- Bitcoin’s trend strength prediction has been fulfilled.

- Bitcoin’s volatility decreases as the win rate decreases.

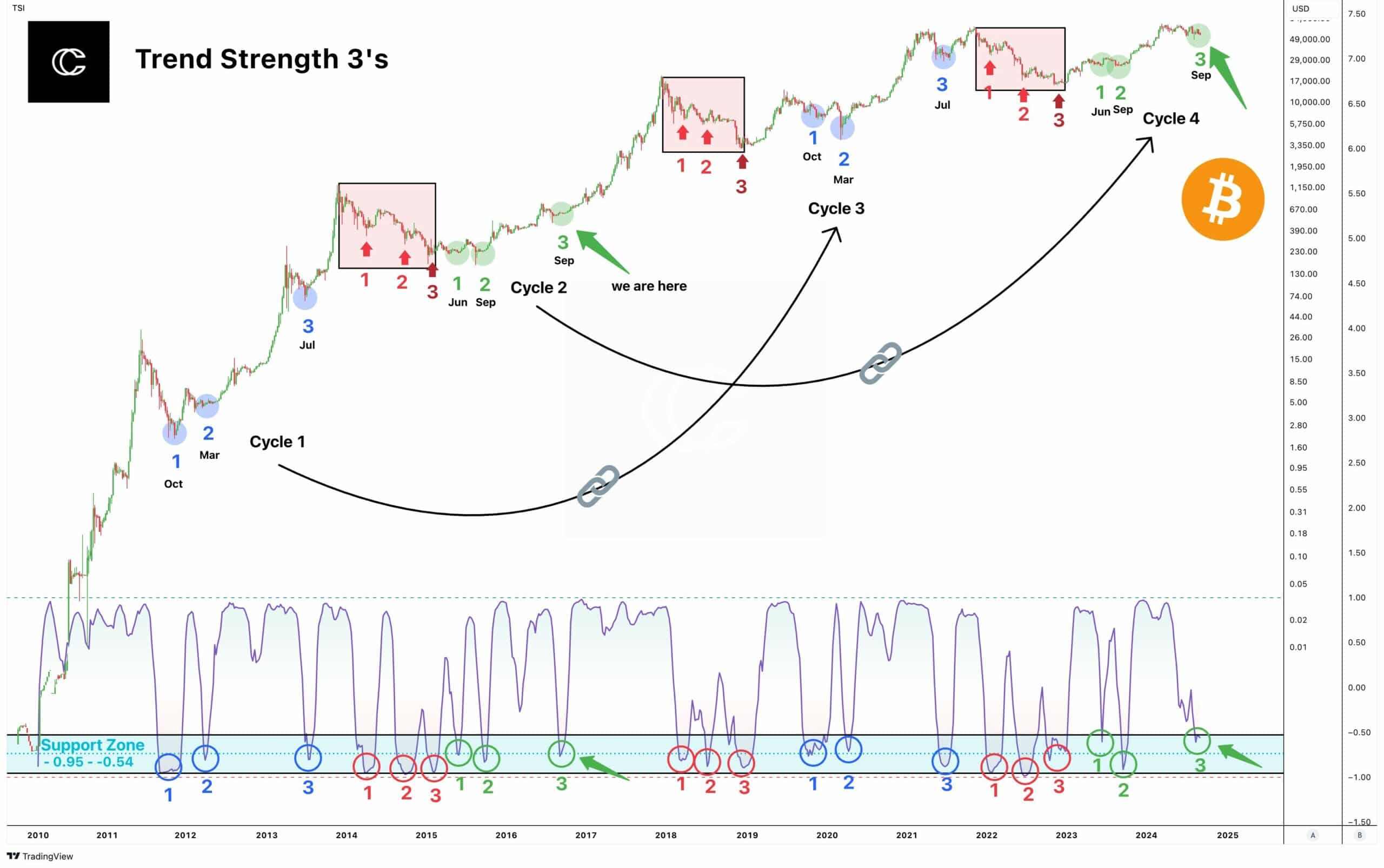

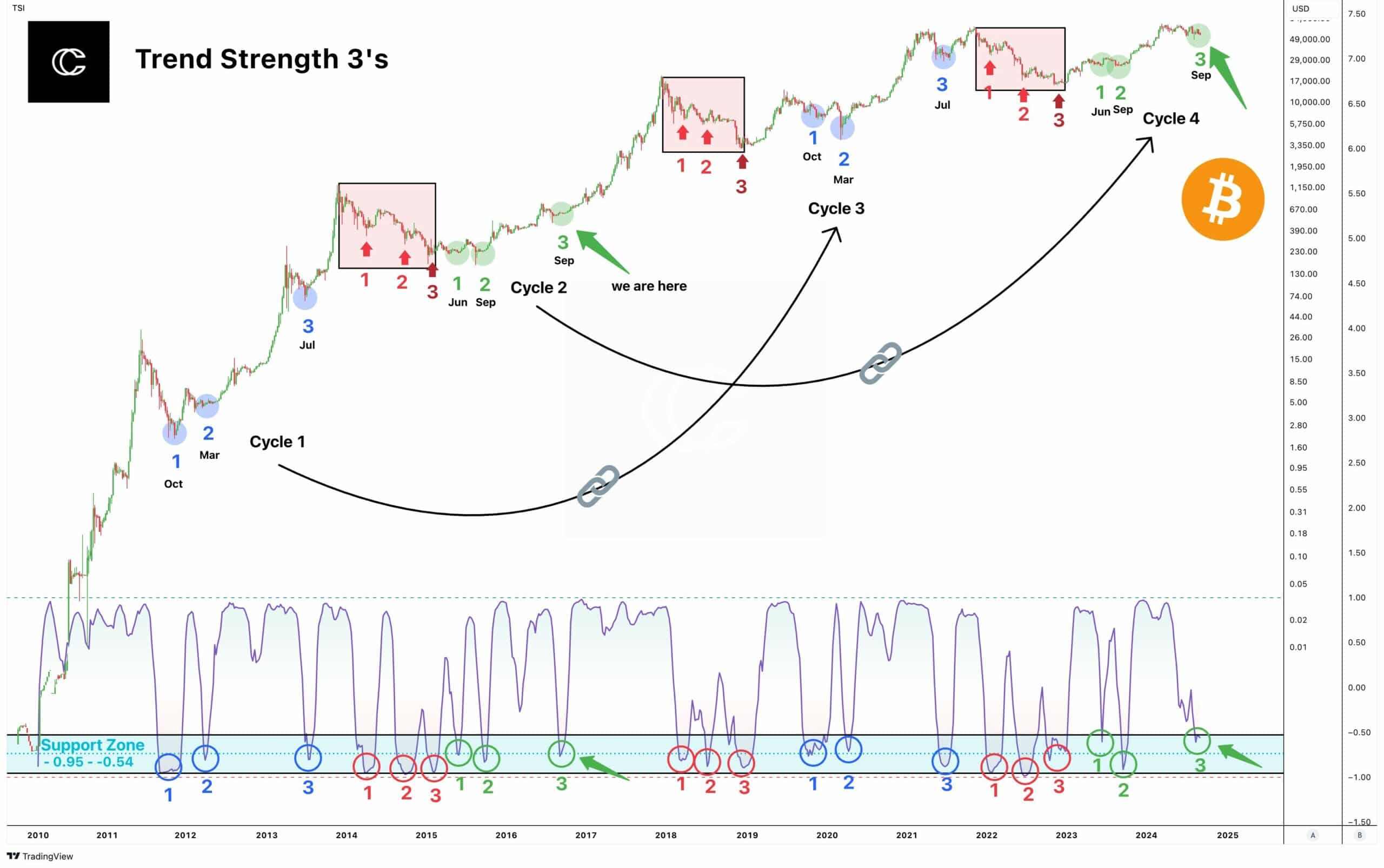

Bitcoin [BTC] has once again demonstrated its cyclical nature, fulfilling the Bitcoin Trend Strength Prophecy.

In 2016, Bitcoin’s price fell into the support zone in September, and the same pattern occurred in 2024.

Throughout these alternating cycles, the market’s movement has remained consistent. This pattern of three dips in the support zone during the same cycle has historically led to a price increase.

As in previous years, the current cycle could mean that Bitcoin’s price is gearing up for another rise on the charts.

Source: TradingView

At the time of writing, Bitcoin was trading at a key support level around the $56,000 price range, with a strong resistance level at $65,000. This newly formed support level could spark a rebound or lead to a further decline.

If Bitcoin fails to hold above $56,000, it could continue to head south and retest $49,000 before making a substantial recovery. However, holding this level could be a sign of upside for BTC in the coming weeks.

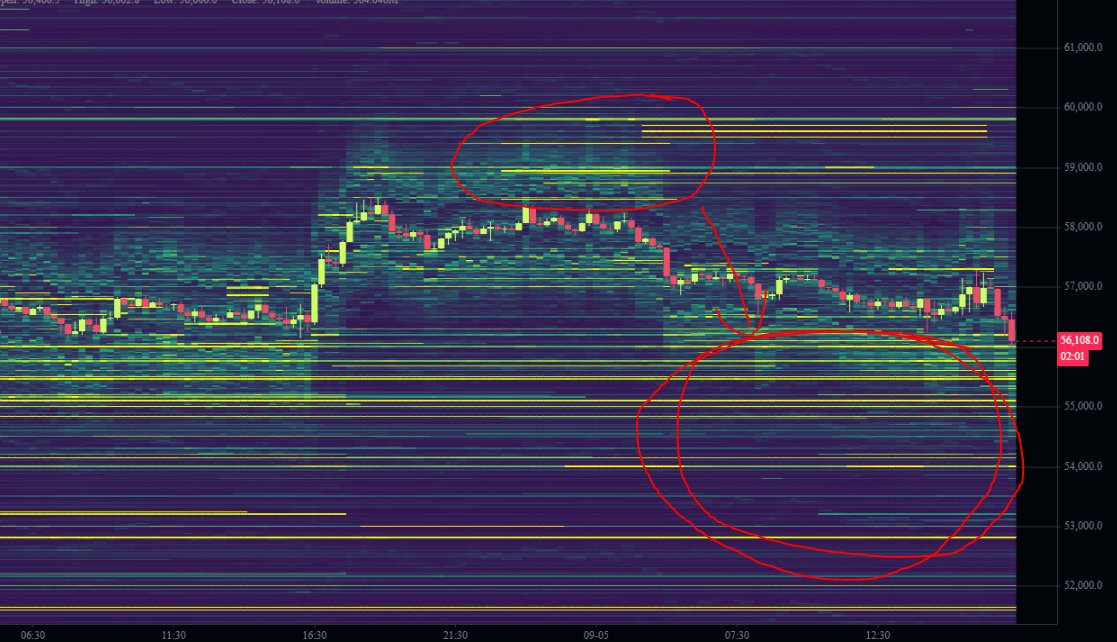

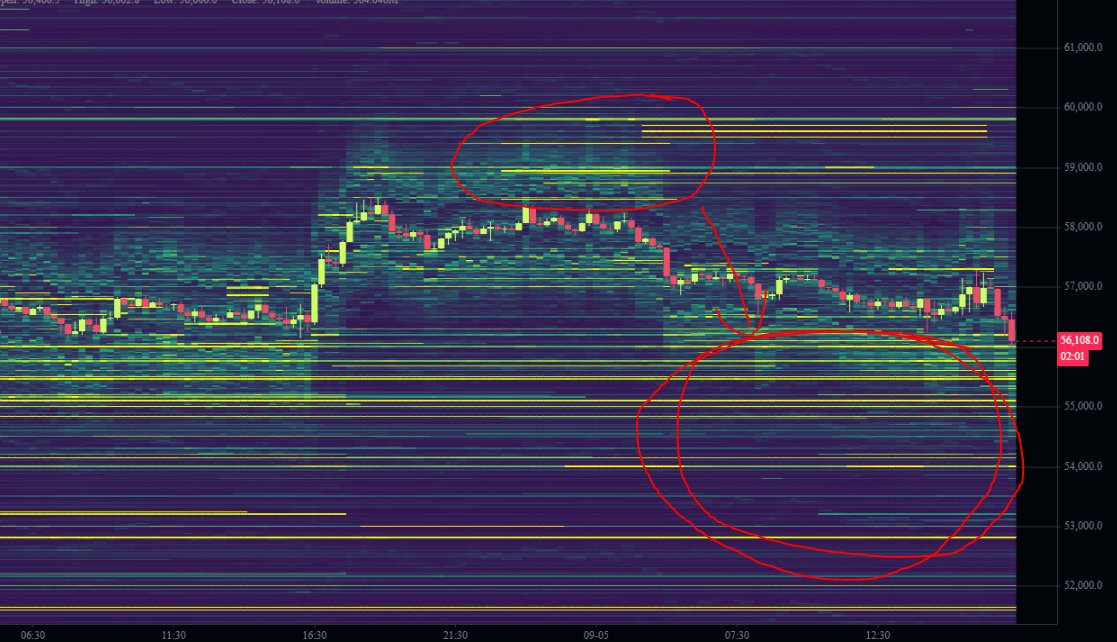

Liquidity levels

In terms of liquidity, sell orders have pushed down the price of Bitcoin, allowing buy orders to be executed. There are numerous bids below the $59,000 level, and this has been the case for the past six months.

Interestingly, the price has remained flat despite significant whale activity as large holders pushed prices down to accumulate more BTC.

Here it is worth pointing out that Binance’s order books revealed a strategy to execute bids at these levels before the price rises again.

Source: Hyblock Capital

Bitcoin’s volatility is decreasing

Another factor affecting Bitcoin’s trajectory is its volatility. With BTC now trading around $56,000, it is significantly less volatile than it was in 2021 – about 4 to 6 times less volatile in fact.

The $60,000 level, once considered a speculative top, has now become a consolidation zone where long-term holders are accumulating Bitcoin.

This means that $60,000 is now the new bottom, a crucial price point that Bitcoin may not visit again for a while if new support levels are established.

Source: TradingView

Fear and greed index

Market sentiment at the time of writing also seemed to reflect the fear we saw at the bottom in 2022. The pervasive fear in the market is keeping many investors on the sidelines, but this could signal an opportunity for a turnaround.

With institutional adoption increasing and more projects building on the Bitcoin network, this current downturn could represent a significant buying opportunity.

In fact, history has shown that such fear can often precede major upward price movements.

Source:

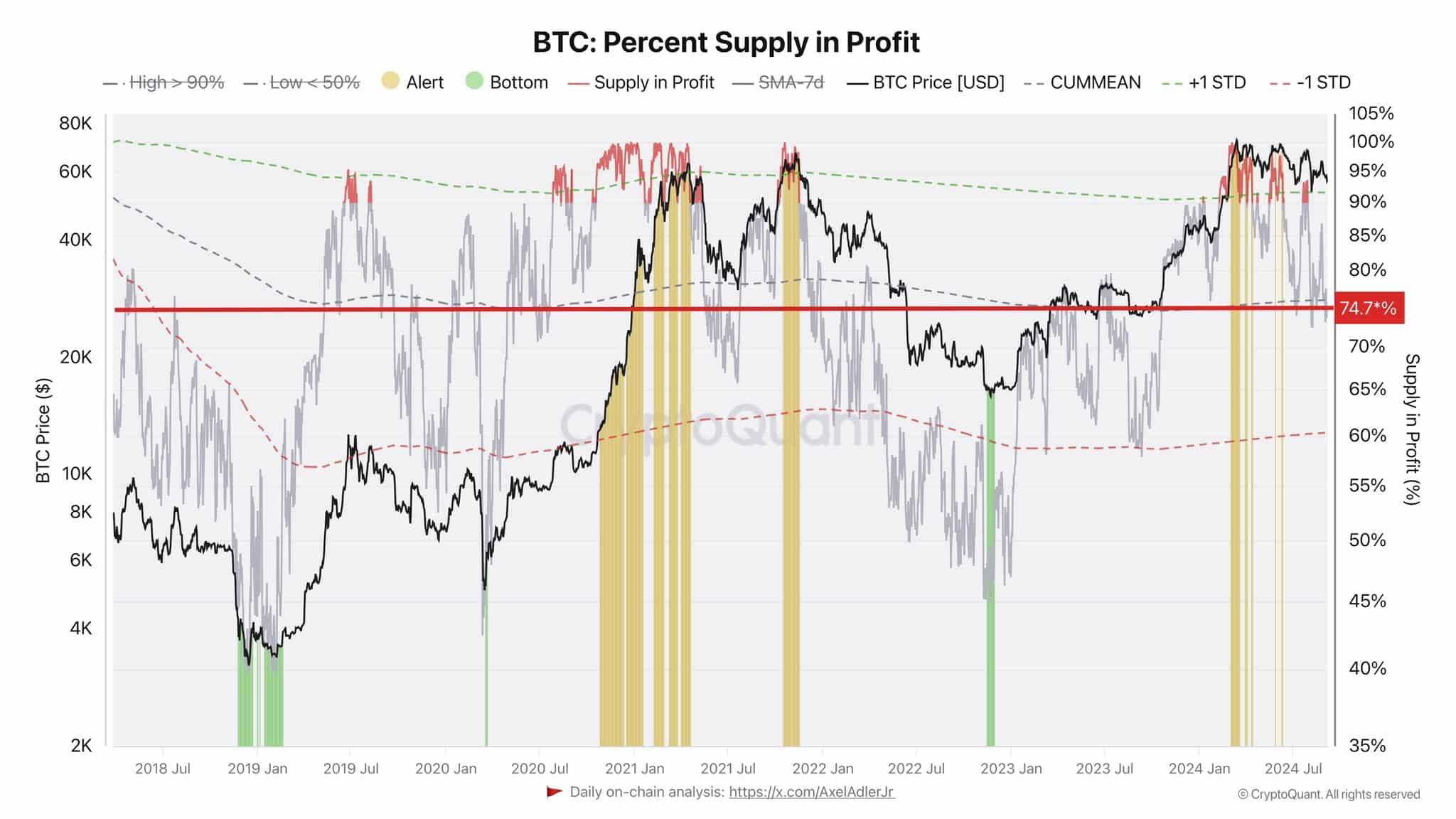

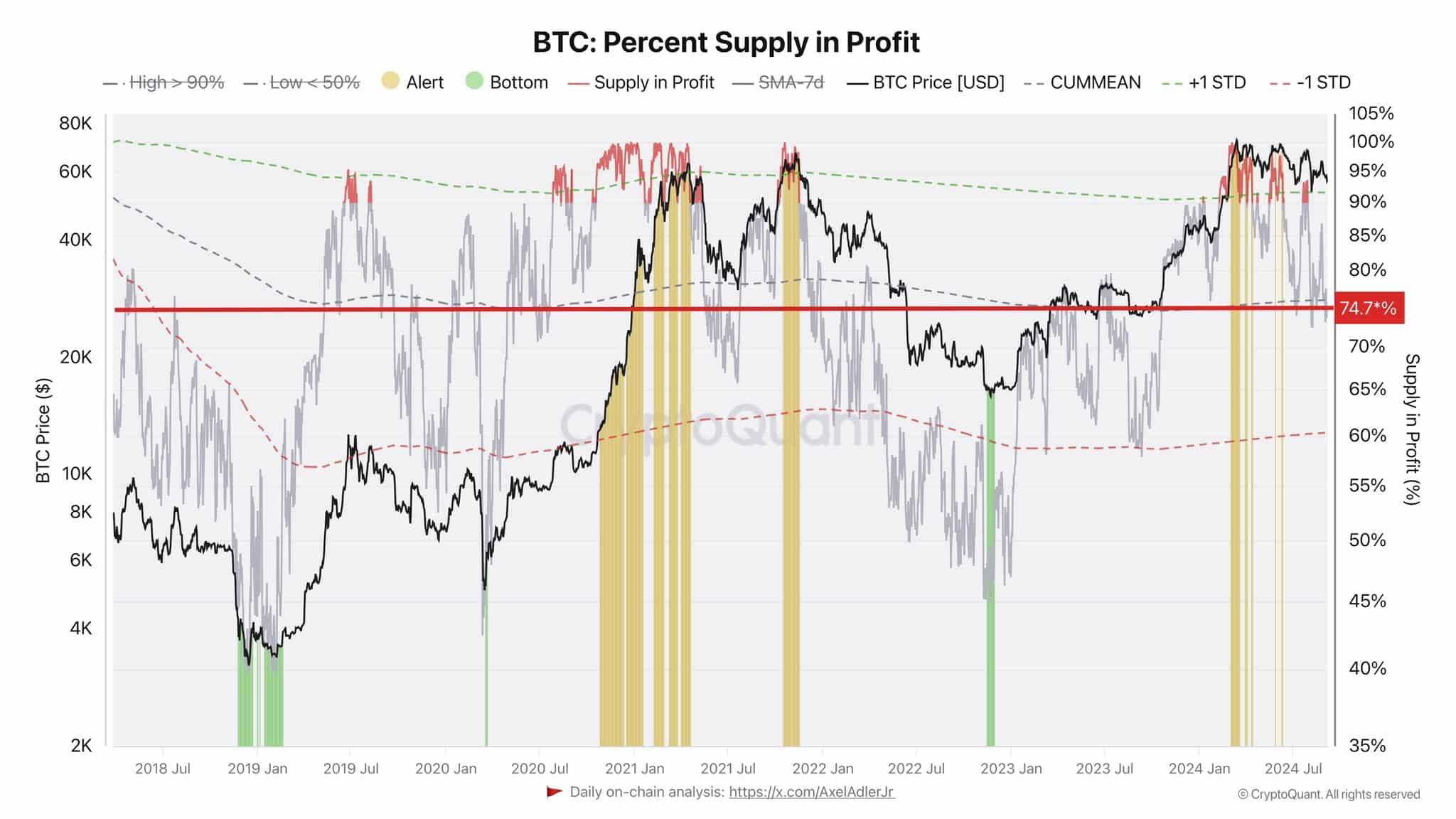

Percentage of supply in profit

However, despite the uncertainty, Bitcoin supply’s percentage of profits has fallen by 25%, meaning fewer investors are making a profit. Approximately 4,938,183 BTC are currently held at a profit, worth approximately $280 billion.

This decline in profitable positions suggests that now may be the time for long-term holders to HODL. Especially since the market could be poised for a recovery and higher BTC prices in the near future.

Source: CryptoQuant