- Selling pressure on Bitcoin was high as the price fell by more than 2%.

- Market indicators remained mostly bearish on the coin.

The ETF approval turned out to be a bearish episode Bitcoin [BTC], as it witnessed a price correction within days. There was some good news for investors, however, as the latest data suggested that the ongoing trend could soon change.

That’s why AMBCrypto took a deeper dive into the state of BTC to see if it was the right buying opportunity for investors.

How Bitcoin Fell Below $43,000

AMBCrypto had earlier reported how the price of the king coin had plummeted a few days after the ETF’s approval. To be precise, BTC fell by over 7% within a 24-hour period.

However, the currency had recovered somewhat at the time of writing; its value was 2.4% less than a week ago.

At the time of writing, BTC was trading at $42,989.21 with a market cap of over $842 billion. Aside from the ETF havoc, another possible reason behind the downtrend could be that BTC’s price is moving in a parallel channel.

Ali, a popular crypto analyst, recently posted a tweet highlighting this development.

It looks like this parallel channel is holding up! This suggests that #Bitcoin was rejected from the channel’s upper limit at $48,000, and now $BTC will return to the lower limit at $34,000, and then bounce back to the upper limit at $57,000. https://t.co/2vDqYpwmpi pic.twitter.com/fBiNsmJ10C

— Ali (@ali_charts) January 13, 2024

According to the analysis, BTCThe company’s price could soon fall to $34,000 before gaining momentum and reaching $57,000. Therefore, should investors wait for the price of BTC to drop further, or is this the best buying opportunity?

Are investors buying BTC?

To check the larger market trend, AMBCrypto took a look at Bitcoin’s statistics. Our analysis of CryptoQuant’s facts revealed that BTC’s foreign exchange reserve was increasing, meaning selling pressure was high at the time of writing.

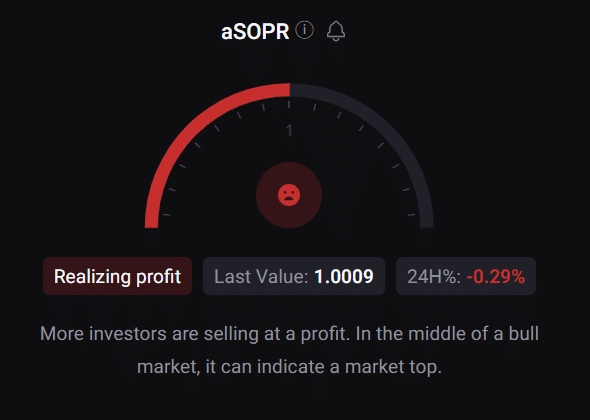

Bitcoin’s aSORP was also in the red. This meant more investors sold at a profit. But in the middle of a bull market, this could indicate a market top.

Source: CryptoQuant

Moreover, BTC’s Network Value to Transactions (NVT) ratio recorded a sharp increase after a decline. A rise in the metric is generally seen as a bearish indicator because it has historically coincided with market tops and periods of overvaluation.

Read Bitcoins [BTC] Price prediction 2023-24

It is therefore wiser for investors to wait a while before they can accumulate more BTC, as the above statistics suggested a further drop in prices.

Source: Glassnode

A similar picture was also revealed when we checked BTC’s daily chart. The MACD showed a bearish crossover. The Relative Strength Index (RSI) also rested below the neutral line, increasing the likelihood of a continued downtrend.

Source: TradingView