Popular crypto analyst Willy Woo thinks on-chain data suggests Bitcoin (BTC) could be in the early stages of a price squeeze.

Wed say a short squeeze, which occurs when large numbers of traders who shorted an asset decide to cut their losses in response to an unexpected price increase, triggering additional rallies, could be in the works for BTC.

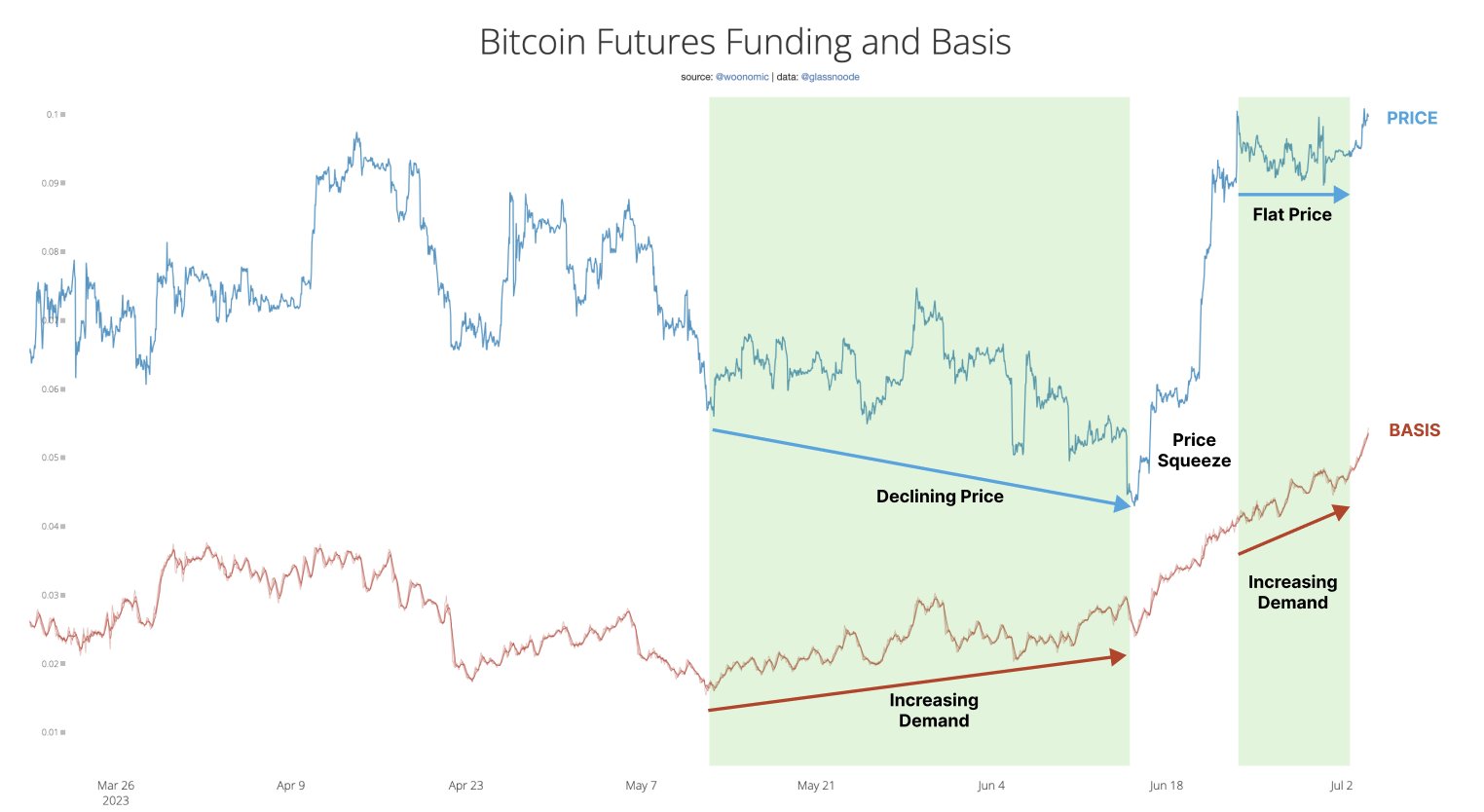

“Price action has been largely dominated by demand emanating from calendar futures markets, the tool of professionals and institutions. Even now, demand continues to rise, suggesting we are in the early stages of another price squeeze.”

The trader tells are 1 million Twitter followers that not all Bitcoin stats look completely bullish though.

“And the downside: demand for calendars is overbought under statistical analysis. It will be important to keep a close eye on the dwindling base. It could exit quite soon, quelling the bullish price action.

Explainer: Basis is the cost of maintaining an investment. In this case, basis = the cost of holding a long position, so can be used as a way to quantify the demand coming from calendar futures.

BTC is trading at USD 30,488 at the time of writing. The top-ranked crypto asset by market capitalization is down 0.88% in the past 24 hours, but is up more than 1.2% in the past week.

Don’t Miss Out – Subscribe to receive email alerts delivered straight to your inbox

Check price action

follow us on Twitter, Facebook And Telegram

Surf the Daily Hodl mix

Generated image: DreamStudio