The general market sentiment for cryptocurrency seems to have shifted to an uptrend. Amid this, popular Solana-based meme coin Dogwifhat (WIF) is poised for a significant upside rally as it stands on the verge of a mega breakout.

Dogwifhat (WIF) Technical Analysis and Upcoming Levels

According to CoinPedia’s technical analysis, WIF almost reached the crucial resistance level of $2.95 with its impressive price rise. However, this is the third time WIF has reached this level since June 2024. Previously, the meme coin experienced a notable price drop of over 50% after reaching this level.

However, this time the sentiment is different as we approach the presidential elections and cryptocurrencies in general experience a notable price increase. If WIF breaks this resistance level and closes a daily candle above the $2.95 level, there is a good chance that it could rise 30% to reach the $4 level in the coming days.

On a four-hour time frame, WIF has already surpassed this level, but on a daily time frame it is struggling to close the daily candle above it. Moreover, the meme coin is in an uptrend as it is trading above the 200-day exponential moving average (EMA).

WIF’s bullish on-chain metrics

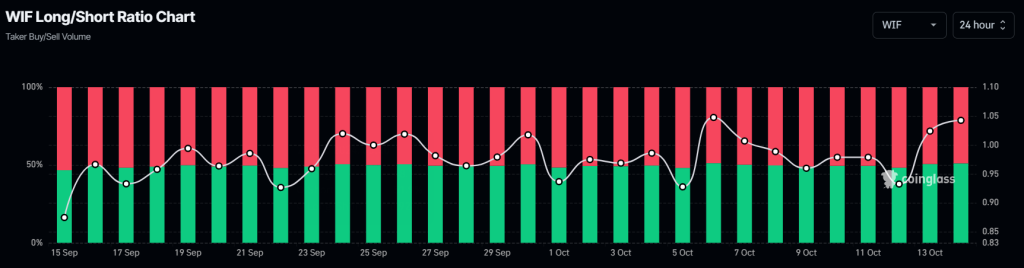

WIF’s positive outlook is further supported by on-chain metrics. According to the on-chain analytics company Mint glassWIF’s Long/Short ratio currently stands at 1.03, indicating strong bullish sentiment among traders.

Additionally, future open interest has shot up 15% in the last 24 hours and 5.5% in the last four hours. This increasing open interest indicates growing interest from traders in the WIF as it approaches the resistance level.

Combining these bullish on-chain metrics with the technical analysis, it appears that bulls are currently dominating the asset and can help traders and investors break through that level.

Current price momentum

At the time of writing, WIF is trading around $2.86 and has experienced a price increase of over 9.5% in the last 24 hours. During the same period, trading volume increased by 45%, indicating greater trader participation compared to the day before, possibly driven by the bullish outlook.