- Solana’s network performance report stated that the network did not reach 100% uptime until February 2023.

- SOL’s price action is seeing a cooling, but selling pressure has been low so far.

Not so long ago, the Solana [SOL] Blockchain had acquired an unfavorable reputation mainly due to multiple instances of network outages. Fast forward to the present and such disruptions have become rare.

Is your wallet green? Check out the Solana Profit Calculator

The Solana network has released its latest network performance statistics and network outage analysis was one of the key observations. The report, which examines the blockchain’s performance in the first half of 2023, confirmed an improvement in network performance.

1/ The Solana Foundation has released the most recent @Solana Network performance report.

The performance of the Solana network has improved in the first half of 2023 as measured by uptime, the ratio of non-voting to voting transactions, and more.

Read the full report: https://t.co/naOftyknLA pic.twitter.com/yI9Q8swWdT

— Solana Foundation (@SolanaFndn) July 20, 2023

According to the report, February was the only month of 2023 where Solana failed to achieve 100% uptime. It achieved an uptime of 97.19% in February. This confirmed that the network has improved so far. In comparison, Solana recorded less than 100% downtime in five months between April and October 2022.

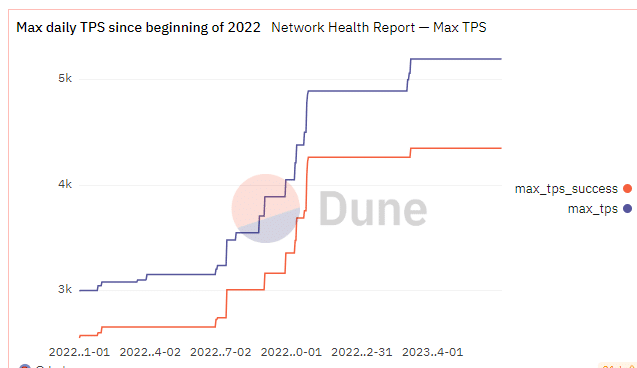

The network report also evaluated Solana’s TPS. A look at the maximum daily TPS revealed a strong improvement since the beginning of 2022. Both the maximum TPS and the maximum successful TPS were at their highest point in the last 18 months at the time of writing.

Source: Dune

SOL price overview

The price action of Solana’s native cryptocurrency SOL indicated that selling pressure was taking away some of the recent gains. It changed hands at $25.46 at the time of writing, representing a 21% drop from its highest price in the past four weeks.

Source: TradingView

The selling pressure was expected given that SOL had been on a bullish rally since the second week of June. Moreover, the recent profit-taking came after the price fell into overbought territory. SOL’s Relative Strength Index (RSI) confirmed outflows since mid-July.

SOL holders and aficionados should note that the cryptocurrency maintained healthy relative strength despite the profit-taking. This could be a sign that most SOL holders have a long-term focus. Some on-chain data cooperated with this observation.

For example, SOL’s weighted sentiment remained upside despite selling pressure.

Source: Sentiment

SOL still maintained a healthy USD daily trading volume, although it has fallen significantly since mid-July. However, a further decline could push SOL volumes back into the lower monthly range. These findings further confirmed that the cryptocurrency’s trading activity had dropped significantly.

Read about Solanas [SOL] price forecast 2023-24

On the other hand, it experienced very low selling pressure and held on to recent gains quite well. As for SOL’s performance for the remainder of July, market conditions will determine the overall outcome. Still, there are clear signs of investor optimism.