In the midst of the current tariff war, Bitcoin (BTC), the world’s largest cryptocurrency per market capitalization is ready for a massive price crash because of the Bearish price action. In recent days, BTC seems to consolidate within a tight reach. On further investigation, however, it seems to have formed a bearish main and shoulder pattern on the four-hour period.

Current price momentum

It seems that the market does not respond to positive news. Earlier, after the daring statement from Treasury Secretary Scott Bessent, BTC started recovering together with great assets, but the upward momentum faded later and all the wins were lost. BTC is currently being traded near the level of $ 82,500 and BTC has registered a price fall of more than 1.10% in the last 24 hours. In the same period, trade volume fell by 50%, indicating a lower participation of traders and investors as a result of remarkable market volatility.

Bitcoin (BTC) Technical analysis and upcoming levels

According to the technical analysis of experts, BTC with the recent fall in price is on its way to the neckline of the Beararish main and shoulder pattern.

Based on recent price action and historical patterns, if the momentum continues and BTC breaks the neckline at the level of $ 81,500, there is a strong possibility that it could fall by 4% to reach $ 78,200 level in the near future.

From now on, it is actively trading under the 200 exponential advancing average (EMA) on both daily and four hours of time frames, which indicates a strong downward trend and weak momentum.

Traders usually wait for a price jump in the active, which explains the recent price peak and the subsequent decrease within less than 24 hours.

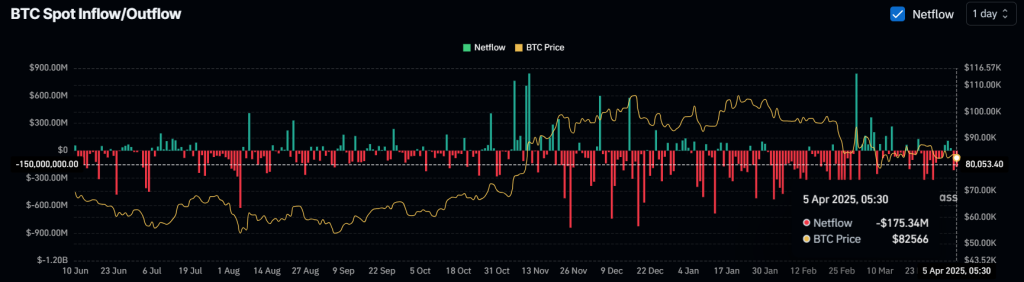

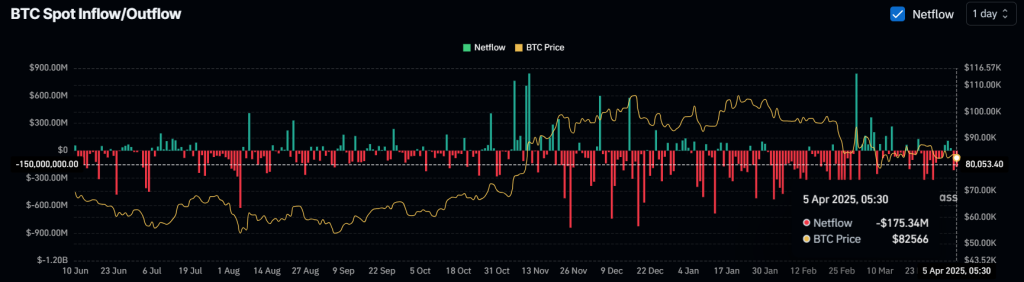

$ 175 million in BTC outflow

Despite the Bearish front views, investors and long-term holders seem to collect it actively, as reported by the on-chain analysis company Coinglass.

Data from Spot -entry/outflow shows that exchanges have witnessed in the last 24 hours of an outflow of around $ 175 million in BTC. Such outflow during a Bearish market sentiment suggests potential accumulation.

Although this can cause the purchasing pressure and activate an upward rally, it usually occurs during a bull run.