Litecoin (LTC) has been trading in a tight price range over the past week, with its value hovering steadily around the midpoint of $64. LTC price action in September remained mainly bearish, with sellers maintaining control of the market.

While LTC has a history of volatile price swings, lately it has mirrored the sideways movement of the overall market, largely influenced by Bitcoin’s swings, which rose from $25,000 to $27,000 before falling to $26,000.

According to the latest data from Coin geckoLitecoin is currently trading at $64.63, with a 24-hour gain of 0.7%. However, according to a recent price report, LTC has experienced a decline of 2.9% over the past seven days, reflecting the prevailing bearish sentiment in the market.

Chase Litecoin Bulls and Avoid the Bears

For those looking for a bullish revival in the price of Litecoin: price report notes that the most important level to watch is the 23.6% Fibonacci retracement level, which is at $69. A break above this level could open the door to further gains, with potential targets at $78 and $80.

On the other hand, if flat trading volume continues, bears could apply further pressure, potentially leading to a drop in the price of LTC to $60.

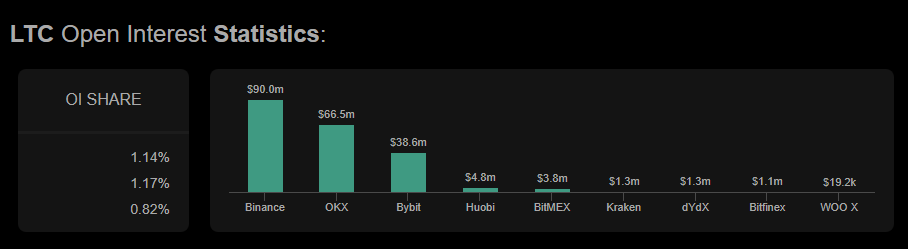

Source: Coinalyze

Market speculators are not particularly enthusiastic about Litecoin’s recent sideways move. The Open Interest (OI) for LTC has continued to decline data from Coinalyze indicating a drop of $9 million in the last 48 hours. This suggests that traders and investors are becoming increasingly cautious as they monitor developments in the Litecoin market.

Litecoin’s investment call in Q3/Q4

Despite recent poor performance, some analysts believe that Litecoin remains an attractive investment opportunity in the third and fourth quarters of this year. Litecoin’s established reputation, solid ecosystem and upcoming halving events are factors contributing to its appeal.

LTC market cap currently at $4.7 billion. Chart: TradingView.com

Halving events have historically had a positive impact on the price of Litecoin, reducing the rate at which new LTC coins are mined and potentially increasing scarcity.

Market participants are closely watching the 23.6% Fibonacci retracement level at $69 for signs of a bullish rebound, while a continuation of flat trading volume could see the LTC drop towards $60.

Despite recent concerns in the market, Litecoin’s strong fundamentals and upcoming halving events make it an investment opportunity worth considering as we enter the latter part of the year.

(The content of this site should not be construed as investment advice. Investing involves risks. When you invest, your capital is subject to risk).

Featured image from Invest Right