- Bitcoin’s price soared above $38,000 after the software company revealed details of its recent purchase.

- BTC has the potential to bounce back in the short term, as evidenced by the MVRV ratio.

The aftermath of MicroStrategy’s recent Bitcoin [BTC] The purchase has bears wondering if times have changed. This is because the Bitcoin price did not fall as much as many expected. However, BTC jumped and was able to recover $38,000.

Led by executive chairman and Bitcoin maximalist Michael SaylorMicroStrategy confirmed it had purchased an additional 16,130 BTC. The company, in its communique noted on November 30 that it now owns a total of 174,530 BTC.

At press time, the value of the new purchase was approximately $611 million. This makes the recent purchase the most MicroStrategy has purchased in about two years.

Although the Business Intelligence (BI) company mentioned that these coins were purchased in November, it appears that the company’s once-criticized Bitcoin strategy is now seen as an impressive decision.

What’s better than one profitable bet? More?

MicroStrategy adopted the Bitcoin standard in August 2020. The first Bitcoin purchase at that time was 21,454 BTC. At the time this was worth about $250 million.

But after Bitcoin went into a tailspin in 2022, the company’s assets fell into a massive unrealized loss.

Many comments also seemed to tear Saylor to pieces for putting his company in such a tight spot.

However, this year has proven to be an important year for MicroStrategy. This is because Bitcoin’s recovery has left the company with billions of dollars in unrealized profits.

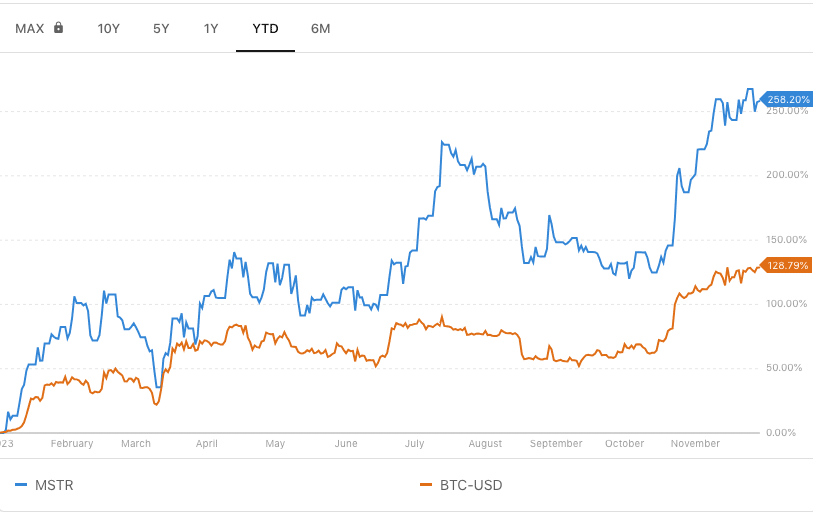

Not only did the price of Bitcoin positively impact MicroStrategy, MSTR stock has done the same. On a Year-To-Date (YTD) basis, BTC has done just that increased with 258.20%. On the other hand, the MSTR is also up 128.78%.

However, AMBCrypto’s analysis of both assets showed that MSTR was more volatile than BTC with 12.76% and 11.79% respectively. This means that the stock has seen greater price fluctuations than Bitcoin in recent times.

It is also important to note that Bitcoin and MSTR are still lower than their All-Time Highs (ATHs). While BTC is down 43.99% from its ATH, MSTR still has a whopping 60.16% to overtake its previous high.

Not every scenario is the same

A look at the Market Value to Realized Value (MVRV) ratio showed that participants may need to be cautious about buying Bitcoin for the short term. At the time of writing, the MVRV ratio was 1.79, as reported by Glassnode.

This benchmark indicates whether a cryptocurrency has a real value or not. Values below 1 mean that most holders are making a loss and are considered a buy signal. However, when the MVRV ratio is above 1, it implies profit for the holders.

But at the same time, caution is preached when accumulating for short-term gains, which was the case this time. Furthermore, the mentioned MVRV ratio may not be a valid sell signal given the current market conditions.

Is your portfolio green? Check the BTC profit calculator

One reason for this assumption is the optimism around a possible approval of a Bitcoin ETF. So, it is likely that the Bitcoin price will not fall in the coming days.

Many also believe that an approval would increase the value of BTC. If this were the case, MicroStrategy’s stake would be worth more than the $6.50 billion it was.