- The increased activity on the chain and in speculative trade pointed to a short -term bullish sentiment.

- The higher period of time of the time remained bearish and $ 130- $ 145 could be the levels that crush bullish hope for recovery.

Solana’s [SOL] Price bounced from the low point of Monday at $ 95.26 to $ 130 on the press, a 36% change within a week.

In an analysis, Ambcrypto noted that the $ 114 region was an important horizontal level. Now that SOL was again acting above this level, a recovery seemed possible.

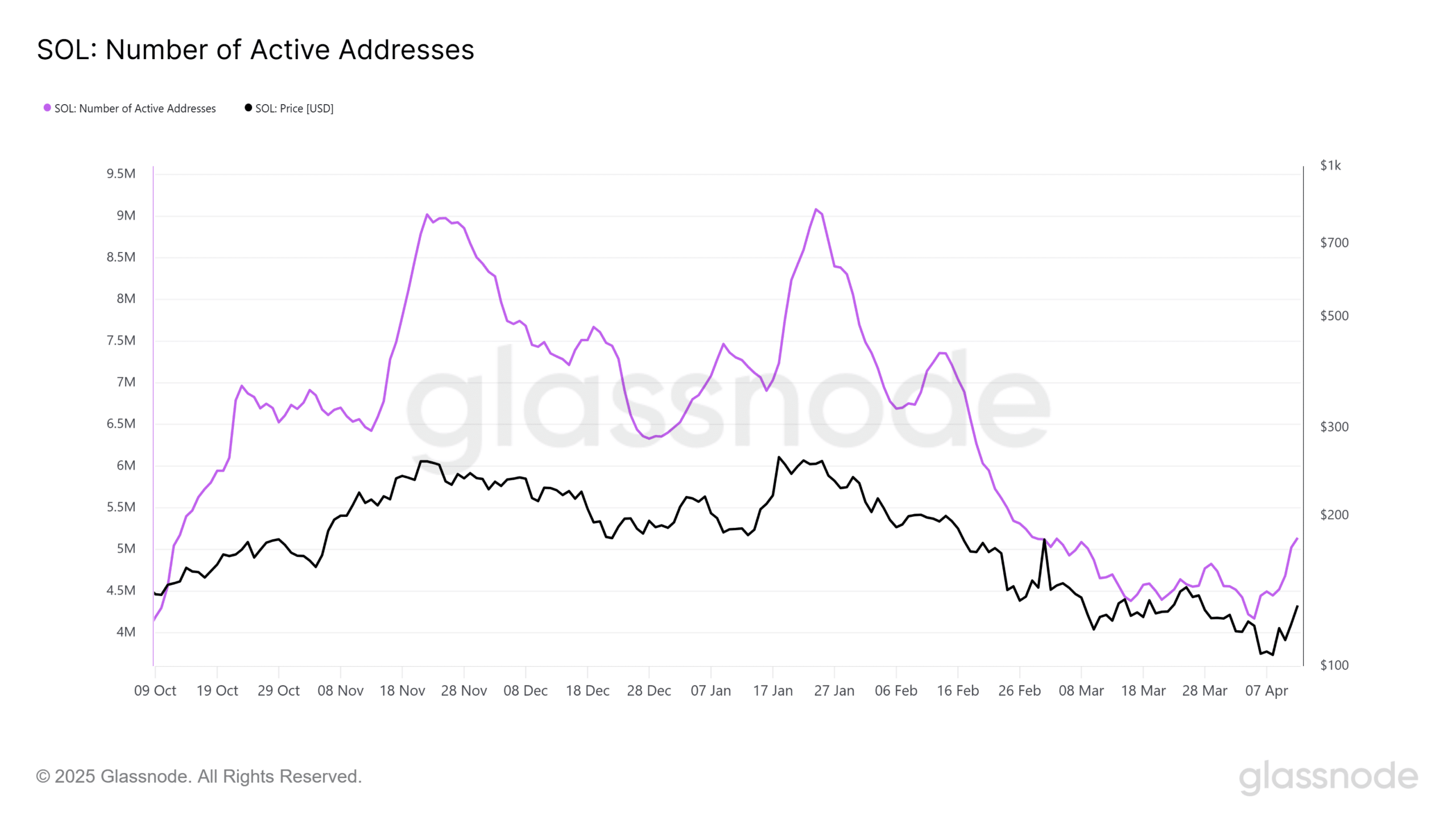

Source: Glass node

The increasing number of active addresses in the past week came alongside the price stop. The 7-day advancing average (MA) was used to smooth out the graph, and it showed that the downward trend of recent months could reverse.

The 7-day MA of the active addresses was above the beginning of March when Sol traded at $ 144.

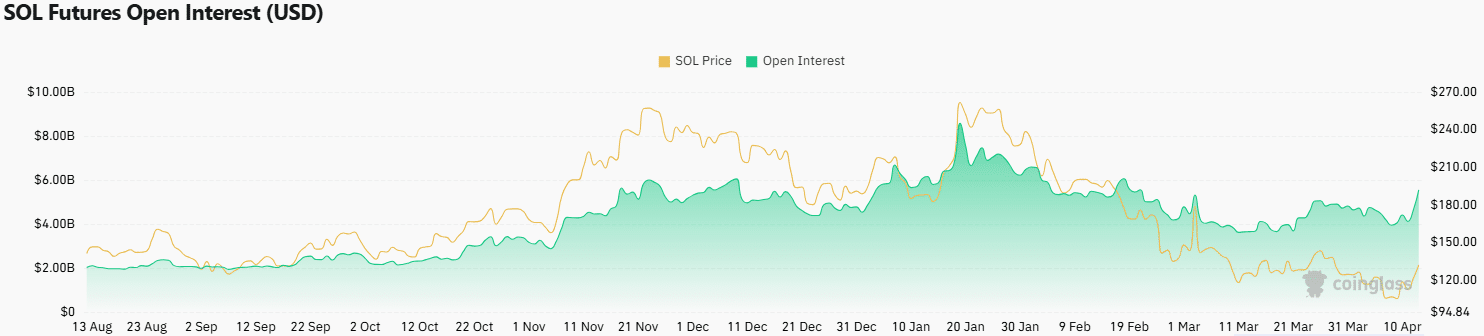

The nearly 40% prize strout of the past week also raised a flurry of speculative trading activities. The open interest (OI) has risen by almost $ 1.5 billion since 8 April.

The OI was higher at the time of the press than at any time in March, another sign of a Bullish Turnaround.

Can Solana Bulls maintain this pressure, or was this bounce a sales option?

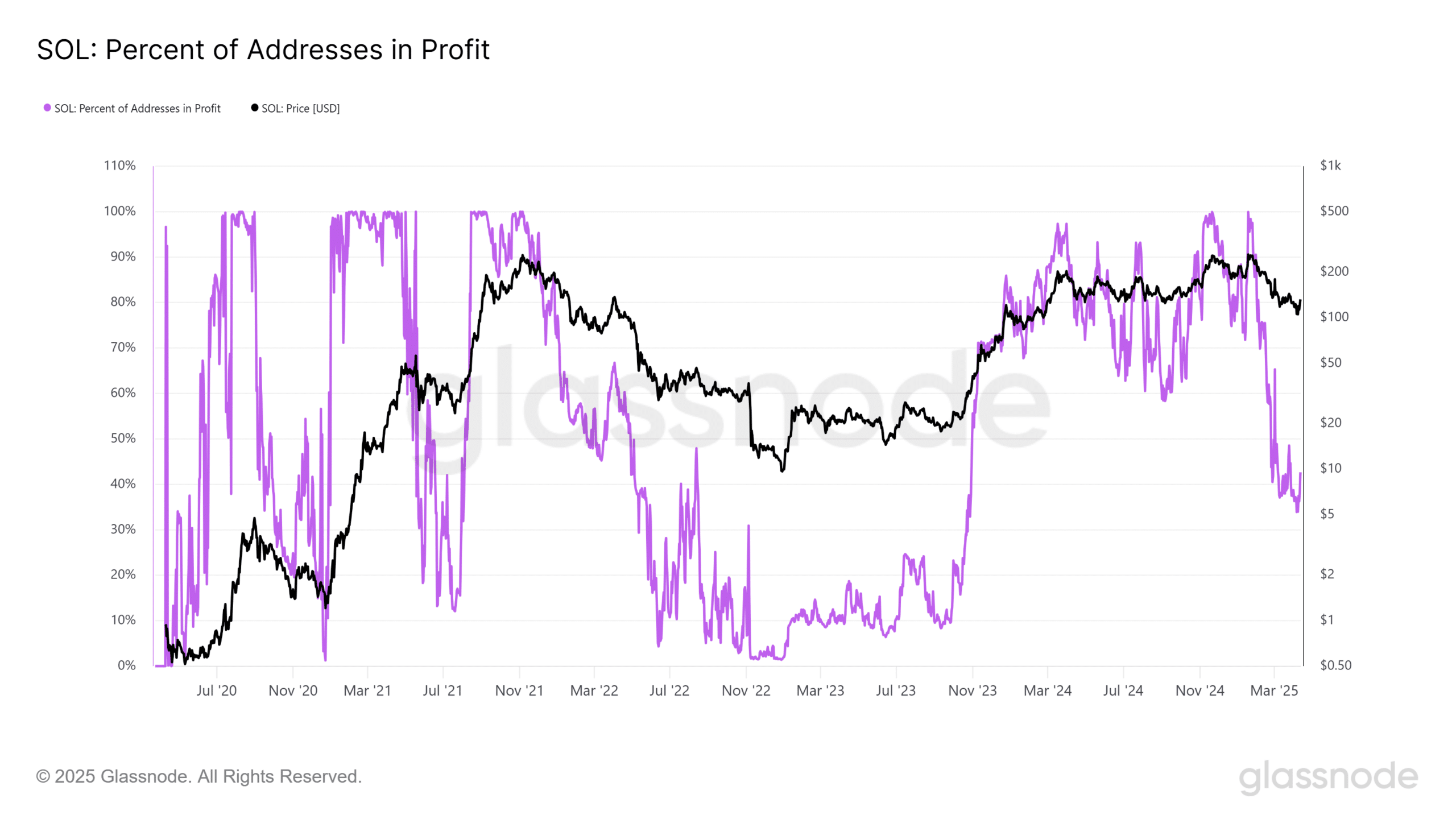

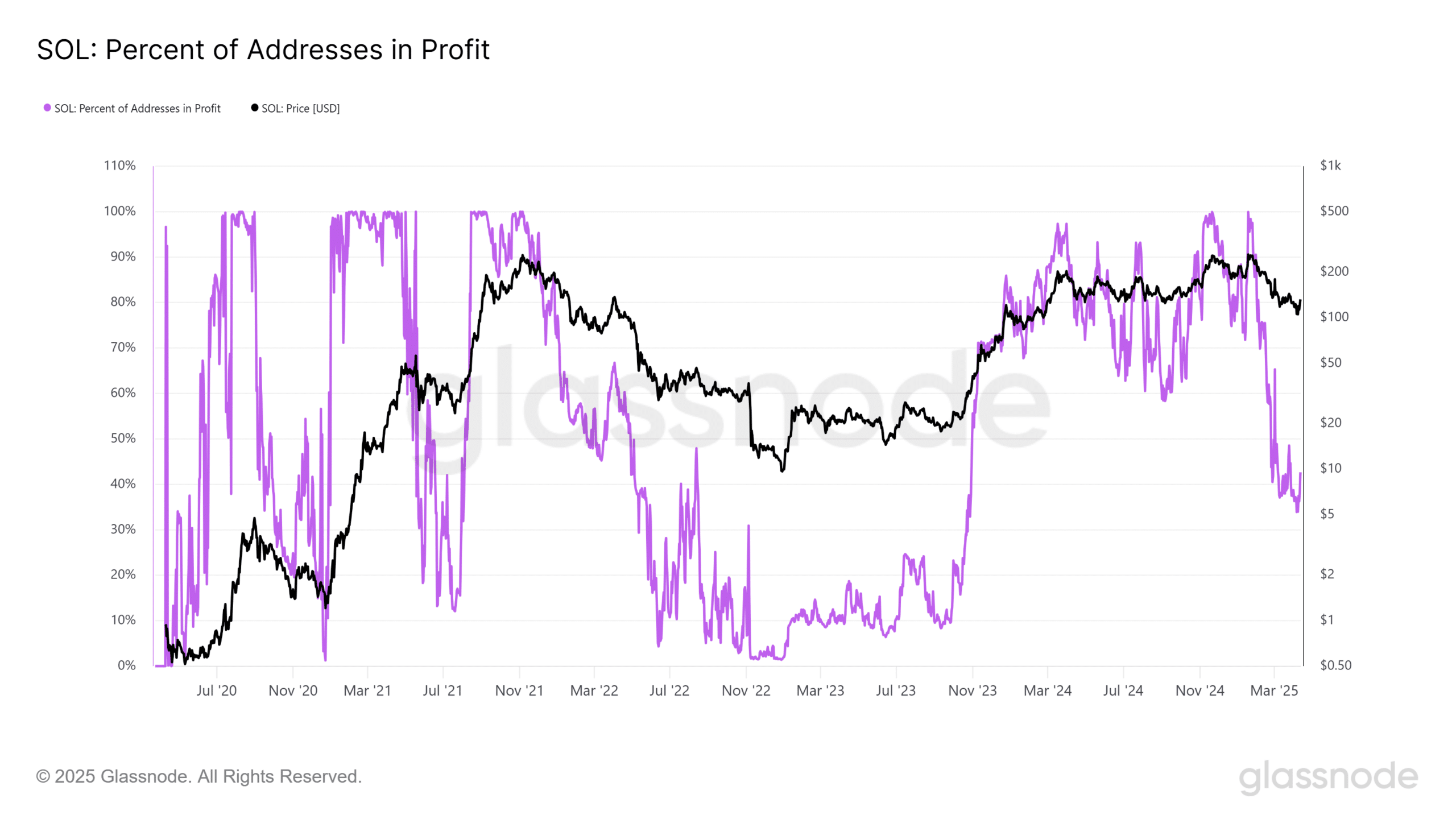

Source: Glassnode

The percentage of unique addresses for which the purchase price was lower than the current market price was represented in the metric above. The downward trend of Solana from $ 240 in January saw the statistics fall to lows that has not been seen since November 2023.

At the time, the Solana prize was $ 40 and the Berenmarkt ended. The circumstances were different this time. During 2024, the $ 120-$ 130 region had served as a strong support.

The decrease in the percentage of the winstadresses indicated that holders would use a price bouncer to try to leave break-even. That is why the recent prices may not have been in the reversal that bulls hoped.

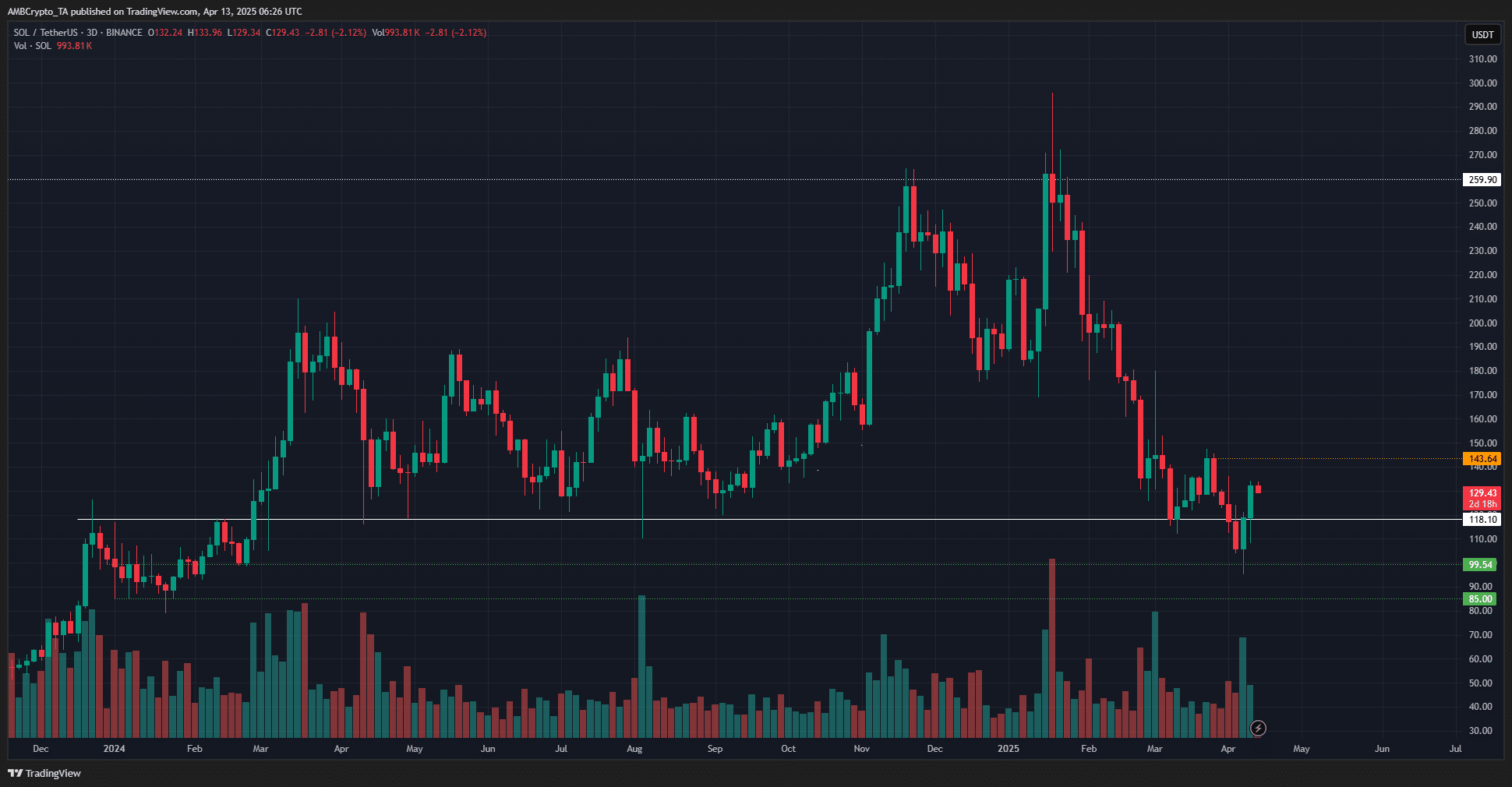

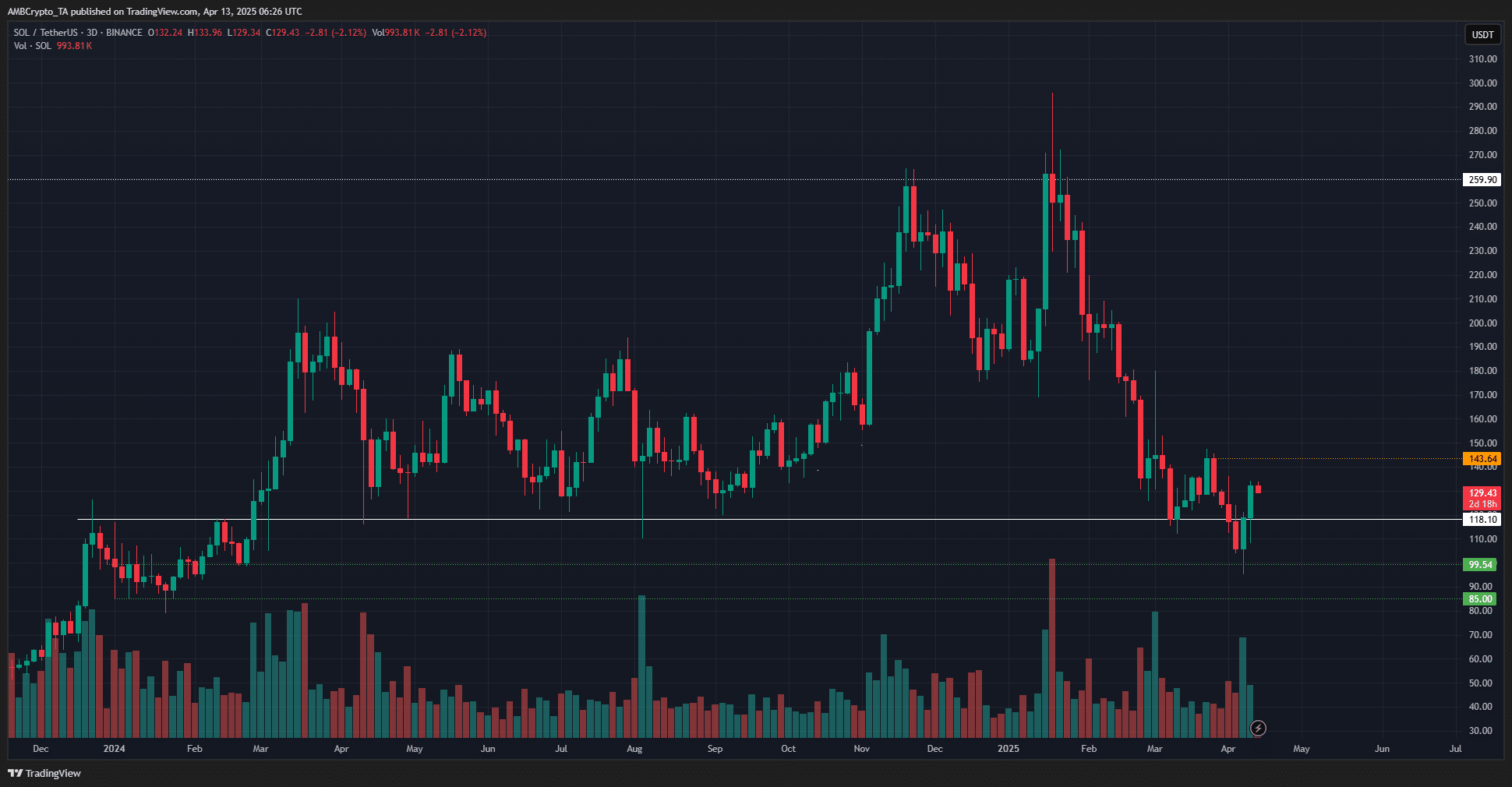

Source: SOL/USDT on TradingView

The 3-day graph emphasized this bearish trend, with lower highlights and lower lows since January. The level of $ 143 was the recent lower high and Sol was not close to violating this level. Traders and investors can use a breakout outside this level to turn their bias bullishs.

In the meantime, the support levels of $ 99 and $ 85 were the following price objectives, as long as the Beerarish structure remained.