- The long-term Bitcoin faithful stuck to its prediction, but pushed it forward.

- The halving may play a role and holders seem to have that in mind.

American venture capitalist and Bitcoin [BTC] investor Tim Draper has made a new prediction about the digital asset’s potential. Draper, who has repeatedly maintained that he was optimistic about BTC’s future price action, doubled down on his earlier $250,000 forecast.

Read Bitcoins [BTC] Price prediction 2023-2024

But this time, the investor changed the timeline when speaking to Bloomberg TV, in aran interview.

Draper: “Why I extended the season”

According to Draper, Bitcoin could reach the mentioned price in 2025. When answering the question of why he pushed the moment forward, Draper opined that Bitcoin was held back by several factors. He said,

“When I predicted it earlier, I didn’t expect the American bureaucracy to be so aggressive. The SEC’s regulation through enforcement has hurt Bitcoin’s price movement. But Bitcoin is here to stay, and it’s a great system.”

Remember, the US SEC has been bad cruel towards crypto companies and projects operating in the jurisdiction. While BTC was not directly targeted, Draper believed the prosecution indirectly affected the coin’s price.

It was not the first time that the renowned entrepreneur made a prediction around the same value. It’s even more interesting that it came around the same time period when Standard Chartered dropped $120,000 prediction within the same period.

In 2021, Draper said BTC would reach $250,000 by December 2022. However, his prediction did not materialize as many unfortunate incidents rocked the crypto market.

Banks don’t like bitcoin because it makes them less relevant, so you see their attempted manipulation over the weekend. #bitcoin $250,000 by late 2022 or early 2023.

— Tim Draper (@TimDraper) January 11, 2021

Now that the centralized ones are out

A major factor leading to BTC’s plunge at the time was the FTX collapse. And Draper didn’t hesitate to tackle this part. He explained that the stock market crash was one of the reasons he had always opposed the operation of centralized entities, saying:

“FTX sent the message that we don’t want any form of centralized currency.”

After missing the earlier projection, Draper went on to say that BTC would reach price in June 2023. So now that the forecast did not materialize in the middle of the year, he felt it necessary to push it forward.

Draper added that the reason for his earlier prediction was that he thought more retailers would recognize how important Bitcoin was. While he admitted it hasn’t happened yet, he said it would soon. He noted that,

“I think it will happen around the same time as the halving. And maybe then we will get my price target.”

With the refinement of his previous prediction by the prominent investor, curiosity and discussion arose among crypto enthusiasts eager to understand the factors behind this revised perspective.

Here for all proceeds

It also seemed that many participants were not interested in quick profits amid the projection that BTC’s long-term price action could be profitable. To address this, an on-chain analyst published his opinion on the CryptoQuant platform.

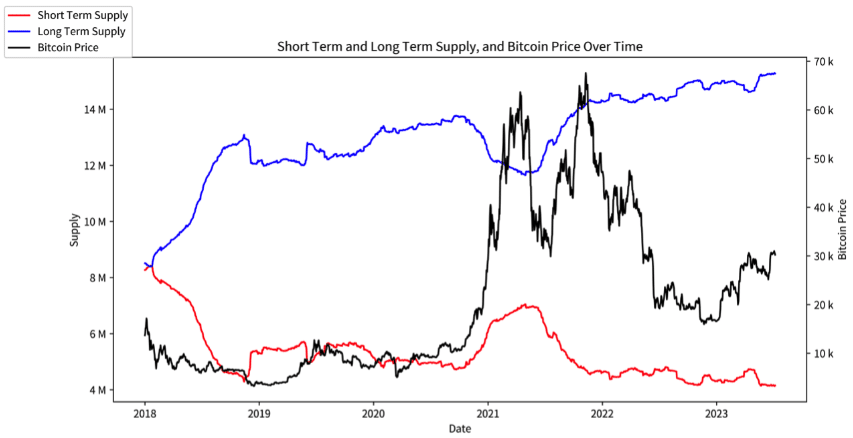

Onchained did this through considering the Long Term Holder (LTH) and Short Term Holder (STH) supply. For context, the LTH describes the Bitcoin cohort that bought the coin more than 155 days ago.

Conversely, the STH refers to investors who bought Bitcoin less than 155 days ago. Analyzing the current situation, the analyst touched on what happens to both cohorts during bullish and bearish cycles. He said,

“During bullish cycles, characterized by rising Bitcoin prices and high levels of optimism, there is a tendency to shift supply from long-term holders to short-term holders. This is visually evident as the red line (STH Supply) rises while the blue line (LTH Supply) decreases.”

Realistic or not, here it is BTC’s market cap in ETH terms

When the above (quote) happens, it means there is an influx of STH. This in turn implies that participants are more concerned about quick profits. He also said,

“Conversely, during bearish cycles, characterized by falling Bitcoin prices and prevailing pessimism, there is often a shift in supply from short-term holders back to long-term holders. This is observed when the red line (STH Supply) decreases while the blue line (LTH Supply) increases.”

When a situation like the one mentioned above occurs, it means that BTC has moved from weaker hands to hands that are willing to hold on for the long haul and accumulate more.

Source: CryptoQuant

From the shared card, the LTH supply was much more than the STH. So this shows how investor sentiment had shifted to long-term dynamics.