- One analyst believed that BTC and ETH could reach new ATHs before the end of the first quarter of 2024.

- Another analyst suggested altcoins could benefit from the potential buying momentum in November.

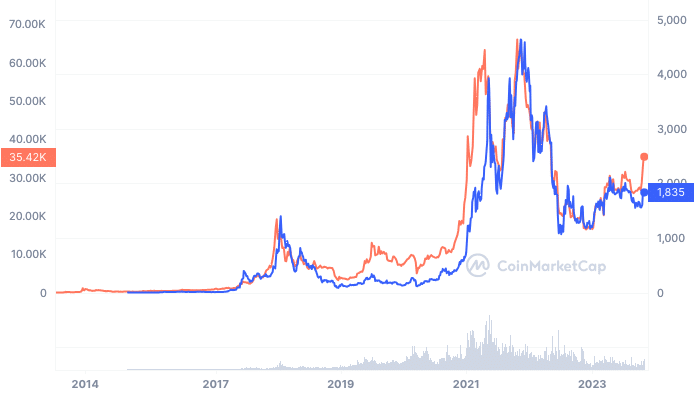

The increase in value recorded by Bitcoin [BTC] And Ethereum [ETH] According to Chris Burniske, this could be just the tip of the iceberg.

Realistic or not, here it is The market cap of ETH in terms of BTC

Burniske, a partner at blockchain network and Web3 infrastructure company Placeholder, noted that a breakout for ETH and BTC could lead to new All-Time Highs (ATHs) for the cryptocurrencies.

Burniske even noted that the projection could become a reality before the end of the first quarter (Q1) of 2024. For context, BTC’s ATH in 2021 was $68,789, while ETH was 4,891 in the same year.

History could be written again

To substantiate his point, the analyst referred to the historical performance of the coins, specifically the period December 2018 to January 2019. He also noted that both cryptocurrencies showed similar price action.

If $BTC & $ETH rip here, and then everything else follows, we could see a repeat of mid-2019 – just high enough to make people believe that maybe, just maybe, new ATHs are just around the corner, before they suffer final destruction (Q1′ 24?) and solid higher lows.

— Chris Burniske (@cburniske) November 2, 2023

A look at CoinMarketCap’s data showed that Bitcoin rose from around $4,000 to $10,000 within the period mentioned above. For ETH, it rose from $113 to $268.

Source: CoinMarketCap

While beating the ATH may seem like a challenge to break, on-chain data showed that a surge could remain in place. AMBCrypto has obtained this inference from the ratio of the market value of the short-term holder to the realized value (MVRV).

BTC and ETH sellers are tired

At the time of writing: Bitcoins STH-MVRV amounted to 1.22. This metric measures the behavior of short-term investors whose demographics are less than 155 days.

With its value rising in recent months, Bitcoin may be able to maintain the rise it has seen recently in the coming months.

Source: Glassnode

Furthermore, AMBCrypto analyzed Ethereum’s seller attrition Constantwhich also seemed to support the bullish thesis.

Using the 30-day price volatility, the Seller Exhaustion Constant detects periods of potentially high losses and the period when it could be a relatively good period to make profits.

At the time of writing, the metric had left the danger zone (colored red) and stood at 0.025. This implies that ETH’s value has more room to rise in the short term than its value opportunity of a decline.

Source: Glassnode

Moreover, Altcoin Sherpa was another analyst who gave his opinion on the BTC/ETH price action. According to Sherpa, the value of ETH and BTC may fall for a while. However, he added that the month was November remains a good buying period for both coins.

Is your portfolio green? look at the ETH profit calculator

Sherpa also mentioned in his tweet that altcoins alongside ETH could benefit from the buying pressure in December and January.

$ETH: ETHBTC is tanking, I think the altcoin buying opportunity is getting better every day. It’s looking more and more like the .048 area will be tagged. November is expected to be a good buying period, with alts doing very well in December/January. #Ethereum pic.twitter.com/3qTaTAsskB

— Altcoin Sherpa (@AltcoinSherpa) November 1, 2023

As it stands now, both BTC and ETH could reach notable highs. However, creating a new ATH seems very difficult to achieve. At the same time, it should not be ruled out.