NFT

As we delve deeper into the dynamic world of NFTs, it is crucial to understand the driving forces behind their rise and fall. And learn to recognize the characteristics of a promising NFT in a crowded digital market.

Here, we examine the factors contributing to the volatility of the non-fungible token (NFT) market and discuss strategies for identifying long-term winners amidst the turbulence.

A rocky path for NFTs

NFTs have had a wild ride in recent years. Having once skyrocketed in value, they have since suffered serious downturns. The NFT market is now teetering on the brink, with economic instability casting doubt on its future.

The digital products received a lot of attention in 2021. Driven by high-profile sales, such as Beeple’s digital artworks that sold for $69 million, and celebrity endorsements, the market experienced exponential growth. NFTs allowed artists, musicians and other creators to monetize their work in unprecedented ways. However, this rapid rise led to concerns about market saturation and speculative bubbles.

The volatility of the NFT market is hard to ignore. Rapid rises were followed by dramatic crashes. Current global economic conditions only exacerbate this instability. Inflation, supply chain disruptions and geopolitical tensions all add to the sense of uncertainty permeating the market.

For example, the COVID-19 pandemic has left lasting traces in the global economy. Rising inflation rates and labor shortages have affected consumer spending and business. These factors weigh heavily on the NFT market, which relies on discretionary spending. In fact, many Americans are deploying government stimulus checks to operate in both the crypto and non-fungible token markets.

Long term viability

Despite the challenges, NFTs have shown resilience. As the market matures, some indicators point to long-term potential. For example, the recent surge in metaverse investment could bolster the NFT market. Virtual land, art, and collectibles could likely benefit from this newfound interest.

Facebook’s rebranding to Meta and the company’s commitment to developing the metaverse signals a broader trend. Large companies, such as Microsoft and NVIDIA, are also investing heavily in virtual reality and augmented reality technologies. These developments could translate into increased demand for NFTs as digital goods become more integrated into everyday life.

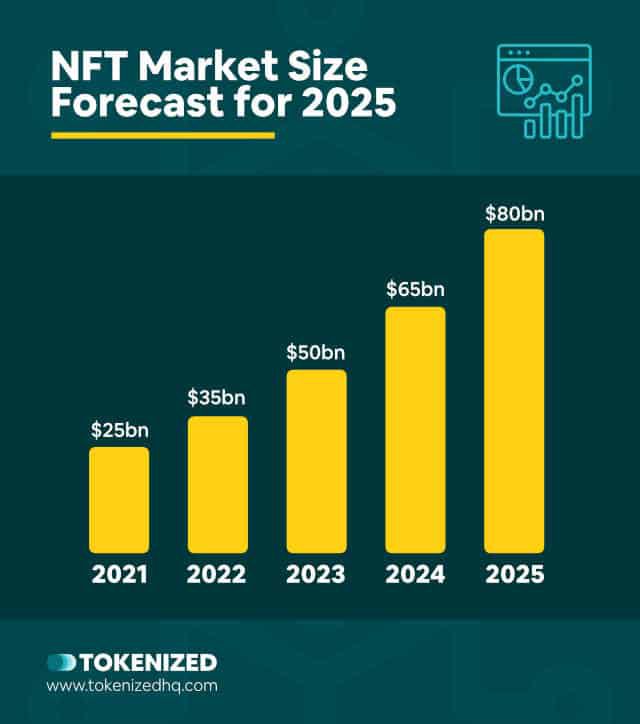

Predicted growth / chart: tokenized

The growing intersection of NFTs and decentralized finance (DeFi) also offers opportunities for growth. DeFi platforms allow users to lend, borrow and trade digital assets without middlemen. NFTs can act as collateral for loans, allowing users to unlock liquidity without selling their valuable assets.

This convergence of NFTs and DeFi has led to innovative platforms such as NFTfi and Aavegotchi, which combine elements of both worlds. Leveraging the DeFi ecosystem will allow the NFT market to find new avenues for growth and overcome some of its challenges.

Spot the winners

Investors should exercise caution in this volatile market. It is essential to separate projects with long-term prospects from those that are doomed to fail. Some indicators can help:

- Utility: NFTs with practical applications, such as gaming assets or virtual real estate, may outperform purely speculative tokens. For example, the popular blockchain game Axie Infinity uses NFTs as in-game assets, giving them inherent value.

- Rarity: Limited supply can drive demand, making rare NFTs more valuable. CryptoPunks, a collection of 10,000 unique pixel art characters, is a great example of this dynamic in action.

- Quality: Artistic merit and creative innovation can set successful NFTs apart from the crowd. Projects like Art Blocks, which generates unique artworks based on algorithms, stand out for their originality.

The bigger picture

The NFT market does not exist in a vacuum. The wider context of cryptocurrency and stock market fluctuations has an impact on its future. With cryptocurrencies such as Bitcoin and Ethereum facing regulatory scrutiny and price volatility, the fate of NFTs, which often rely on these currencies, becomes even more uncertain.

In addition, turbulence in the stock market can affect them. As investors seek safe havens in times of crisis, the NFT market may struggle to maintain its allure.

Concerns about the environment

The impact on the environment is another factor that influences their future. NFTs are mainly minted on energy-intensive blockchain networks such as Ethereum, which rely on the proof-of-work (PoW) consensus mechanism. The high power consumption associated with PoW has led to sustainability concerns.

In response, several projects are exploring more environmentally friendly alternatives, such as proof-of-stake (PoS) networks, which use significantly less energy. The transition from Ethereum to PoS, known as Ethereum 2.0, could help address these concerns and potentially boost the market.

The road ahead

The NFT market faces numerous challenges, including market saturation, economic instability, and environmental concerns. However, with the growth of the metaverse, DeFi integration and the emergence of eco-friendly blockchain networks, there is reason for cautious optimism.

Investors who carefully consider usability, rarity and quality when assessing the market are more likely to identify winners in this volatile market. While the future remains uncertain, the potential for innovation and growth should not be underestimated.