- Market analysts suggested that Bitcoin could surpass altcoins as the BTC/ALT ratio reached historic levels.

- Bitcoin also hit a new all-time high as foreign exchange reserves continued to decline.

Bitcoin last month [BTC] has been the center of market activity and has attracted both private and institutional investors. This interest has caused a price increase of 34.16% within one month.

Over the past 24 hours, BTC has gained another 1.06%, reaching a record price of $94,002.87 at the time of writing.

AMBCrypto’s analysis indicated that trends and data from emerging markets indicate that Bitcoin could be on the verge of another significant rebound.

Analyst predicts potential upside for BTC

Popular crypto analyst Benjamin Cowen highlighted a critical moment for BTC and suggested that Bitcoin may be on the cusp of another major rally.

According to Cowen, the ALT/BTC pair reached a valuation similar to the level of November 24, 2020, just before a major shift in liquidity from altcoins to BTC.

Historical data shows that this liquidity gap pushed Bitcoin to new highs in five weeks in 2020, while altcoins largely stagnated.

Source:

Noting the parallels, Cowen says:

“The ALT/BTC pairs are at the same valuation today as they were in November 2020, just before the last decline in ALT/BTC pairs began.”

If the pattern repeats, BTC could see a rapid rise, reaching new highs as altcoins take a back seat during the expected shift.

The minting of stable coins could signal an inflow into BTC

Recent data has shown a significant increase in stablecoin minting, with USDT’s total market cap now reaching $128.90 billion, often a bullish signal for the broader crypto market.

In one remarkable developmentTether [USDT] recently minted a billion USDT on the Ethereum blockchain.

Such large-scale coin operations typically reflect growing demand and are typically used by market participants to acquire other cryptocurrencies.

Given the recent ALT/BTC pattern, it is likely that a significant portion of this newly minted USDT will flow into Bitcoin if history repeats itself.

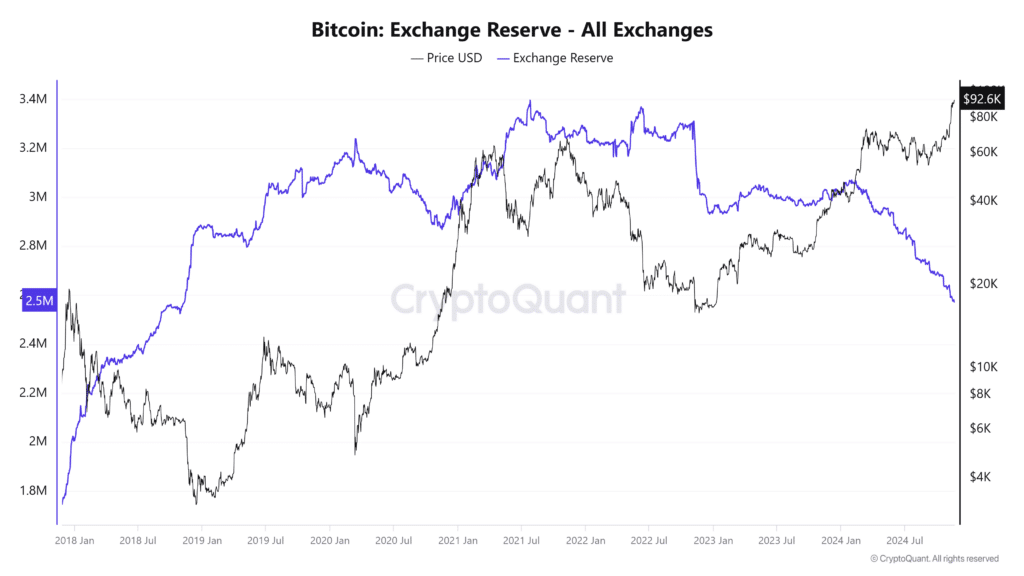

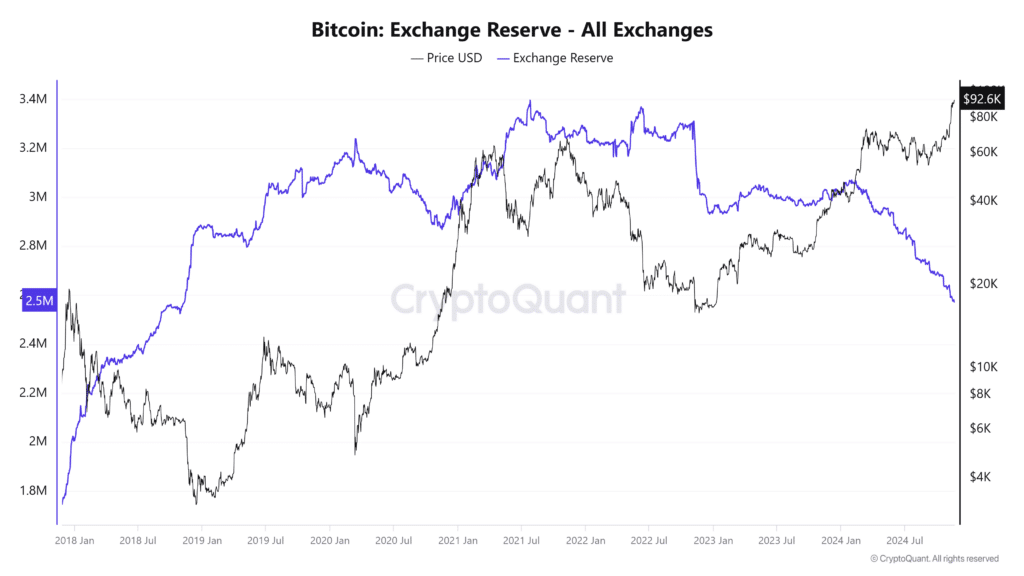

Falling foreign exchange reserves indicate a market shift

Data from CryptoQuant revealed a notable decline in Bitcoin exchange reserves, with daily and weekly figures showing declines of 0.34% and 0.77% respectively.

At the time of writing, the total Bitcoin reserve on exchanges has fallen to 2,572,477,995 BTC, the lowest level since 2019.

Source: Cryptoquant

Read Bitcoin’s [BTC] Price forecast 2024–2025

A consistent decline in available BTC on exchanges is often considered a bullish indicator as it suggests market participants are choosing to hold their Bitcoin in private wallets rather than sell it.

This shift reflects growing confidence in Bitcoin’s long-term value.