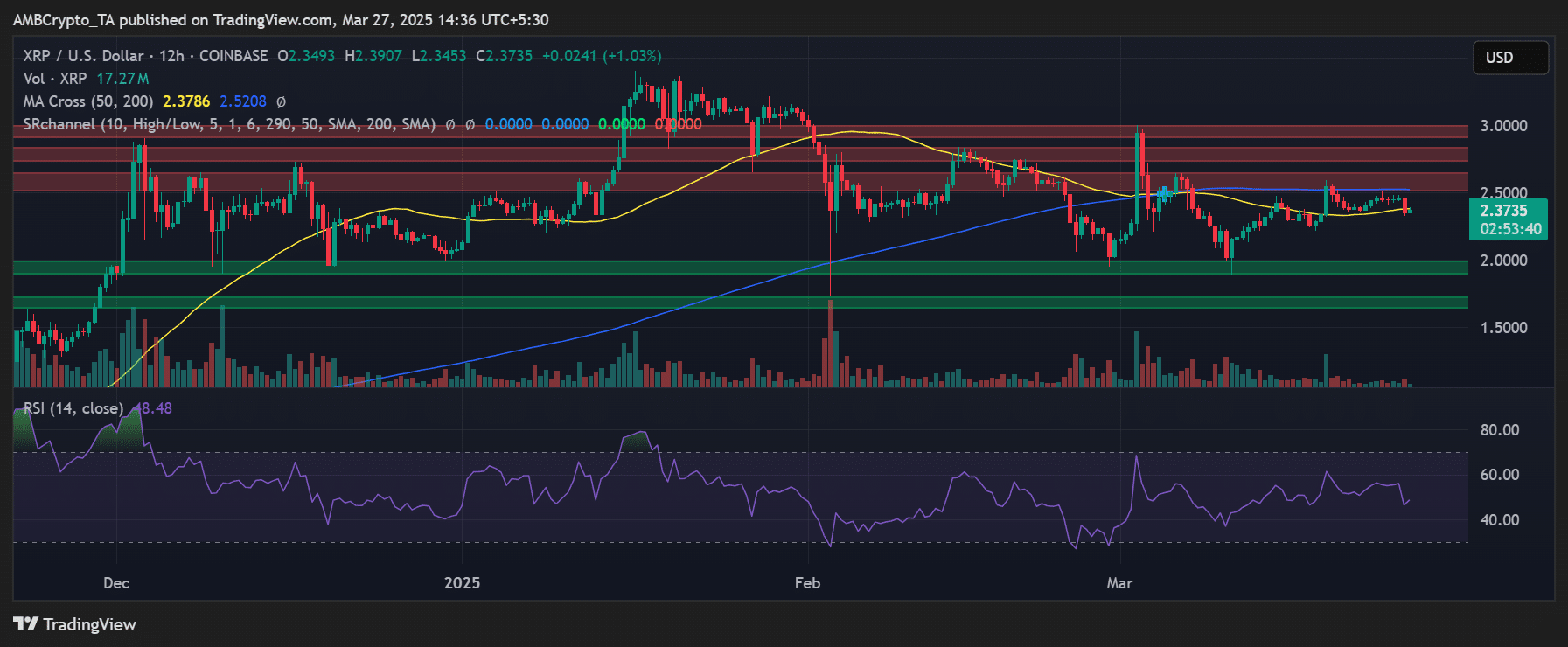

- XRP price remains under the resistance of $ 2.50, with support that now looked around $ 2.35 – $ 2.00.

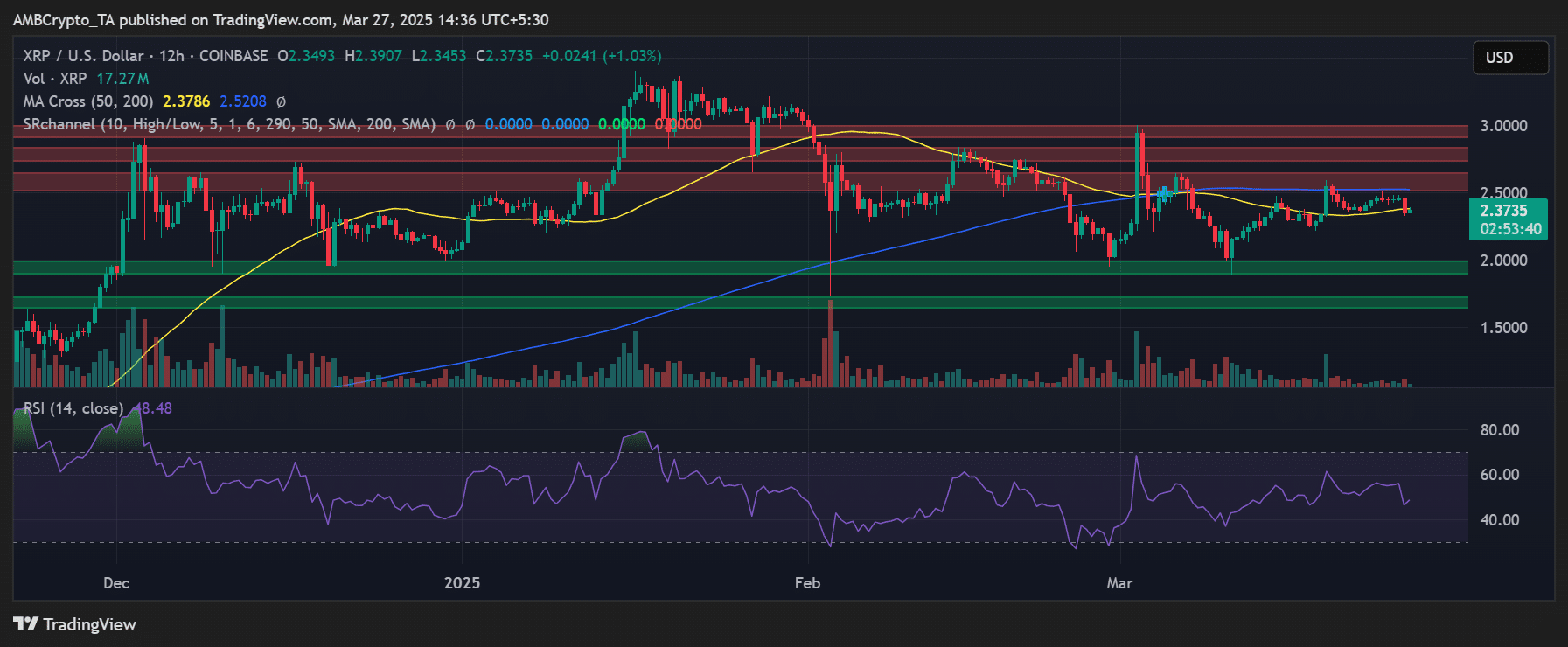

- Open interest in XRP -Futures has fallen from $ 5.8 billion to $ 2.8 billion, indicating the speculative demand of the blur.

The recent rally at XRP was put in his spurs just below the crucial resistance zone of $ 2.50.

As the price is struggling to maintain upward momentum, hints signs of both the derivatives and the spot markets that Beerarish can be mounted.

XRP -Price consolidates under critical resistance

The XRP graph showed it active that around $ 2.37 floated after he had been rejected near the $ 2.50 for the third time in two weeks. This resistance zone aligned with a dense supply area visible on the price chart.

Despite testing higher levels, Bulls is unable to get a foothold above $ 2.50, a sign that sellers still have control.

Source: TradingView

XRP acted just above its 50-day advancing average of $ 2.37 on the press, but far below the 200-day advancing average of $ 2.52. This mixed technical setup reflects indecision in the market.

The relative strength -Index [RSI] Is on 48.48, which indicates a neutral momentum mode with a slight bearish bias.

A breakdown under the 50-day MA could expose token to downward risk to the psychological support zone of $ 2.00.

Futures Market activity is missing about conviction

Data from the XRP Futures open interest Graph painted a similar careful image.

After a peak around mid -January with a value of almost $ 5.8 billion, open interest rate gradually falls and currently fluctuates around $ 2.8 billion.

Source: Glassnode

The decrease in speculative positioning means that traders do not yet have faith in a strong bullish breakout.

This is further supported by stagnating volume trends, which suggests that the recent price promotion is largely powered by spot -market traders instead of speculators in leverage.

Without an increase in open interest or a shift in sentiment, XRP may have difficulty overcoming its current resistance.

Where XRP may go

If XRP does not defend the $ 2.35 zone, a drop to $ 2.00 could follow.

At the top, a strong daily close to $ 2.50 with volume confirmation would invalidate the Bearish Setup and free up the road to the range of $ 2.75- $ 3.00.

However, this would require renewed purchasing power, something that is currently missing.

With both technical resistance and derivatives weakened, bears can have a slight lead in the short term. However, any major shift in market sentiment or fundamental catalyst can quickly reverse the trend.