Two more asset managers have temporarily waived fees on their spot Bitcoin ETFs, Bloomberg ETF analyst James Seyffart said on January 9.

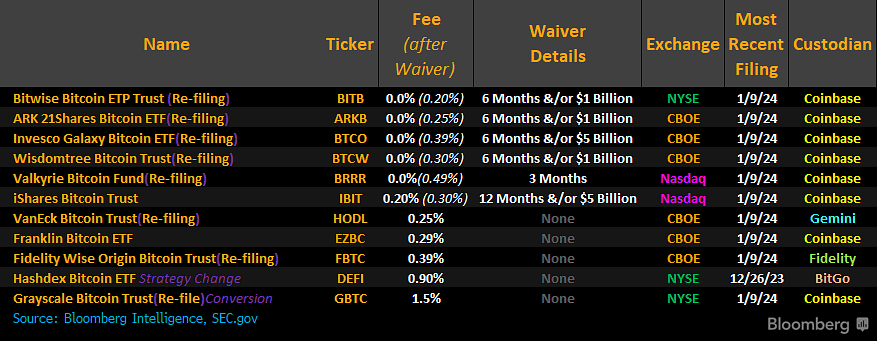

Seyffart indicated that WisdomTree will waive its fees for six months or the first $1 billion of assets, reducing fees from 0.30% to zero during the waiver period.

He also indicated that Valkyrie Investments will waive its fees for three months, reducing the fee from 0.49% to zero during the waiver period.

Each company’s latest S-1 filing shows that the exemption applies to sponsorship costs. That term describes the compensation the sponsor receives — in this case Valkyrie or WisdomTree — collects compensation from the ETF Trust for services performed under the Trust Agreement and for other services paid for by the Sponsor.

These waivers also align Valkyrie and WisdomTree with four other ETF applicants that have similarly waived fees: Bitwise, Ark Invest, Invesco and BlackRock (iShares). All but one company plans to waive fees entirely during the waiver period: only BlackRock will maintain a 0.20% fee post-waiver. Five other spot Bitcoin ETF applicants have not announced any exemptions.

‘Fee wars’ have also reduced regular fees

In addition to the introduction of waivers, several companies have cut their regular fees in recent days through competing filings in what has been dubbed a ‘fee war’.

Blackrock, Ark Invest, WisdomTree and Invesco each reduced or itemized their fees in filings on January 8. Grayscale, while its fee is significantly higher than others, has also reduced its fee from 2% on January 8 to 1.5%.

Many sources expect that the US Securities and Exchange Commission (SEC) will approve a spot Bitcoin ETF tomorrow, January 10, and trading will begin in the coming days. Although approval is not certain, the SEC has had extensive contact with applicants and is expected to decide on Ark Invest’s application tomorrow.

The post WisdomTree and Valkyrie Add Waivers to Spot Bitcoin ETF Applications appeared first on CryptoSlate.