- Toncoin’s recent rally from its six-month support has positioned the altcoin at a crucial resistance level near $6.

- Derivatives data reaffirmed a near-term bullish edge.

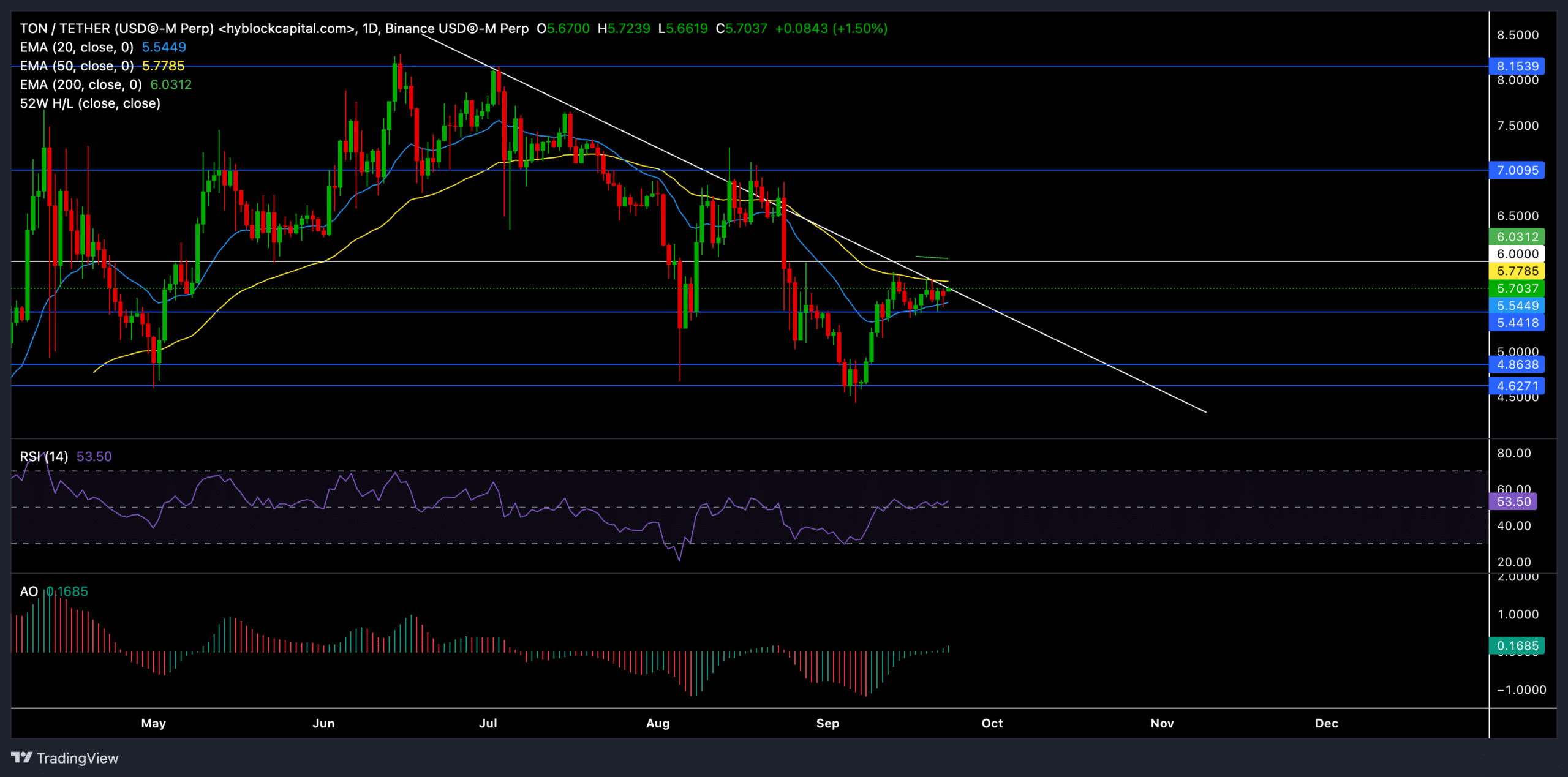

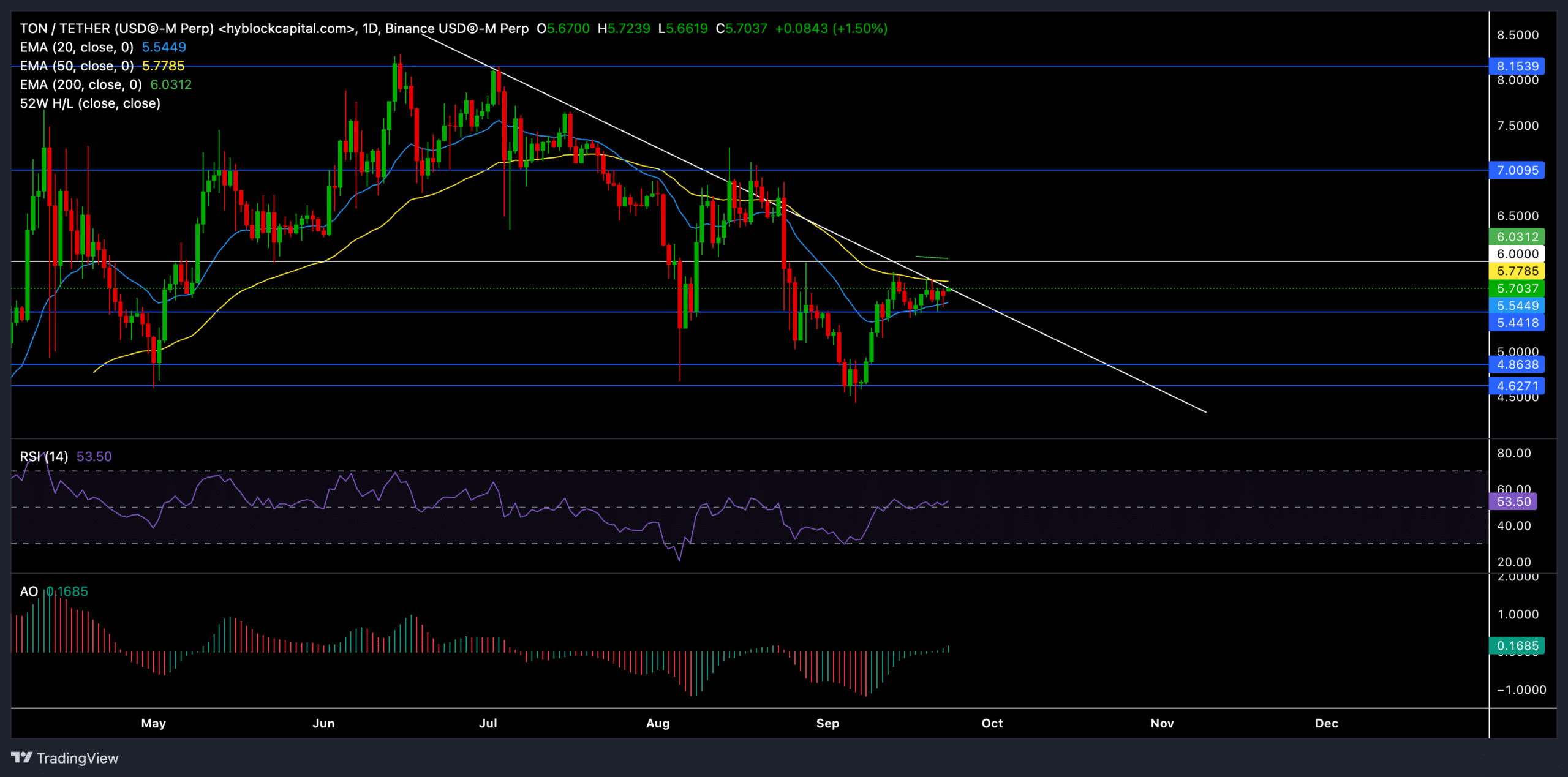

After testing the six-month support range near $4.6-$4.8, Toncoin has [TON] recently witnessed a strong bullish rebound. As a result, the altcoin rose nearly 22% over the past two weeks and regained a spot above its 20-day EMA ($5.54).

At the time of writing, TON was trading at $5.70. It sought to challenge the long-term trendline resistance that it has been holding tight since July. A break above this resistance could set the stage for further gains in the coming days.

Toncoin bounces back after testing key support: what’s next for TON?

Source: TradingView, TON/USDT

TON’s recent recovery has put the stock at a critical point. If bulls push the price above the $6 resistance (coinciding with the 200-day EMA at $6.03), Toncoin could see an extended rally towards $6.78 and possibly $7.00 in the near term.

Breaking these levels would confirm a strong bullish recovery, opening the door for a broader uptrend.

However, if TON fails to break above the $6 level, a pullback to the $5.54 support (near the 20-day EMA) is likely. A sustained close below this support could trigger a deeper correction, causing the price to pull back towards the USD 5.00 and USD 4.86 levels.

The Relative Strength Index (RSI) currently stood at 53.50, reflecting neutral momentum. The RSI’s position just above the midline suggests that buyers are still in the game, but they need to move higher to confirm further upside.

It is worth noting that the Awesome Oscillator recently closed above the zero level and showed a slight bullish edge. A sustained position above this level will reaffirm the bullish bias.

Derivative data revealed THIS

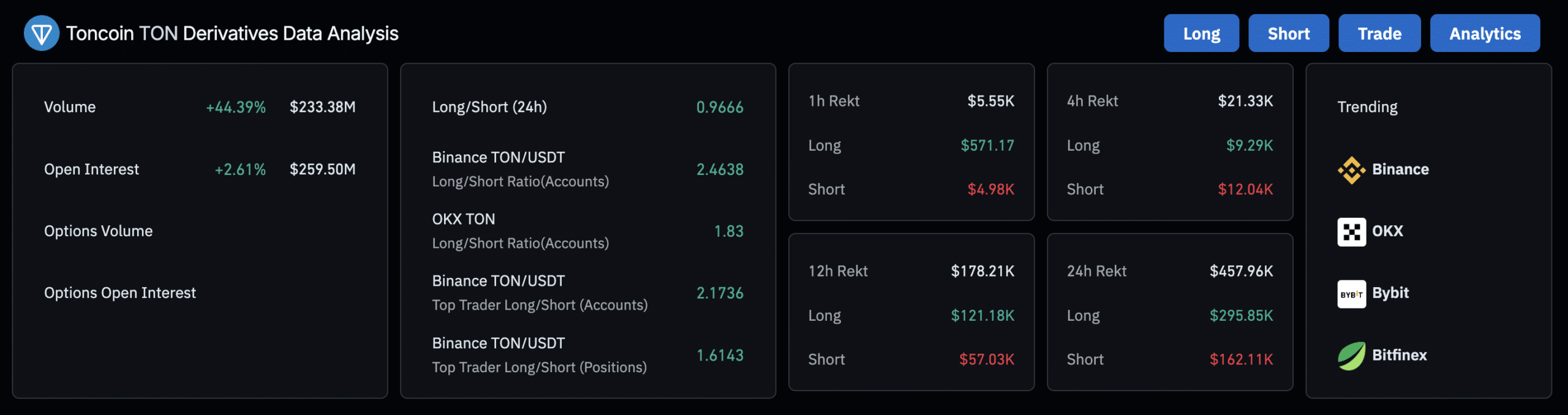

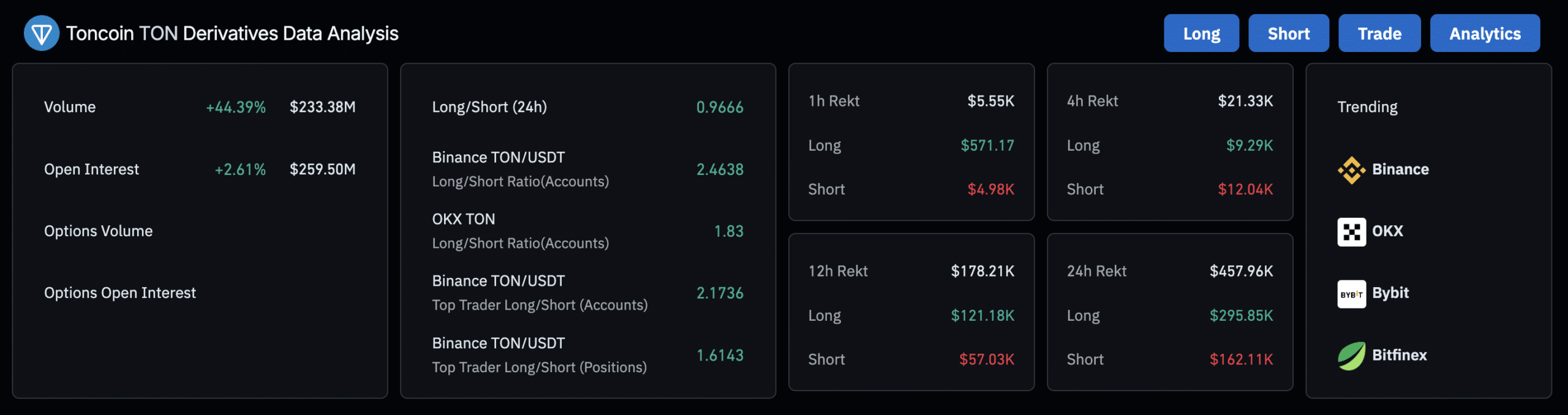

Source: Coinglass

TON volume rose +44.39% to reach $233.38 million, reflecting renewed interest in the coin. Open interest also saw a slight increase of +2.61%, indicating that traders were still keeping their positions open amid the recent price action.

While the overall long/short ratio was slightly bearish at 0.9666, the Binance long/short ratio for accounts showed a bullish scenario at 2.4638. This indicated that countless Binance traders had placed their bets on a sustainable recovery.

Read Toncoin’s [TON] Price forecast 2024-25

Similarly, the trader’s long/short ratio on OKX stood at 1.83, reinforcing the bullish bias among key market participants.

Traders should closely monitor RSI and derivatives data for signs of further bullish momentum or a reversal. Buyers should also consider Bitcoin’s movements and overall sentiment before making a purchasing decision.