Bitcoin (BTC), the world’s largest cryptocurrency by market capitalization, is poised for a significant price drop as investors made billions in gains over the past 24 hours. Additionally, BTC has formed a bearish price action pattern, further supporting this negative outlook.

Posting $5.64 billion in profits

On October 10, 2024, a prominent crypto analyst posted on These huge profit takings in a short period indicate a significant price drop in the coming days.

Current price momentum

Currently, BTC is trading around $60,730 and has registered a price drop of over 2.75% in the last 24 hours. During the same period, trading volume fell by 8%, indicating lower participation from traders and investors compared to the previous days. This recent price drop appears to be possibly caused by significant profit taking.

Bitcoin technical analysis and upcoming levels

However, CoinPedia’s technical analysis suggests that BTC appears bearish as it has formed a bearish inverse cup and is riding the price action pattern on the daily time frame. Whenever an asset forms this bearish pattern, it is often seen as a signal of a potential price decline.

BTC is currently near the neckline of this pattern, with crucial support at $60,200, supported by the 200 Exponential Moving Average (EMA). If BTC breaks this level and closes a daily candle below $60,000, it could fall to $58,000 or lower.

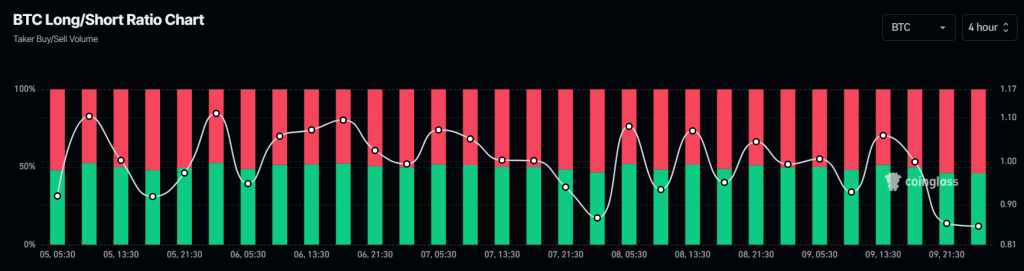

Bearish BTC’s long/short ratio

This negative outlook is further supported by on-chain metrics. According to on-chain analytics firm Coinglass, BTC’s long/short ratio currently stands at 0.931, indicating strong bearish market sentiment among traders. Meanwhile, 54.05% of top traders have short positions, while 45.95% have long positions.

Combining this long/short ratio with technical analysis and recent profit booking, it appears that bears are currently dominating the asset, potentially leading to a significant price drop.