- Research into the potential price impact of Bitcoin due to the recently rising political tensions.

- A look at similarities between now and 2022 and assessing differences that could lead to a different outcome.

Bitcoins [BTC] price action has had several influences over the years. From economic influences to geopolitical exposure, but could the escalating geopolitical outcomes in the Middle East have an impact on Bitcoin?

Before we explore Bitcoin’s potential impact, it’s worth pointing out something. Conflict, especially of a physical nature, is against human progress, and we sympathize with those affected by it.

The threat of major geopolitical conflicts has a widespread impact, especially on markets.

Investors are typically more reluctant to invest not only in Bitcoin, but also in the broader risky investment landscape during times of conflict.

This was the case in February 2022, when the conflict between Russia and Ukraine began. Bitcoin and the rest of crypto saw significant outflows as the investment landscape shifted to a cautious stance.

Will Bitcoin find itself in a similar situation this time?

Bitcoin has already experienced significant outflows over the past five days, moving from $66,000 to $60,450 at a time.

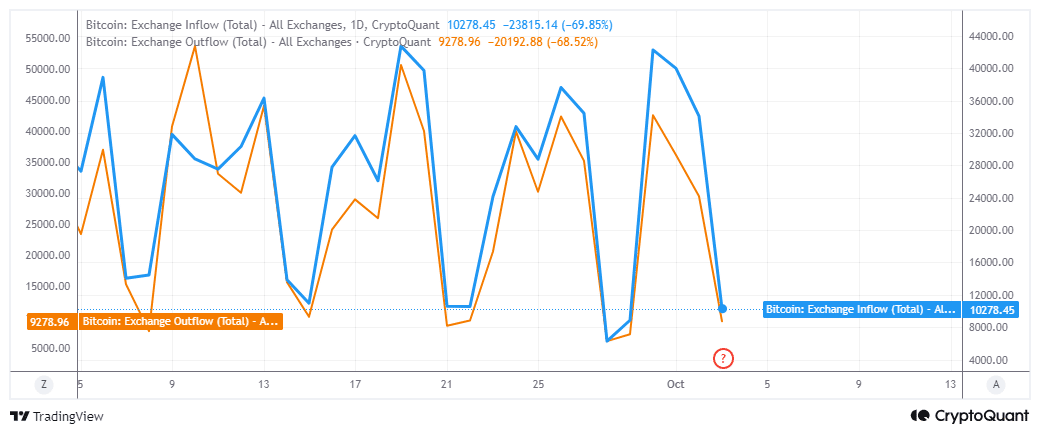

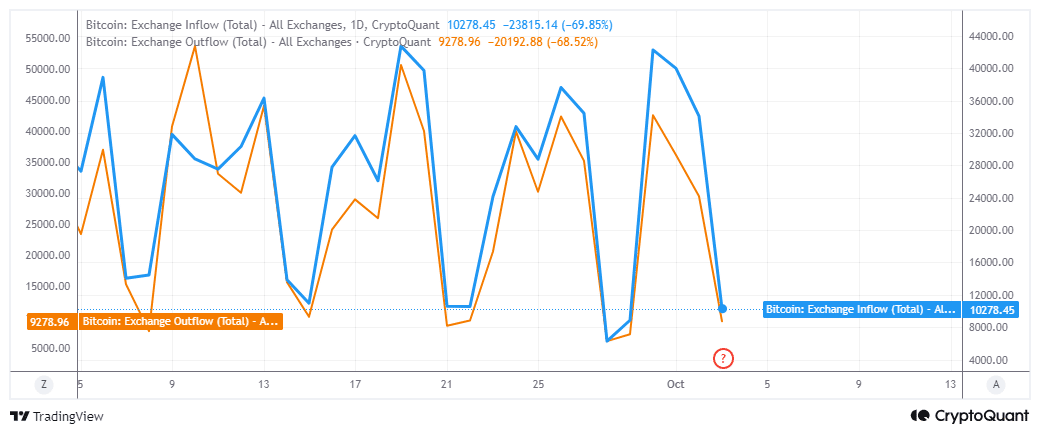

The inflow in the currency market in the last 24 hours was 10,278 BTC, while the outflow in the currency market was lower at 9,278 BTC.

Higher inflows than outflows indicated that Bitcoin could fall below $60,000 by the weekend if selling pressure continues.

However, it is worth noting that both inflows and outflows have decreased over the past three days.

Source: CryptoQuant

It was unclear whether the volatile geopolitical situation had affected market sentiment so far. This is because the selling pressure this week could also be the result of profit-taking from Bitcoin’s rally in September.

While it is possible that the rising tensions could impact Bitcoin by affecting sentiment, the current situation is also a bit different.

BTC’s selling pressure in early 2022 had multiple factors weighing on the cryptocurrency.

This was around the same time that governments were raising interest rates, causing liquidity to flow out of the market much faster.

Read Bitcoin’s [BTC] Price forecast 2024–2025

One of the biggest differences this time around is that global liquidity is about to grow thanks to interest rate cuts. In other words, the dynamics are very different this time.

Ultimately, geopolitical tensions may still have an impact in the short term, but that impact may be mitigated by the changing liquidity situation.