- Solana’s liquid staking protocol proves to be beneficial for the network in the DeFi sector.

- The number of developers increases as the ecosystem begins to flourish; SOL is witnessing a minor correction.

The past few months, Solana [SOL] huge volatility observed. This affected the ecosystem of which it was part and its price. However, the recent popularity of the DeFi sector could positively influence the protocol in the future.

Realistic or not, here is the market cap of SOL in terms of BTC

Solana dives into Liquid Strike

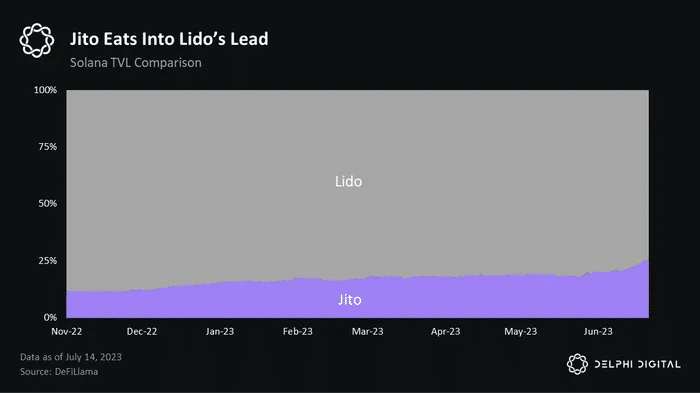

Based on data from Delphi Digital, the rise of Solana DeFi was notable after the FTX debacle. During this time, the community showed strong support for Solana-first protocols such as Jito, which stands as Solana’s first MEV-powered liquid strike derivative.

Jito’s token will provide positive revenue opportunities while simultaneously improving Solana’s decentralization and strengthening the security of its network. Delphi Digital’s data indicated that the Jito protocol was eroding Lido’s market share at press time.

Source: Delphi Digital

The popularity of Solana’s dApps can not only improve the state of the ecosystem, but also attract new users to the platform.

Solana has emerged as one of the most scalable blockchains, with a remarkable capacity to process up to 65,000 transactions per second (TPS). With the issues surrounding FTX resolved, the ecosystem and community used this period to re-evaluate and focus on development. In addition, the price of SOL has experienced a substantial increase of more than 200% to date.

In addition, there is a positive increase in the number of developers deploying smart contracts on the Solana blockchain. This update highlighted the potential emergence of a promising future for the protocol.

Source: token terminal

State of SOL

At the time of writing, SOL was trading at $23.81. Since June 10, there has been an 83.14% increase in the price of SOL, marked by several higher highs and higher lows, indicating a bullish trend.

However, after testing the support level at $32.33, SOL experienced another price drop. Despite the significant decline, it was not enough to definitively establish a bearish trend.

Is your wallet green? Check out the Solana Profit Calculator

However, the Relative Strength Index (RSI) suggested that momentum was on the sellers side at the time of writing. The Chaikin Money Flow (CMF) also implied that the cash flow showed a bearish result for SOL.

Source: Trade View