Charles Edwards, founder of Bitcoin and digital assets hedge fund Capriole Investments, published a detailed examination of Bitcoin’s current market stage, suggesting a bullish trajectory, potentially reaching the $100,000 mark. The analysis revolves around the identification of a Wyckoff ‘Sign of Strength’ (SOS), a concept derived from the age-old Wyckoff method that studies the dynamics of supply and demand to predict price movements.

Understanding the Wyckoff ‘SOS’: Bitcoin to $100,000?

The Wyckoff Method, developed by Richard D. Wyckoff, is a framework for understanding market structures and predicting future price movements through the analysis of price action, volume and time. The ‘Sign of Strength’ (SOS) within this methodology indicates a point at which the market is showing signs of demand exceeding supply, indicating a strong bullish outlook.

Edwards’ observation of an SOS pattern in Bitcoin’s recent price movements suggests that the market is at a pivotal point where continued upward momentum is highly likely. In Capriole’s latest newsletterEdwards provided an accurate portrayal of Bitcoin’s market behavior, highlighting a period of volatility and consolidation in the $60,000 to $70,000 range.

This phase was anticipated by the hedge fund. Currently, with Bitcoin moving above all-time highs of the last cycle, it is matching the predicted zigzag SOS structure. Edwards explains: “It wouldn’t be surprising if there was a liquidity grab to an all-time high […] Any consolidations above the monthly level of $56,000 are extremely bullish. It would be unusual (but not impossible) if the price continued to rise in a straight line.”

The ‘zigzag’ phase also aligns perfectly with the halving cycle, as BTC tends to consolidate ‘both months either side of the halving’. Edwards added that “the reality of much lower supply growth + unlocked pent-up trading demand will then set in and launch twelve months of historically the best risk-reward period for Bitcoin.”

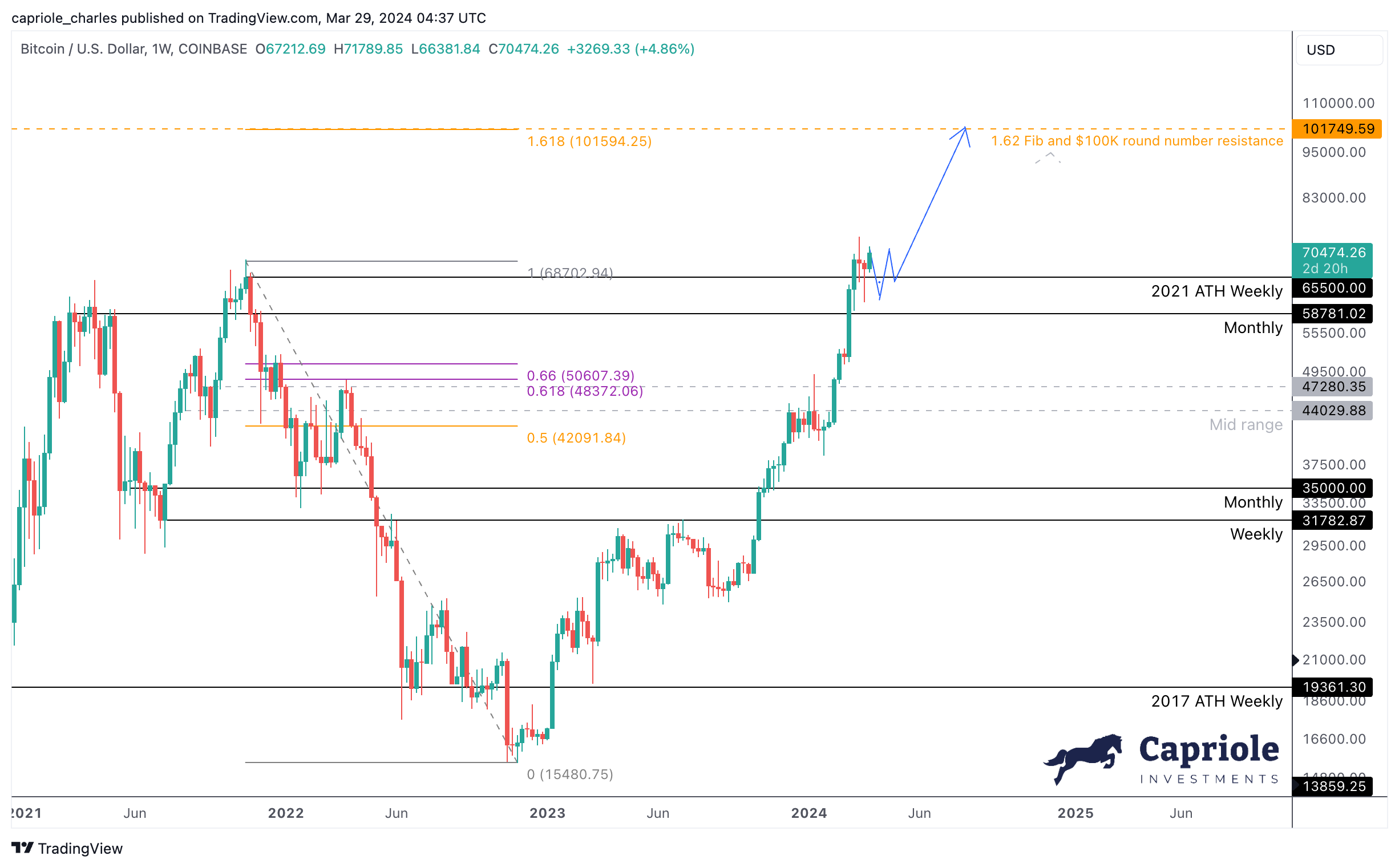

From a technical perspective, Bitcoin’s search for price development territory above $70,000 is devoid of significant resistance levels. This opens a path to psychological and Fibonacci extension levels, with Edwards pinpointing $100,000 as the next major psychological resistance.

The 1.618 Fibonacci extension from the 2021 high to the 2022 low is quoted at $101,750, which serves as a technical marker for potential resistance. Reflecting on investor sentiment, Edwards states, “You can also imagine that a lot of investors would be happy to see six-figure Bitcoin and take profits in that zone,” acknowledging the psychological impact of such milestones.

BTC’s fundamentals support the Bull case

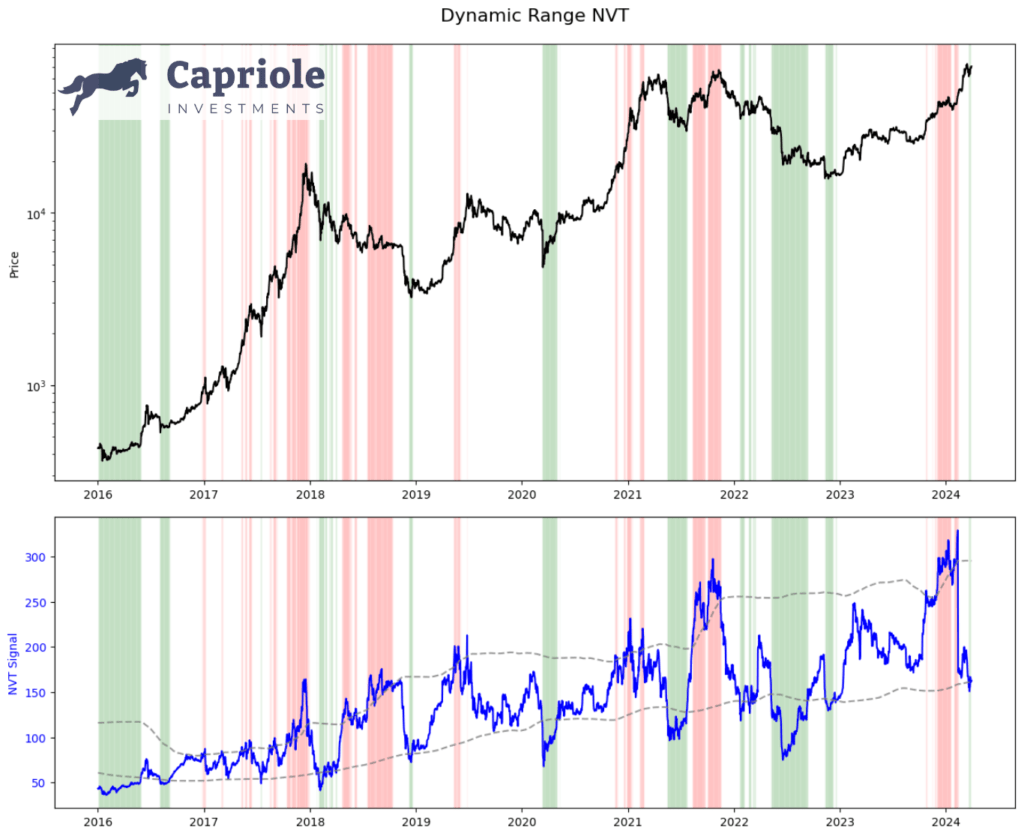

Edwards also dives into the importance of fundamental factors and underlines their role in providing a bullish backdrop for Bitcoin. The introduction of the Dynamic Range NVT (DRNVT), a unique metric for Capriole, indicates that Bitcoin is currently undervalued. Edwards describes DRNVT as “Bitcoin’s ‘PE Ratio’,” which assesses the value of the network by comparing on-chain transaction throughput to market capitalization.

Current DRNVT readings suggest an attractive investment opportunity given Bitcoin’s undervaluation at record highs. “What’s fascinating at this point in the cycle is that DRNVT is currently in a value zone. With prices at record highs, this is a promising and unusual indication of the opportunities ahead in 2024. It’s something we didn’t see in 2016 and 2020,” Edwards noted.

With both technical indicators and fundamental analysis pointing to a bullish future for Bitcoin, anticipation surrounding the upcoming Halving event adds even more momentum to the positive outlook. Despite expectations of near-term volatility and consolidation, Edwards says confidently, “the odds are starting to shift back up.”

At the time of writing, BTC was trading at $69,981.

Featured image from Shutterstock, chart from TradingView.com

Disclaimer: The article is for educational purposes only. It does not represent NewsBTC’s views on buying, selling or holding investments and of course investing involves risks. You are advised to conduct your own research before making any investment decisions. Use the information on this website entirely at your own risk.