- At $52,000, Bitcoin could be the last golden buying opportunity.

- Large traders who lose their BTC positions could drive the price down to this critical support level.

Since the beginning of the month, Bitcoin [BTC] has not shown significant market movements. After reaching a peak of $59,844.10, the price has fallen to $56,855.25, a clear indicator of the market’s growing bearish trend.

Sustaining the bearish pressure could ultimately serve as a strategic advantage for investors looking to accumulate at lower prices.

Golden opportunity for $52k

Crypto analyst Carl Runefelt has identified a crucial pattern in BTC’s recent trading activity. According to his analysis, BTC oscillated within a descending channel, characterized by a sideways and downward trajectory.

Historically, a further decline is expected if an asset trades within such a pattern.

True to form, BTC has registered a 4.62% decline over the past week, which are indications that it could continue to slide towards the lower limit of the channel.

What makes this scenario particularly attractive is the convergence of the bottom of the channel with a major support zone at $52,000.

Should the price of BTC reach this level, it could trigger a significant breakout from the descending channel and propel the asset to new highs.

Source:

Runefelt sees this scenario as a crucial buying opportunity, noting:

“It could be our last golden opportunity to acquire it so cheaply.”

So, BTC is unlikely to revisit these levels once it starts its upward trajectory. This prompted AMBCrypto to investigate the likelihood of a further decline in BTC’s price.

Investors Heed Bitcoin’s Bearish Call

AMBCrypto’s analysis found that large holders and institutional traders expected a further decline in BTC prices, as evidenced by significant market sell-offs.

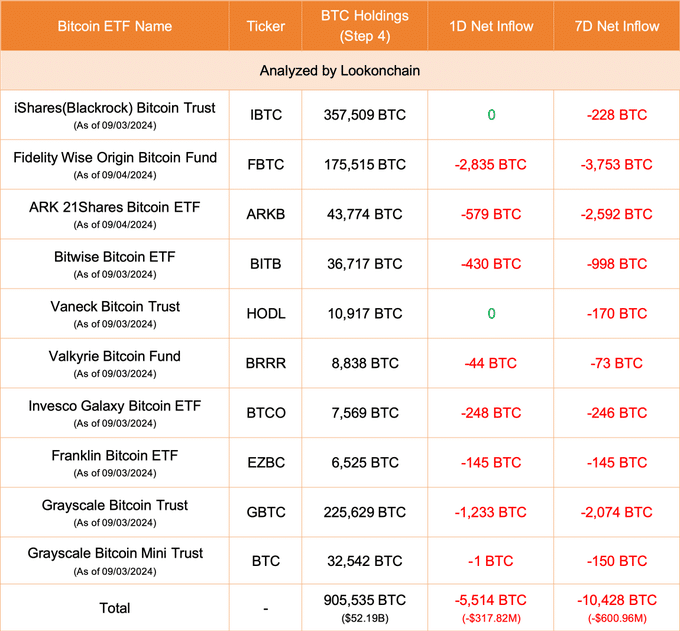

Data from Lookonchain indicated substantial outflows from BTC spot ETF companies – which primarily cater to institutional investors – over the past 24 hours and week.

Specifically, the withdrawals amounted to 5,514 BTC ($317.82 million) and 10,428 BTC ($600.96 million) respectively.

Source:

Further reporting by Lookonchain highlights Ceffu’s actionsa digital asset management company, which transferred 3,063 BTC worth $182 million to Binance last week [BNB].

This suggested a strategy that supports selling over long-term investing.

Such moves indicate a shift towards less volatile assets, such as the USD, as investors seek to preserve capital value.

If these trends continue, a dip for BTC towards the critical $52,000 level, in line with the bottom of the trading channel, looks increasingly likely.

Larger holders in bearish outlook

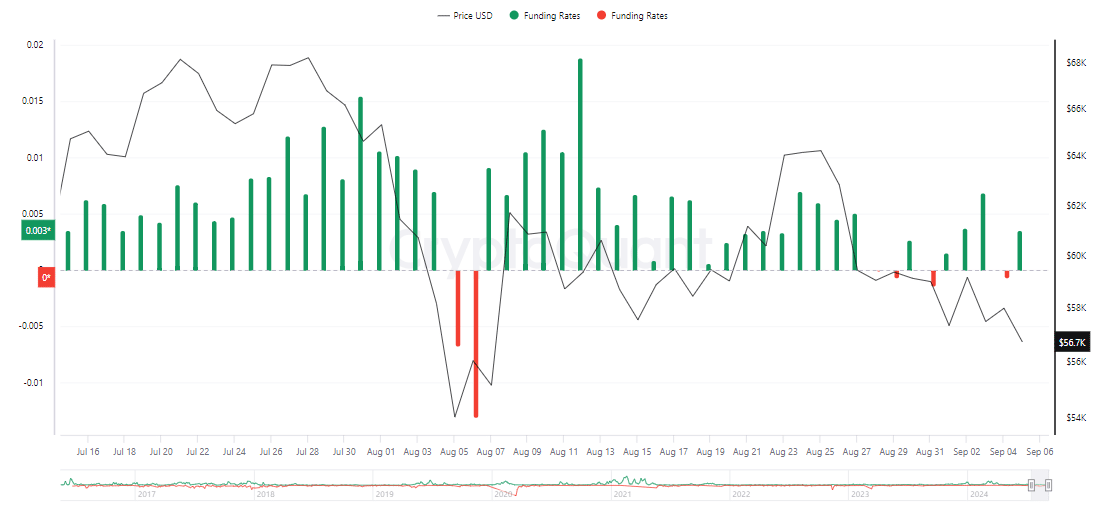

CryptoQuant reported a growing bearish sentiment among retail traders. The funding rate has steadily declined since September 3, from 0.006839 to a press-time value of 0.004357.

Source: CryptoQuant

If this trend continues for consecutive days, it could signal a further decline in BTC from current levels.

Read Bitcoin’s [BTC] Price forecast 2024–2025

The Open Interest supported this perspective and showed a decline towards the low on September 1. According to CoinglassAt the time of writing, there had been a modest decline of 0.58% over the past 24 hours.

Continued bearish pressure is likely to further lower the Open Interest, which would have a direct impact on the price of BTC, potentially pushing it down from its current position.