- Bitcoin whale addresses have increased to over 2,000.

- BTC is moving closer to the $70,000 price zone.

The adoption of Bitcoin [BTC] spot ETF in the United States generated varying responses on different measures.

One such measure indicated that whales increased their accumulation as prices rose to record highs. How profitable have their investments been in recent months?

Bitcoin whales show ETF excitement

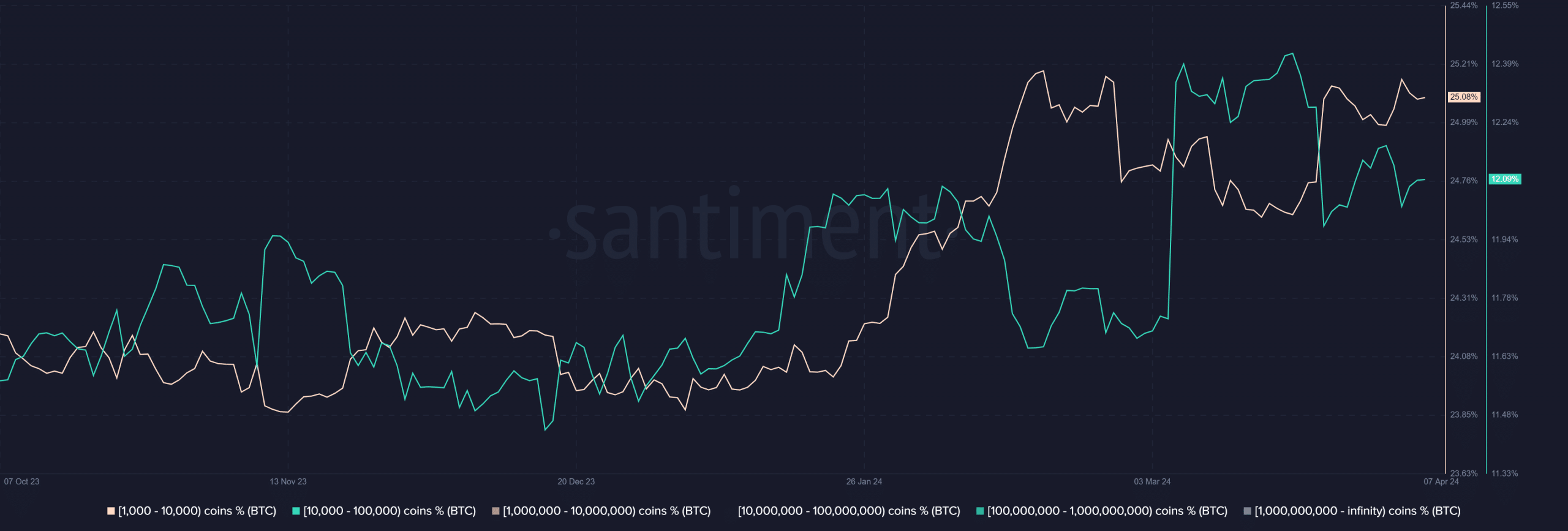

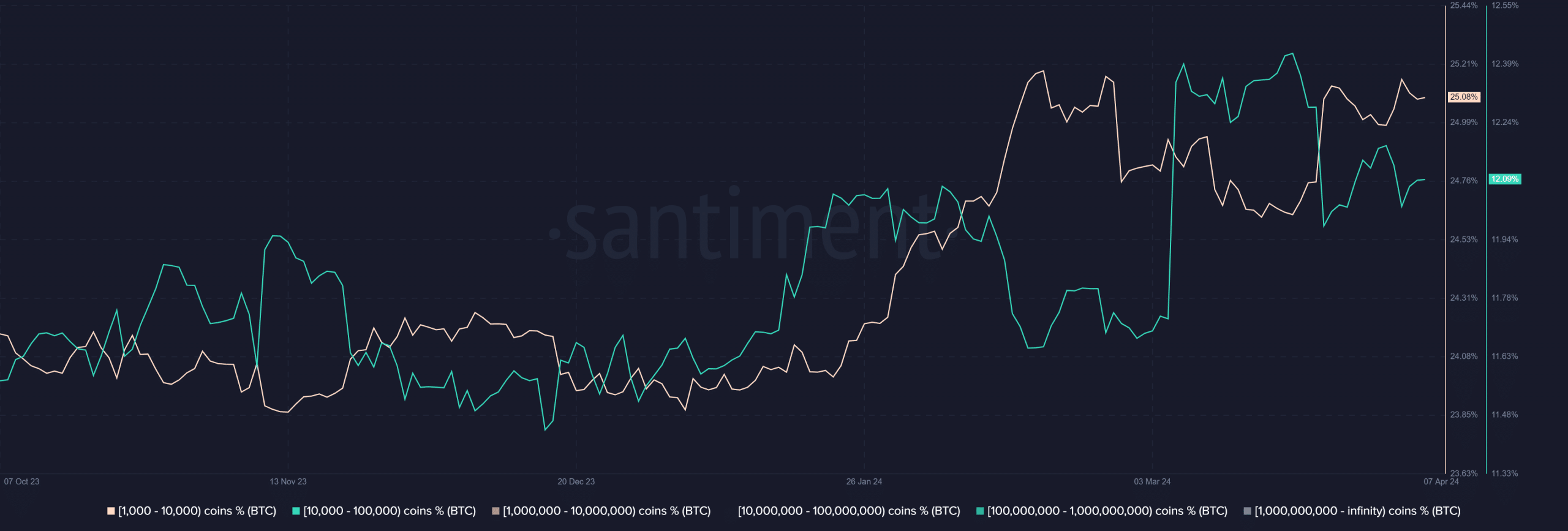

An analysis of whale addresses holding 1,000 or more Bitcoin revealed a significant increase following the approval of the spot ETF in January.

The graph shows an increase in the number of addresses from approximately 1,800 to more than 2,000.

Source: Santiment

Despite a slight decline in recent weeks, the number remained above the 2,000 mark. The balance at these addresses increased by more than 220,000 BTCs, equivalent to approximately $14 billion.

This suggested that the adoption of the spot ETF led to an increase in activity among whales, with more of these addresses accumulating additional BTC.

Bitcoin whale remains in the profitable zone

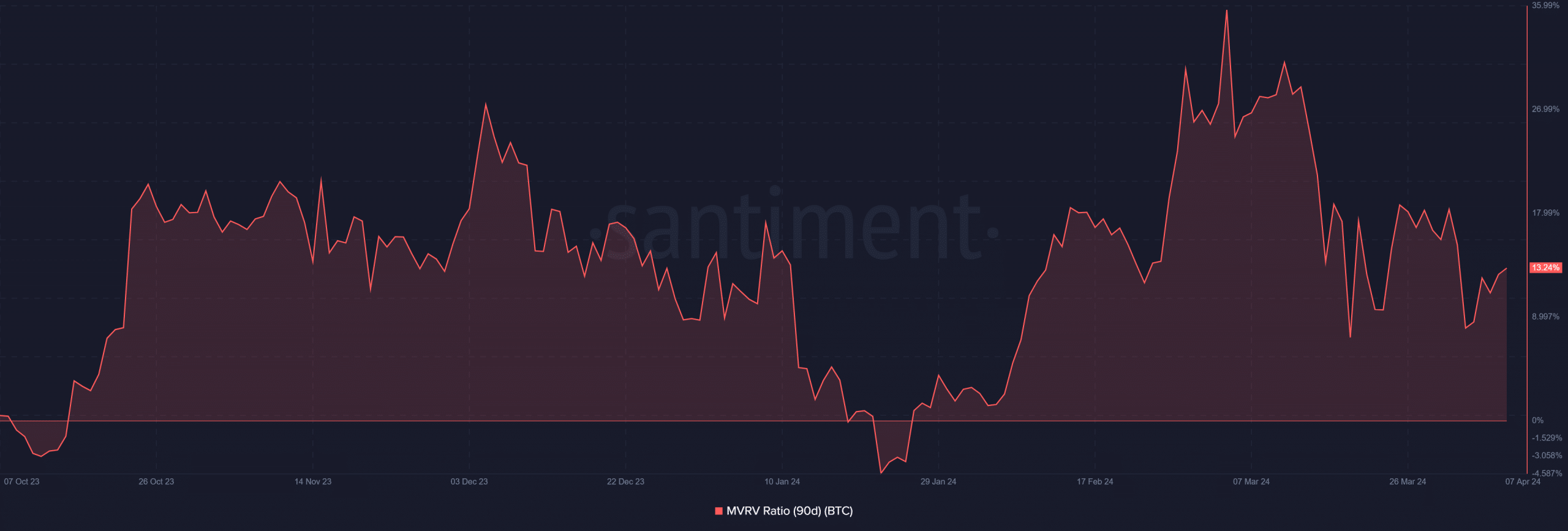

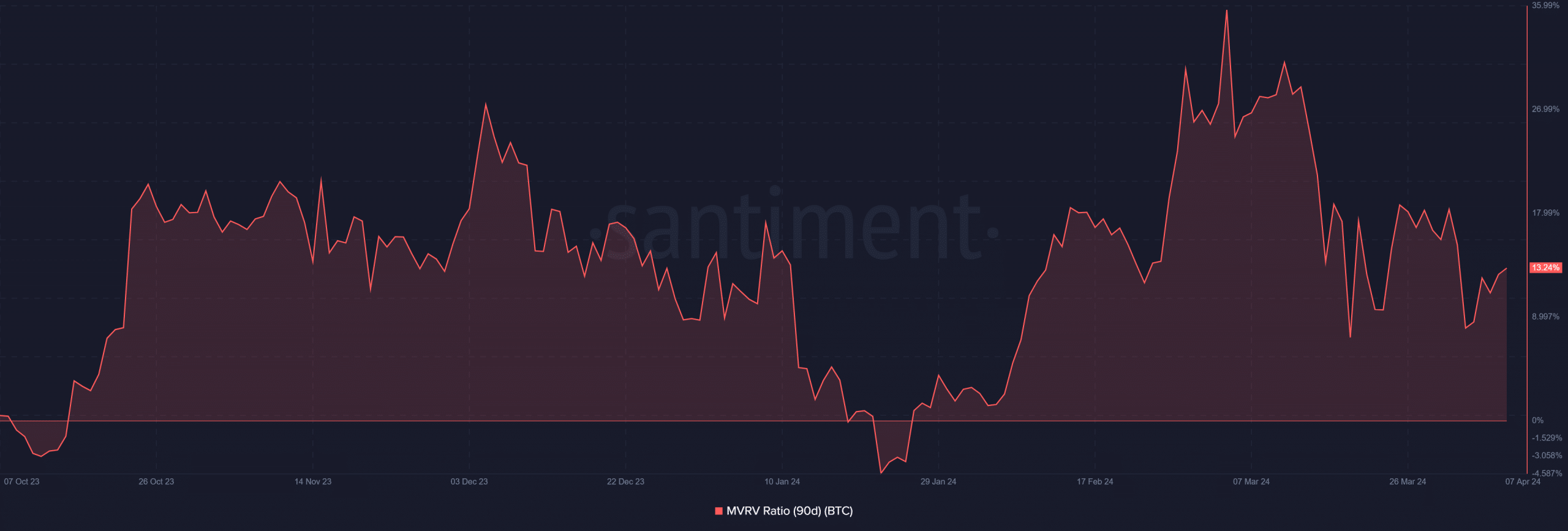

The assets these whales have accumulated in the months since the ETF’s approval have proven profitable. Analysis of the Bitcoin 90-day market value to realized value ratio (MVRV) showed it to be above 0.

Source: Santiment

The MVRV then rose to over 35% in March before experiencing a significant decline.

At the time of writing this article, the MVRV had dropped to approximately 13.24% and returned to the region it was in before the approval. This decline is attributed to the recent price drop in BTC.

However, despite this decline, the current reading of the MVRV indicates that whales who purchased during this period are still making a profit.

BTC is getting closer to $70,000

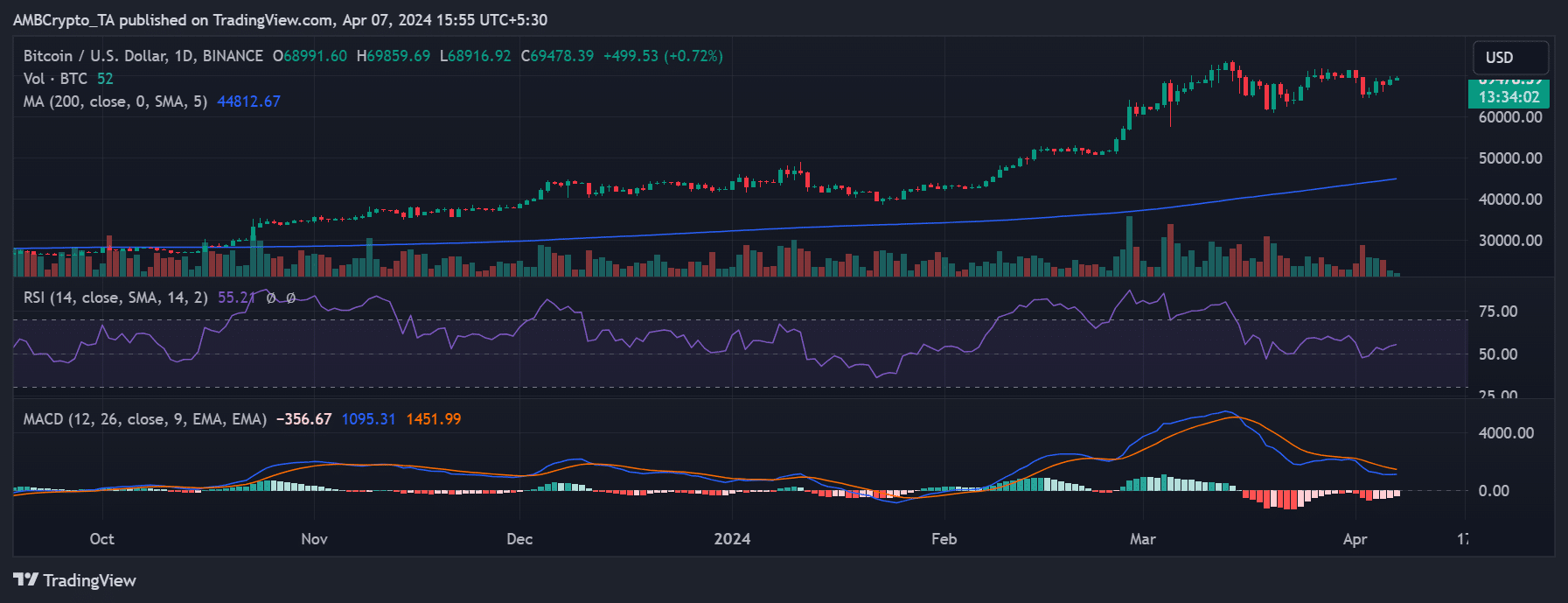

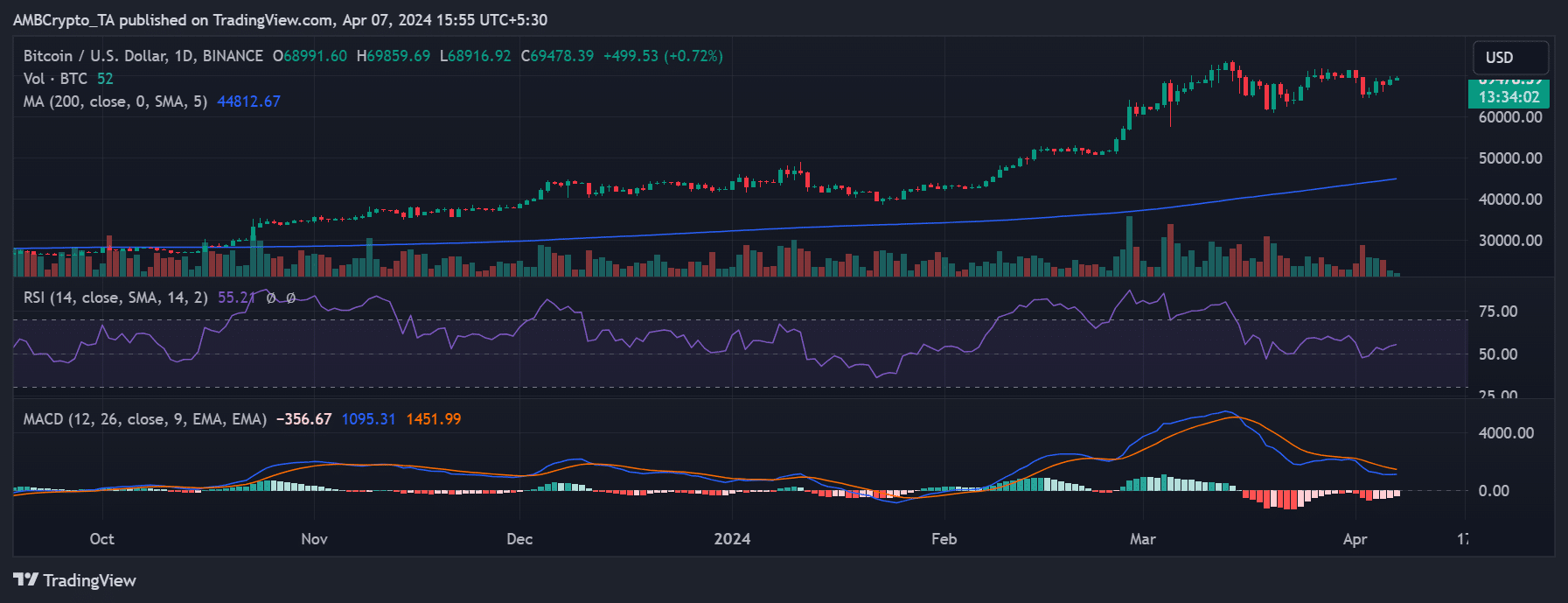

AMBCrypto’s analysis of Bitcoin’s price trend on a daily time chart revealed a notable increase following the approvals, reaching new highs.

Is your portfolio green? Check out the BTC profit calculator

However, the price has moderated in recent weeks, dropping below the established threshold above $70,000. Despite the decline, it remained close to the $70,000 price zone.

At the time of writing, BTC was trading at over $69,000. Moreover, it was in a bullish trend, as evidenced by the fact that the Relative Strength Index (RSI) was above 50.

Source: TradingView