- Dormant XRP tokens will be reactivated, boosting liquidity and fueling investor confidence.

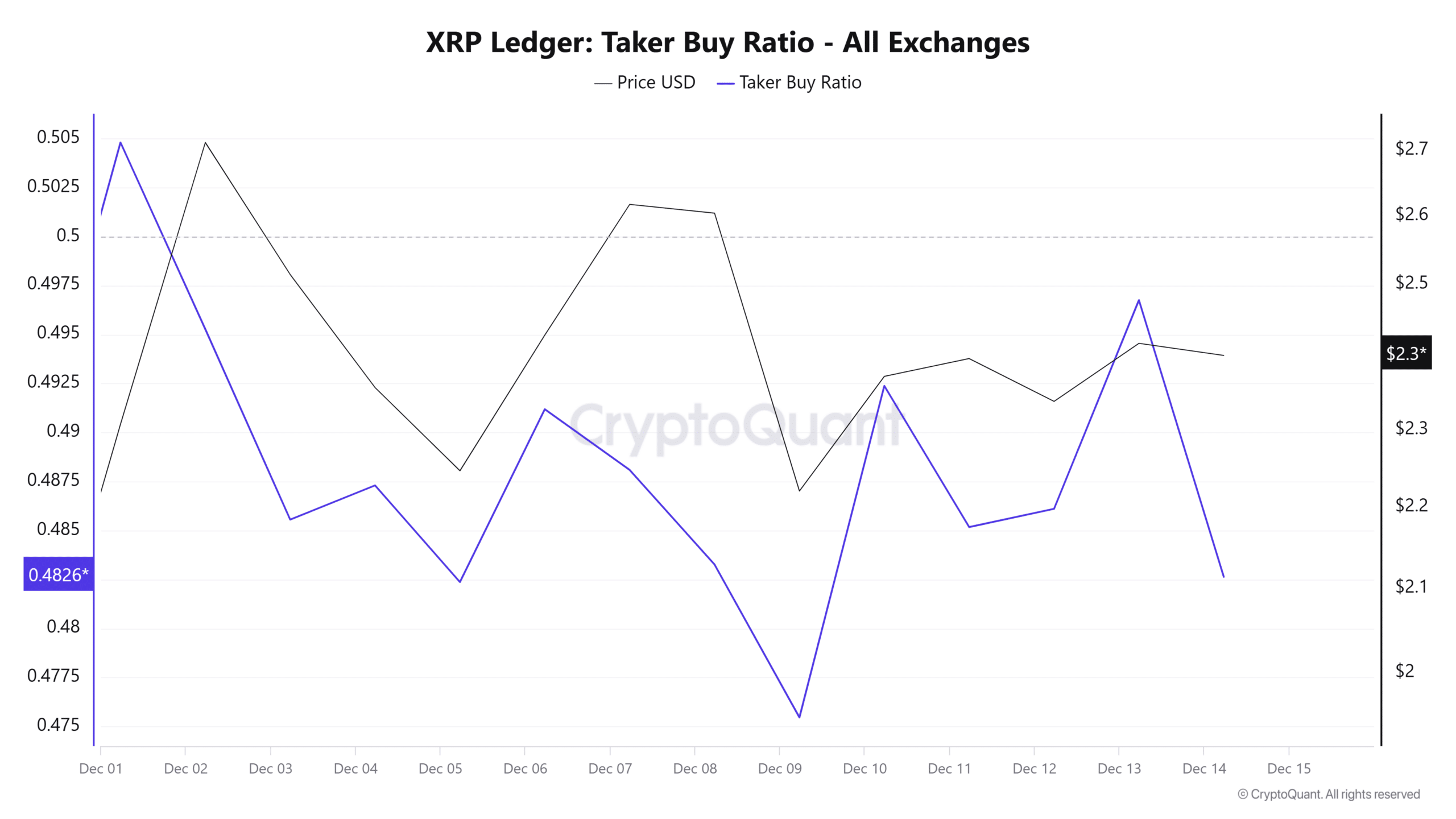

- The rising taker buy ratio reflects the growing bullish dominance in the XRP derivatives market.

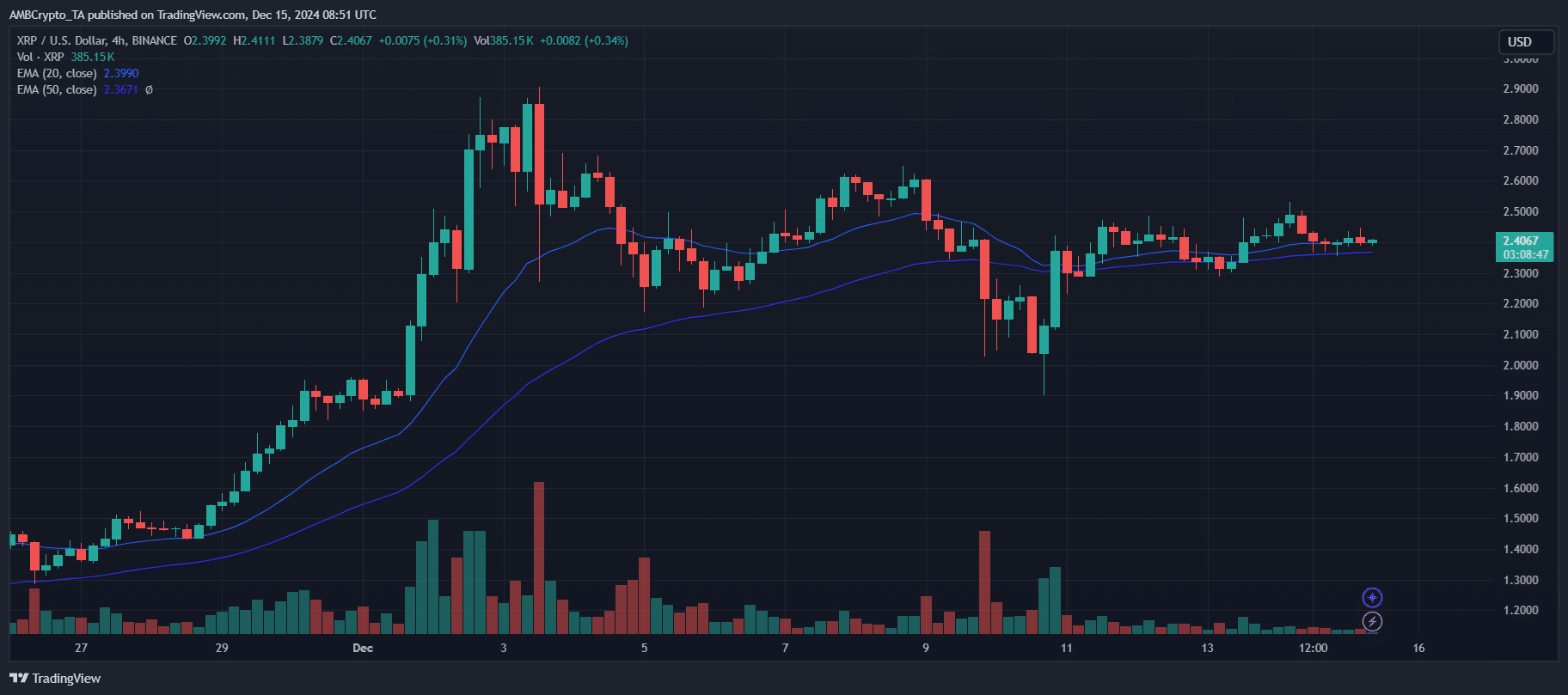

Ripple’s takes place on December 10th [XRP] The price briefly fell below $2, fueling speculation that the extended uptrend may be running out.

However, the rapid recovery of 8% in the past 24 hours has revived optimism.

Beyond the surface, under-the-radar indicators suggest that XRP’s rally has more room to grow, indicating that the bullish momentum is far from over. Here’s what could drive XRP higher.

Dormant XRP tokens are on the move

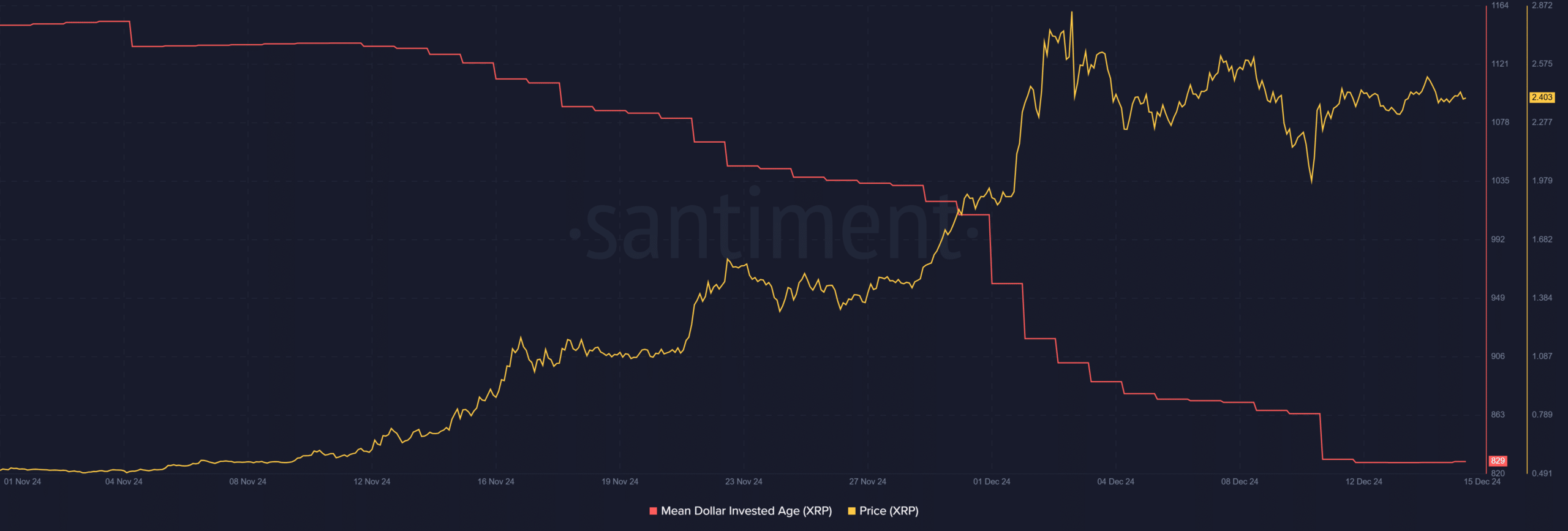

The Mean Dollar Invested Age (MDIA) for XRP has fallen sharply, indicating significant activity on the chain.

Historically, a low MDIA reflects the reactivation of previously dormant tokens, often signaling renewed investor confidence.

In contrast, a rising MDIA implies stagnation, as coins held by long-term stakeholders remain untouched, limiting upside potential.

Source: Santiment

Currently, XRP’s MDIA has fallen to its lowest level since early November.

This downward shift signals that long-dormant tokens are returning to circulation, increasing liquidity and trading volumes – both crucial factors for sustained price momentum.

The recirculation of dormant assets typically coincides with bullish phases, as new trading activity signals both private and larger stakeholders taking advantage of price movements.

Combined with XRP’s rapid price recovery, the declining MDIA underlines growing market participation and strengthens the case for XRP’s bullish outlook.

If this trend continues, XRP could continue its upward trajectory.