Many analysts have weighed in on the potential trajectory of the flagship cryptocurrency, Bitcoin. This time, Bloomberg analyst Mike McGlone has marked the possibility of the Bitcoin price falling further and when this could happen.

Bitcoin price may fall further

In a tweet On his X platform (formerly Twitter), McGlone noted that Bitcoin is at risk of falling to $10,000 (which could happen by the end of the year) as the battle continues. the $30,000 resistance level.

This resistance level has long been touted as the key to a continued breakout in Bitcoin price. However, based on the analysis McGlone shared, it seems unlikely that this will happen.

Bitcoin has risen significantly in 2023 as the crypto asset traded for around $16,000 at the start of the year. But McGlone warned this could be a “short-covering rally.”

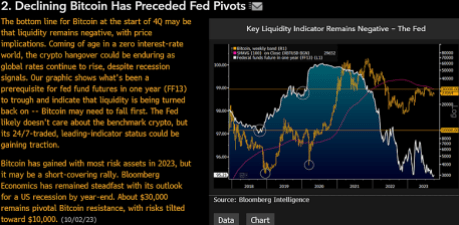

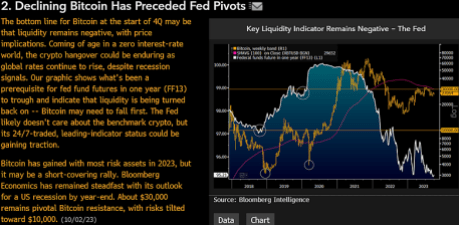

As part of this analysis, he noted that liquidity in the Bitcoin ecosystem remained negative heading into the fourth quarter. This ultimately means that there is more selling pressure than buying pressure, which could impact the price of Bitcoin.

Another factor is rising interest rates. McGlone noted that Bitcoin rose to prominence in a “world without interest rates” with greater financial freedom. But now, Bitcoin (among other cryptocurrencies) could continue to weather a hangover as “global interest rates continue to rise.”

Global inflation It is said to be on the rise, and to curb this, authorities are raising interest rates, which could limit spending and, by extension, liquidity flowing into the crypto market.

Meanwhile, the analysis noted Bitcoin’s importance in the grand scheme of things. Bloomberg Intelligence has drawn a link between FED Fund futures and the price of Bitcoin. According to projections, Bitcoin must fall further before a liquidity turnaround in those funds can occur.

While the Federal Reserve While he may not care about Bitcoin, he stated that Bitcoin’s “24/7 traded, leading indicator status could gain popularity.”

BTC could fall to $10,000 | Source: X

The fate of the broader crypto market

In another tweet, McGlone noted that cryptocurrencies “may be heading towards a recession.” To make this point, he emphasized the relationship between the crypto and stock market and stated that the latter could succumb to an “ebb” if the stock market experiences a “typical pullback” due to a recession.

Despite the ‘broader intermittent fluctuations’, this projection is reflected in the ‘downward trajectory’ of the economy. Bloomberg Galaxy Crypto Index (BGCI) and Russell 2000 Index (RTY) versus their all-time high in 2022. Both markets have remained tepid and continue to consolidate as they anticipate a “catalyst” that could trigger a price increase.

This analysis is similar to that of crypto analyst Nicholas Merten, who, while outlining the direct relationship between both markets, noted that if the shares of big tech companies like Apple and Microsoft don’t start rising, there could be a “really big problem” for the crypto market.

BTC price still holding above $27,000 | Source: BTCUSD on Tradingview.com

Featured image from Investor’s Business Daily, chart from Tradingview.com