As the highly anticipated US Consumer Price Index (CPI) data for June will be released today at 8:30am EST, the Bitcoin (BTC) market is at a critical crossroads. As inflation concerns persist and the Federal Reserve’s next steps come under scrutiny, market participants eagerly await the impact of the CPI data on BTC’s price trajectory. The expectations are as follows:

- Heading y/y at 3.1% (last 4.0%)

- Head m/m at 0.3% (last 0.1%)

- Core CPI y/y of 5.0% (last 5.3%)

- Core CPI m/m of 0.3% (last 0.4%)

The Fed’s fight against inflation

Inflationary pressures have been a cause for concern in recent months, drawing the attention of investors and economists alike. As headline inflation cools rapidly and is expected to fall further to 3.1% (from 4.0% in May), core CPI, which excludes volatile food and energy prices, has become increasingly important.

In recent public appearances, members of the Federal Reserve (Fed) have taken an aggressive stance and expressed concern about a possible resurgence of inflation related to increased core inflation. The underlying concern stems from the fact that inflation has fallen mainly due to supply chain issues being resolved, while core inflation remains high.

The increase in wages could contribute to a cycle of increasingly sticky core inflation. While core CPI was 5.3% in May, experts now expect a gradual decline to 5.0% in June. While this is progress, it shows how sticky core inflation currently remains. An unexpectedly sharp decline would therefore be extremely bullish.

Any number below expectations could lead to a rally in the Bitcoin and cryptocurrency markets, as Christopher Inks, renowned trader and psychology coach, tweeted:

CPI will be released with a big expected drop from 4% last time to 3.1% expected this time for the main number. If the core CPI drops below 5% that would be huge, and you better hang on to your pants. Will used car sales cause the core to fall much more than expected?

A surprise in core inflation could have a significant impact on the next Fed rate hike. The next FOMC meeting is July 26. Currently, the CME FedWatch tool is forecasting a 25 basis point rate hike at 92.4%, which is holding markets back. This probability is likely to plummet if core CPI surprises negatively.

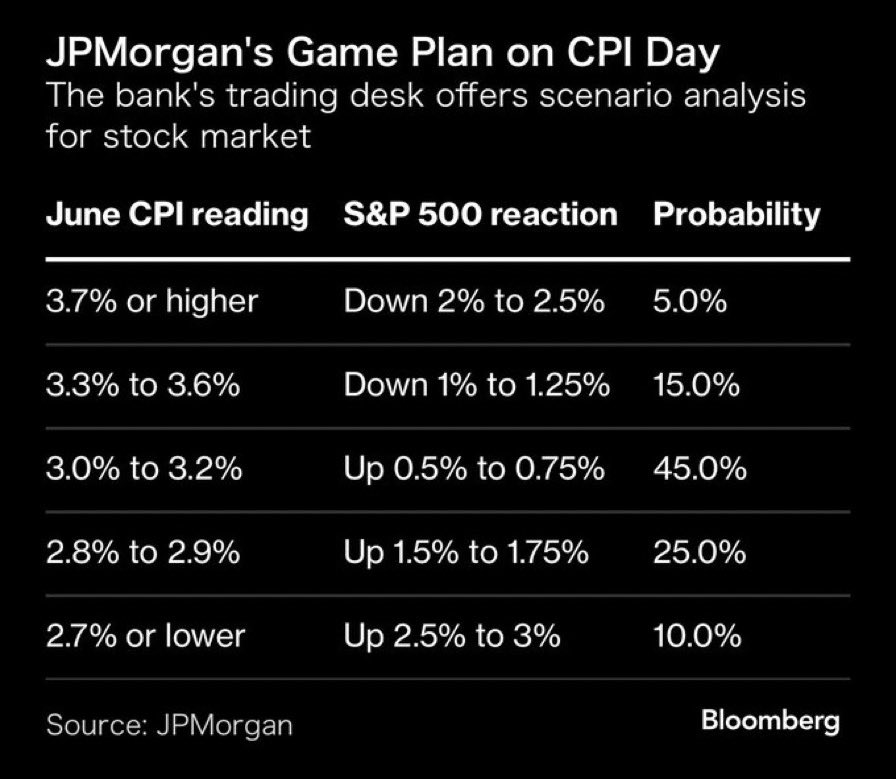

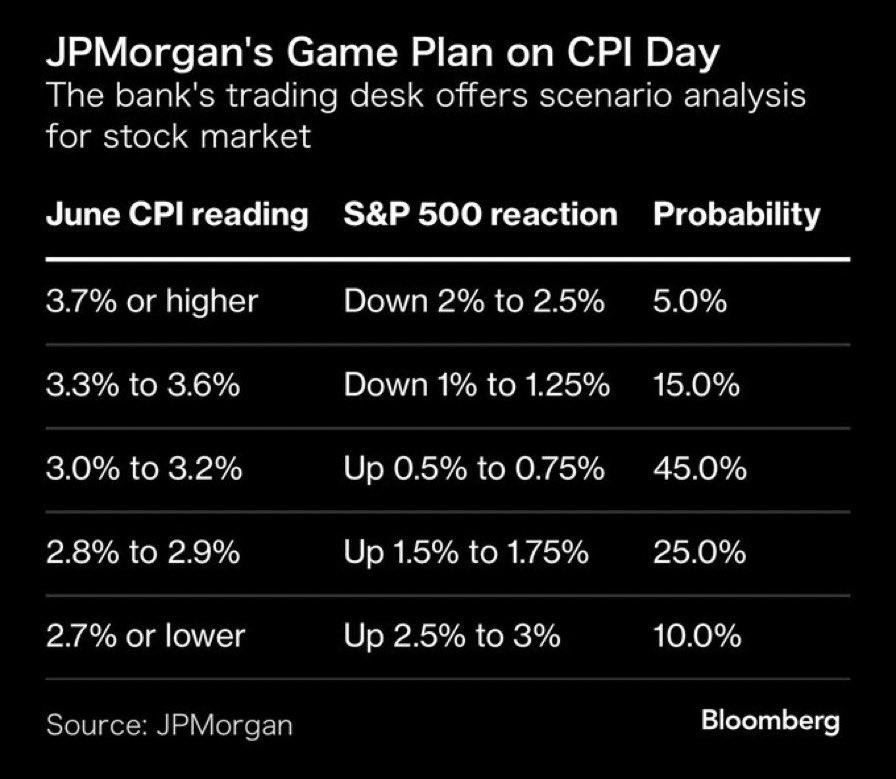

As usual, JP Morgan has laid out a game plan for the S&P 500 ahead of today’s release of the consumer price index. According to the banking giant, a fall in the CPI to 3%-3.2% with 45% is the most likely. The S&P 500 could then gain between 0.5 and 0.75%.

The second highest probability is given by JP Morgan for a fall in overall CPI to 2.8% to 2.9% (25%). In this case, the S&P 500 could be up 1.5-1.75%. In addition, the banking giant gives a 10% chance of CPI falling to 2.7% or lower, while breaching its forecast value (above 3.3%) is just at 20%.

Potential scenarios for Bitcoin

If CPI numbers come in higher than expected, indicating heightened inflationary pressures, BTC could face a temporary pullback. In the event that the CPI falls within the predicted range, BTC’s response may be moderate. Investors will be watching the data closely for signs of continued inflation, which could potentially result in a slight drop in Bitcoin’s price.

A lower-than-expected CPI figure, pointing to easing inflationary pressures, could spark a bullish rally in BTC. Investors can take this as a positive sign of a continued interest rate pause by the Fed. A lower-than-expected core CPI reading has the potential to provide a much-needed boost for Bitcoin.

At the time of writing, Bitcoin price has managed to break above the mid-range resistance and is trading at $30,767.

Featured image from iStock, chart from TradingView.com