- XRP Futures Traders disconnecting in the middle of market -wide volatility.

- Bullish signals were coming up – will the bulls grab the chance?

Ripple [XRP] Deserves the critical support of $ 2, but with “extreme” fear that the market engages, the resilience is confronted with a crucial test.

Source: TradingView (XRP/USDT)

Unlike most high caps, the daily graph of XRP shows strong support, whereby sellers have been rejected at important levels, which enhances a bullish structure.

With the RSI soil and futures traders overlay Up to three months lows, more than $ 1 billion in liquidations last week, ripple eyes on a potential rebound once the sales pressure has decreased from the place.

A decrease of 40.97% in volume, however, gives a weak conviction at the level of $ 2, suggesting that it has not been fully determined as a “dip”.

For a long -term recovery, larger players must absorb the constant pressure on risky.

XRP at Crossroads: Fighting or flights?

Despite a sharp rise in sluice The volumes of Binance remain far below 1.6 billion at the beginning of February, when Ripple fell to $ 2.30 – which resulted in a rebound of 17% the next week.

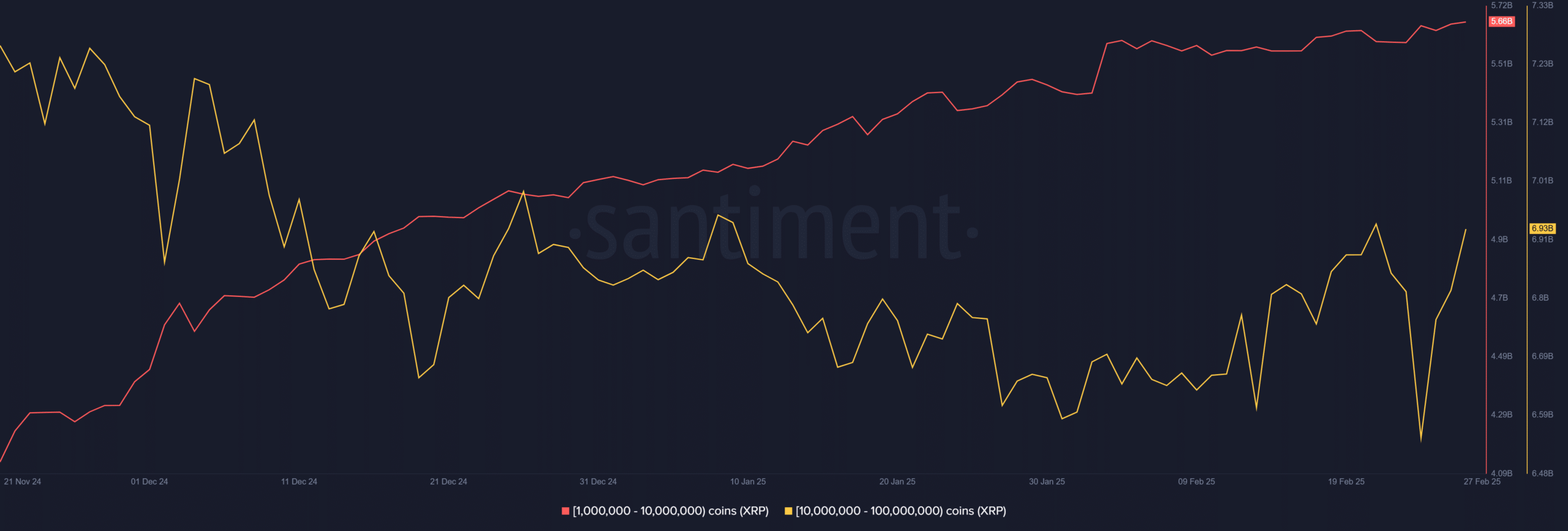

Retail participation remains damped, with FOMO to go into. Walvisportfeuilles with 1 m-10m XRP, however, have risen to a highest point in three months of 5.66 billion XRP.

In addition, portfolios with 10 m-100 m XRP have collected 390 million XRP in the last three days, which strengthens the buy-side liquidity.

Source: Santiment

Ripple has kept this strategic accumulation above the support of $ 2, with the Altcoin trade at $ 2.22, at the time of the press.

Futures traders wind themselves in positions and large players absorb the sales side. However, a definitive soil remains elusive until retail capital arrives the market again.

Speculative positioning remains a key factor. If futures traders increase leverage while the spot demand is lagging behind, the risk of long squeezing can retain the accumulation.

Monitoring of liquidity dynamics is crucial, so caution remains justified.