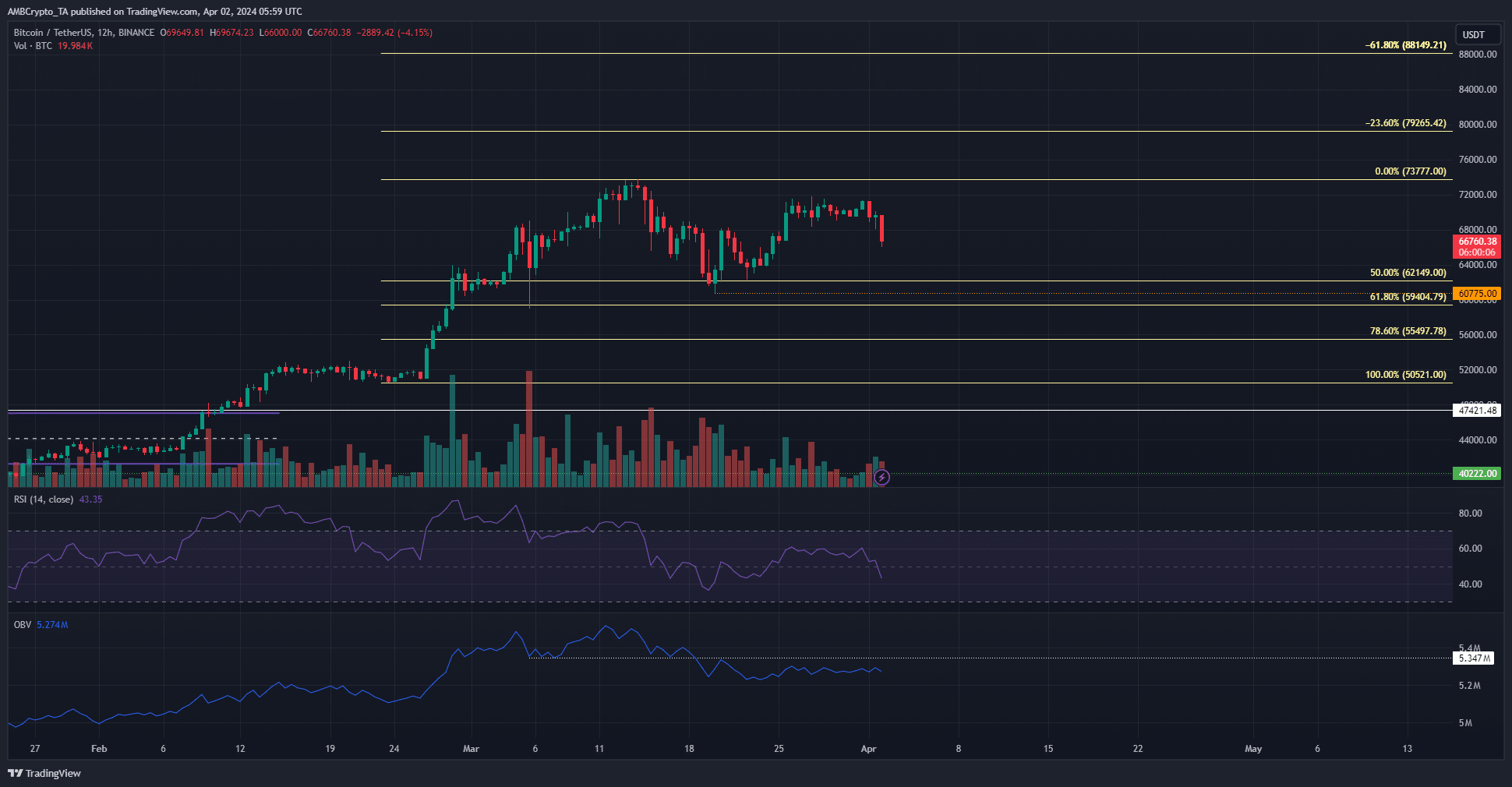

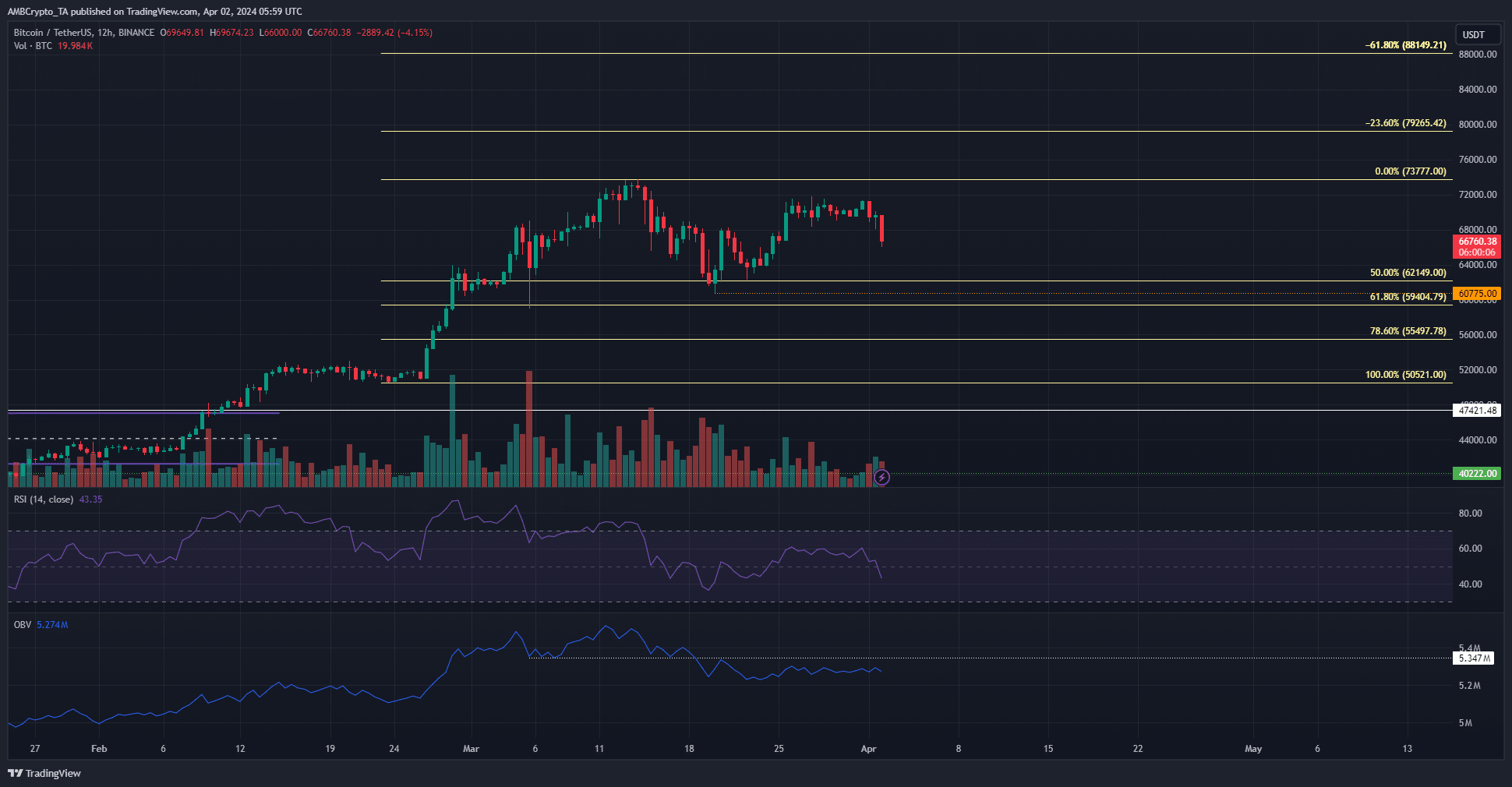

- Bitcoin saw a momentum shift as the RSI dropped below neutral 50.

- The OBV failed to climb to a previous low, indicating increasing selling pressure.

Bitcoin [BTC] has noticed rapid losses in the past 24 hours. In particular, a 4.9% drop occurred within an hour on April 2, which witnessed millions of dollars in liquidations.

The price collapsed below a level of liquidity and the forced selling drove prices down.

The long-term outlook for BTC remained optimistic as ETF inflows were extremely strong. AMBCrypto reported that the metrics for BTC were bearish and prices fell hours later.

Will Bitcoin fall to the swing low at $60.7k?

Source: BTC/USDT on TradingView

On the 12-hour chart, the market structure was still bullish. A drop below $60.7k will turn the structure bearish. The Fibonacci retracement levels highlighted the $55.5k and $59.4k as critical levels.

There was a decline of 4.2% in the past 36 hours. As of April 2, there was $62.2 million in value long liquidations on Bitcoin. The second-half RSI fell below neutral 50, signaling a shift in momentum.

The OBV showed a downward trend in March and was still below a key level. This showed that selling pressure has been dominant in recent weeks and that more losses could follow.

The $64.5k level is an interesting level this week as it is a short-term support level. Still, technical indicators and the price action in the lower time frame showed that Bitcoin may not rise sharply in the near future.

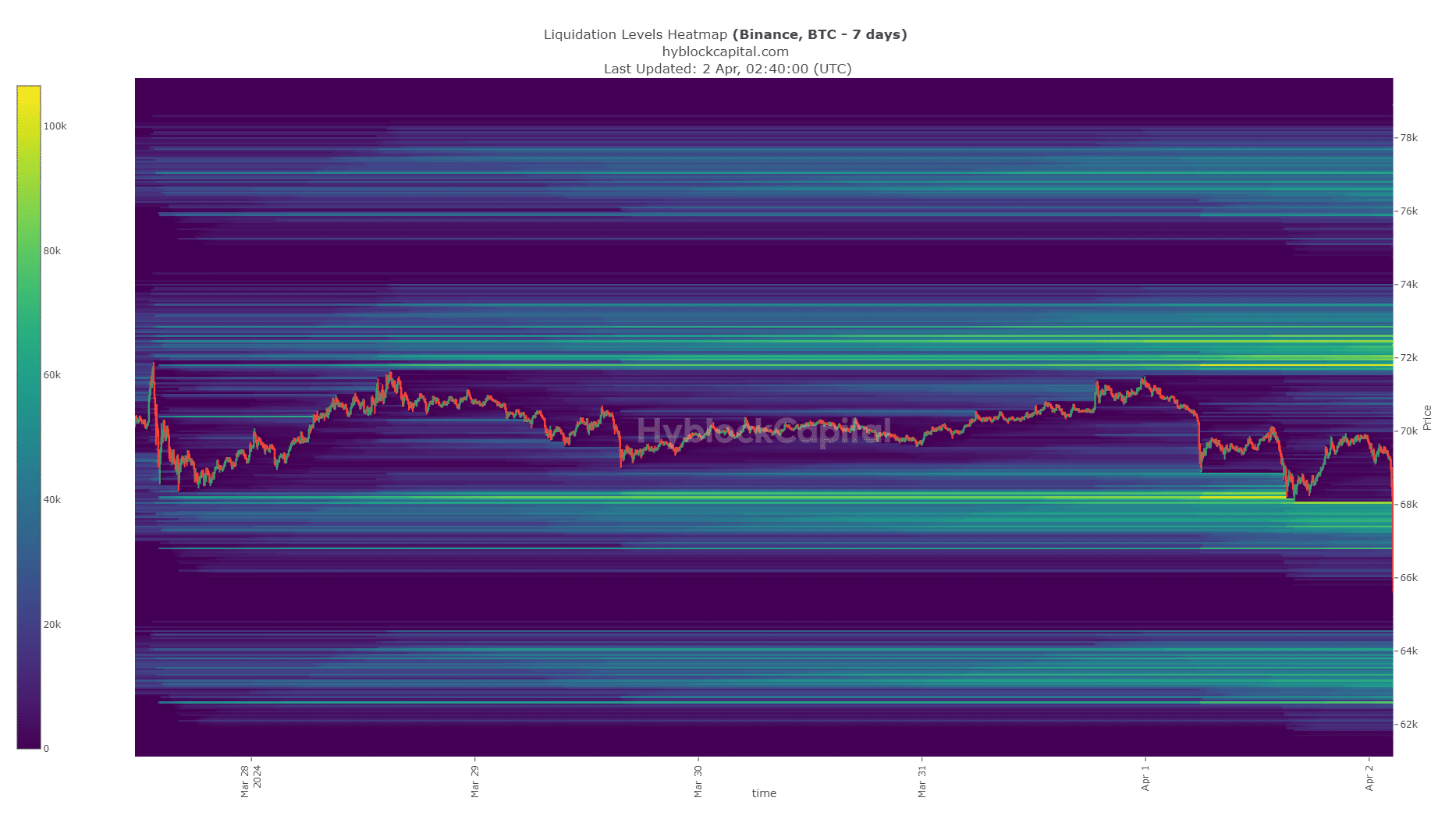

Bitcoin could fall to the next liquidity pool south

The $68,000 liquidation level was wiped out and a liquidation cascade ensued that pushed BTC prices to $66.4k.

Read Bitcoin’s [BTC] Price forecast 2024-25

Prices could move higher to liquidate the highly leveraged late bears, but a significant amount of liquidity was at $64,000.

From $62.8k to $64k there was a fair concentration of liquidation levels. Bitcoin’s proximity to this region indicated that it could conquer this zone next. Therefore, traders should be prepared for more losses.

Disclaimer: The information presented does not constitute financial, investment, trading or other advice and is solely the opinion of the author.