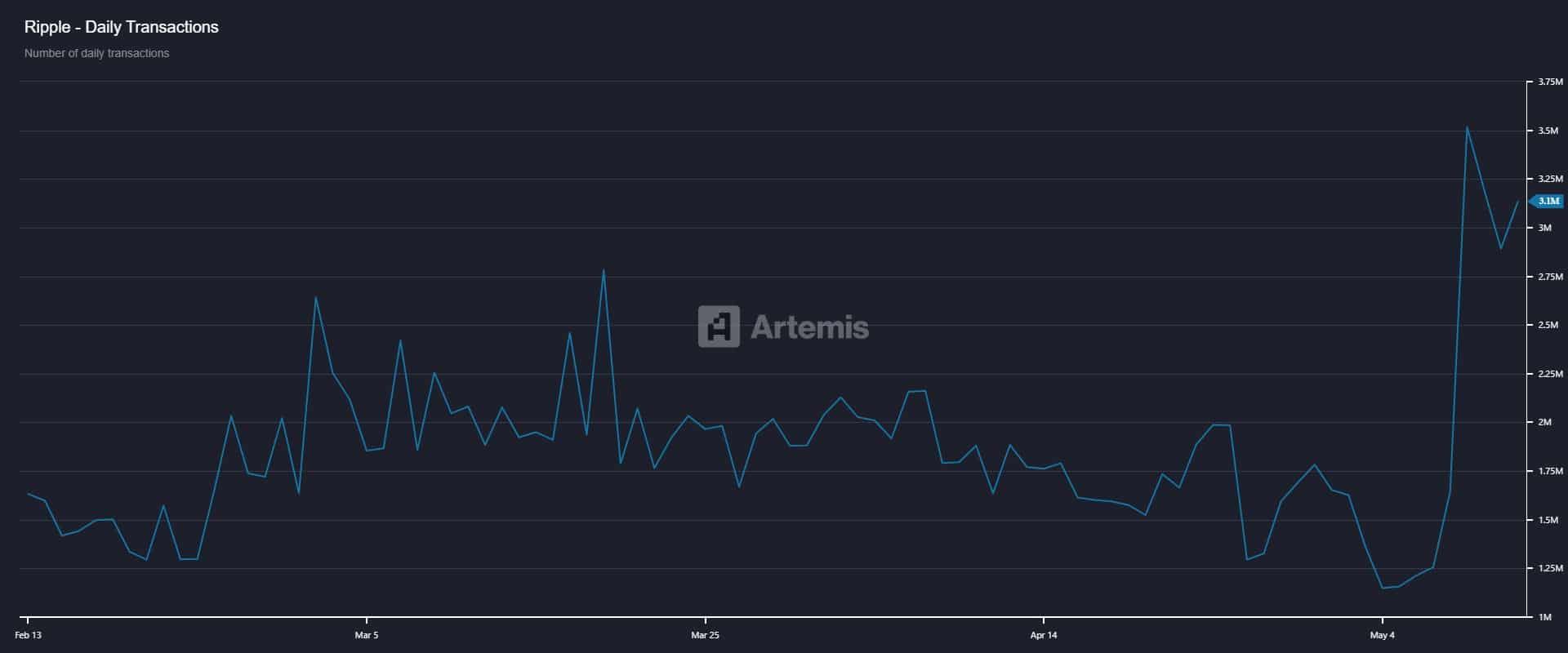

Although the market seems bullish and ready for a big step, two important catalysts for activating the rally daily active addresses and daily transactions are.

At the time of writing, both statistics have to reclaim earlier highlights, which means that the current number of investors will remain lower than in the past.

Source: Artemis

This has led to reduced transactions and a lower utility for XRP. If those investors return to the market, XRP could continue its upward process because they would probably start collecting the asset.

Without resistance or level of supply, XRP has a considerable potential to achieve some of the most important profit in the market.