- XRP has fallen in recent days.

- The item is one of the losers among the top items of the past 24 hours.

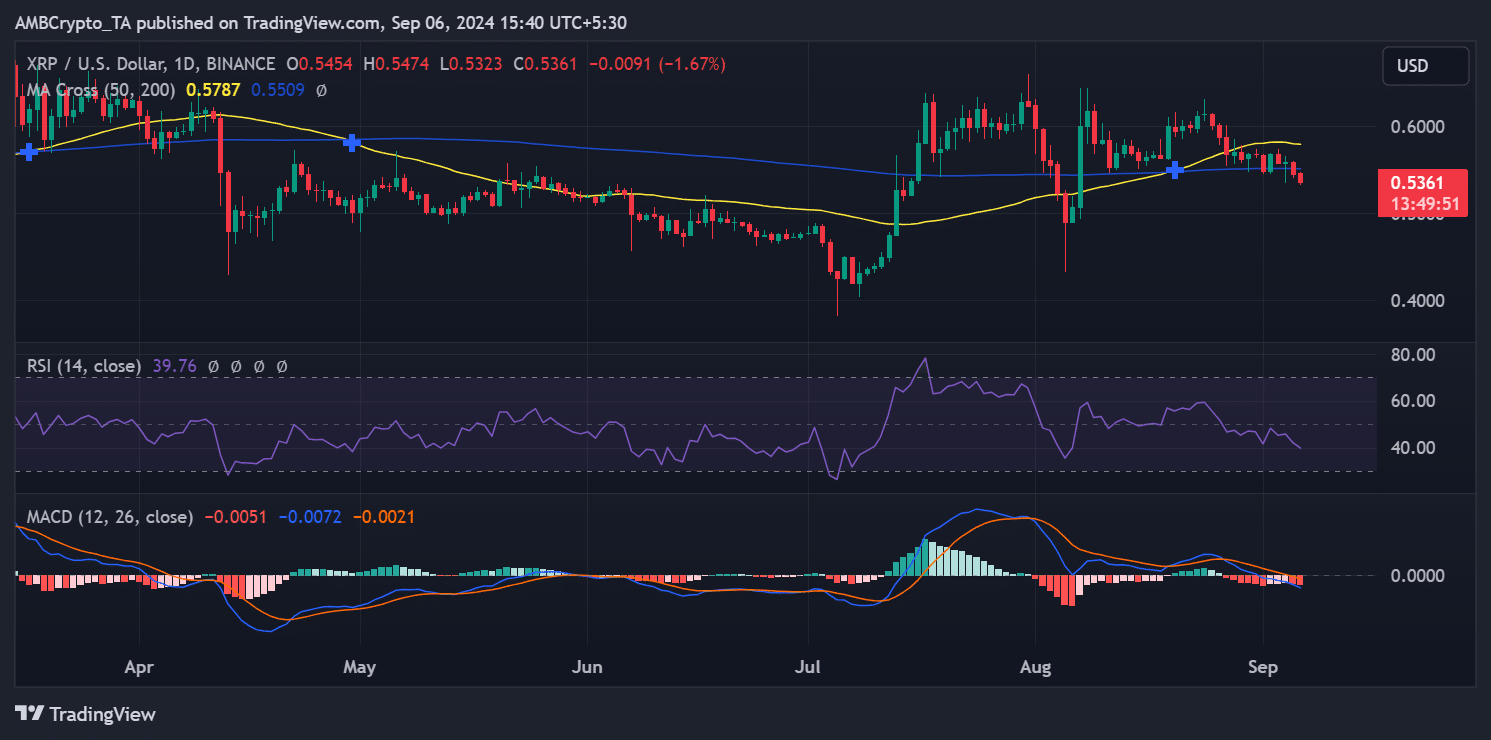

Ripple [XRP] has faced increasing downward pressure as it struggled to maintain its recent price levels. The asset was trading at $0.5361 at the time of writing and has seen bearish momentum in recent weeks.

Technical indicators such as the Relative Strength Index (RSI) and moving averages suggested that the market is approaching oversold conditions. Data also shows that profit supply continued to decline.

XRP is gearing up for more declines

XRP’s recent price movement highlighted the struggle to regain upside momentum, with the asset trading below both the 50-day and 200-day moving averages.

The 50-day moving average was around $0.5787, while the 200-day moving average was around $0.5509.

This setup shows signs of a potential “death cross,” a bearish signal that occurs when the 50-day moving average crosses below the 200-day moving average.

This crossover is generally seen as a negative indicator, suggesting that XRP’s downward trend may continue in the short term.

Furthermore, the asset has failed to break through key resistance levels, further highlighting the lack of bullish momentum and contributing to the overall bearish sentiment in the market.

Source: TradingView

Additionally, XRP’s Relative Strength Index (RSI) currently stands at 39.76, putting it close to oversold territory. An RSI below 40 often indicated that an asset is experiencing strong selling pressure and may be undervalued.

While this low RSI could indicate a potential recovery, the weak market momentum suggests that any reversal could be short-lived unless there is a significant increase in buying interest.

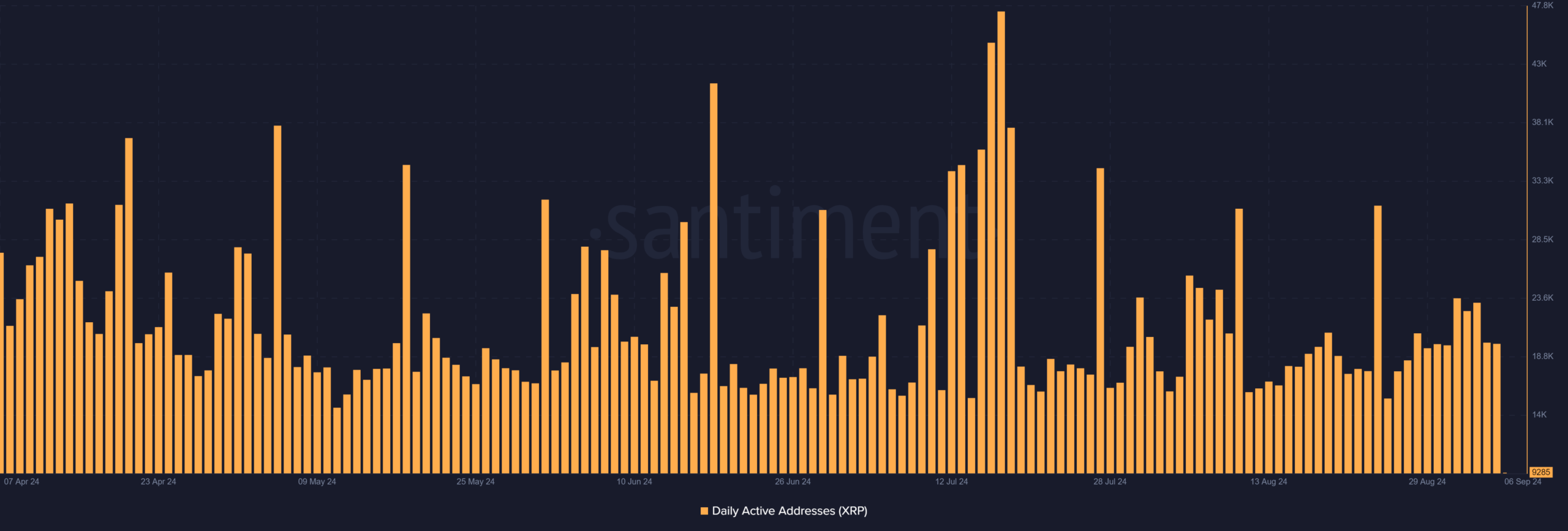

Less address activity

AMBCrypto’s analysis of Ripple’s daily active address chart revealed a decline in recent days. The number has since dropped, after reaching around 23,000 active addresses between September 1 and 3.

Over the past two days, the number of active addresses has fluctuated between 20,000 and 19,000.

Source: Santiment

This decrease in the number of active addresses suggests that the chance of an XRP price increase is small. Lower levels of on-chain activity generally indicate reduced user engagement and market participation.

Without sufficient activity, the case for significant upward momentum in the price of XRP becomes less compelling, as a lack of network engagement could indicate waning investor interest and declining trading volume.

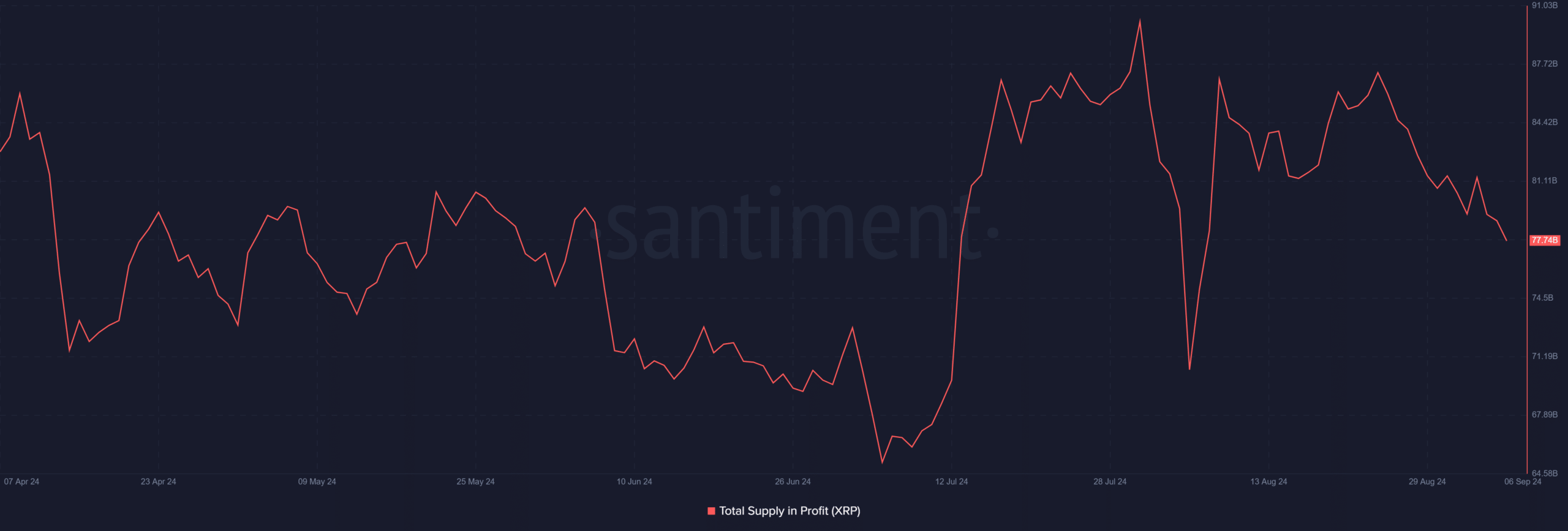

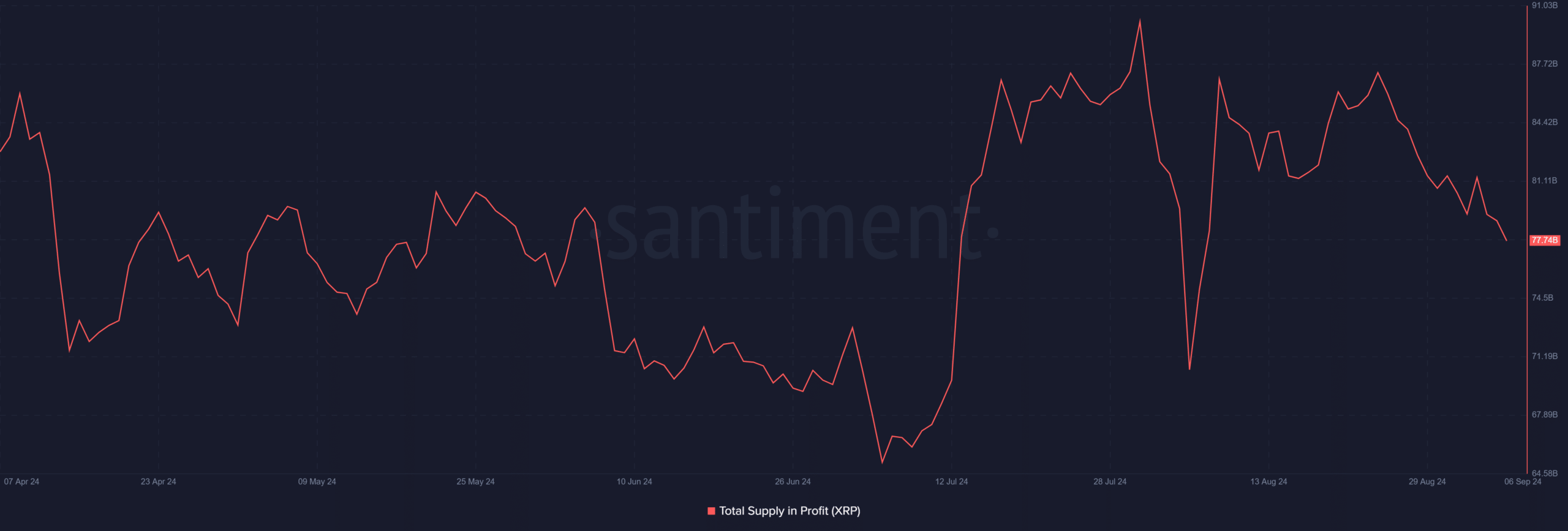

More XRP supply disappears underwater

AMBCrypto’s analysis indicated that the recent price drop of XRP has had a significant impact on the profit supply. Around August 24th XRPs offer in profit amounted to approximately 87.2 billion.

However, the decline has accelerated since then. At the time of writing, the profit offering has fallen to approximately 77.7 billion XRP.

Source: Santiment

Realistic or not, here is the XRP market cap in terms of BTC

This sharp decline highlights how the continued downward pressure on XRP has pushed more holders into losing positions.

The rapid decline in profit supply reflected the broader bearish trend, with fewer investors able to sell at a profit amid falling prices.