- BTC is up over 2.5% in the last 24 hours along with a surge in volume.

- Market sentiment turned bearish on BTC, as did a number of metrics.

Bitcoin [BTC] has shocked investors over the past month thanks to the latest bull rally. As we entered the second month of the last quarter, a key indicator turned bullish.

Read Bitcoins [BTC] Price prediction 2023-24

Market confidence in Bitcoin is low

Over the past seven days, the price of the king of cryptos has risen by more than 3%. Even though the momentum had dropped, the price chart still remained in the green. According to CoinMarketCapThe value of BTC has risen by more than 2.5% in the past 24 hours.

At the time of writing, it was trading at $35,379.27 with a market cap of over $690 billion.

The better news was that 24-hour trading volume also increased by more than 90%, indicating that investors were actively trading the coin.

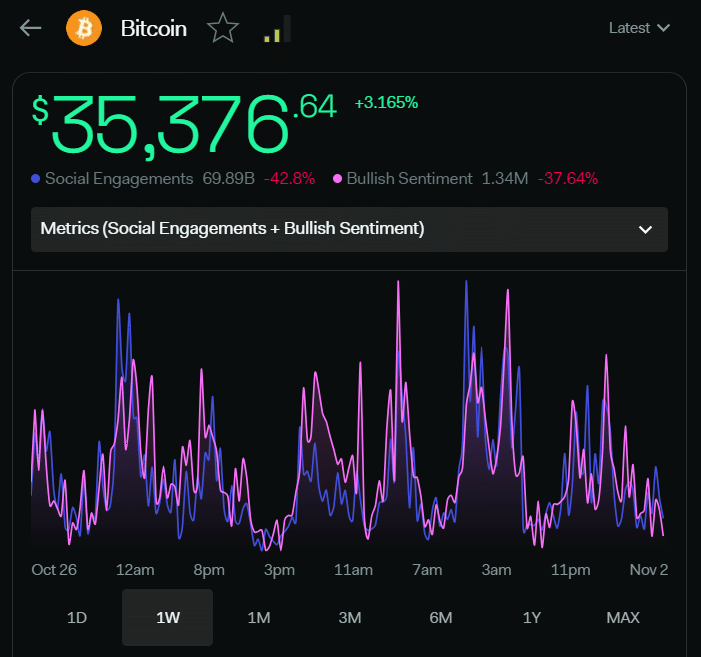

As the price of the coin rose, market sentiment turned in favor of the sellers. This was evident in the data that AMBCrypto analyzed via LunarCrush, which showed that bullish sentiment around the token had dropped.

Not only that, but social engagement also plummeted last week, meaning Bitcoin’s popularity had waned somewhat.

Source: LunarCrush

Will Bitcoin surprise investors again?

While market sentiment looked bearish for the king of cryptos, CryptoCon, a popular X account (formerly Twitter), highlighted a key bullish metric. According to the tweet, one of the most important Bitcoin indicator breakout for the cycle has just occurred for a rare second time this cycle.

Not only does this usually mean that good things will happen in the short term, but it also marks the beginning of all the greatest historical movements.

The most important #Bitcoin indicator breakout for the cycle has just occurred for the rare second time this cycle.

This not only means that good things will usually happen in the shorter term, but also marks the beginning of all the greatest historical movements:

– The bull comes in… pic.twitter.com/WWlKPEy4u7

— CryptoCon (@CryptoCon_) November 1, 2023

Therefore, a closer look at the blockchain’s statistics sheds light on what you can expect from it. From additional data analyzed by AMBCrypto via CryptoQuantSelling pressure on BTC was high at the time of writing. This was evident from the fact that the foreign exchange reserve increased.

Is your portfolio green? look at the BTC profit calculator

The aSORP was also in the red, meaning more investors were selling the token at a profit, which could indicate a possible market top.

Nevertheless, BTC‘s derivatives metrics such as Funding Rate and Taker Buy Sell Ratio were green, indicating that investors in the futures market were purchasing BTC at the higher price at the time of publication.

Source: CryptoQuant