- WIF fell by 4.54% in 24 hours.

- As memecoins bleed, dogwifhat could drop to $1.98 before buyers attempt another uptrend.

Memecoins have seen a huge rally in the past month. However, in the past week, this sector has suffered huge losses. In the midst of this, dog hat [WIF] has experienced a massive drop on the daily charts.

At the time of writing, dogwifhat was trading at $2.24. This marked a decline of 2.41% on the weekly charts, with an extension of the bearish trend by 4.54% on the daily charts.

Previously, WIF had been on an upward trend, rising 47.25% over the past month.

The latest price action raises questions about dogwifhat’s future trajectory.

The prevailing market sentiment

According to AMBCrypto’s analysis, WIF has returned and is forming a bearish engulfing pattern after undergoing a sharp rise 48 hours ago. This indicates possible short-term selling pressure.

As such, this could result in a further market correction before a new uptrend is undertaken.

In this context, a bearish engulfing pattern usually forms after a sustained uptrend observed on the monthly charts.

It signals that buyers are losing control and sellers are taking over, potentially leading to a reversal in price direction.

Since WIF was consistently rejected at $2.5, it indicates that sellers are dominating the market.

If the rejection continues, WIF could fall below $2, while there were buying opportunities for buyers to re-enter the market and try to break higher.

What WIF graphs indicate

As noted above, dogwifhat has experienced strong downward momentum over the past week. As such, prevailing market conditions indicate that WIF could face a further decline on the price charts.

Source: TradingView

For starters, dogwifhat’s Directional Movement Index is in a strong downward trend, with the negative index at 26.5 above the positive index at 22.

This indicated that sellers were in control and the price was experiencing strong downward momentum.

The fact that DMI- is above DMI+ suggested that the market trend is bearish and is turning bearish. This was further confirmed by a rising ADX, which was a signal that the bearish trend was gaining strength.

Source: Santiment

Additionally, WIF Open Interest in USD per Exchange has fallen over the past week, from $242.9 million to $187.9 million at the time of writing.

Such a decline indicated that investors were not opening new positions and closing existing positions. This indicated that investors were not confident in memecoin’s prospects.

Source: Coinglass

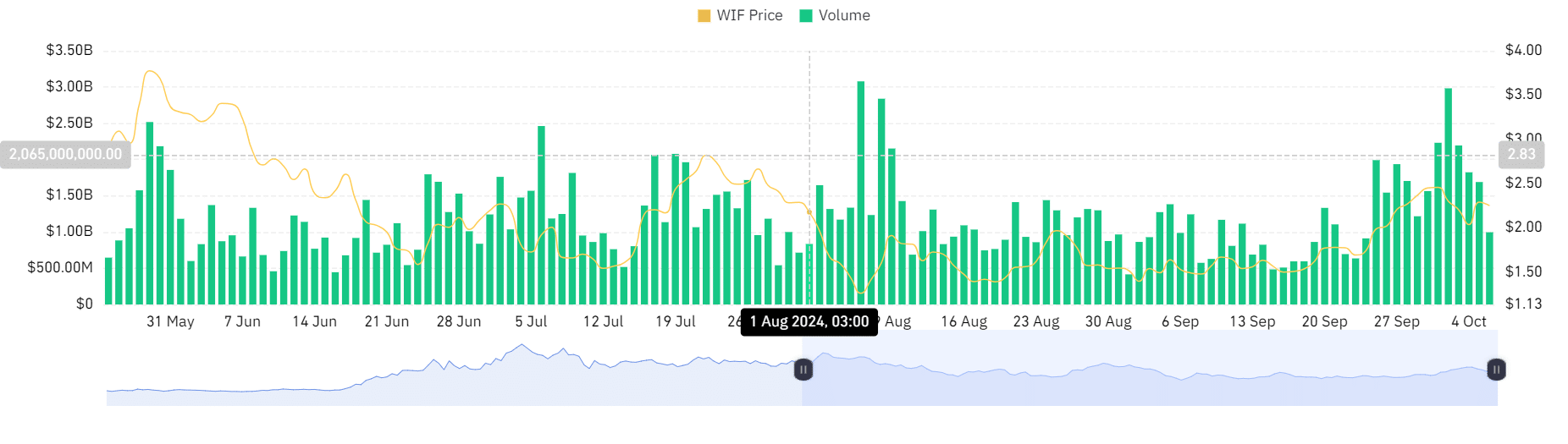

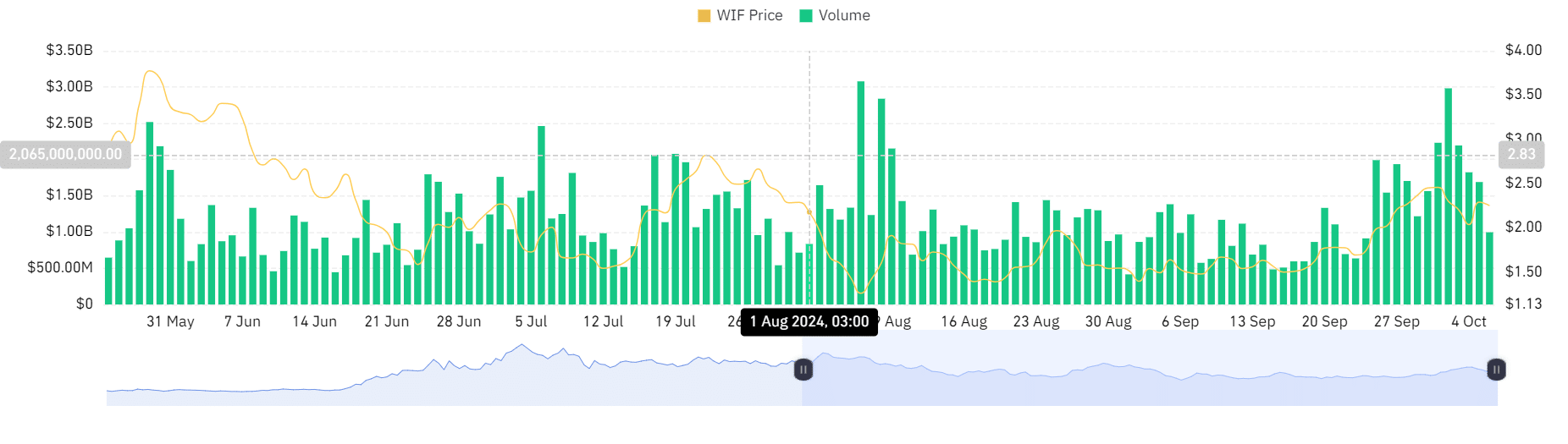

Finally, WIF volume was reduced from $2.9 billion to $995.9 million. This indicated that buyers were losing momentum, meaning the rally could lose momentum.

Read dogwifhat’s [WIF] Price forecast 2024–2025

Such a significant drop in volume suggested that sellers were taking control and that a pullback was imminent.

Therefore, current market conditions could push WIF to further decline its price charts. As such, the memecoin will find its next support at $1.98, where there is a buying opportunity to reenter the market.