- A recent update aimed for speculation about the approval of an XRP ETF

- Although the short -term front views may be positive, XRP remains susceptible to market risks

The weekly rebound of XRP of his sub-$ 0.95 levels was activated by a high impact Fud-Flush. However, it seems like a calculated game for the racing, instead of any opportunistic trade.

In fact, the movement coincided with broader sentiment rotation after important legal headlines. In particular the confirmation by Paul Atkins as chairman of the US Securities and Exchange Commission (SEC) on April 9. Unnecessary to say that this is intensified Market speculation about a possible shift in the position of the committee, in particular with regard to the long-term sec versus Ripple case.

However, that is not all, because it also hopes for a long-awaited approval of an XRP exchange fund (ETF).

Main developments that shape XRP news in Q2

The XRP market remains supported by growing optimism around the clarity of the regulations and the potential for an XRP-oriented ETF.

On April 9, the US Senate confirmed The appointment of President Trump of Paul Atkins as SEC chairman. Atkins is seen on a large scale as crypto-friendly, which increases the chance of regulating de-escalation.

By adding fuel to the story, the SEC and Ripple were jointly submitted to suspend the current appeal, causing Ripple’s Deadline of Ripple to push after 16 April.

As a result, market analysts believe that the SEC can postpone the action until Atkins is formally sworn, which makes it possible to relieve the road for a 3-1 vote for withdrawing the profession.

The market reaction was immediately. After the XRP news, the Altcoin rose no less than 14.28% in one day and pushed XRP above $ 2 after three consecutive days of downward pressure.

Source: TradingView (XRP/USDT)

Despite the actions of more than 30% below the peak after the $ 3.30 elections, these recent developments can significantly reform the valuation views of Altcoin for Q2.

Market sentiment and ETF Buzz

Following the XRP news-controlled catalyst, Open Interest (OI) increased from $ 2.87 billion to $ 3.26 billion, indicating a sharp increase in leverage participation.

On Binance, long positions Nearly 70% of the XRP/USDT -century market made and emphasized a strong directional bias to further upwards.

In the meantime, short -term holders (StHS <155 days) left the long -term capitulation phase They went up to $ 1.60. This cohort seemed to have strategically beaten positions to increase the profit of XRP’s January rally, which achieved a peak of almost $ 3.30.

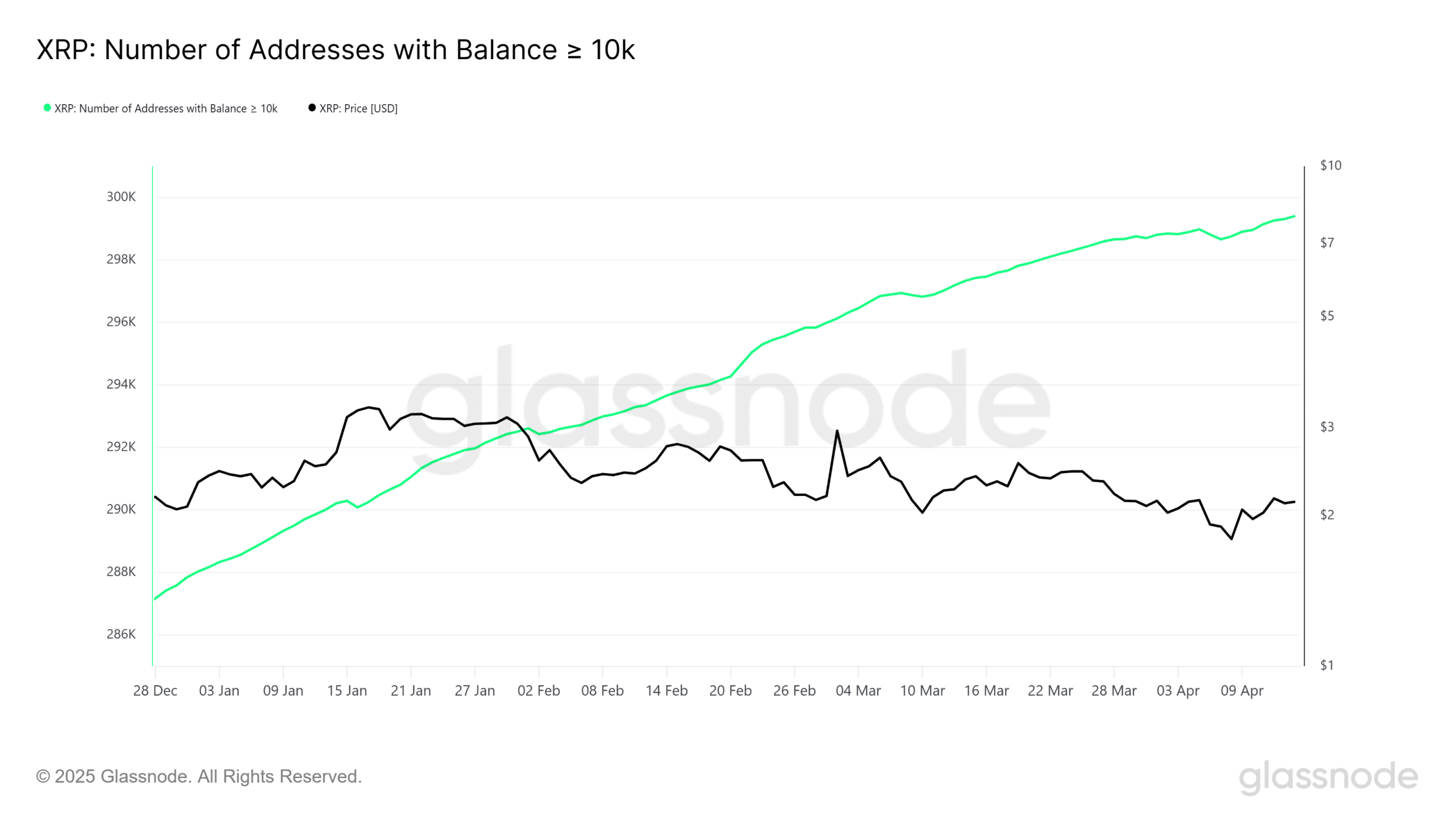

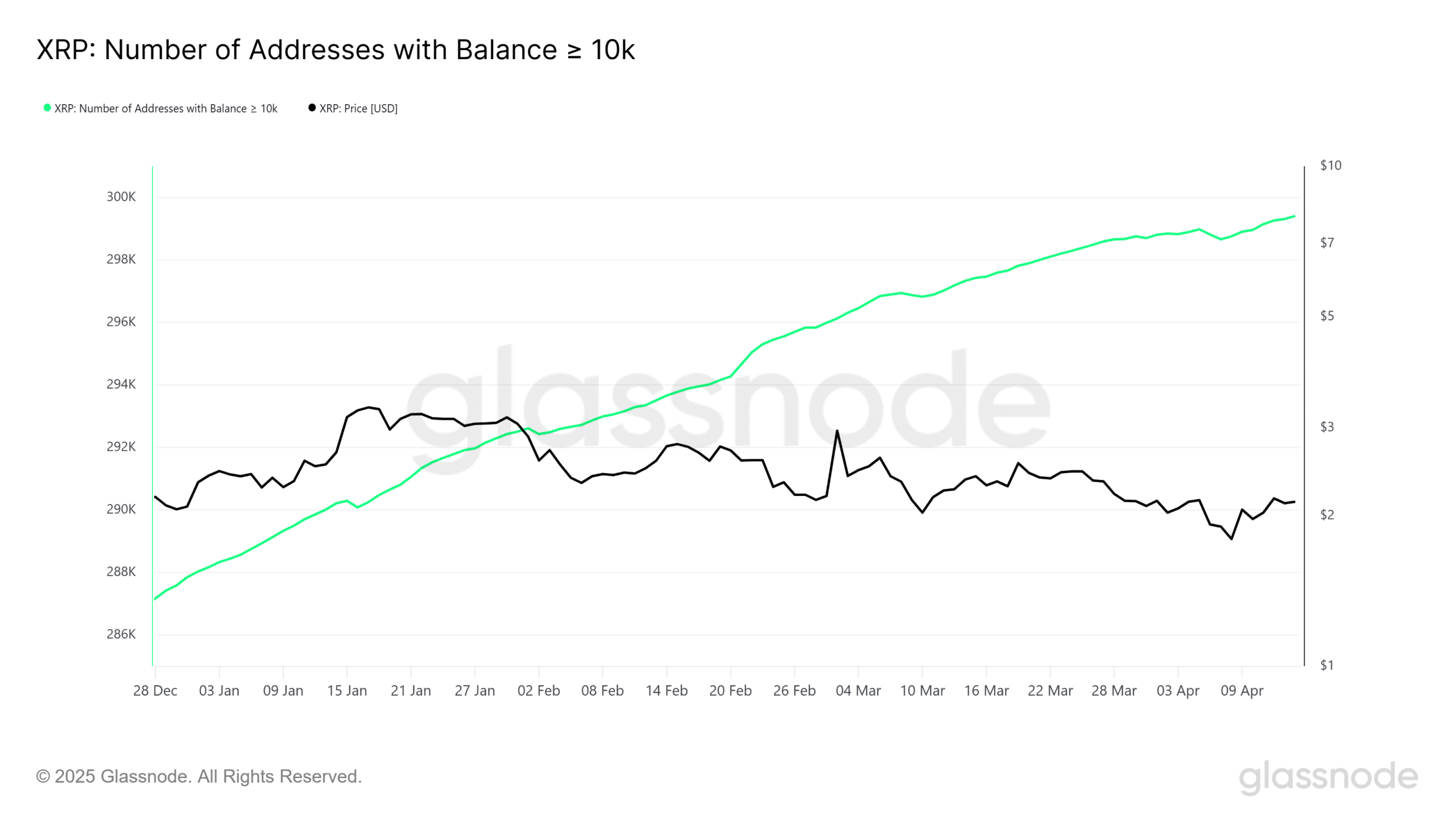

And the good news? The number of addresses with more than 10,000 XRP rose to a record high, almost the historic 300K mark.

Source: Glassnode

This cohort now represents approximately 4.28% of all XRP addresses-What points to a growing concentration of holders with a high-stake and possibly institutional trust building under the surface.

This is exactly where exhibition -related funds (ETFs) start the conversation.

XRP-related ETF Speculation is warming upEspecially in the aftermath of the pro-Crypto shift in the sec. In combination with the growing institutional footprint of XRP, the case has never looked more credible for an ETF.

That is why short -term volatility, driven by shaking with weakness, can be expected.

However, these underlying statistics will be the key. First, for XRP to take advantage of the narrative shift and then to feed a bullish Q2 process.