- The Litecoin proponent says LTC can continue to follow Bitcoin’s bull cycle trend.

- HODLers have stopped cashing out and accumulation has taken over.

Bitcoins [BTC] impressive run in recent weeks has maintained its “lighter version”. Litecoin [LTC] on the sidelines. Despite not attracting the same crowd as the king coin, LTC has had a relatively good last 30 days as its price rose to $66.38.

Realistic or not, here it is The market cap of LTC in terms of BTC

An increase for BTC is an increase for LTC

Meanwhile, the price increase is not the only notable development that has taken place within the Litecoin network. According to Crypto-Keys.com founder and Litecoin supporter Shan Belew, Litecoin’s fair network value has increased since October 22.

The real network value of Litecoin continues to rise today. It is now $1249 – $3178.

This range will increase as Bitcoin reaches the full bull market. It sounds crazy, but 30k is not out of the question this cycle. $LTCUSD pic.twitter.com/w8kI6kNzWg

– Shan Belew

? (@MASTERBTCLTC) October 21, 2023

The benchmark is defined as the value the cryptocurrency could reach if Bitcoin starts to rise in a full bull cycle. Belew’s prediction was that the value of LTC could rise between $1,249 and $3,178, likely after Bitcoin’s halving in 2024.

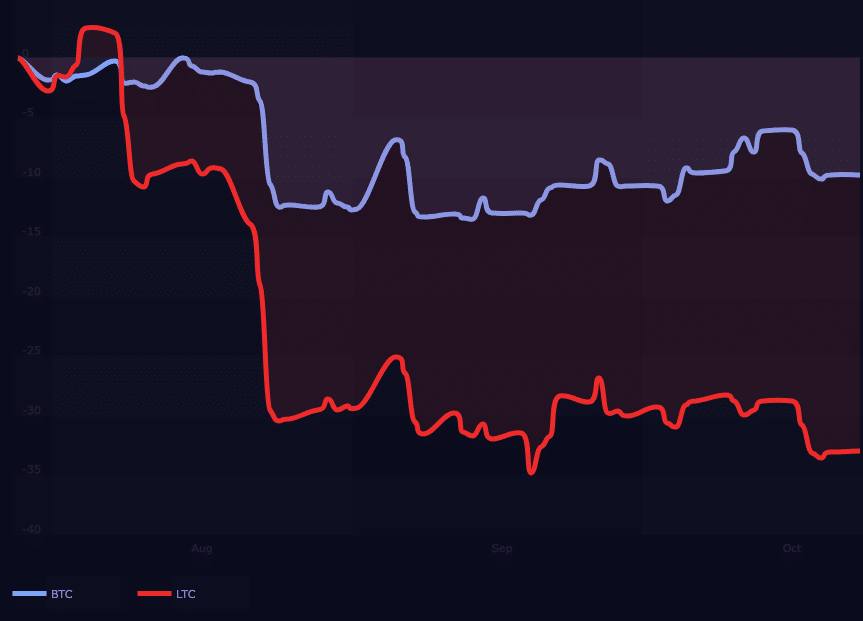

On an all-time basis, LTC’s performance was nowhere near BTC. However, over the past three months, the correlation coefficient between Bitcoin and Litecoin has been 0.78.

The correlation between historical prices or gives back about Litecoin and Bitcoin is a relative statistical measure of the extent to which these cryptocurrencies tend to move together.

Values of the correlation coefficient usually ranges from -1 to +1. Normally, the correlation of zero (0) is possible when the price movement of Litecoin has no effect on the direction of Bitcoin. Conversely, a correlation of one (1) implies perfect directional movement.

Source: Macroaxis

With a value of 0.78, the coefficient implies that Litecoin tends to follow the direction of Bitcoin. If the value of BTC were to increase exponentially, LTC would likely come with it.

Considering LTC’s price action, the four-hour chart against the USD showed that some profit taking has occurred after the coin’s monumental rise began on October 19.

Long-term bets on the light currency

For example, there was resistance at $64.99. Later, after buyers tried to push the price up, sellers decided to return LTC to $64.01. With the current technical outlook, the price of LTC could continue to rise in the coming days.

This was because the 20-day exponential moving average (EMA), in blue, has made a crossover above the 50 EMA (yellow). This is usually one buy/long sign. So, traders may want to remain bullish on the currency.

Source: TradingView

If a decline occurs, Litecoin will likely recover as the 200 EMA (cyan) was above both the 50 and 20 EMAs. Moreover, the technical indicator, on-chain data also supports the LTC revival that will continue for the time being.

Source: Glassnode

Read Litecoins [LTC] Price prediction 2023-2024

This conclusion is derived from that of Litecoin Hodler net position change, created by Glassnode. The Hodler’s net position change shows the monthly position change of long-term investors. When the statistic is negative, it means HODLers are cashing out.

However, the statistic was 400,994 at the time of writing. This means that new positions are being built up. This gives LTC the strength to withstand any major selling pressure.