- A Bitcoin accumulation address made a considerable purchase after the last attack of the market collection

- Graphs emphasized the possibility that the price crossed to the $ 90,000 zone

Bitcoin [BTC] Has succeeded in maintaining a steady price threshold in recent days, which indicates that it is indicated on the potential rebirth of a market trally.

And yet the crypto has registered a slight decrease of 3.81% last week to act at $ 81,016 at the time of the press. According to Ambcrypto, buying volume in the derivatives and institutional markets has been higher lately and this could soon cause an upward move.

Will Bitcoin add another $ 13,000 to its price?

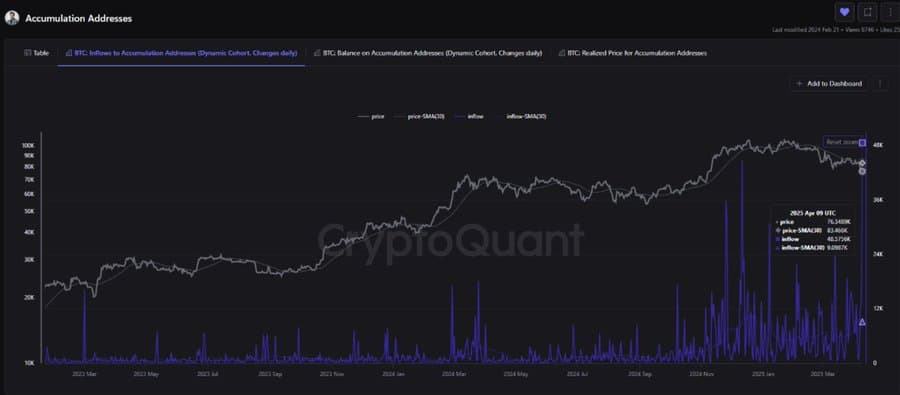

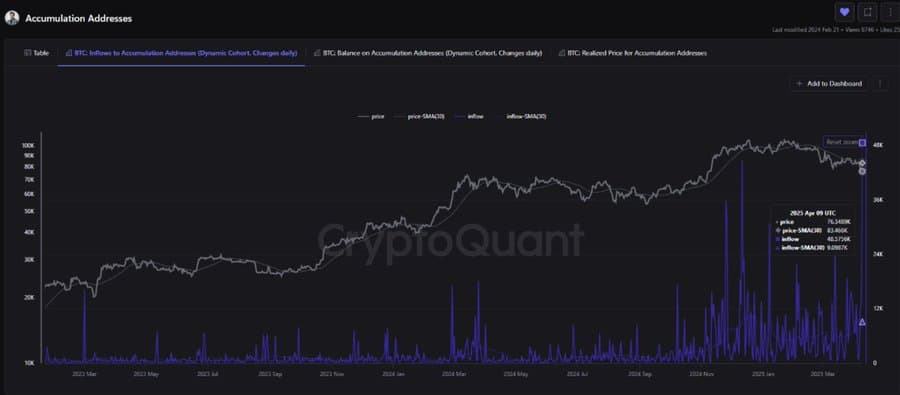

A cryptoquant report showed that a Bitcoin accumulation address, known for buying the active in strategic market positions, has recently made the second most important purchase in the past three years.

After the price decrease up to the $ 76,000 region, the address bought 48,575 BTC, worth around $ 3.6 billion-the largest purchase of one day since the acquisition of 95,000 BTC on 1 February 2022. Interesting enough, both transactions were roughly the same amount in dollar $ 3.6 billion.

Source: Cryptuquant

An important purchase such as this from a whale account usually implies that an incoming rally could be on the horizon. This can give confidence to the overall market, which leads to more purchasing activity.

Further analysis showed that if the rally started, it would probably have a free run until it touches the $ 94,500 zone. This is a level where there is a remarkable sales pressure, which could push the price lower. If this rally arises from the time price level of the press, BTC would have added $ 13,480 to its dollar value.

Source: Glassnode

Other markets support a run -up

Institutional and derived market traders have placed bets on a push for bitcoin higher in the charts.

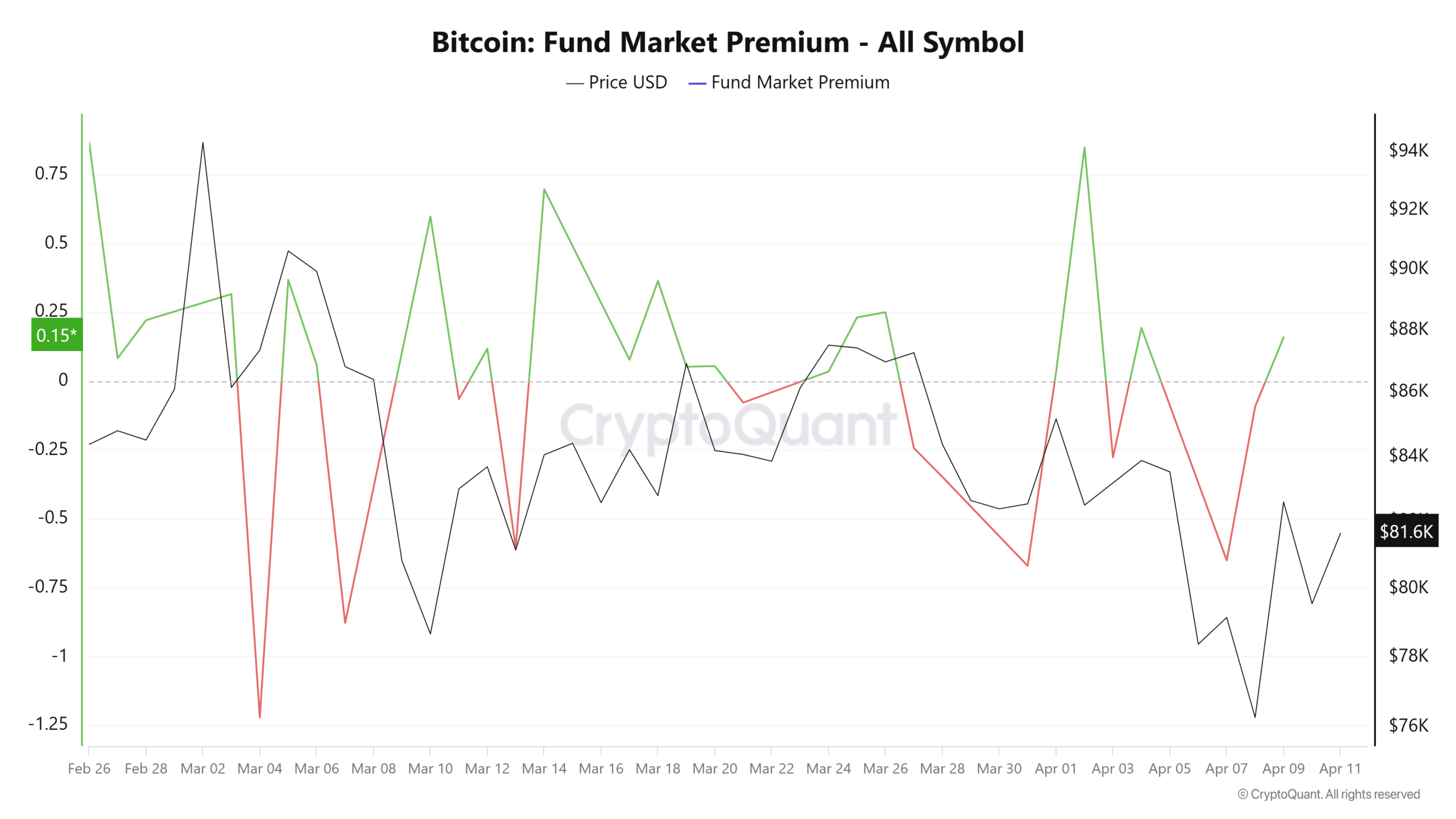

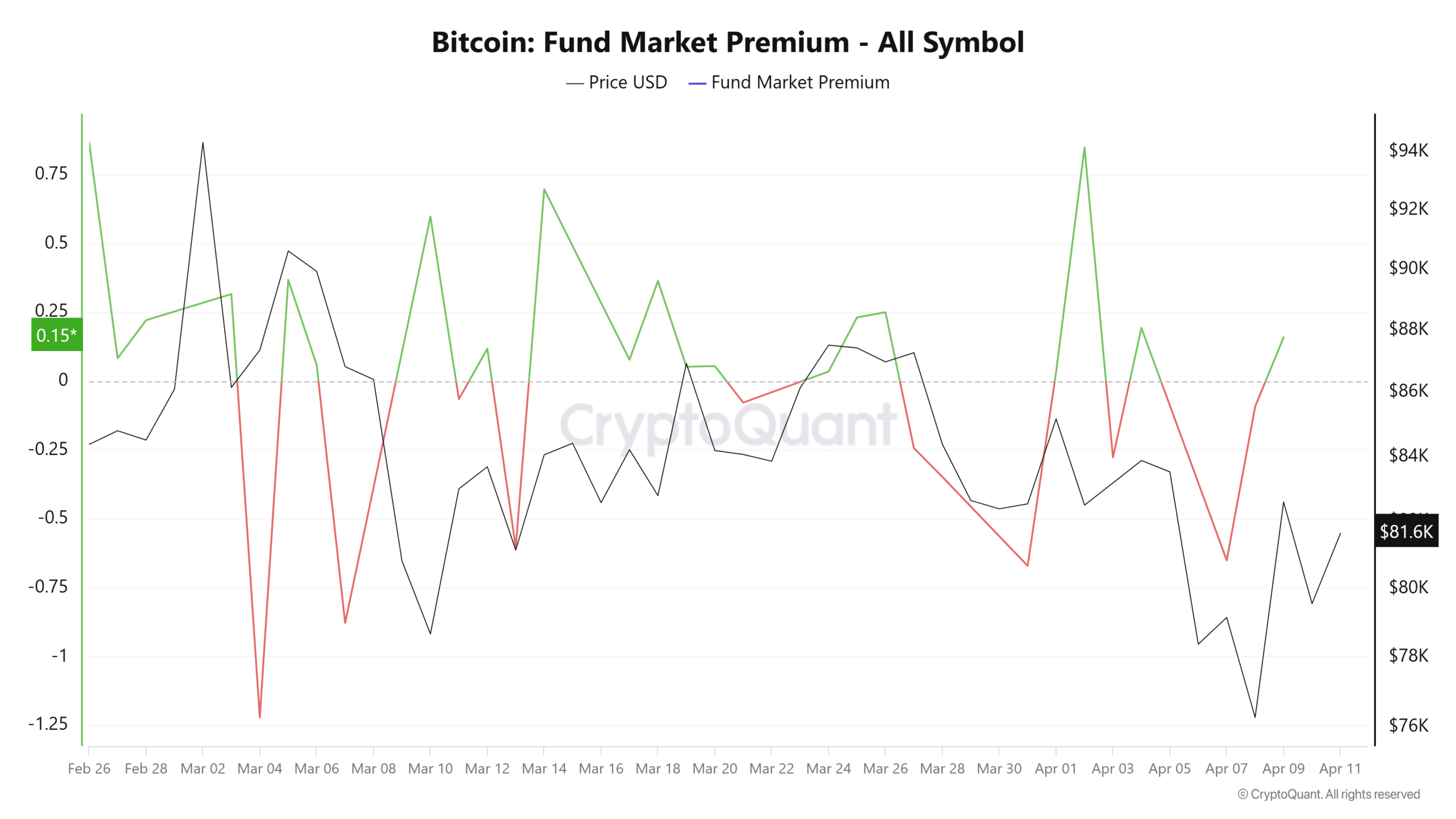

At the time of writing, the fund market premium, which follows institutional investor activities, emphasized continuous purchase activities.

The institutional investor story is determined on the basis of the price difference between Bitcoin on institutionally focused platforms and retail -oriented platforms (such as Binance). If this difference is positive, as in the case of Bitcoin at the moment with a lecture of 0.15, it is a sign of net purchase activity on the market.

Source: Cryptuquant

Bullish also remained in the derivatives market, with more buying than selling volume in the last 24 hours.

Based on the Takker Buy/Sell Ratio, after a previous day dominated by sellers, buying has also resumed. This activity appeared to be clearly traceable on the graph, characterized by a remarkable green peak, which led to reading a period of 1.09.

Miners participate in the race

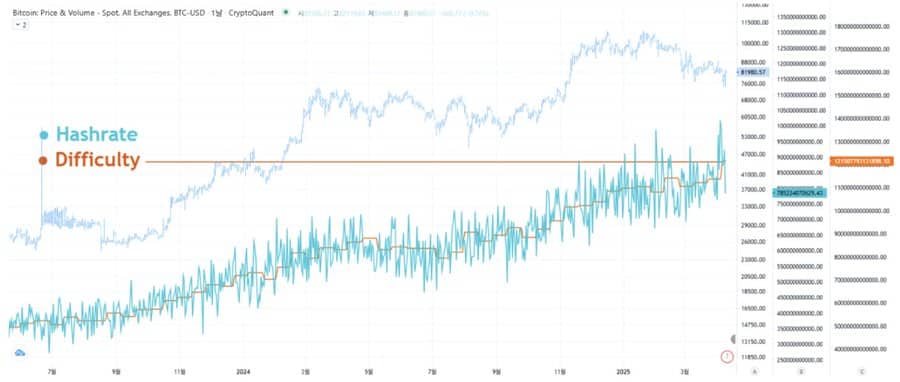

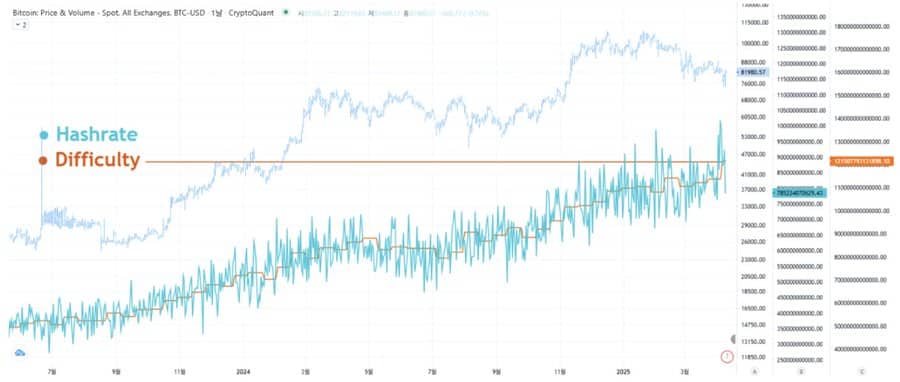

Despite the decline of Bitcoin Saw of its high above $ 109,000, there is continuing growth in his hashrate.

Hashrate refers to the total computer power that is used by miners to process transactions and secure them on a proof-of-work blockchain such as Bitcoin. A growing hassle implies that the network becomes safer, which contributes to the trust of investors.

Source: Cryptuquant

According to Crypto analyst Ki Young Ju, based on his hashrate, Bitcoin could possibly collect to a market capitalization of $ 5 trillion of his € 1.6 trillion. This would mean an estimated meeting of 3 times, which pushes it into the charts actively to $ 243,000.