The financial world is abuzz with speculation about the resilience of cryptocurrencies amid potential global financial turmoil and a looming recession in the United States. XRP, with its unique status, has become the center of these discussions, following a series of comments and analyzes by renowned crypto analyst Egrag Crypto.

XRP Price Amid a 50% Stock Price Crash

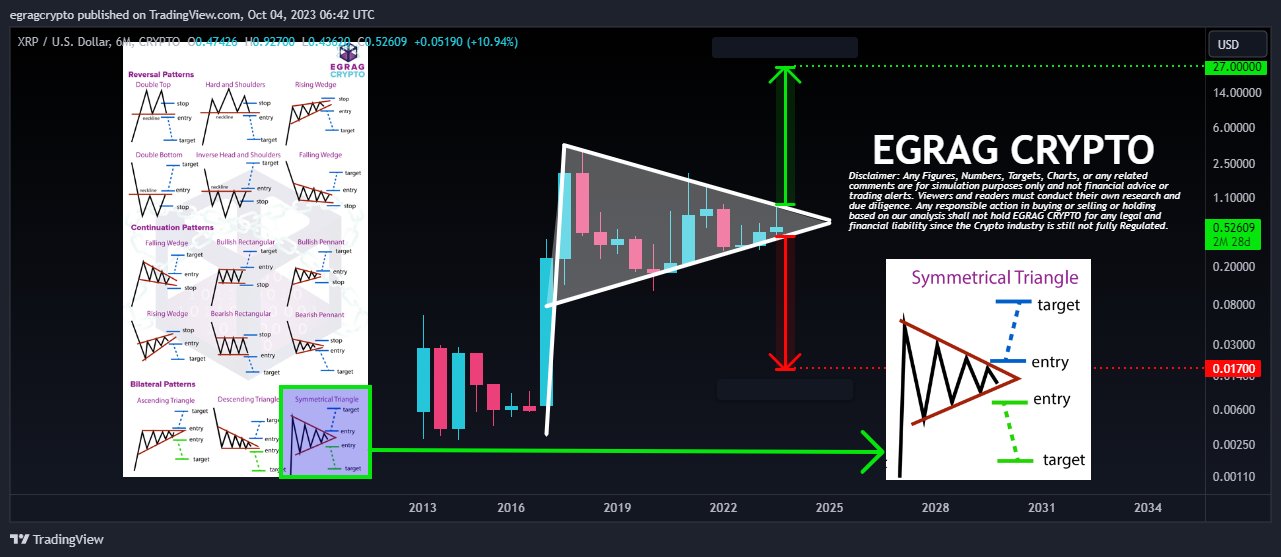

On X (formerly Twitter), Eggag taken an in-depth look at the six-month chart of the XRP price, presenting two scenarios that couldn’t be more different: a crash to $0.017 and a rally to $27.

The analyst highlighted the groundbreaking nature of XRP due to the remarkable degree of legal clarity it offers, which sets it apart from other digital assets. “The current state of XRP offers a remarkable degree of legal clarity, making it a breakthrough digital asset in terms of regulatory recognition,” Egrag said.

This legal recognition, combined with the role it plays in simplifying cross-border payment solutions, strengthens the case for XRP to potentially rise to a $27 price target, Egrag claims. But his analysis was not purely optimistic. He warned his followers of looming shadows in the broader financial spectrum.

A significant number of technical analysts have predicted a dramatic 40% to 50% downturn in global stock and equity markets. Egrag pondered the implications of such a downturn on cryptocurrencies, especially XRP. He shared the following chart and warned of a possible sharp XRP price crash:

Under such circumstances, a measured movement of 0.017c becomes a relevant consideration. I am somewhat baffled by the dichotomy presented by certain technical analysts who foresee a collapse in traditional markets while advocating that crypto stick to the four-year cycle.

He further noted that “it is imperative to maintain a consistent and non-contradictory stance when assessing these scenarios,” highlighting the inconsistency of predicting both a market collapse and a steady four-year crypto cycle .

Mixed reactions from the community

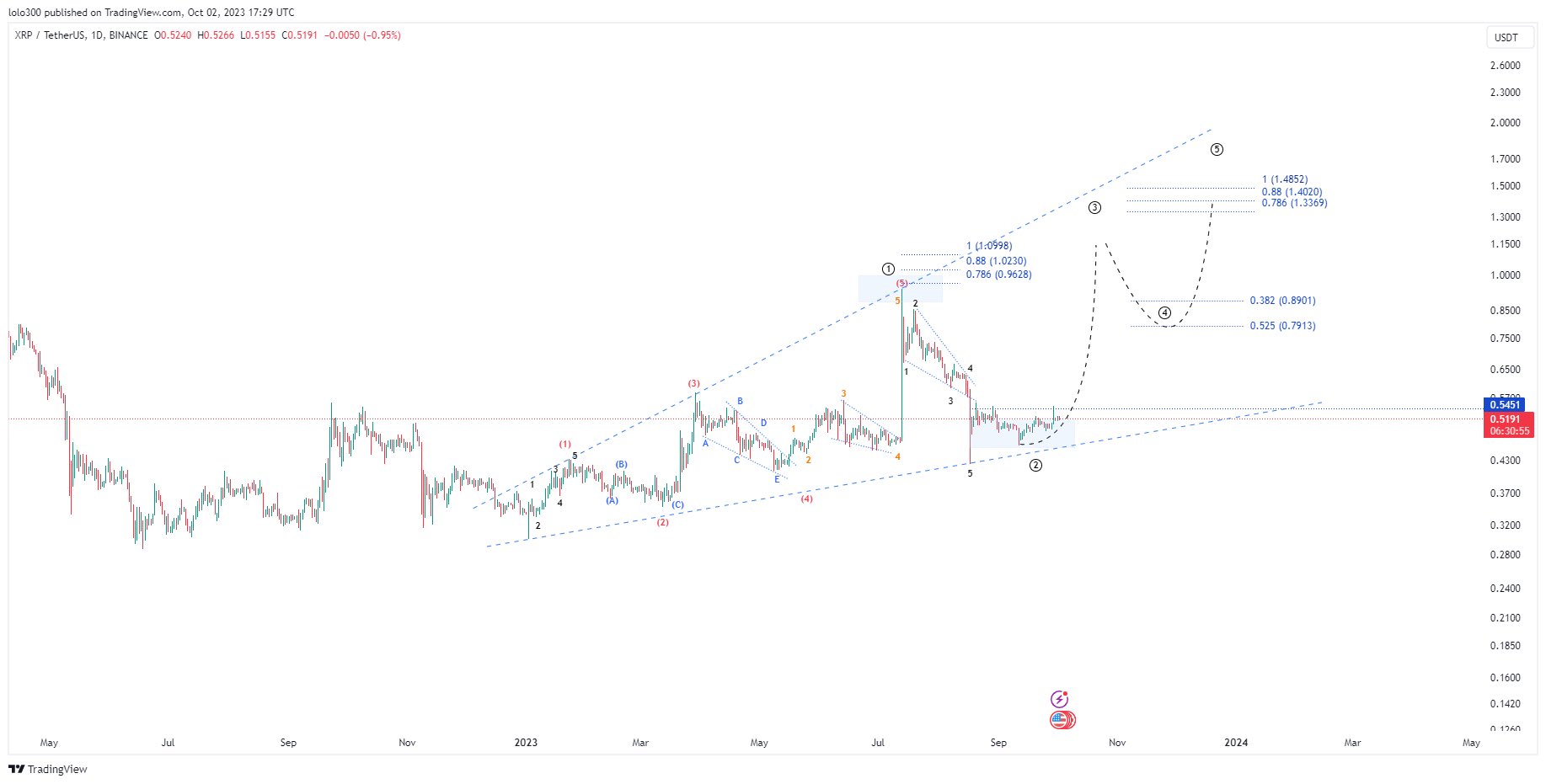

Feedback on Eggag’s analysis was multifaceted. @300Mill300, a prominent voice in the crypto space, extrapolated from Egrag’s initial analysis and offered a chart that was bullish for XRP. He predicted a rally to $1.15 in early 2024, followed by a brief pullback to $0.79, and a subsequent bullish rise to reach $1.40 by the end of 2024.

However, sentiment was not unanimously optimistic. Rainmaker, a crypto enthusiast with almost a decade of experience, sounded a note of caution. He predicted a pronounced “washout” ahead of each Bitcoin halving, which would send the XRP price down, possibly to the mid-$0.20s.

In response, Egrag showed his balanced attitude. While he agreed with Rainmaker on the potential drag of macroeconomic elements on XRP, he remained bullish on XRP’s intrinsic strengths. He noted, “I think the overall macro will drag it down, but otherwise it’s as solid as a rock.”

Analyst Ata Yurt joined the discussion and had a different perspective. He expressed skepticism about XRP achieving the mentioned price points, stating: “At $0.017 there would be no sellers or buyers… At $27 there will be no buyers either, apart from a small group of FOMO orders, the majority will come in FOMO at $3 or $5. as these are the expected levels taking into account previous ATH.”

Yurt proposed a more pragmatic approach, suggesting a mix of technical analysis and market psychology. He believes the $5 mark for XRP is more achievable and urges the community to consider a linear chart for review.

Egrag, not one to shy away from discussion, responded with a thought-provoking question: “Good idea, but what if the stock and equity markets crashed by 40-50%? Then what?” Yurt responded by estimating Bitcoin’s potential fall in such a scenario, speculating that if Bitcoin were to lag and fall 60%, XRP, relative to BTC, would be around $0.22-$0 .25, a figure he considered more realistic than Eggag’s prediction of $0.017.

The bullish case: XRP to $27?

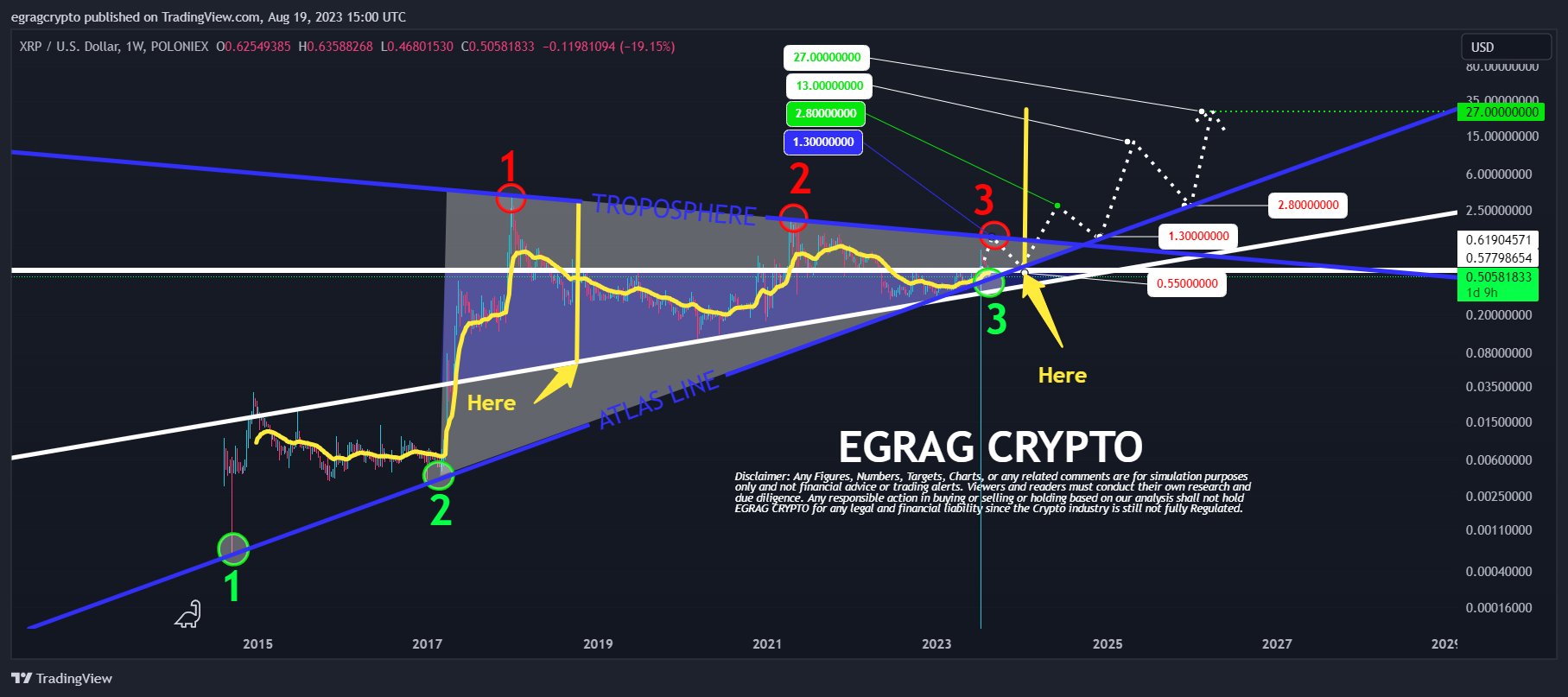

Eggrag recently took to social media, to emphasize a potential roadmap for XRP’s ambitious journey to $27 through its interpretation of the “XRP ATLAS LINE”.

Egrag predicts positive short-term momentum that could push XRP towards the $1.3-$1.5 zone. However, the digital coin may not last long there as it expects a dip back to the $0.55 region, a crucial retest for a breakout. Once this phase is over, it will see a dynamic rebound that pushes XRP to its previous highs of $2.8-$3.0.

But that’s not the ceiling. Egrag foresees a more aggressive jump to the $13-$15 price range, although he also foresees a significant sell-off around this price point. Its analysis then moves back to a reconnection to previous levels around $2.8-$3.0, before finally reaching the coveted $27.

At the time of writing, XRP was trading at $0.5327.

Featured image from Shutterstock, chart from TradingView.com